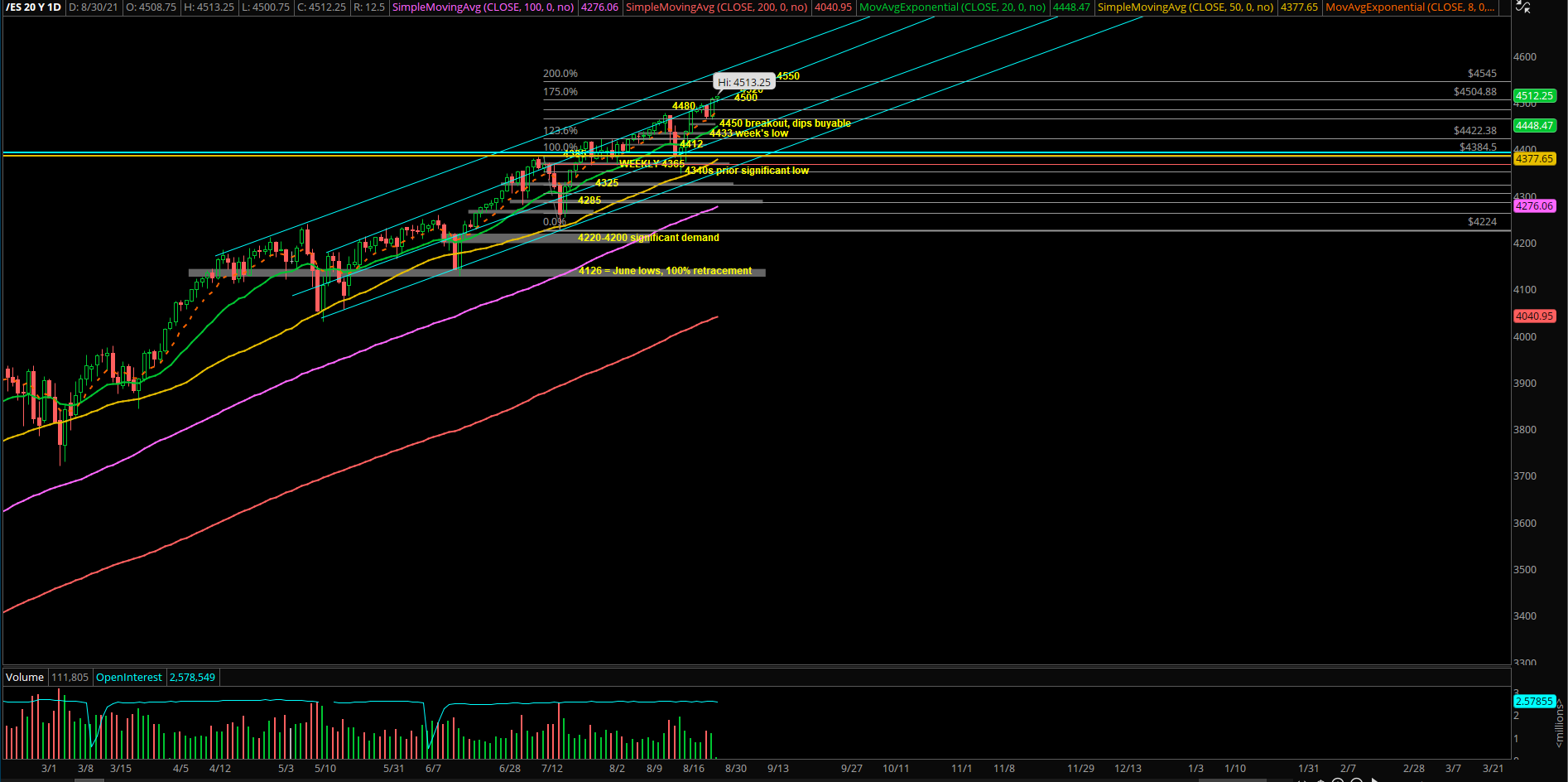

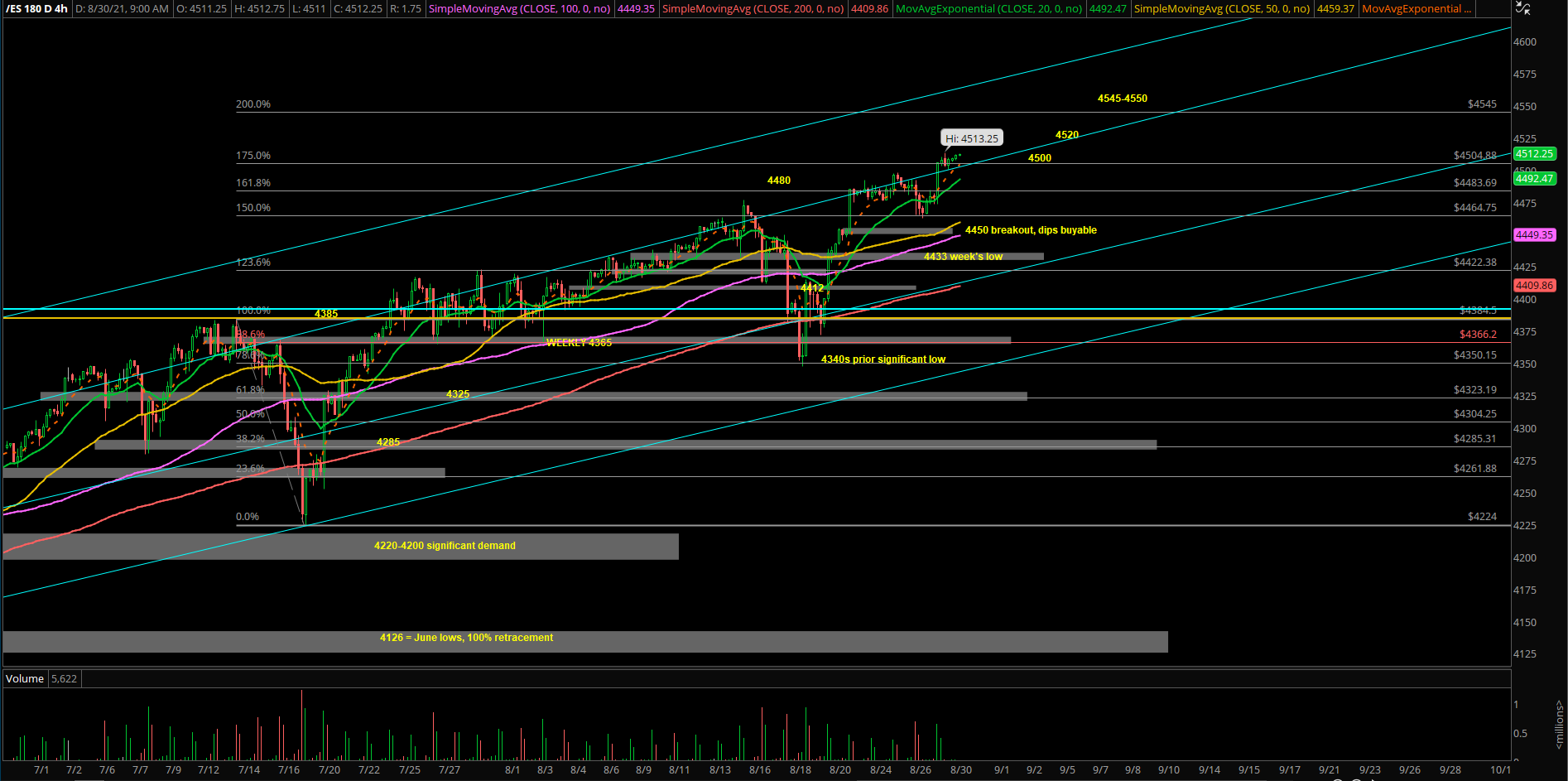

Market Analysis for Aug 30th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Prescient and Actionable, New ATHs into Month End

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

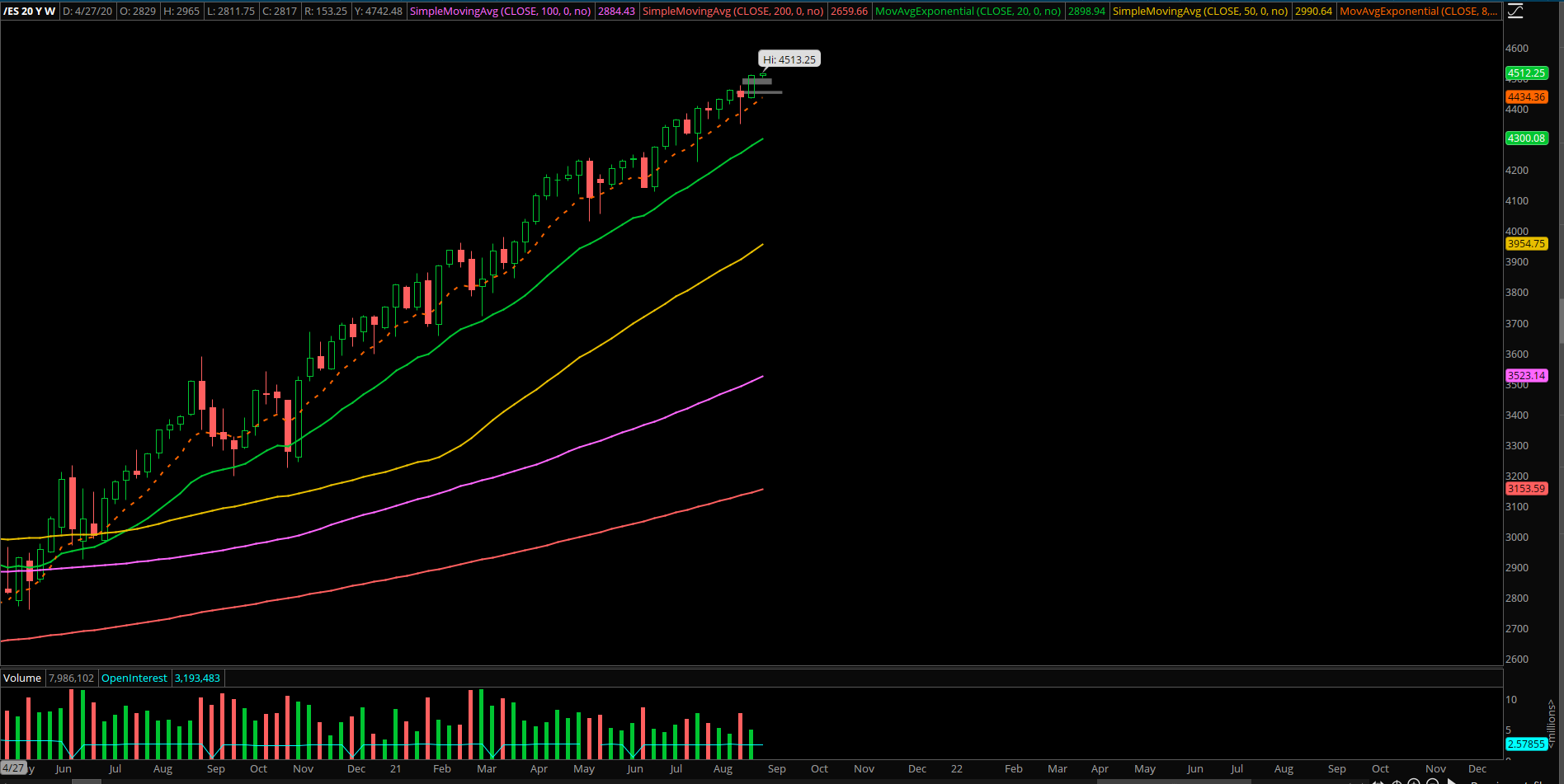

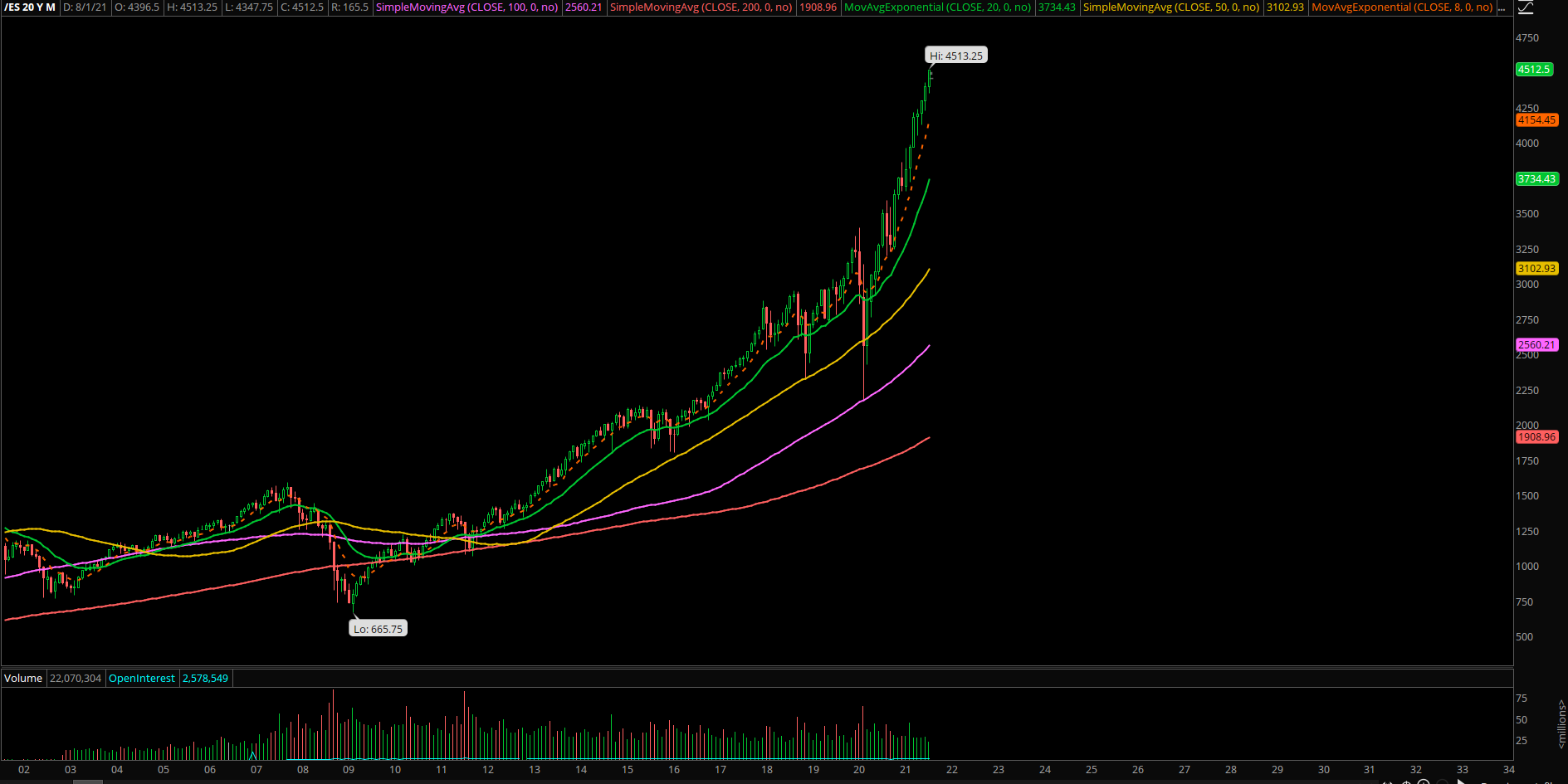

- Zero surprises as we filtered out the noise and listened to the market setups. Price action hovering at fresh all time highs as we head into another month end closing print. Déjà vu, we keep extracting alpha from the markes, same old process, rinse and repeat until music stops…it’s a bull train for a reason

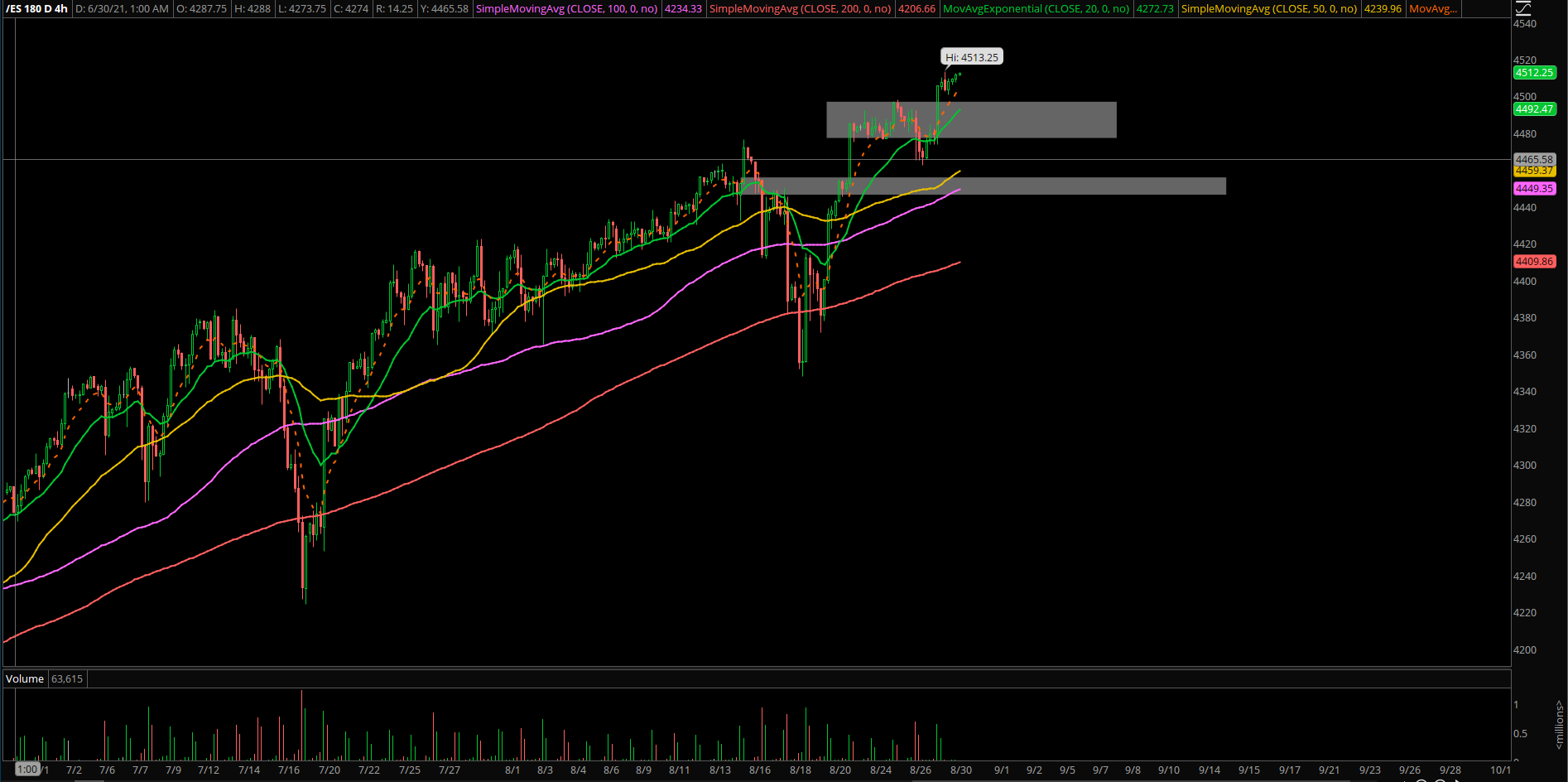

- If you recall, last week formulated a solid on-trend basing pattern for the majority of the week and then finally broke out to new highs via the Jackson Hole timing catalyst excuse. Essentially, we noted in the Thursday premarket report, where we may get a potential window of opportunity of a dip back into support zone in order to accumulate cheap long positions given the risk vs reward. Our scenario turned into reality and now we’re enjoying the fruits of our labour

- Going into this week, immediate supports are 4500/4492/4480. Any dip remains buyable into Tuesday’s end of month high print. Then, we need to be careful of early Sept for a quick dip potential and then a pump up again into mid Sept according to seasonality stats. We’ll adapt on the fly

- Any breakdown below 4465 will be treated as a breakout failure, meaning get out of its way until it stabilizes/dust settles as downside range would open up again into 4450/4435..etc