Market Analysis for Feb 11th, 2022

E-mini S&P 500 Futures: Keep It Simple Stupid – Simple Inside Week, Rangebound Continues. Are You Winning?

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

Context section:

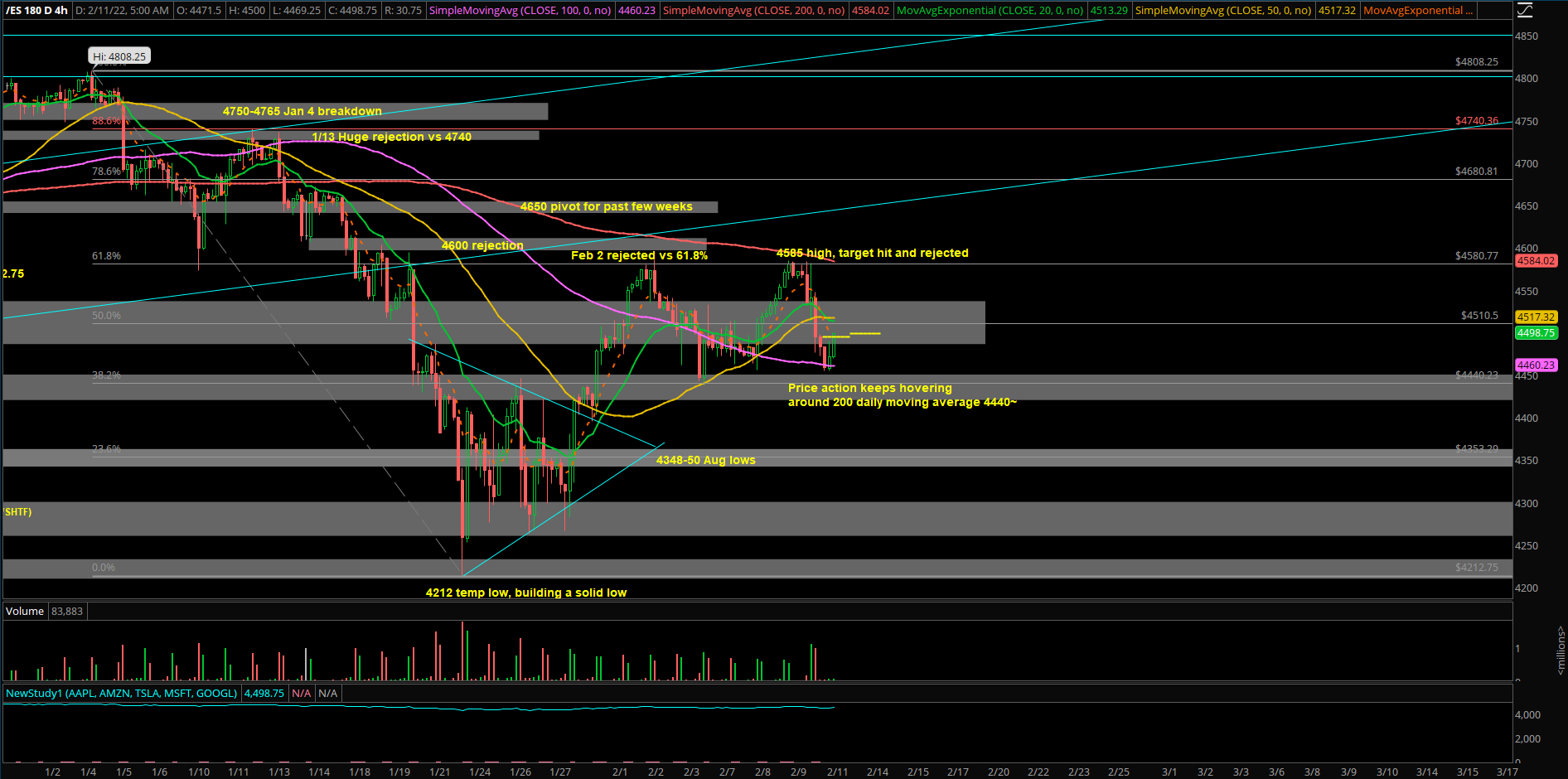

- 1/18-1/21 a decisive +massive WEEKLY breakdown occured on ES+NQ as price closed below the multi-month trading channel and below the WEEKLY 20EMA. Volatility+price expansion (weekly closed at 4390)

- 1/24-1/28 a massive WEEKLY sticksave from Monday 1/24 ES 4212 lows + NQ 13700s, with price action ending near the high of the week at ES 4420s and NQ 14400s, confirming Monday’s temporary bottom setup (weekly closed at 4423)

- 1/31-2/4 4395-4586 confirming the higher lows and higher highs formation and the market stabilizing compared to previous weeks (weekly closed at 4492, +1.5% vs prior week)

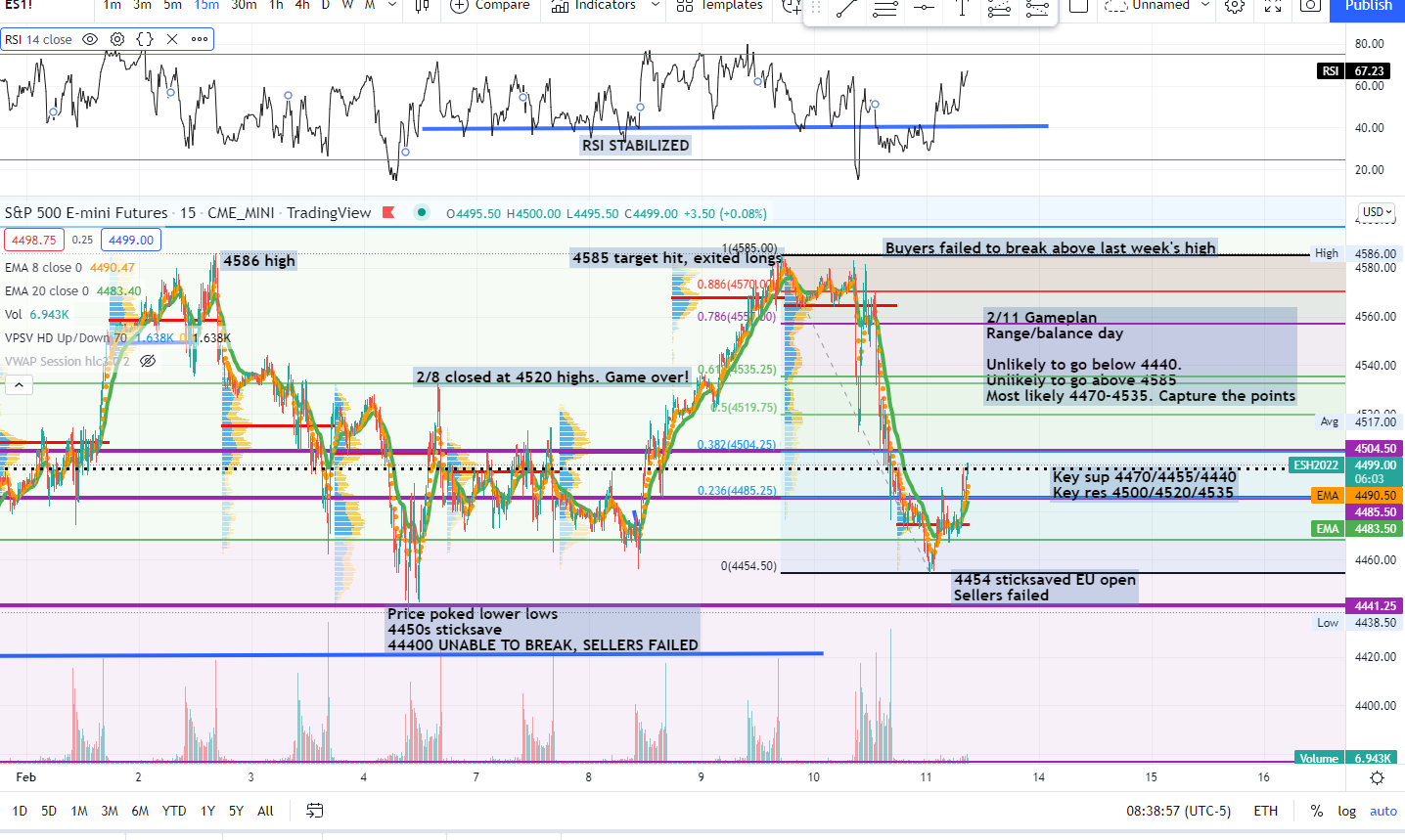

- Monday 2/7 was an inside day, both sides failed to capitalize on their respective intraday breakout 4500s+/breakdown 4470s setup. Lots of trapped market participants

- Tuesday 2/8 was an inside day of last Friday’s range, yesterday’s sellers tested into 4455 lows, buyers absorbed all selling pressure and closed the day at 4520 HIGH OF THE DAY

- Wedesday 2/9 was a gap up and go as expected, HLs+ and HHs into EOD 4580

- Thursday 2/10 was a double top rejection vs 4585 key level (last week’s high area), intraday low was 4476 and session closed at 4498

- The longer price action stays in a massive range bound of 4200-4700, the better it is for bulls due to stats. Especially, if price action keeps holding above our 4348-4350 key level. Sellers being unable to break below 4440 would be your first hint of gummy bears

Current parameters:

- Overnight range = 4500-4454, 46 points width, opening as -0.03% FLAT, backtested against the 4440-4450s range low zone of past few sessions and held

- The chances of getting bodybagged here is quite high here given the context+structure of how this ongoing week went, inside week + inside/rangebound Friday

- Primary expectation for today is range/balance day which could evolve into a full flown stampede if below 4440 or above 4585. Bi-directional = be expert at flip flop

- Current price = 4495, key sup levels are 4470/4455/4440, key res levels are 4500/4520/4535. Execute

- When price expansion occurs above 4585, then 4600/4650/4700 are next

- When price expansion occurs below 4440, then 4400/4350-4348 are next

- Focus and generate alpha during 9:30-11:30AM, then enjoy the finer things in life. Making money is one thing, but enhancing your PnL/time executed is a key component of actually winning in the markets. Capture your chunk and live life to the fullest

- Gameplan is great, but it’s all about real-time execution here. Adapt, be water

Bigger picture:

- ES 1/24 4212 temp bottom + NQ 1/24 13700s temp bottom

- Chances are 4212 temp low is becoming a solid low of Q1 2022 (ongoing process)

- If one was bear inclined on the markets making a new lower low vs the current lows, we would need to see at least a couple DAILY closing prints below ES 4348-4350 in order to change this opinion

- The longer price action stays in a massive range bound of 4200-4700, the better it is for bulls due to stats. Especially, if price action keeps holding above our 4348-4350 key level. Sellers being unable to break below 4440 would be your first hint of gummy bears

- If one was to take their best shot from half court here, the best bet is a quick throttle towards 4585/4600, stabilize, form another daily higher lows then head into 4650/4700 next few sessions

- Reality: this is what is occurring at the moment, market rejected vs 4585, now waiting to form the next daily higher lows