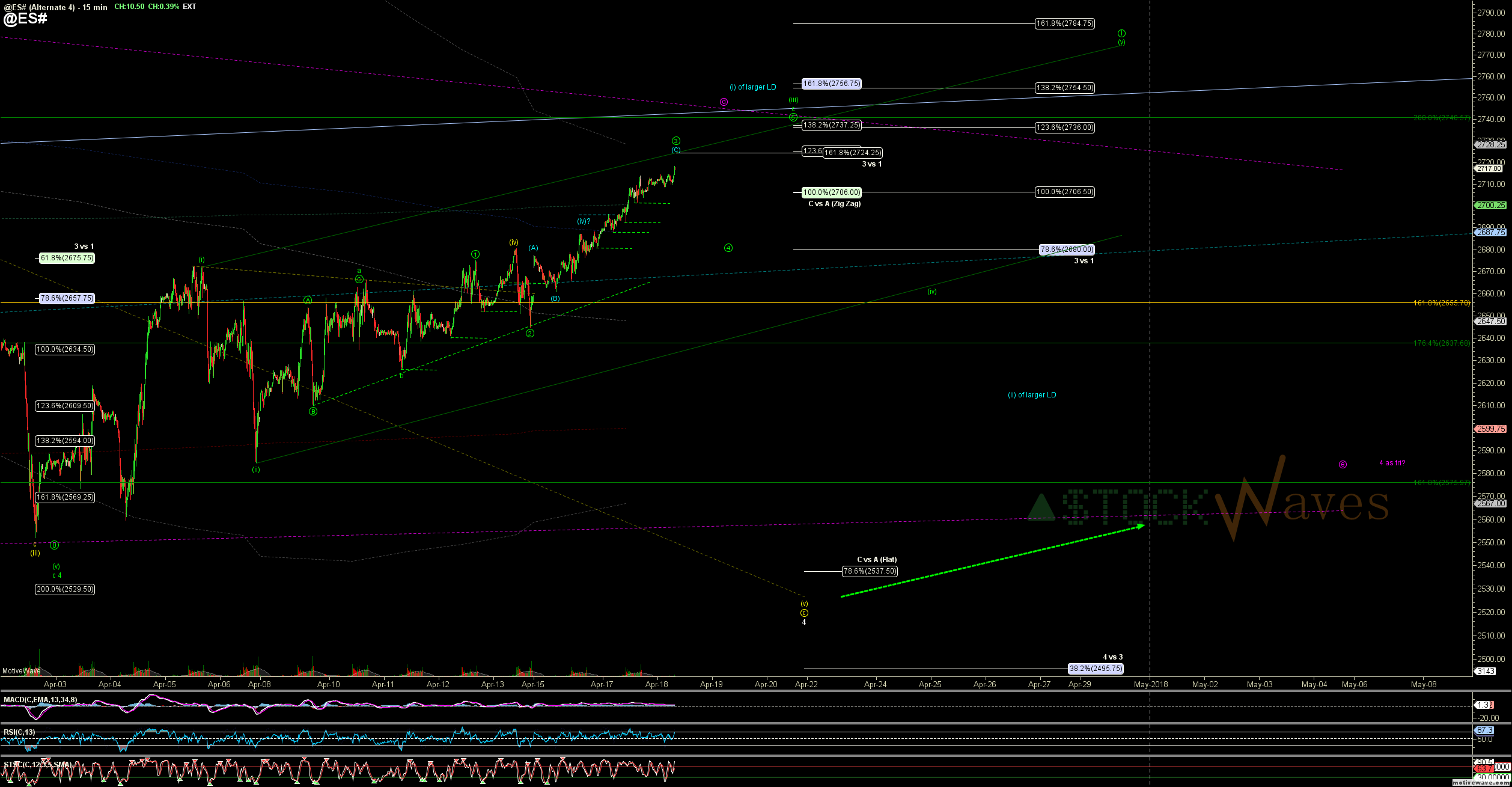

4th may not be complete but another low in ES/SPX less likely.

The pivot over 2695 makes a (v) of c to a new low much less likely. (SPX/ES)

While it still tracks nicely as the (iii) of our green LD, it easily opens up the door more for 2 other variants to the end of 4 or start of 5 we have discussed. Namely the triangle for one more down move as e (but not to a new low only ~2600 region), and the alt larger LD where this abc up is just the wave (i) set for a fade soon as (ii) also down toward the 2600 region.

If the green LD is going to maintain the edge it needs to hold any micro 4 consolidations above the 2680 region and press toward 2737s or even 2754.50. This could still easily be the purple d, but might be a bit large at that point for just a wave (i) of a blue larger LD. Wave (iv) of the green LD need to hold the 2660 region and then get another abc move up as (v) toward 2780s. Then the ideal support for a circle ii retrace would be 2660-2630, but after Leading Diagonals it is not uncommon to get deeper and/or wider retraces.

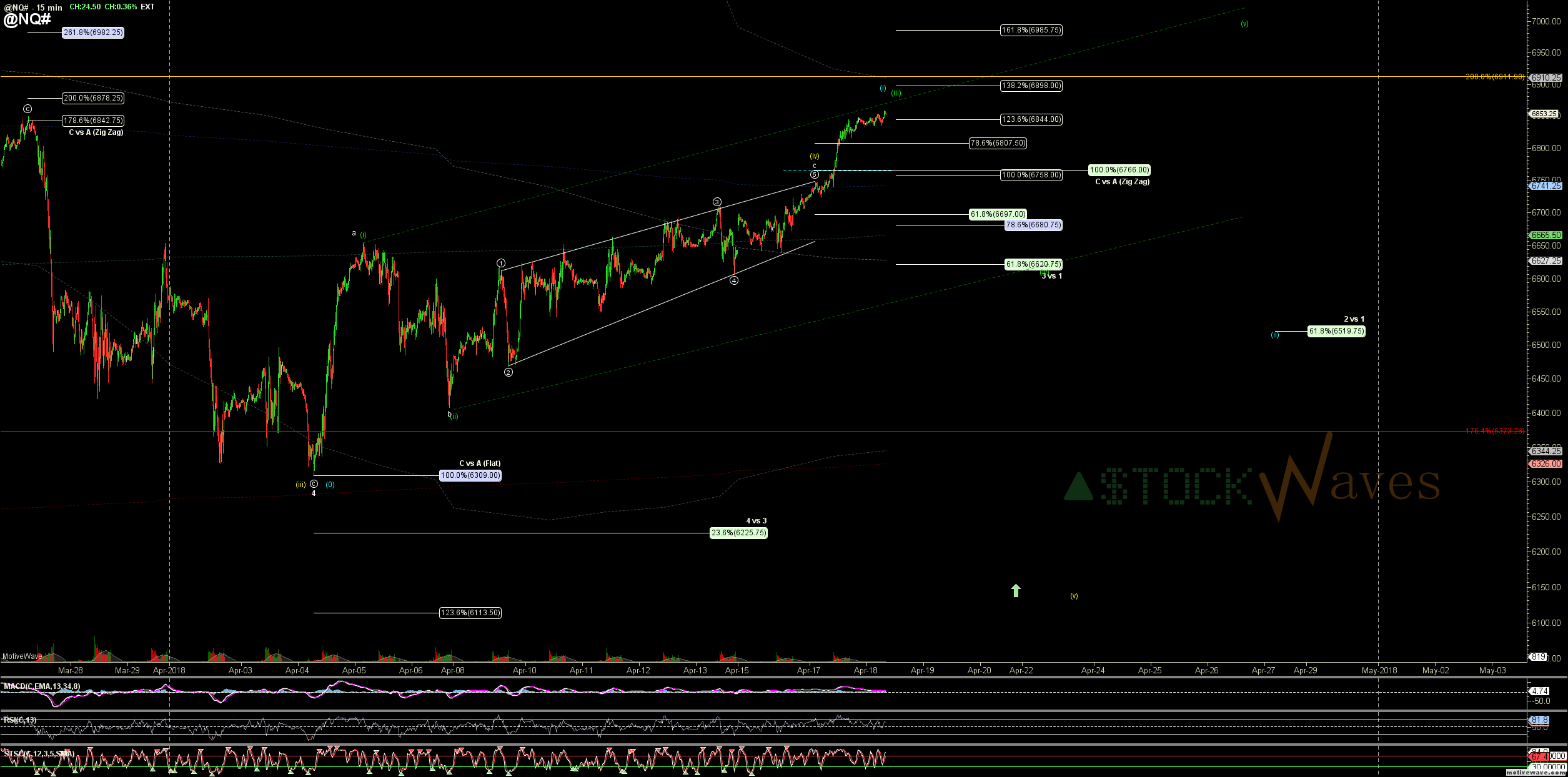

With some of the Momo names from our stock waves lists pushing hard yesterday the NQ got over its 6762 pivot that makes another (v) lower less likely. The triangle count does not work here, so either (iii) of the green LD (which fits with many of our Tech names) or the alt (i) of a larger LD.

Not every name is helping bend the indices UP though... Many DowJones names are still lagging and at best count as the (i) of a larger LD for circle i, but many still threaten OML. These could accomplish this objective even if SPX, NDX & DJIA all manage to hold the previous April lows in favor of just deep retraces. From our work in StockWaves the 2 sectors most likely to lead in weakness are XLP, XLF & XLI. It is also ER season and that can mean Shenanigans for some stocks and certainly for IV... it is not uncommon for some stocks to get a final spike on ER only to reverse it and be "green" by the next open... or pop to complete a micro 5th wave up only to start the fade in ii right away.

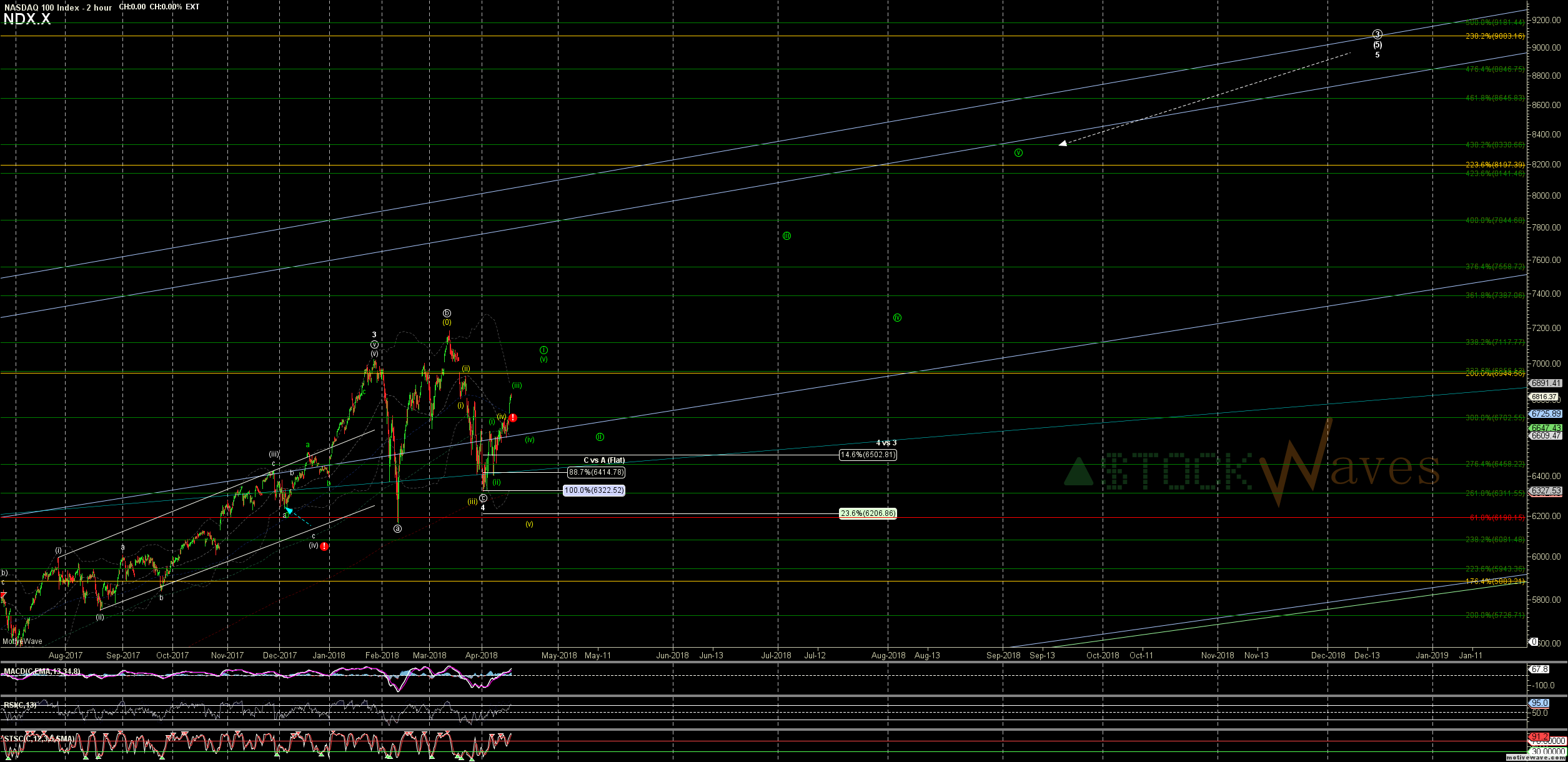

A note about preference: Based on Fib projections to reach 3369 it would be better if this were only (i) of a larger LD for circle i of 5 in SPX (rather than the green smaller LD) no that we are less likely to get a final drop and "V-bottom" reversal for a strong impulsive wave i of 5. (BIG Macro chart)

An interesting observation: The extension potential we have been pointing out in StockWaves for FANG names (and AAPL) as well as some other Momos projects to complete well before the projected run in S&P and Dow for the full 5th... perhaps NDX/NQ does not participate in the v of 5 b/c it already topped... We will be following this and other sector rotation very closely! Come join us!

A final promo: We put out 2 huge lists of our picks for the coming wave 5 on April 4. We also did a Webinar going over which ones had potential for bottoms in place and where support should be for any that try to make a new low, many are up very nicely and several even enough to confirm the start to the projected moves.