A Bit More Clarity

As I really was not able to provide a lot of guidance in my mid-week metals update, I am writing another one now since we have more information.

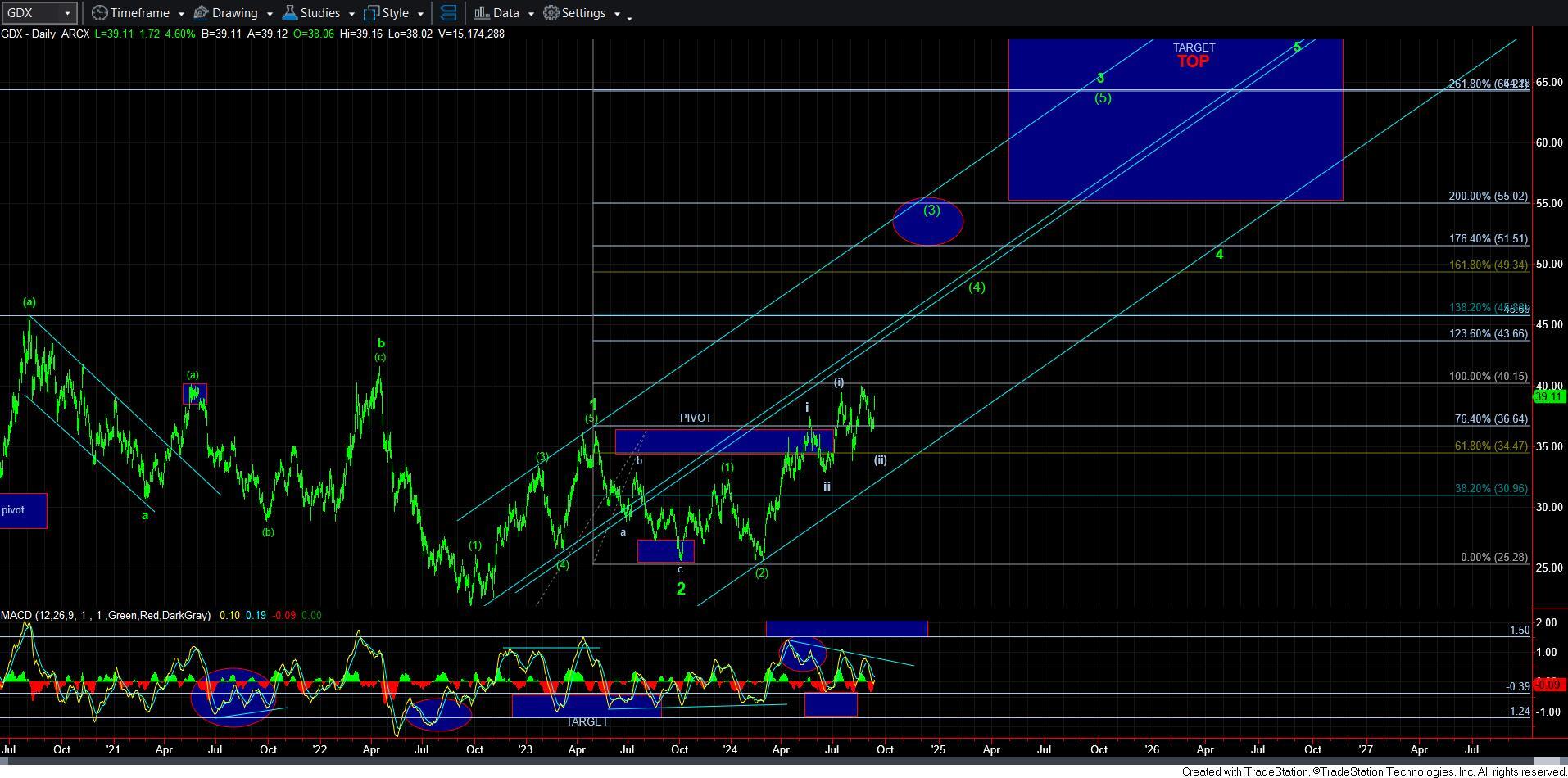

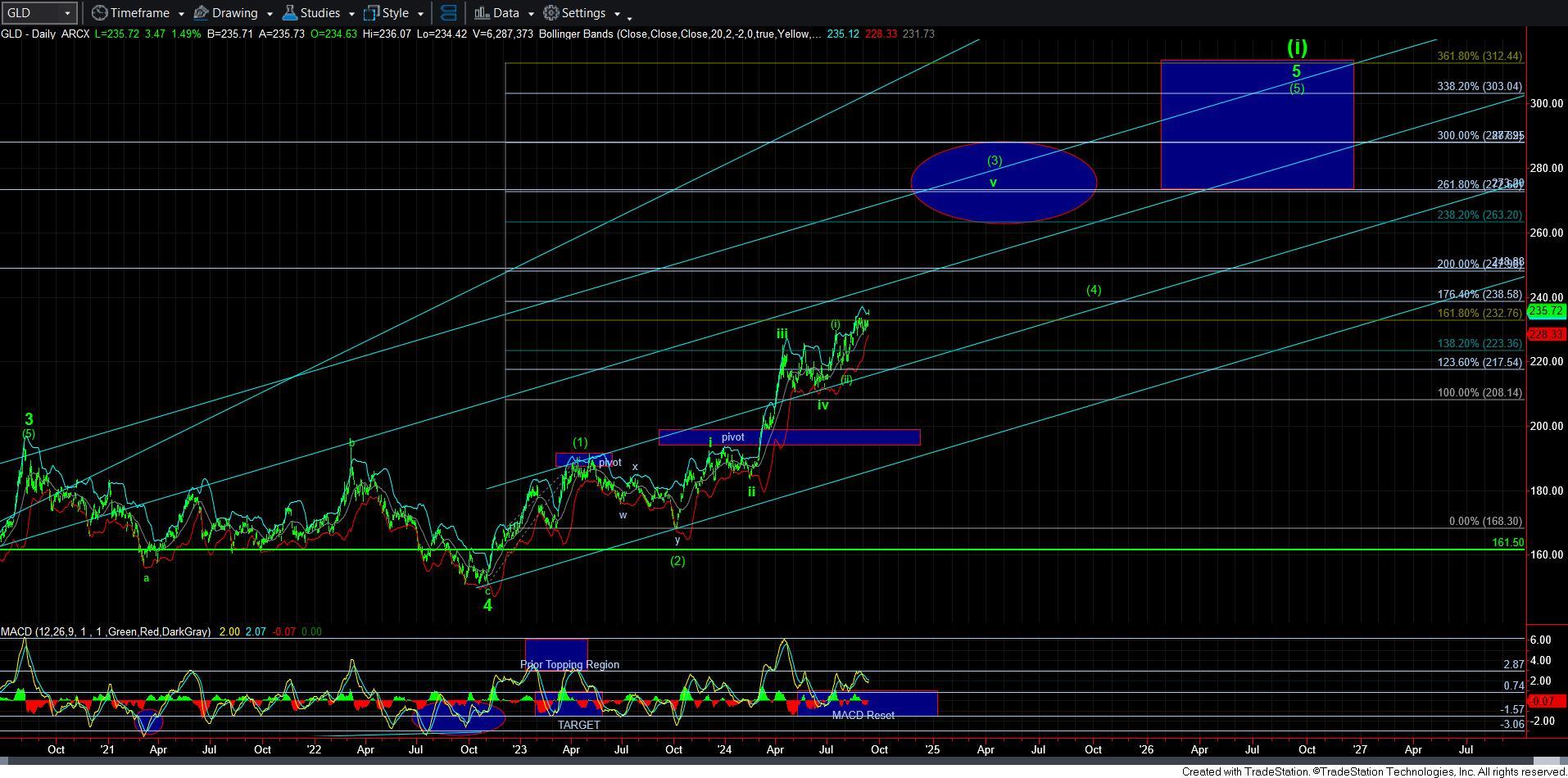

While I am not really going to add to the analysis in GLD, as I am still thinking this 5th wave may be taking shape as an ending diagonal, and I cannot say there is a ton more clarify in GDX, I will say that I have two solid paths to now work with in NEM – which is a good proxy for GDX – and silver.

Let’s start with NEM. The current rally is seemingly taking shape as a 5-wave structure, which I am primarily counting as wave [1] of wave [iii] of iii of 3. This means that once it completes, we should get a relatively smaller pullback for wave [2] and then break out over the high of wave [1], which would likely propel us to the 64-68 region rather quickly in the heart of a 3rd wave.

Of course, I still need to consider the alternative I outlined over the weekend, which was presented in yellow. And, the yellow count would suggest this is a [c] wave in a b-wave rally, which means we get one more 5-wave decline for a c-wave back down to the top region of the support box below before we are ready for the break out.

I am going to view silver in the exact same way as NEM, as it is quite reasonable to do so. My primary view now is if we complete 5 waves up, as shown on the 8-minute silver chart, we would be completing wave [1] of wave [iii] of 3 of iii of [3]. Of course, we would need to see a wave [2] pullback, which if we are really following this path will likely be short and shallow, and then rally back over the high of wave [1] to have us targeting the 37-40 region rather quickly.

Now, in similar fashion to NEM, the alternative suggests that we are completing a [c] wave in a b-wave, which will then point us down towards the lows struck in early August in a 5-wave c-wave decline of the yellow wave 2. This would likely be a very fast and sharp decline, as it would be the last to scare out the remaining weak holders in the silver market, and will likely see an equally strong reversal to begin wave 3.

So, there is going to be one more test in the next decline before I can say we are in a high probability heart of 3rd wave. But, I still think that the last quarter of 2024 will provide us with some impressive fireworks on the upside in the metals complex as the set-up has been building for quite some time.