Market Analysis for Sep 10th, 2021

Gummy bears again or finally a surprise?📣

Just quick observations (I'm not here, but still outperforming):

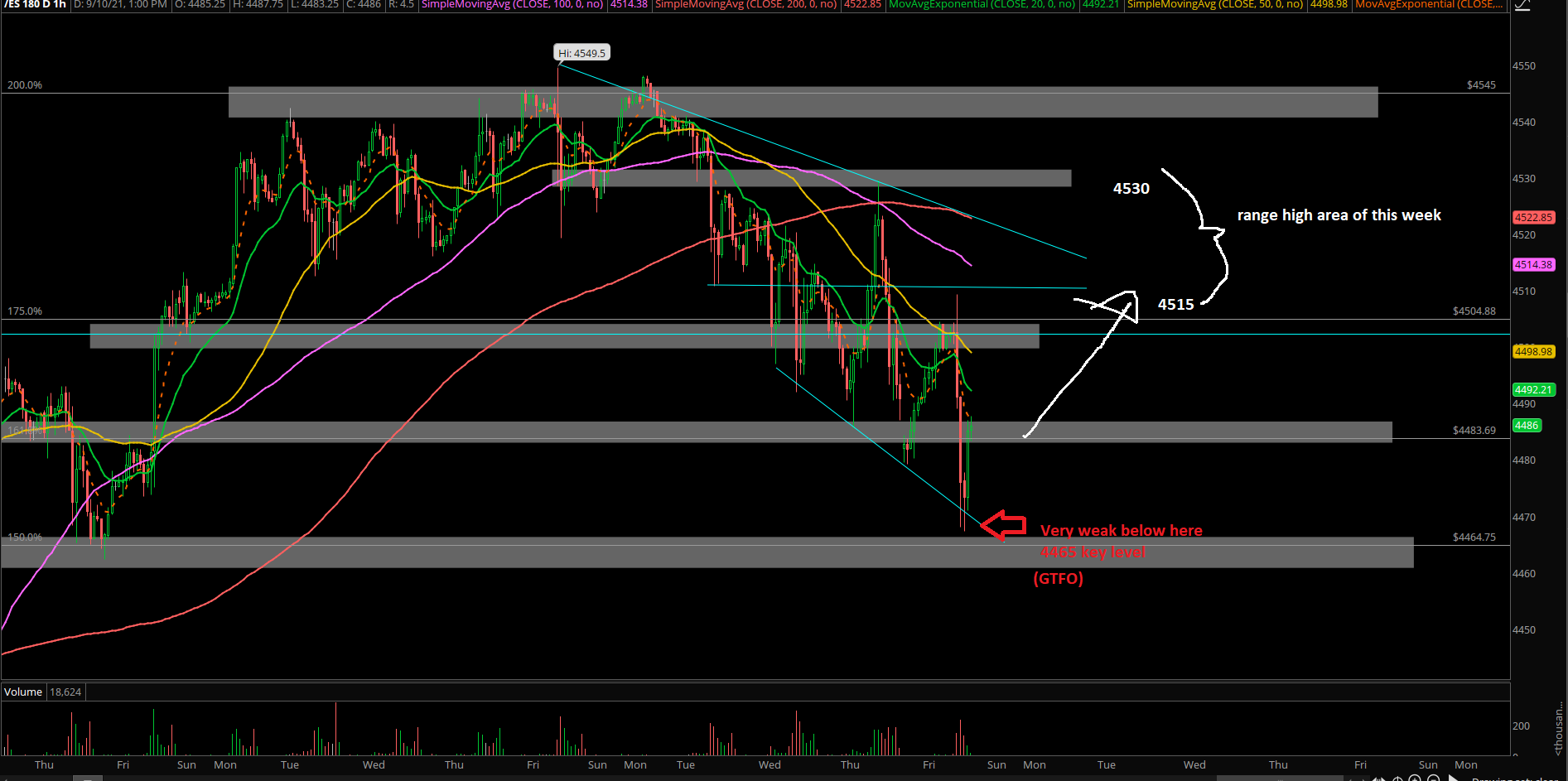

- If you recall, we took short-term profits at last week's high (ES+RTY) and hedged our tech heavy stocks portfolio (NQ)

- Not many surprises as market is churning in early Sept, decent little pullback on the indices into their respective trending supports over the past few days

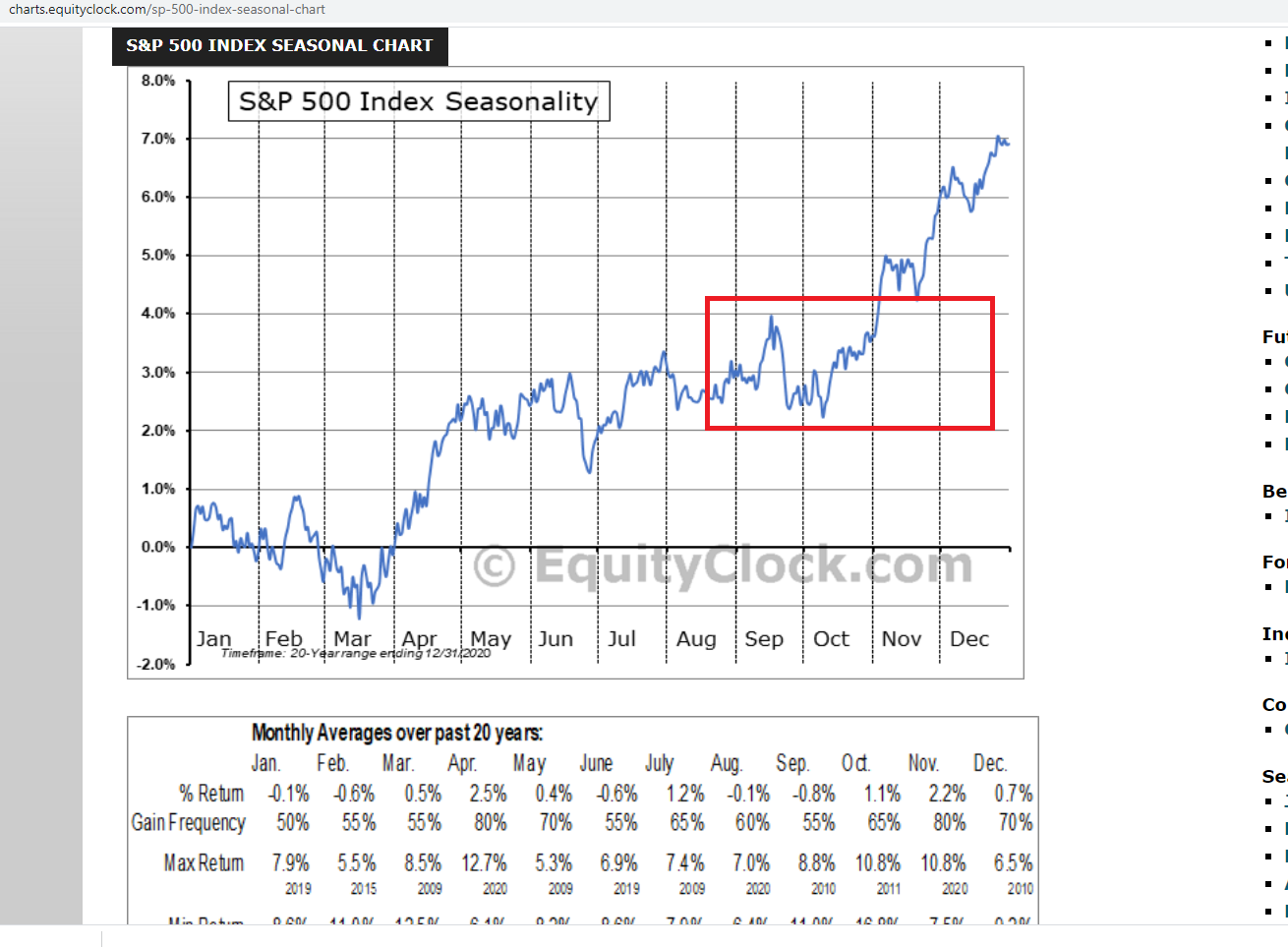

- S&P seasonality looking for a pump into mid-Sept. Now, 4492 ESU21 (Sept) or ES 4482 (ESZ21 Dec contract). NQ still stuck between 15500s-15600s, high level consolidation doing well.

- Currently, seeing decent short-term risk vs reward for ES longs...vs daily 20EMA area. Targets back to 4515/4530. Must hold this week's current low or likely wrong/more downside. (Dec chart below)

- Be back next week👋