Market Analysis for Aug 16th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Likely Slow and Steady Grind Until Jackson Hole

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

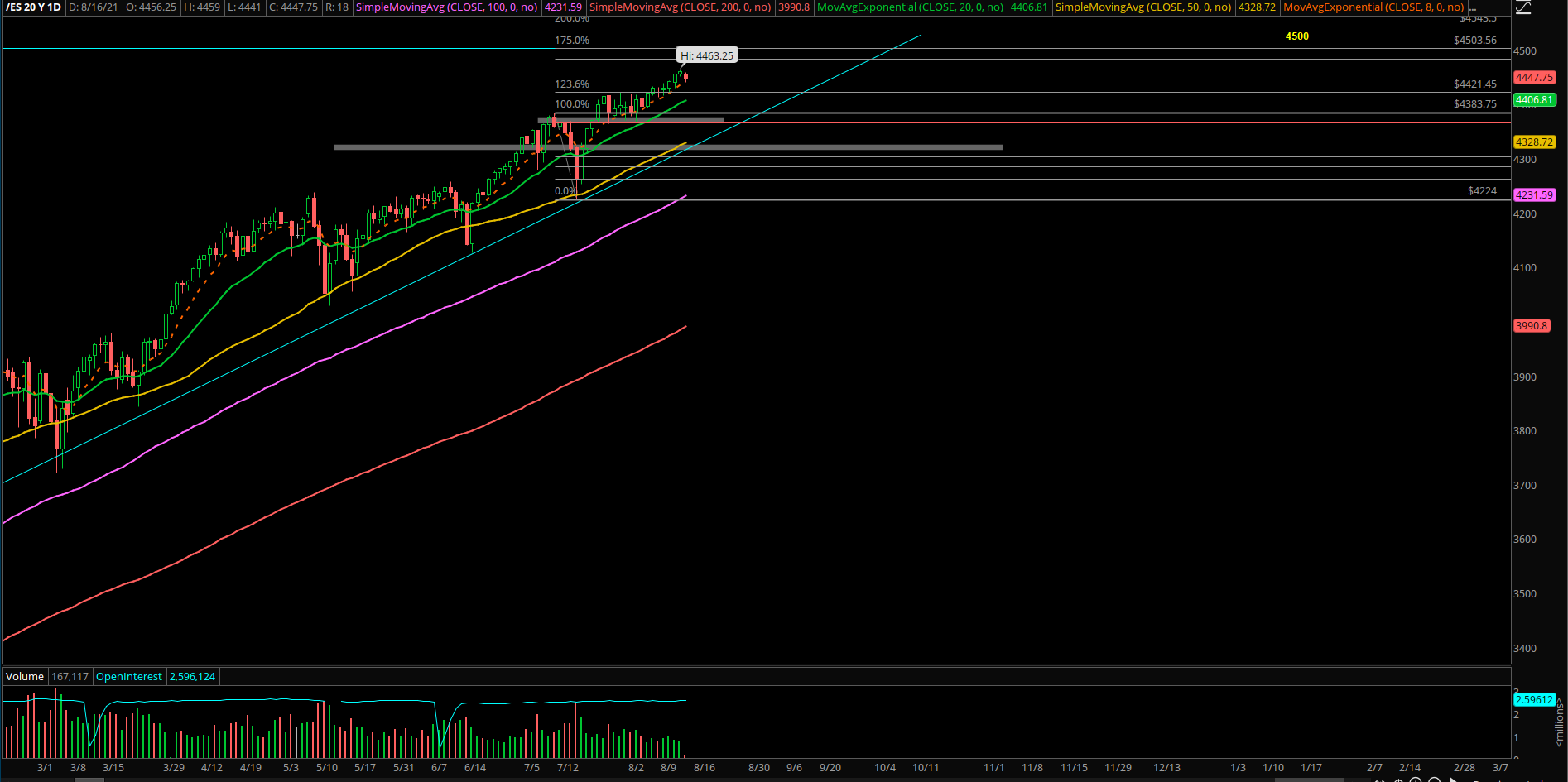

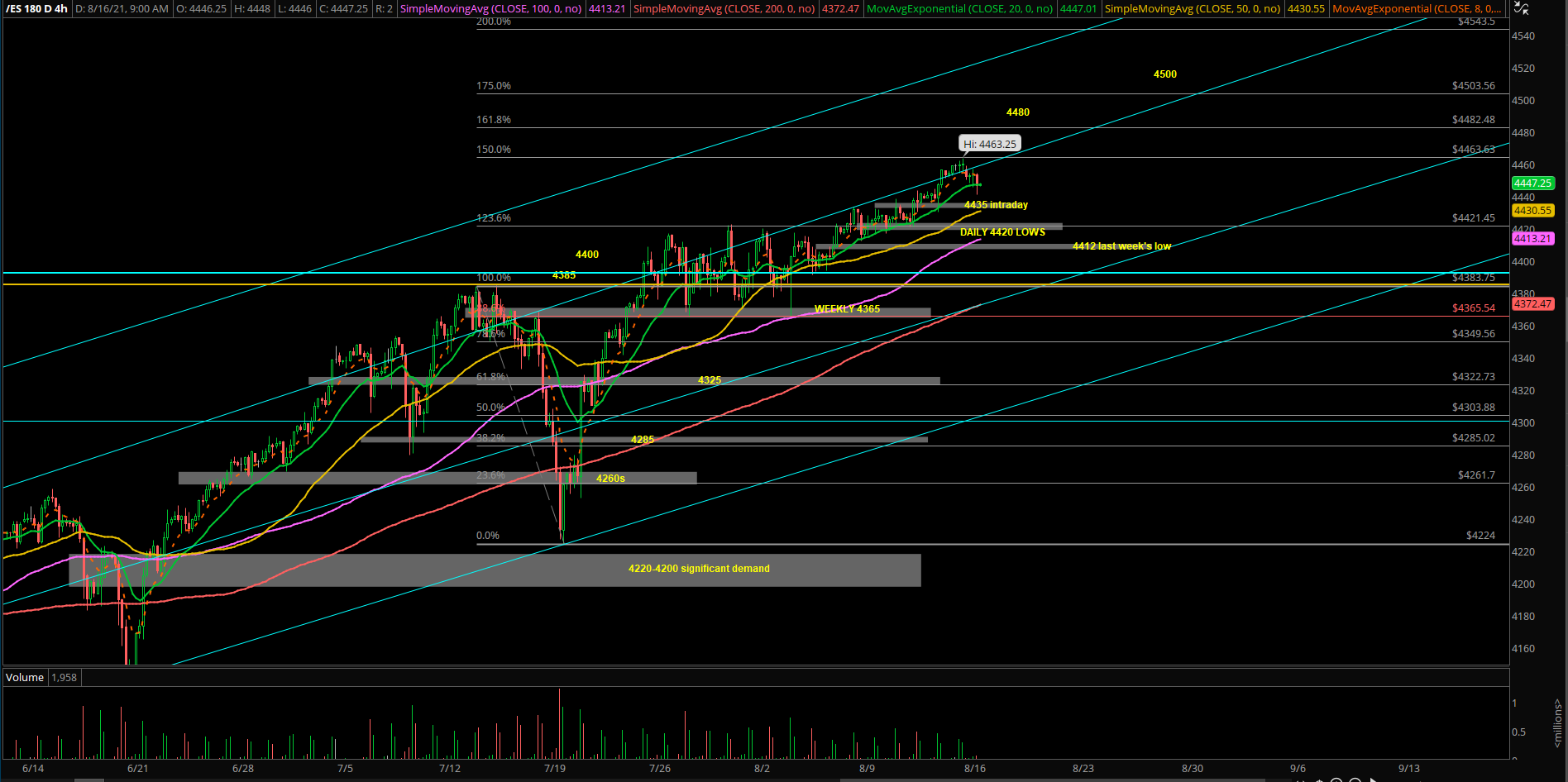

- Last week, the ES market gained +0.75% or 33 points as the slow Summer grind up movement continues its assault. The trending supports keep moving slightly higher once higher lows+higher highs establish themselves and market likely in a grind until Jackson Hole near EOM

- Market right now testing the daily 8EMA trending support as we enter this new week

- ES support levels moved up a little; all intraday dips remain buyable when trending above 4435, grind up into 4480/4500. Use 4420 as daily timeframe must hold support (EOD pricing)

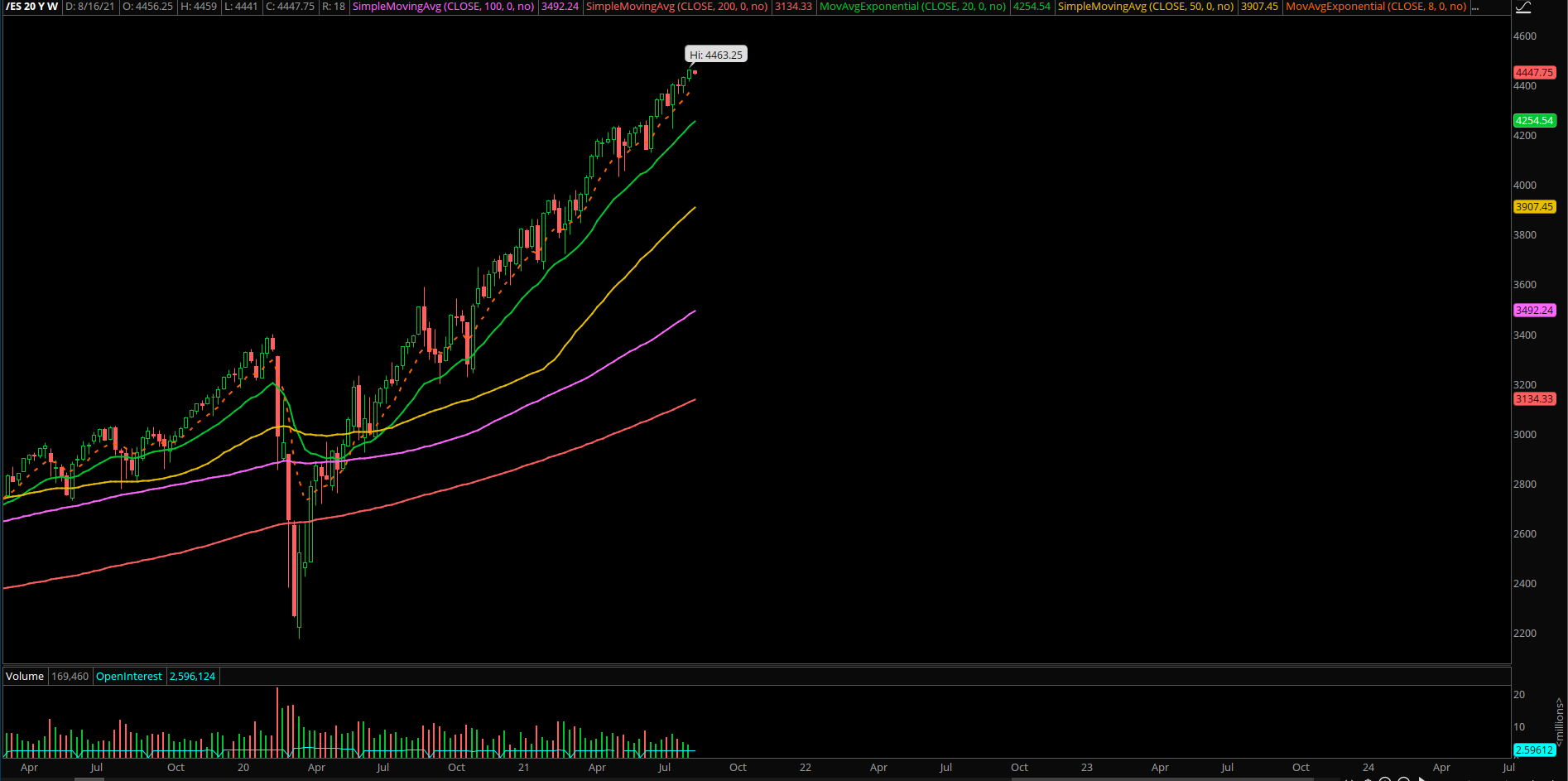

- Zooming out, all weekly dips must stay above last week’s 4412 to be deemed as buyable, otherwise risk opens to 4365, then 4325-4300. Level by level approach

- A break under 4420 intraday would be your first big warning to short-term momentum changing that could lead to a bigger timeframe change on weekly

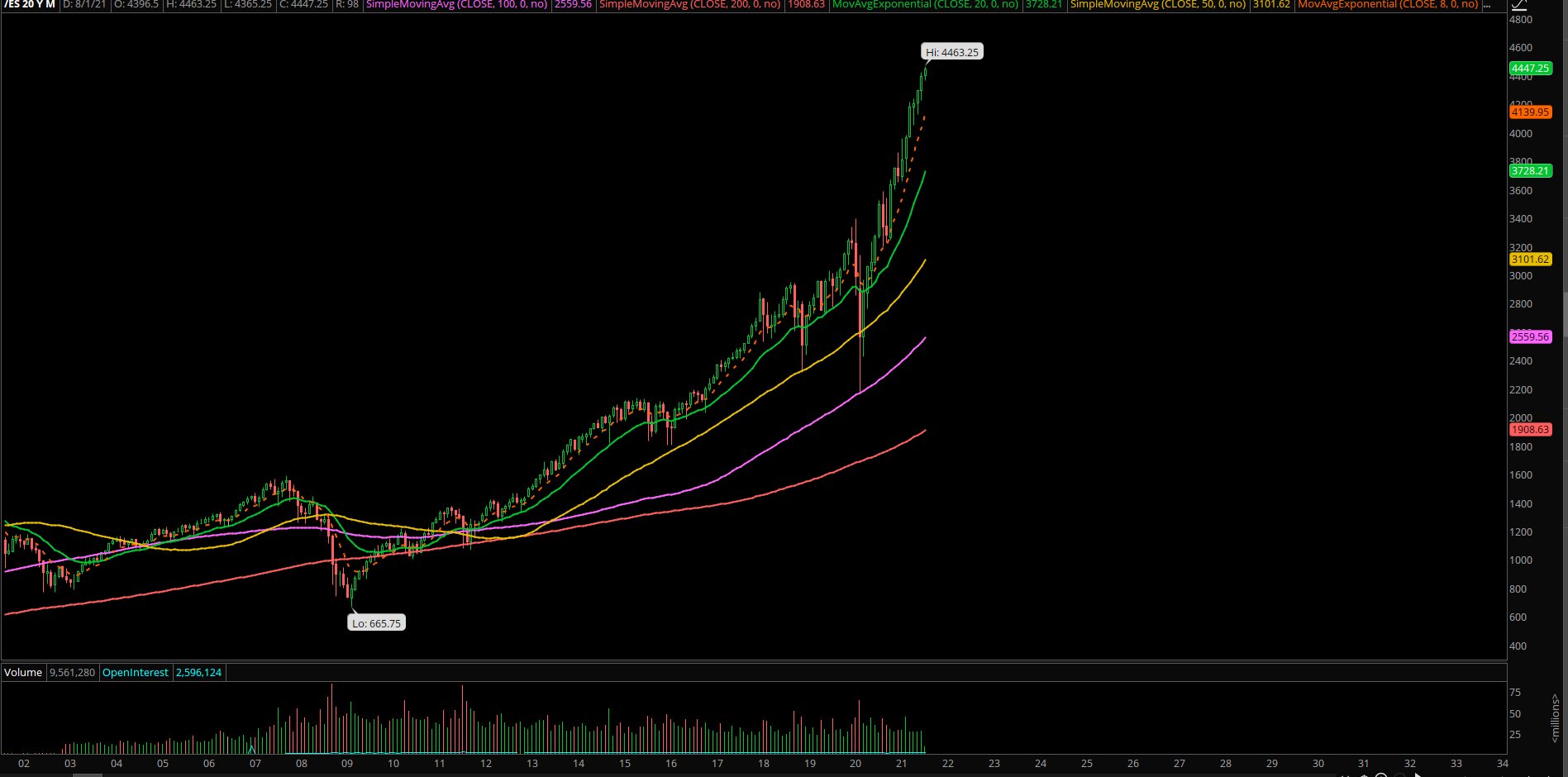

- Different timeframes here, know which one you are participating into and reconfigure stops/risk

Same context (copied and pasted):

- Overall, not much has changed because it’s August and the environment fits with historical stats alongside with trading volume drying up across the indices and a lot of the important stocks

- As demonstrated in Ricky’s service, many of his bonus stock setups in the past few months have significantly outperformed the market benchmark of S&P 500. Names such as AMD, AAPL, ADSK, ADBE, AMZN, DOCU, NVDA, REGN, SE, TSLA. The key is to pick and try and ride the ‘best in breed’ setups until they rotate/lag/invalidate and also cut losers aggressively in order to have your money compound in better setups. There are lots of decent setups providing quick +15-20% returns via common shares alone and the occasional +30% runners.

- Again, we have to manage risk on a tighter leash here as there’s still not much follow through in the equity indices(typical, slow Summer environment), it’s a very specific sector rotation and also concentrated into specific individual names. As we discussed in Ricky’s service over the past couple weeks, XLF+XLB (financials and materials) outperforming their counterparts and leading nicely with this ongoing breakout. See if XBI stabilizes a bit this week to take over leadership potential

- Know your timeframes here, fairly methodical lazy river grind up thus far as we expected given the past couple months of preparation for the Summer trading environment. Racket up stops and try to hang on tight for the best performing train setups, cut laggards/underperformers, rinse and repeat