Market Analysis for Jan 26th, 2022

1/26 Recap

Gave 4385 key level this morning for long opportunities.

Today's current low 4381.

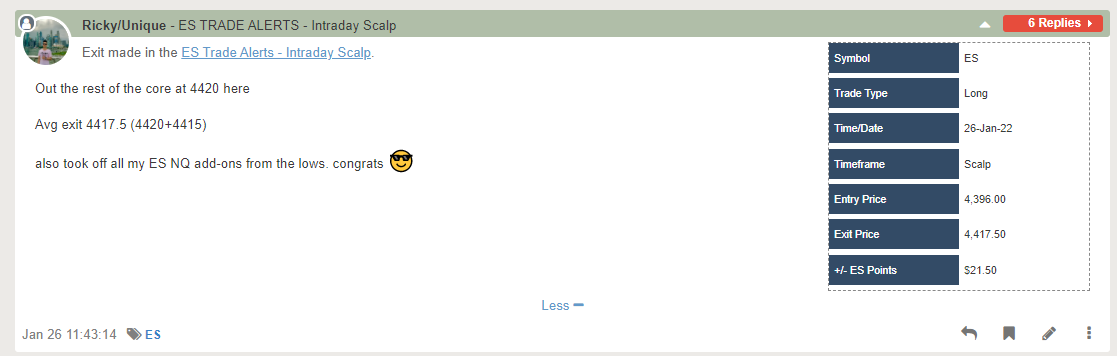

We bought the lows again as demonstrated in real-time. Now, 4420. Done for the day. Good luck FOMC 😎

Current parameters:

- Overnight range = 4423-4308, ES hovering at 4400s +1.4% as we head into RTH open

- FOMC today, meaing our expectations/ideas are only good until 2PM EST, then levels don’t matter much as price discovery occurs. Be like water today, adaptable

- We’re expecting a massive fight here vs 4400-4420 once RTH opens, bull biased based on overnight +100 points rally from 4308 globex lows…gummy bears may be trapped

- It will determine whether it’s a gap up and go (9:30am-12pm) vs a range high rejection of 4400-4420 back into 4385/4350-48 supports

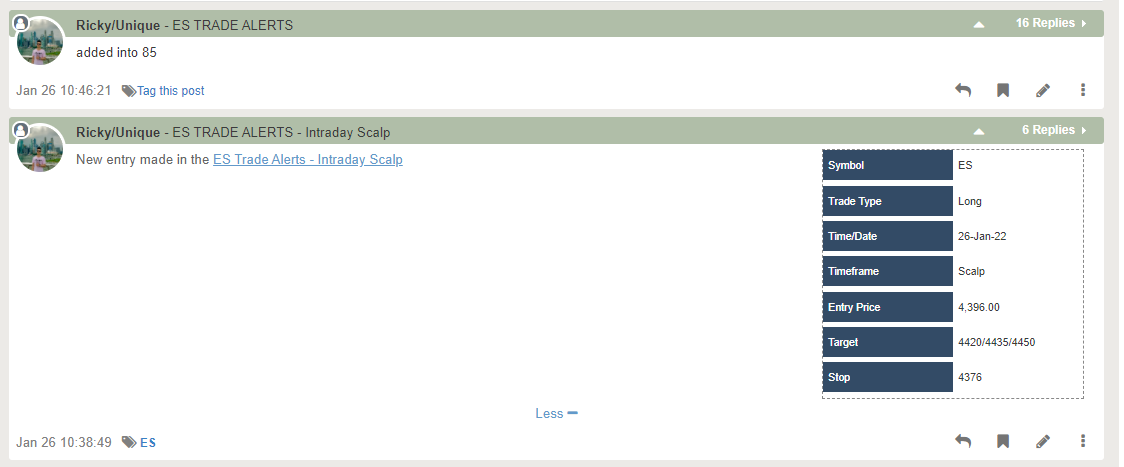

- Main focus this morning should be looking for long scalp setups espiecally if price stays above 4385 after RTH open

- Immediate supports are 4385/4350-4350-48 for long opportunities

- Bears would need to hold 4420/4400 current resistance area to stay rangebound until FOMC

- A decisive break above 4420 could entice large buyers to step into play and head into 4450/4500-4520 important backtest area

- A decisive break below 4350 would entice large sellers to revisit yesterday’s 4300 higher lowslow and possibly more price expansion to the downside (not our primary scenario at the moment given the overall context)