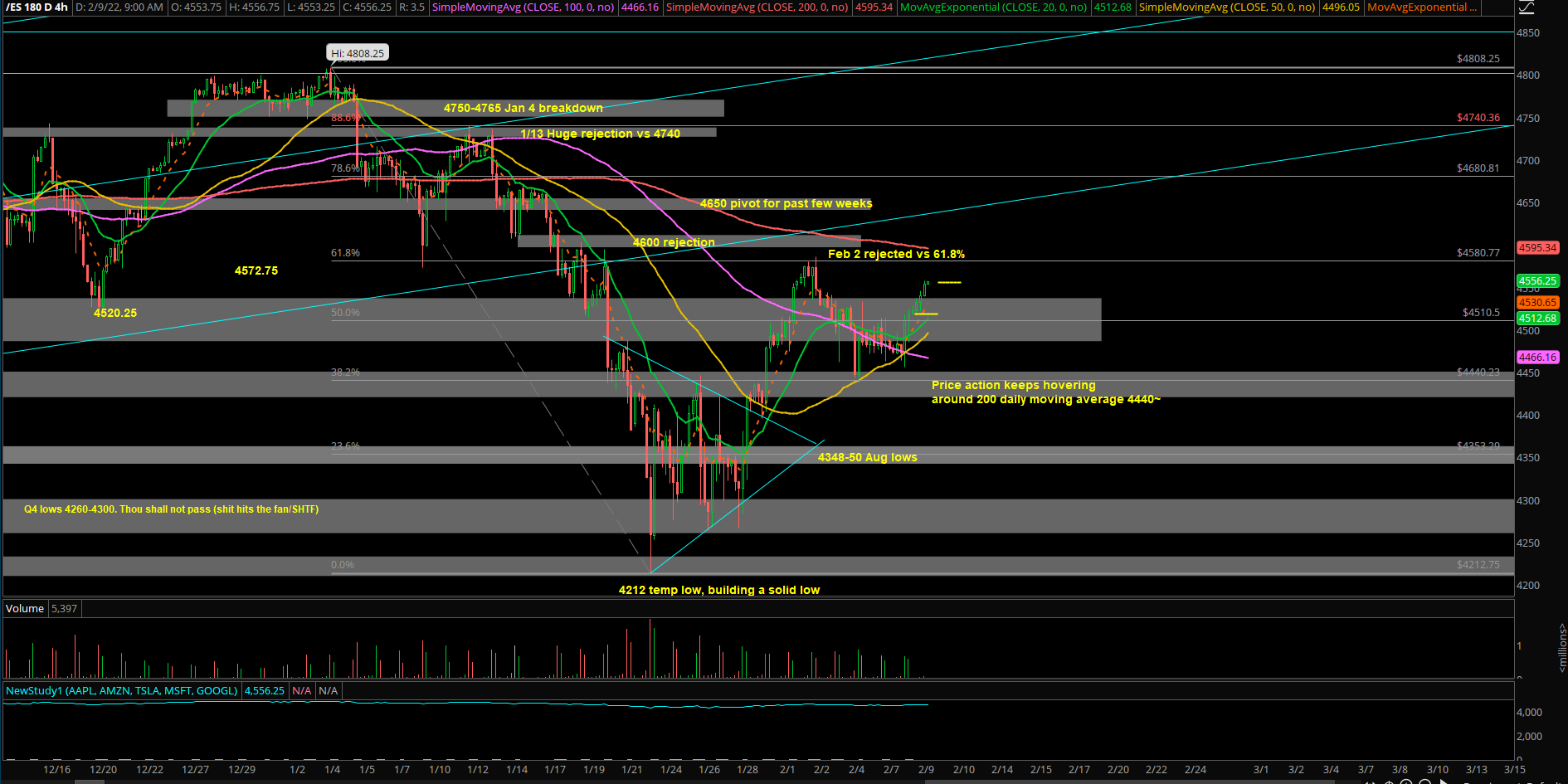

Market Analysis for Feb 9th, 2022

E-mini S&P 500 Futures: Keep It Simple Stupid – We Stand Tall, Devouring Gummy Bears

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

Context section:

- 1/18-1/21 a decisive +massive WEEKLY breakdown occured on ES+NQ as price closed below the multi-month trading channel and below the WEEKLY 20EMA. Volatility+price expansion (weekly closed at 4390)

- 1/24-1/28 a massive WEEKLY sticksave from Monday 1/24 ES 4212 lows + NQ 13700s, with price action ending near the high of the week at ES 4420s and NQ 14400s, confirming Monday’s temporary bottom setup (weekly closed at 4423)

- 1/31-2/4 4395-4586 confirming the higher lows and higher highs formation and the market stabilizing compared to previous weeks (weekly closed at 4492, +1.5% vs prior week)

- Monday 2/7 was an inside day, both sides failed to capitalize on their respective intraday breakout 4500s+/breakdown 4470s setup. Lots of trapped market participants

- Tuesday 2/8 was an inside day of last Friday’s range, yesterday’s sellers tested into 4455 lows, buyers absorbed all selling pressure and closed the day at 4520 HIGH OF THE DAY

- The longer price action stays in a massive range bound of 4200-4700, the better it is for bulls due to stats. Especially, if price action keeps holding above our 4348-4350 key level. Sellers being unable to break below 4440 would be your first hint of gummy bears

Current parameters:

- Overnight range = 4557-4517, 40 points width, opening as +0.95% GAP UP, decisively above last Friday’s range (4532-4438) and Monday + Tuesday’s range (4524-4463)

- The chances of devouring gummy bears is quite high here given the context+structure of how this ongoing week went

- If you recall, Monday and Tuesday failed to break below 4440 after a few attempts in order to create a range expansion/liquidation breakdown into 4348-4350. If bears cannot complete their job, then it’s time for the opposing side to showcase their strength. This is exactly what occurred. Yesterday’s low 4450s->4520s high

- Primary expectation for today is GAP UP and GO which could evolve into a full flown stampede into end of week. Focus on long biased trades only when above 4520. Absolutely, no shorting allowed when above 4520. This could extend

- Current price = 4555, short-term target remains the same at 4585/4600, unchanged from yesterday

- We remain full sized long as we caught the higher lows entry of 4485-4488 perfectly on Feb 8th

- Adapt in real-time as things could change quickly given the nature of momentum+breakout sustainability of what needs to occur. Lastly, NQ above 14650-14670, our key levels from yesterday’s report. Now, 14900s, gummy bears at risk if >15k…full throttle ahead

- Conversely, IF a decisive breakdown below ES 4520 occurs at any point, be careful of bull trap/bull breakout failure. Then, price is stuck back in the range of 4535-4440

- Our primary goal today is to extract as much alpha as possible given it’s a potential trend day up so one side has a clear advantage going into the RTH open

- Focus and generate alpha during 9:30-11:30AM EST via higher lows higher highs setup, then enjoy the finer things in life. Making money is one thing, but enhancing your PnL/time executed is a key component of actually winning in the markets

Bigger picture:

- ES 1/24 4212 temp bottom + NQ 1/24 13700s temp bottom

- Chances are 4212 temp low is becoming a solid low of Q1 2022 (ongoing process)

- If one was bear inclined on the markets making a new lower low vs the current lows, we would need to see at least a couple DAILY closing prints below ES 4348-4350 in order to change this opinion

- The longer price action stays in a massive range bound of 4200-4700, the better it is for bulls due to stats. Especially, if price action keeps holding above our 4348-4350 key level. Sellers being unable to break below 4440 would be your first hint of gummy bears

- If one was to take their best shot from half court here, the best bet is a quick throttle towards 4585/4600, stabilize, form another daily higher lows then head into 4650/4700 next few sessions

What are the key levels to be aware of?

- Resistances 4550, 4565, 4585, 4600, 4620, 4640, 4650, 4685, 4700, 4713, 4728, 4740, 4750,

- Supports 4550, 4535, 4520, 4500, 4485, 4470, 4450, 4440, 4420, 4400, 4385, 4375, 4350, 4348, 4320, 4300, 4280, 4260, 4225, 4212, 4200, 4165, 4150

(for those that need a little more hand holding or explicit direction, plot these horizontal key levels or at least the first 3 resistances/resistances and see how they help you, review daily)