Market Analysis for Apr 26th, 2022

Educational - 4/26 Countertrend Scalp Demonstration

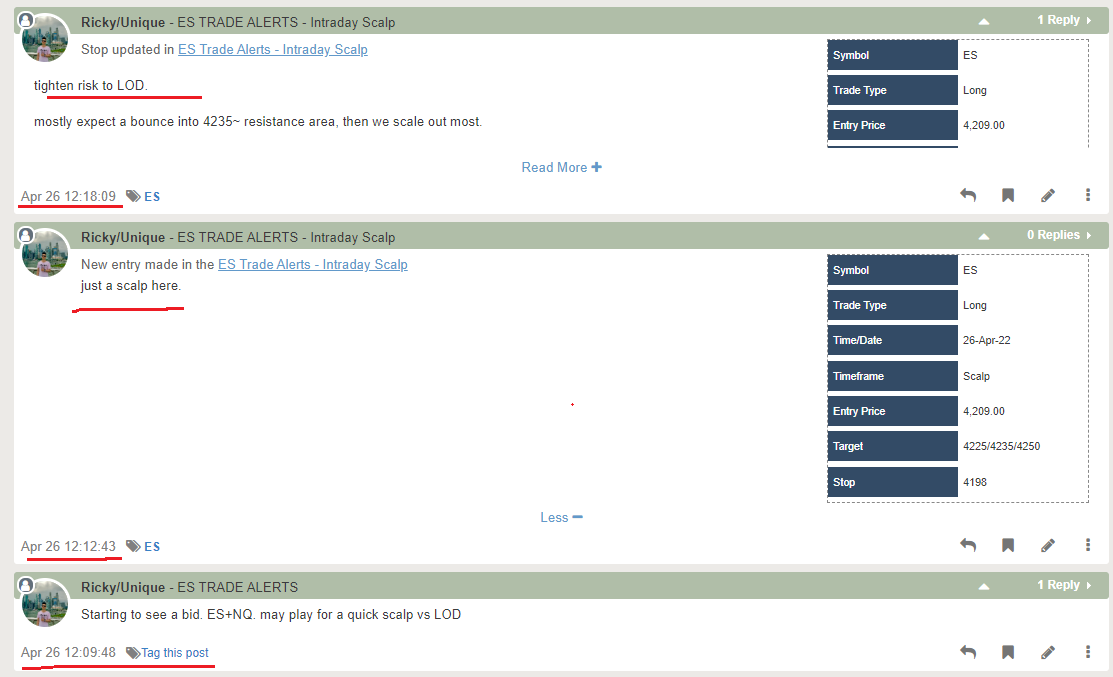

Patience is key here...even if you wanna be hero(countertrend vs a trend day), gotta be selective with countertrend attempt(s)

Context: we missed the overnight/premarket southbound train setup ES 4300s->4200s move, so only had a limited options on how we were gonna play rest of day.

Stay in cash or wait for an area to scalp long or wait for a bigger deadcat bounce to short again

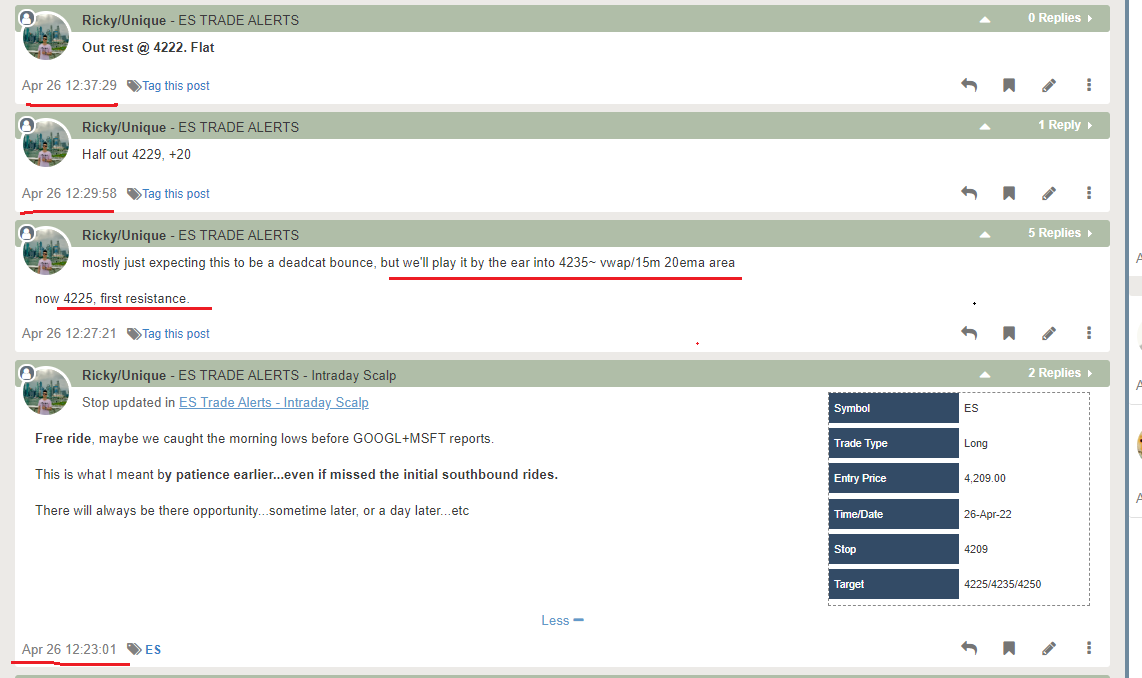

Some conditions were met earlier...in.

1) ES 4200s key support kept holding (4/25 lows area and today's current low = 4201, basically the support area that needed stall against if countertrend had 1 shot here)

2) You need to wait till the market momentum stalls/ bids to show up

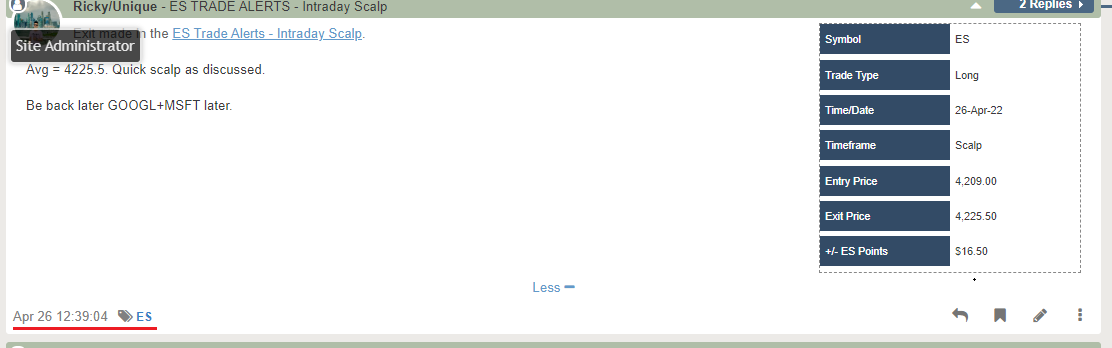

3) We entered at ES 4209 which was the breakout area on micro charts and set stoploss to just below LOD for a quick scalp attempt.

We completed a textbook setup: hit major support -> found some buyers -> quick little pump into VWAP/15m 20ema area.

Trade duration: 25 minutes. 12:12->12:37pm. Result: +16pts or +800USD per contract. Zero MAE (max adverse excursion, no heat taken)

---

With all that's said and done, it's too late to chase shorts now without a bigger deadcat and too late to attempt countertrend longs again. Back into cash mode

Now, uncertain again, dpes market keep selling into ES 4100 or bounce back into 4300 because good earning reaction?

We'll know more once GOOGL+MSFT report earnings...when dust settles...less uncertainty. Must respect downside risk since technical charts are broken