Market Analysis for Jan 25th, 2022

1/25 EOD recap:

Key levels worked flawlessly from premarket gameplan. Did you execute properly?

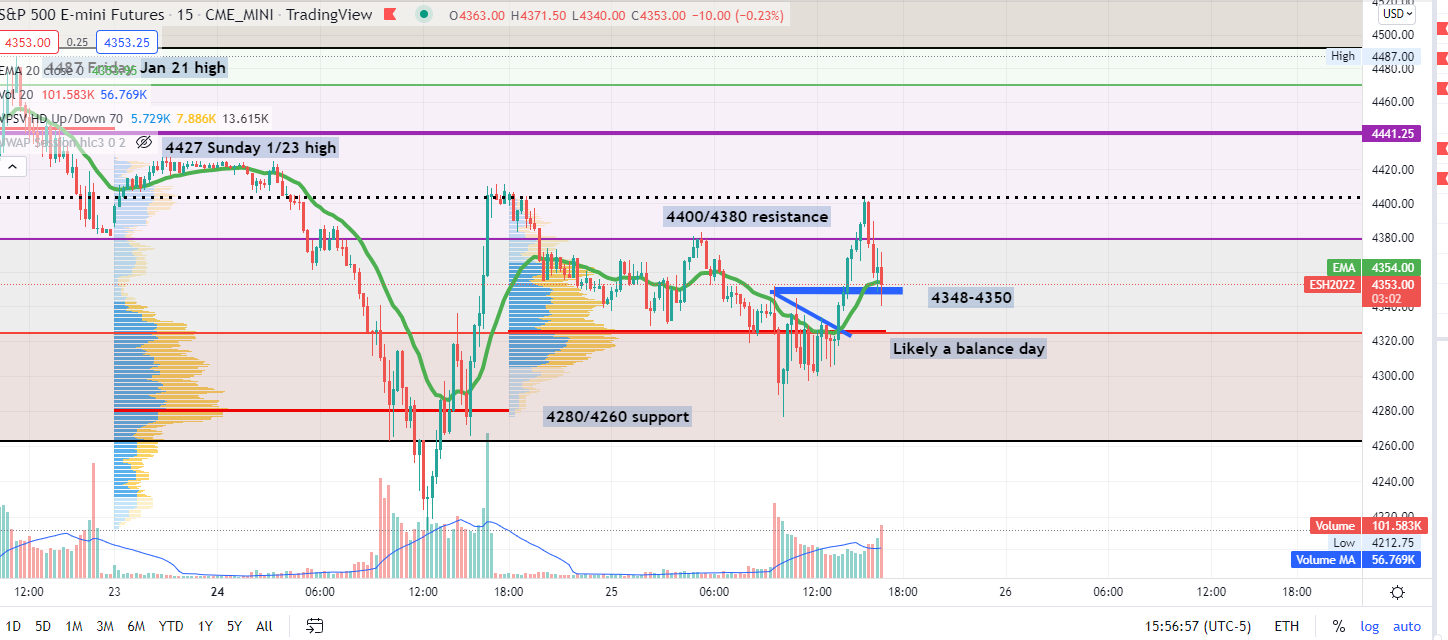

- We’re expecting a balance/range day given the previous session’s massive 200 point or 5% range until price proves otherwise

- Main focus should be bi-directional scalp opportunities via the key levels

- Bulls would need to hold vs 4280/4260 previous point of control area

- Bears would need to hold 4400/4380 current resistance area to stay rangebound

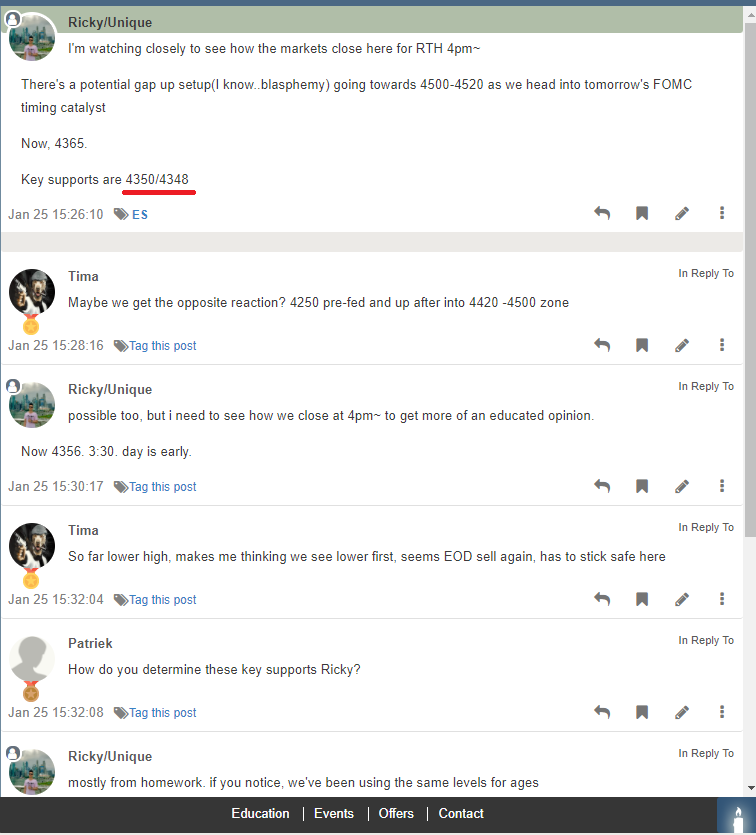

- A decisive break above 4400 could entice large buyers to step into play and head for 4500-4520 backtest within the next few sessions

- A decisive break below 4260 would entice large sellers to revisit yesterday’s 4412.75 temp low and possibly more price expansion to the downside (not our primary scenario at the moment given yesterday’s context)

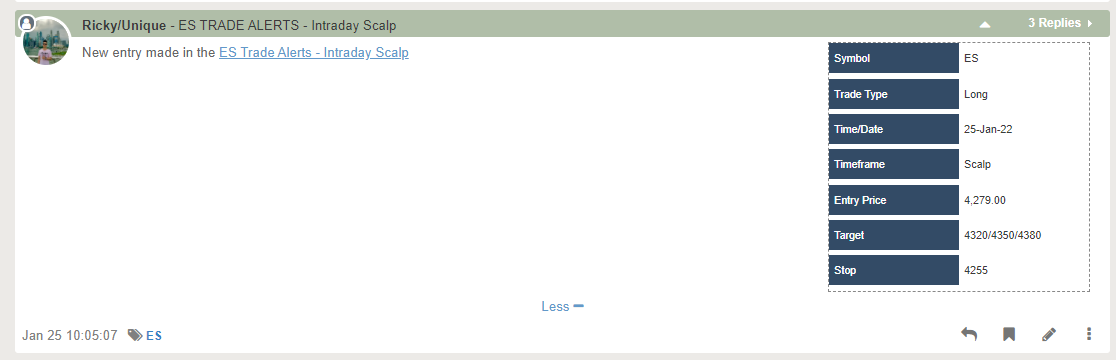

Today's RTH high/low = 4402.75/4276.50 (we bought morning lows)

Also, gave afternoon 4348-4350. Zero MAE (maximum adverse excursion) for +20-25 points, a quick mechanical bounce.

We'll be back tomorrow for FOMC timing catalyst, staying mostly bull biased here so will look for dip buys tomorrow morning if so.