Market Analysis for Apr 14th, 2022

E-mini S&P 500 Futures: Keep It Simple Stupid –Daily 20EMA Trend Remains Critical, Rangebound Into Long Weekend

Context section:

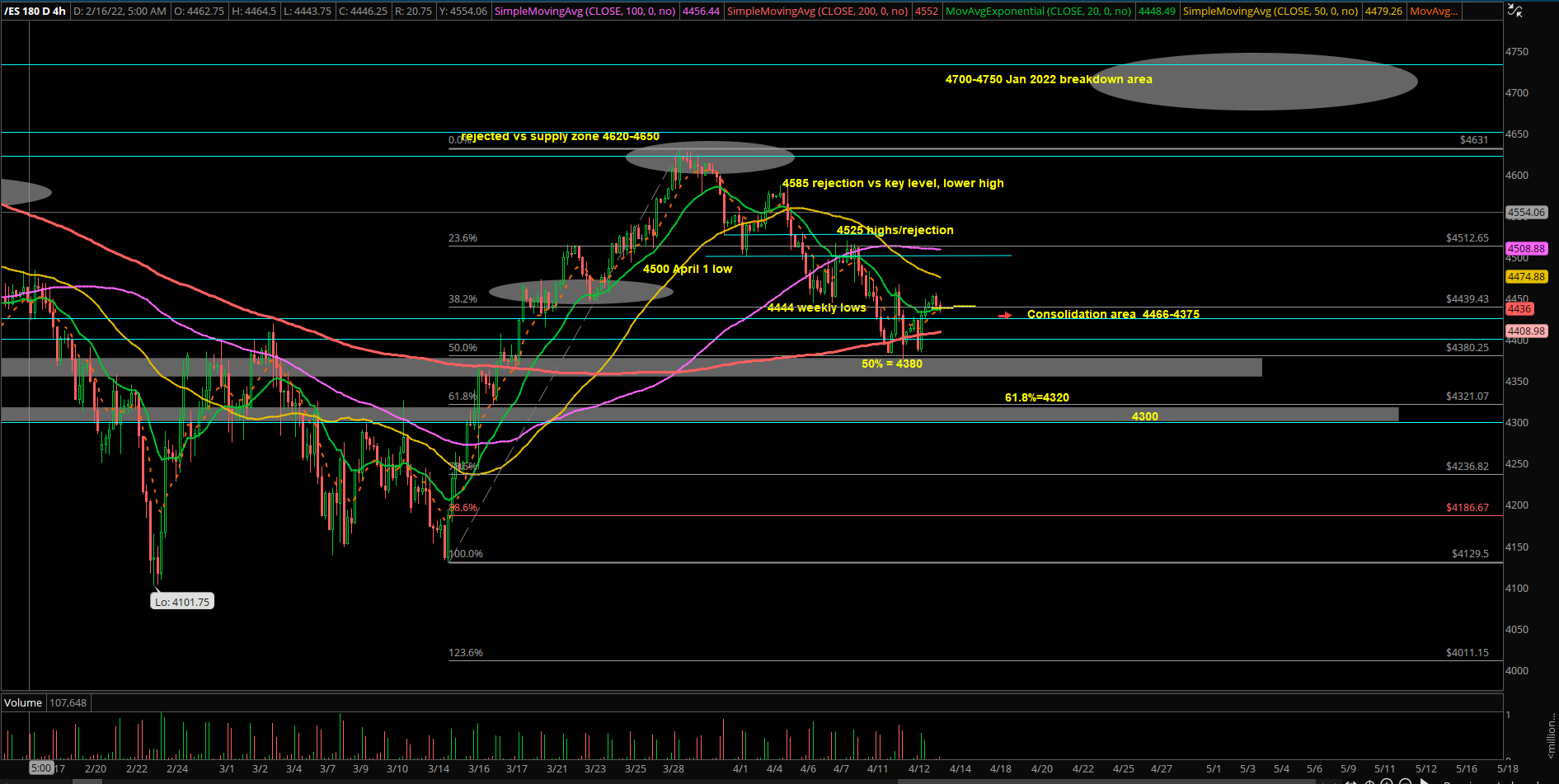

Starting from mid Jan 2022, since the decisive breakdown below the trending daily 20EMA + 4650s area, the market has continued trading in a massive sideways range of 4630s-4100s. And within this period the majority of time has been spent between 4585-4250.

In addition, no short-term directional trend that has outlasted for more than 2 weeks before it reversed into the other side testing extremes. Whipsaw environment.

- Feb’s monthly range = 4586-4101.75

- March’s monthly range = 4631-4129.5

- Ongoing April month range = 4588-4375.5

As of writing, April’s price action has been trading entirely within the previous month indicating indecision and consolidation before the next decisive monthly move (eventually outside the range)

Current parameters:

April 11th weekly range = 4491.25-4375.50

If you recall, bears failed their assault below the 4380-4375 support yesterday as RTH open and our primary concern of an inside day played out accordingly It was a Flat open into a +1% trend day on ES closing at highs of 4440s (+2% for NQ/Nasdaq). In essence, price action around 61.8% of the past two days’ losses. However, price action still remains below DAILY 20EMA, higher timeframe sellers remain in control when below 4444/4466 (daily closing prices)

- Yesterday range = 4449.5-4384

- Overnight range = 4455.75-4432.50, current price = 4440

- Price action attempting to turn into neutral/bullish mode as it keeps flirting under resistances

- Yesterday closed slightly just below our key level 4444. Bulls had a decent double bottom 4380s->4440s trend day. Could treat as day#1 of a potential bottom. They need to show a strong day#2 going into long weekend in order to change the trajectory of this ongoing daily trend. Otherwise, the risk is still lower lows towards 4365/4350/4320 area in the bigger picture

- Main focus today for continuation off of yesterday’s bullish momentum is to look for a dip into 4425 key support with a minor support at 4415 for a potential scalp buy opp

- Overall, main concern today is price is stuck 4455-4425 or 4455-4400 heading into long weekend. Friday = market closed, don’t plan on trading after morning, cannot force here

- Gameplan is great, but execution is key, adapt in real-time with the flow. Be water

Bigger picture:

Ongoing short-term bear trend below daily 20EMA. Daily closing prices need to ultimately remain below 4444/4466 in order to have a shot driving prices further down. The 50% fib retracement of March has been fulfilled at 4380s. Next logical target would be the 4350/4320 area, the latter being 61.8% retracement.

For bulls to reverse this short-term downtrend, needs a daily close above 4444 (prior week’s low) for initial confirmation of some sort of range low being in place and having a reference point. This must be followed quickly by a breakout above 4466. Otherwise, we cannot see a sticksave in place because 4/12 was a disappointing gap up and crap moment for bulls. Level by level approach, we cannot revisit 4500-4520 or above without first reclaiming some key resistances.

Also, important to keep an eye on NQ 13800-13850 major support, higher timeframe buyers may show up and defend this region for a bigger sticksave/bounce. A lot of megacap stocks at an important juncture as well. Based on overall context, we’re likely more near a range low/weekly low for ES+NQ so need to be careful of being overly confident on the bearish side here.