3 Reasons I Invest In Dividends For My Retirement

3 Reasons I Invest In Dividends For My Retirement

Summary:

The financial markets can be volatile and uncomfortable for many; Dividend stocks provide much needed stability.

Dividend payers have outperformed the market consistently including periods of inflation and across interest rate cycles

The comfort of passive stream of recurring and growing cash flow to provide comfort in turbulent markets

Dividend investing is a potent and proven strategy for building wealth over the long term. Despite its popularity among retirees, this method is proven very effective for all age groups as cash is placed predictably directly into your pocket to supplement your employment paycheck.

There are many strategies for making money in the financial markets; we choose one that suits our needs and lifestyle the best.

In this article, we outline the strengths of dividend investment as a strategy that has worked through periods of recessions, wars, inflation, and high and low-interest rates. The concept is time-tested and continues to be very effective in building wealth over decades and providing for your retirement needs.

1. Dividends are the most efficient forms of capital return

Companies have several ways to return capital to their shareholders:

Stock Buybacks

Acquisitions, new market entry, transformations

Dividends Payments

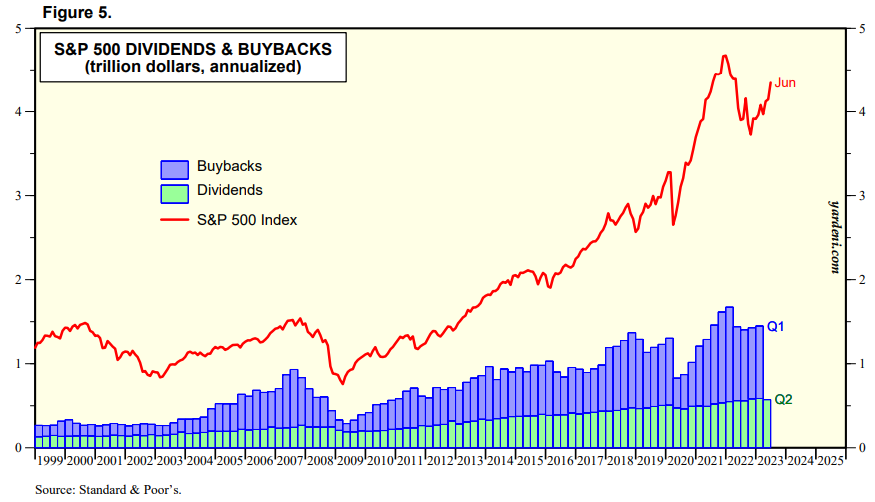

Stock buybacks involve agents, brokers, and lawyers to execute the transaction while ensuring compliance with SEC rules. History tells us that share buybacks are typically done more at relatively high valuations, and companies are very quick to suspend buybacks during times of economic uncertainty.

Yardeni Research

Acquisitions and strategic transformations involve significant expenses with the involvement of investment bankers, consultants, and lawyers, and there are ongoing integration/transition costs to achieve the committed synergies. According to the Harvard Business Review, 70%–90% of acquisitions are abysmal failures.

Among the three listed above, dividends are the only form of “pure” capital return to investors. The transaction is highly transparent, and investors end up with cold hard cash in their accounts. These cannot be inflated or manipulated using accounting schemes.

2. Cash infusion irrespective of economic conditions

Instead of worrying about your portfolio's price performance on a day-to-day basis, I only keep an eye on the dividends rolling in and examine its safety every quarter.

Companies paying and growing their dividends have more seasoned operations and a proven history of profitability. It is also relatively easy to study and keep track of dividend safety, be able to predict distressed dividends and anticipate dividend cuts.

“Let your profits run” is a popular expression in the trading community to resist the impulse to sell winning positions too early. However, market volatility can be unsettling, and staying invested in winning stocks is easier if they are paying you to keep holding them.

3. Income investing beats long-term inflation

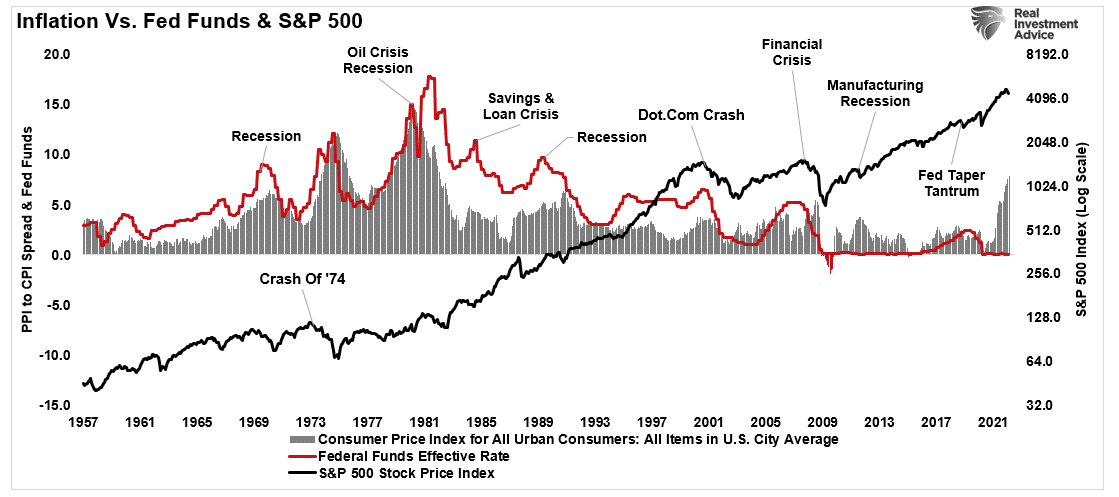

The U.S. economy currently faces the challenges of high-interest rates and sticky inflation pressures, causing widespread economic uncertainty. Since 1973, we have seen at least four bear markets and periods of inflation.

Realinvestmentadvice.com

Yet, high-yielding stocks and those providing regular dividend growth delivered market-beating returns to shareholders. These predictable returns position you well to outrun any rise in inflation and rising rate cycles that are expected in the future.

Conclusion

At High Dividend Investing, we adopt the Income Method, a powerful strategy that suits all age groups and serves as a critical tool for achieving financial independence. Every dollar you earn passively from dividends sets you one step closer to this goal and positions you well to retire early.

Dividends are a highly cost-effective form of capital return that exclusively benefits shareholders.

Since dividends are hard cash to investors, they cannot be manipulated by accounting schemes.

Dividends provide support in bear markets through reliable cash flow infusion. An income investor does not have to sell stock during unfavorable market conditions to produce the necessary cash flow.

Dividends have consistently outperformed inflation and have provided excellent returns through interest rate cycles.

Patience is crucial for successful investors, and slow and steady always wins the race. A diversified portfolio slowly but surely produces dividends through thick and thin with limited effort on your part. Be happy in retirement, enjoy the things that you like to do instead of worrying about the market gyrations. Our Income Method generates predictable returns making retirement investing simple, straightforward, and less stressful!

This is one of many such educational articles we plan to post on the public side. To get 100% of all the educational material for your savings and retirement needs, we encourage you to take a free trial for High Dividend Investing.