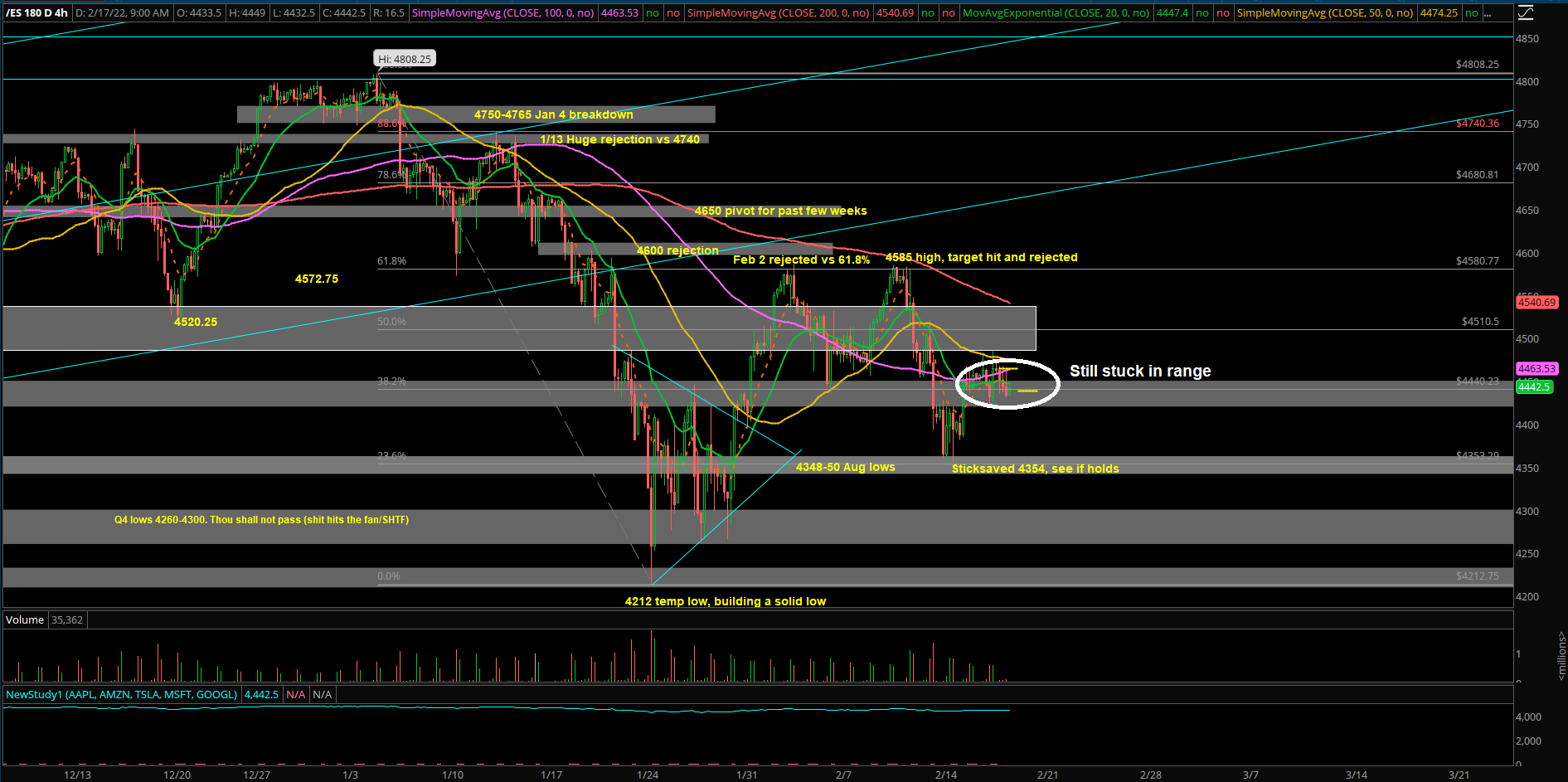

Market Analysis for Feb 17th, 2022

E-mini S&P 500 Futures: Keep It Simple Stupid – Treating Low Of Week In, Ongoing Feedback Loop Squeeze P.3

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

Context section:

- 1/18-1/21 a decisive +massive WEEKLY breakdown occured on ES+NQ as price closed below the multi-month trading channel and below the WEEKLY 20EMA. Volatility+price expansion (weekly closed at 4390)

- 1/24-1/28 a massive WEEKLY sticksave from Monday 1/24 ES 4212 lows + NQ 13700s, with price action ending near the high of the week at ES 4420s and NQ 14400s, confirming Monday’s temporary bottom setup (weekly closed at 4423)

- 1/31-2/4 4395-4586 confirming the higher lows and higher highs formation and the market stabilizing compared to previous weeks (weekly closed at 4492, +1.5% vs prior week)

- 2/7-2-11 double top rejection vs 4585, weekly closed at 4400s, -2.2% vs prior week

- 2/14 price sticksaved at 4354 during overnight, then higher lows at 4357 during RTH

- 2/15 gap up and held for the entire RTH session, bullish consolidation mode

- 2/16 red to green day, bottomed at 4422, decent sticksave vs our 4420 key level

- The longer price action stays in a massive range bound of 4200-4700, the better it is for bulls due to stats. Especially, if price action keeps holding above our 4348-4350 key level.

Current parameters:

- Overnight range = 4475-4431, 44 points width, opening as -0.6% GAP down vs Wednesday’s closing print of 4470.

- Current price = 4440s, meaning price action still chopping around within our range levels. It is not as bullish as expected because price action could have been at 4500+ by now given yesterday’s red to green setup (4420s to 4480s)

- Primary expectation for today is bullish consolidation/trend continuation focusing on long setups into 4500/4585 when above 4440/4420. In simplest terms, look for HLs+HHs pattern to ride. Be patient and wait for levels to hit, try not to chase. Harder area to execute

- A break above 4470 after RTH open would enhance the odds for bulls

- Conversely, a decisive break back below 4440 would be considered early weakness and an early warning that this may turn into a bull trap/reversal pattern/failure. Then, if below 4420 could be deadly, opens bigger backtest back into 4400/4385/4350

- Focus and generate alpha during 9:30-11:30AM, then enjoy the finer things in life. Making money is one thing, but enhancing your PnL/time executed is a key component of actually winning in the markets. Capture your chunk and live life to the fullest

- Gameplan is great, but it’s all about real-time execution here. Adapt, be water

- Zooming out a little, we’re still treating low of week already in from Monday 4350s

Bigger picture:

- ES 1/24 4212 temp bottom + NQ 1/24 13700s temp bottom

- Chances are 4212 temp low is becoming a solid low of Q1 2022 (ongoing process)

- If one was bear inclined on the markets making a new lower low vs the current lows, we would need to see at least a couple DAILY closing prints below ES 4348-4350 in order to change this opinion

- The longer price action stays in a massive range bound of 4200-4700, the better it is for bulls due to stats. Especially, if price action keeps holding above our 4348-4350 key level. Sellers being unable to break below 4440 would be your first hint of gummy bears

- If one was to take their best shot from half court here, the best bet is a quick throttle towards 4585/4600, stabilize, form another daily higher lows then head into 4650/4700 next few sessions

- Reality: this is exactly what is occurring at the moment, market rejected vs 4585 last week. Backtested vs 4348-50 key support this week by holding 4354 low of week in order to form the next daily higher lows.

- Bulls have the short-term control again as it was confirmed Feb 15 by a daily close above 4440. First things first, we need to see a bullish price expansion/continuation into past 2 weeks high of 4585 for sustained momentum.

- Then, it opens up bigger picture back into 4650-4700, if so. Step by step, day by day, level by level process.