Market Analysis for Sep 20th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Big Sell Underway, Weekly 20EMA + Monthly Lows

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

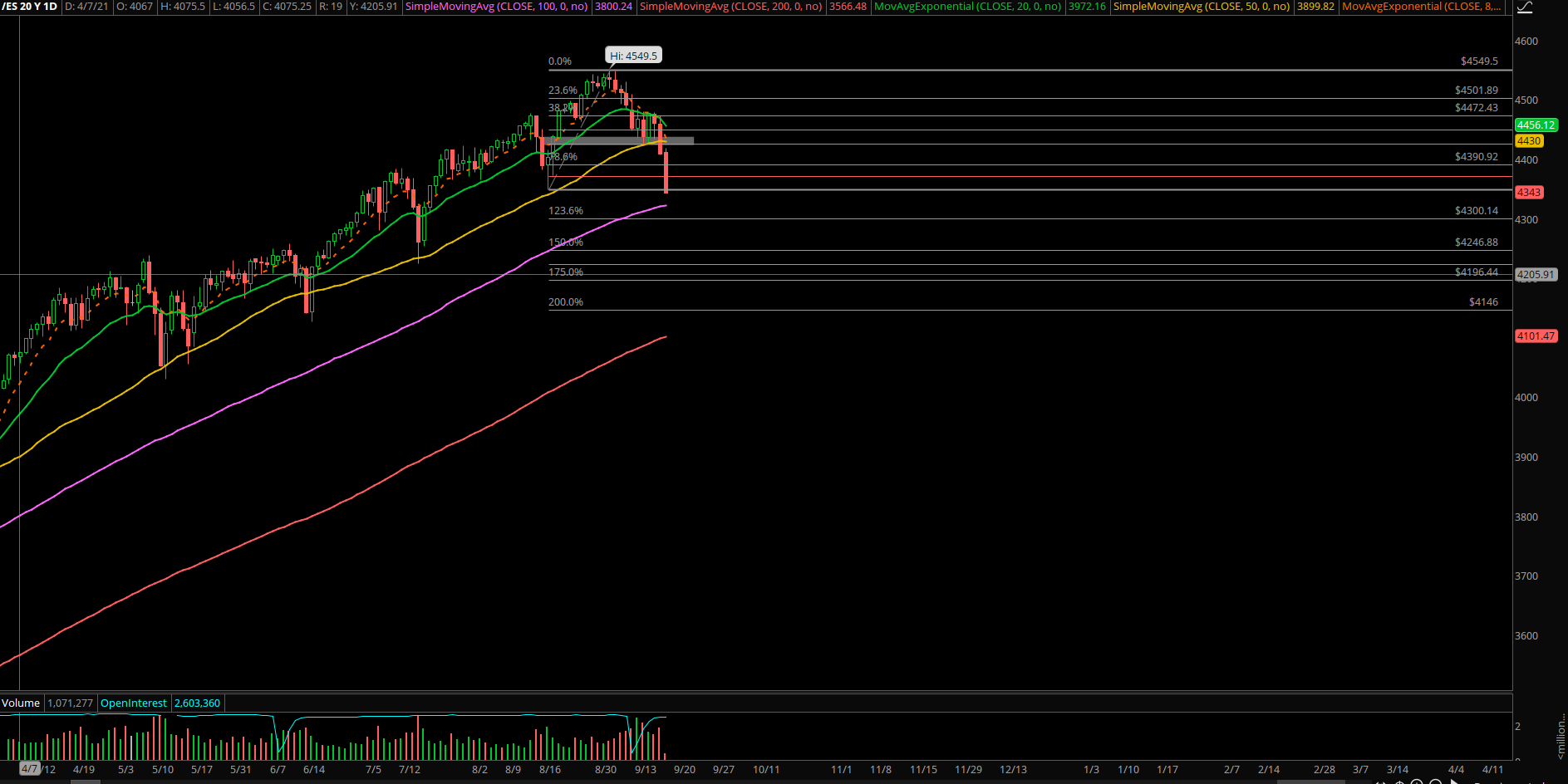

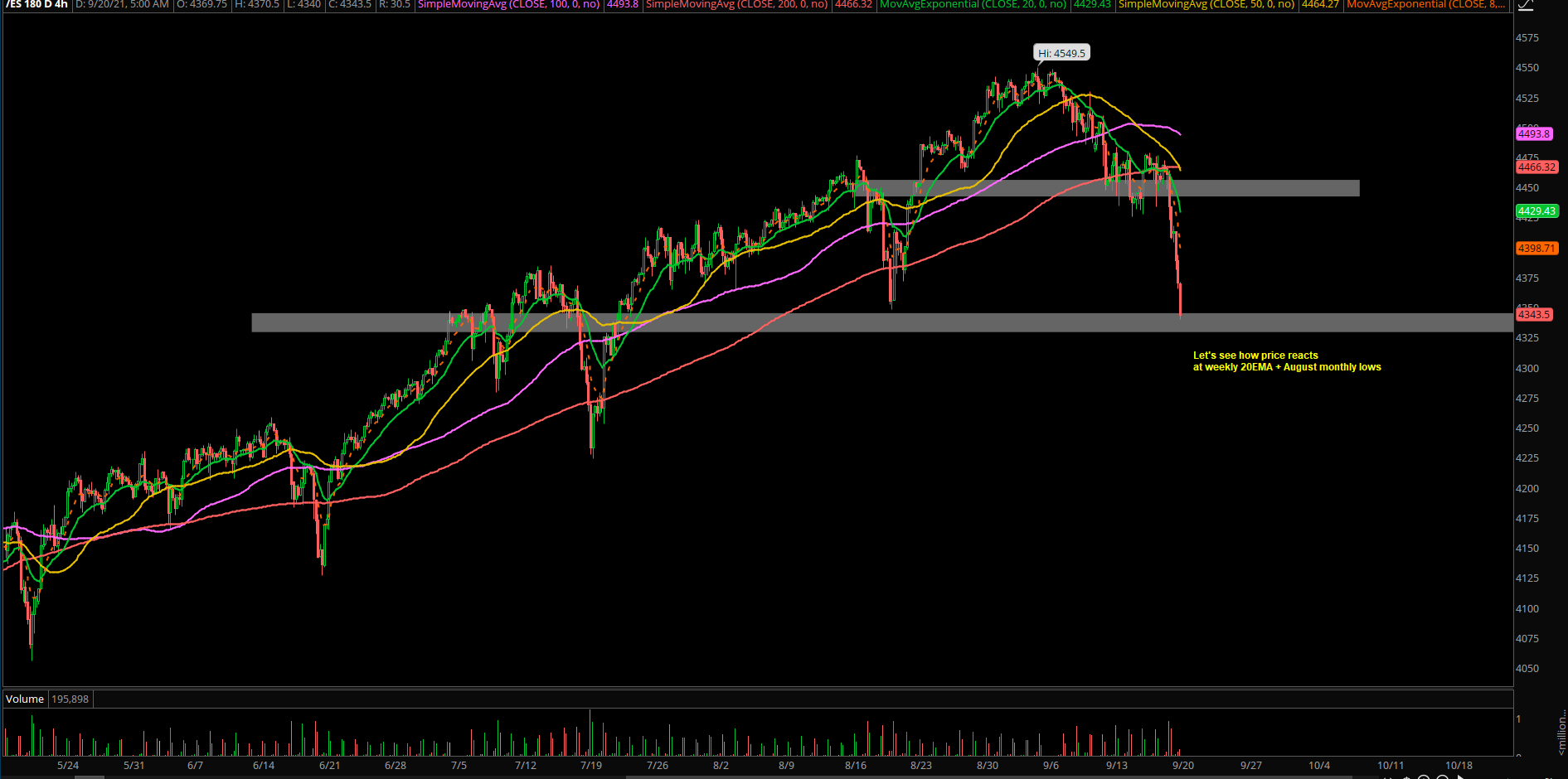

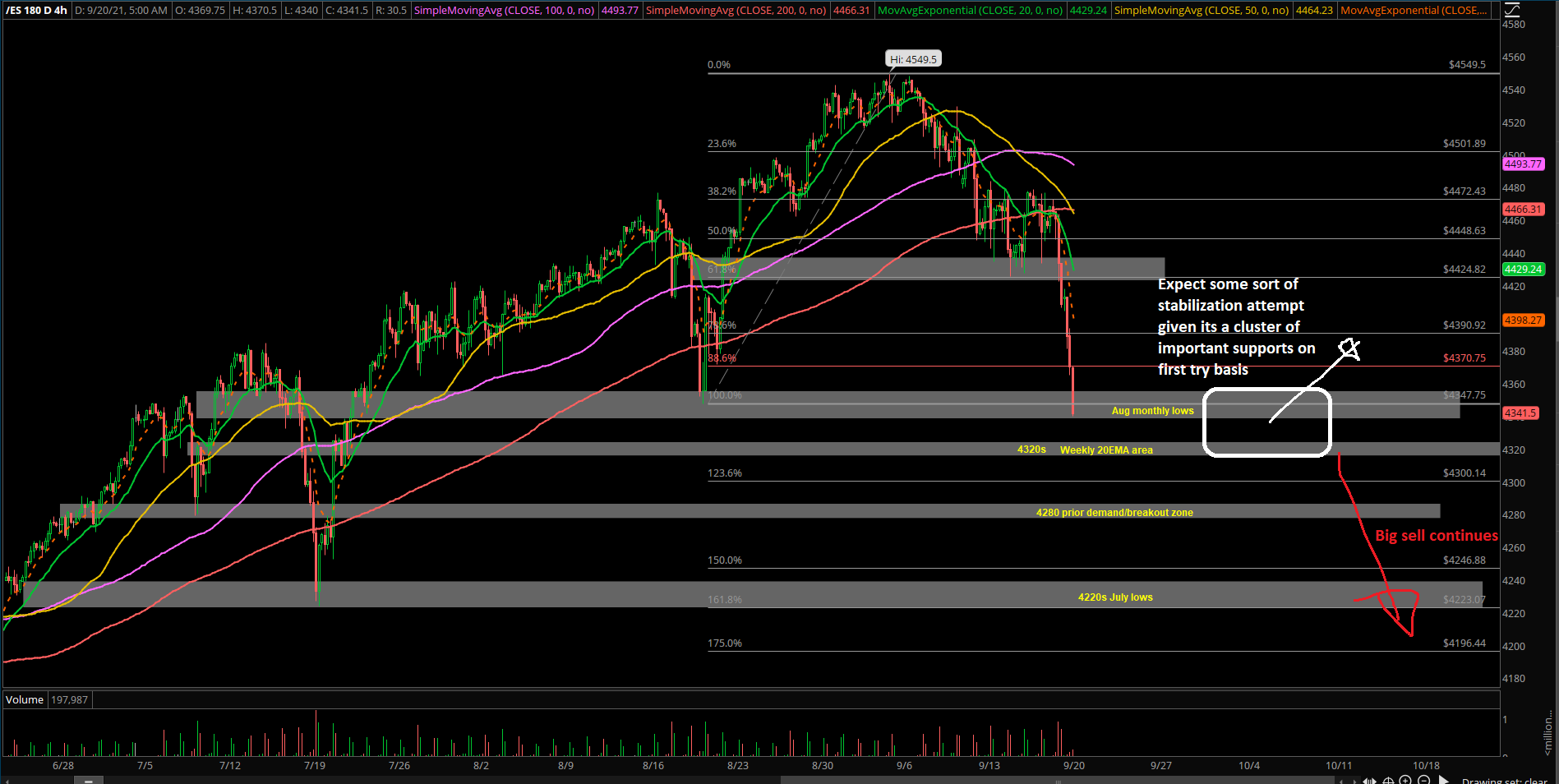

- Big sell underway as the price action closed below our key support of 4425 last Friday

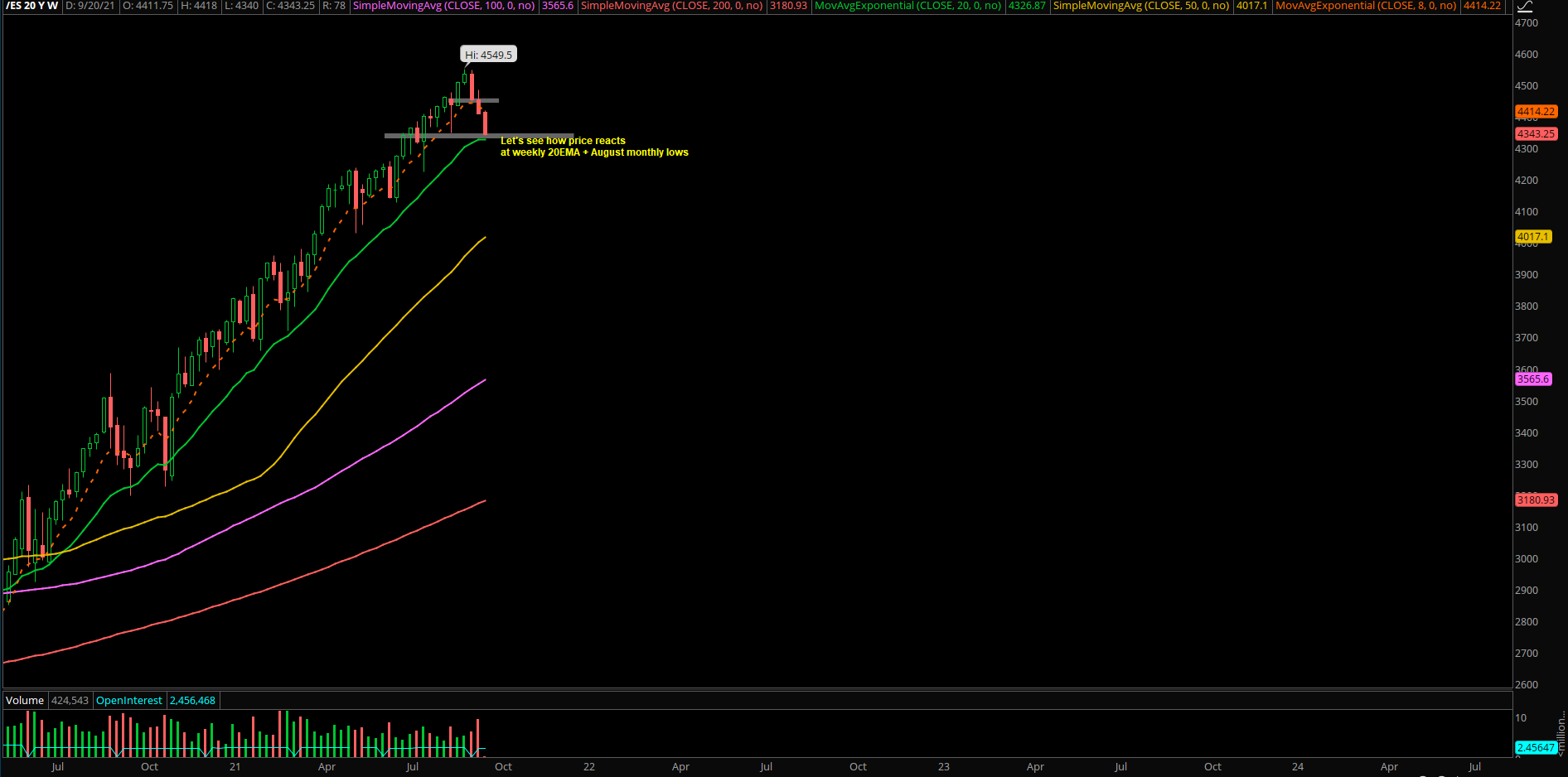

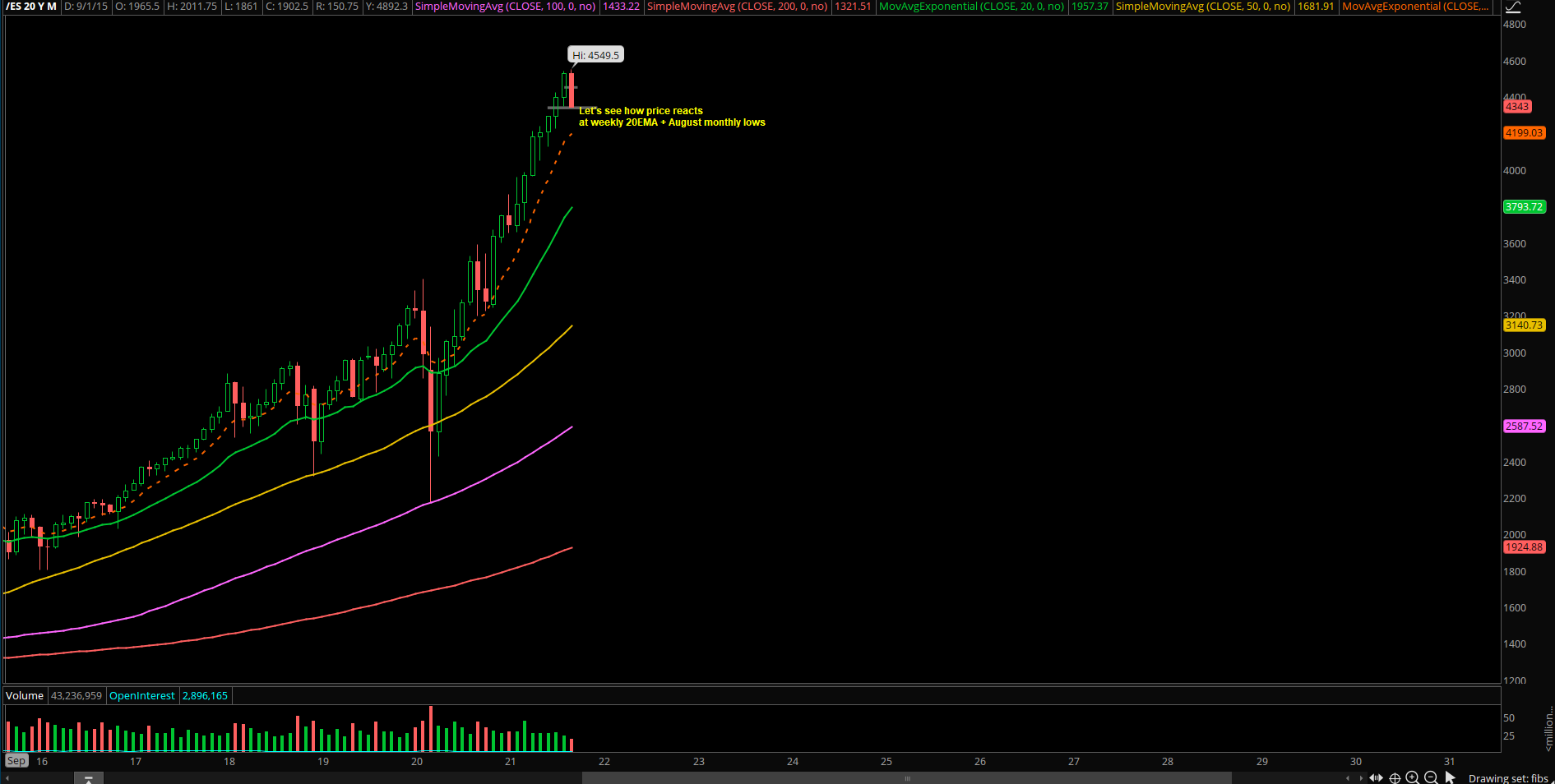

- As of writing, ES -4.5% off ATHs, NQ -4% off ATHs. ES backtesting August monthly lows already at 4330s and NQ backtesting 61.8% of the August around 15080s. Let’s see if the more stable NQ sibling continues into this week or whether it changes character by accelerating downside

- All daily bounces that are below 4420 are treated as deadcat bounces. Bulls would need at least a minimum of 1 daily close above 4420 before price action could confirm a temporary stabilization event

- ES weekly 20EMA = 4320s, typically this is the area where all types of pullback have stabilized in the past few years, at least on a first try basis. This means that we expect bulls after the RTH open to attempt an intraday stabilization event

- If that doesn’t happen then it would tell us a lot about the current momentum and structure of the breakdown; bears are not here to play around

- If this 4340s-4320s (August monthly low+ weekly 20EMA+below 2std BB lows) area cannot temporarily hold, then next key supports levels for bears to attack are 4300, 4280, 4250, 4200

- A quick deadcat would target back to 4365/4385 area (the 1hr 8/20ema trending resistances)