Market Analysis for Jul 26th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Zero Surprises, Weekly Fulfilled 4400 Target

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers). In addition, we share bonus setups across commodities such as GC/GOLD,CL/Crude oil, PL/platinum,ZS/soybeans and individual stocks from time to time in order to generate more alpha/outperform.

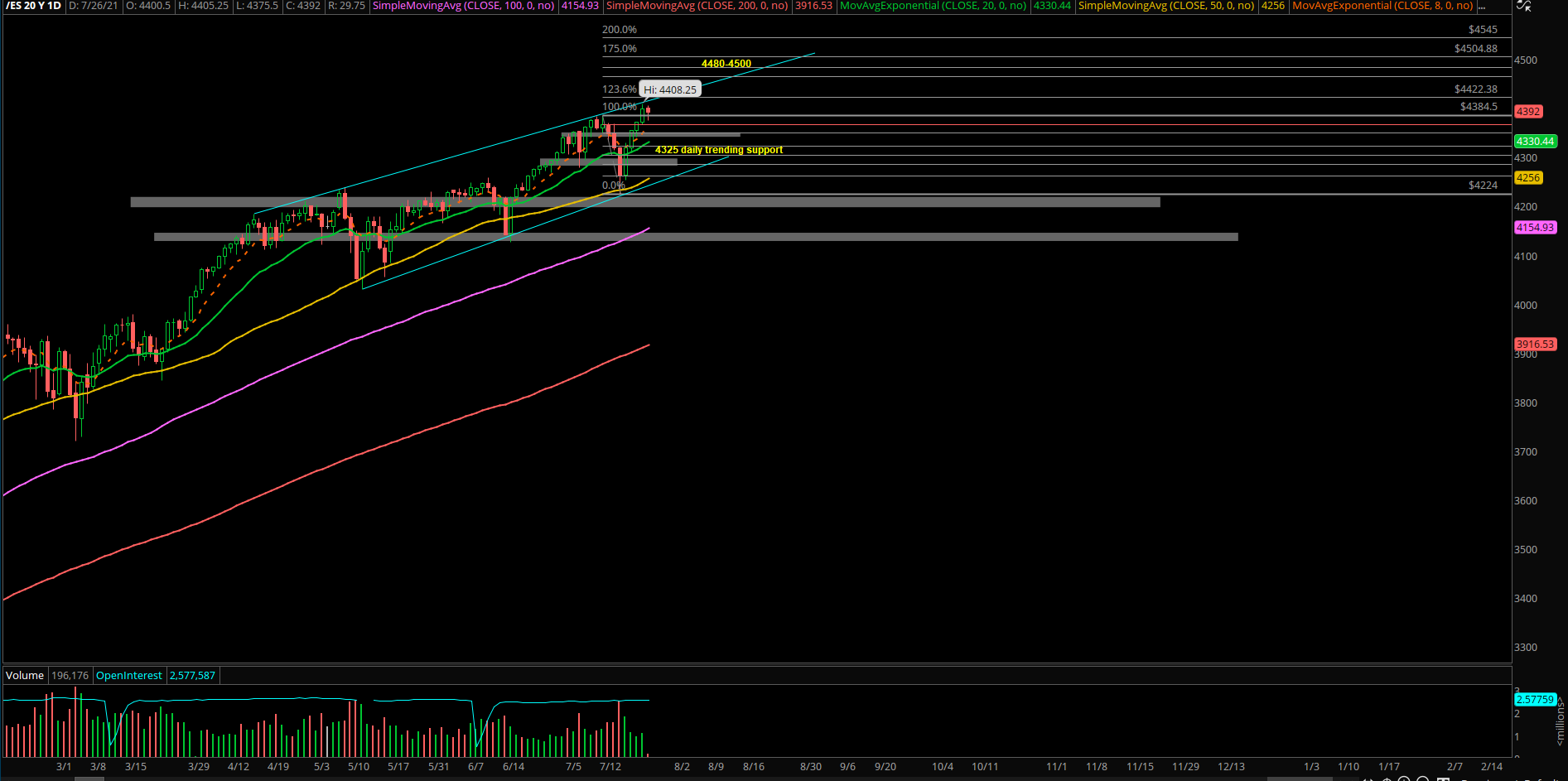

- No surprises as last week fulfilled and closed at our 4400 target as expected on Friday.

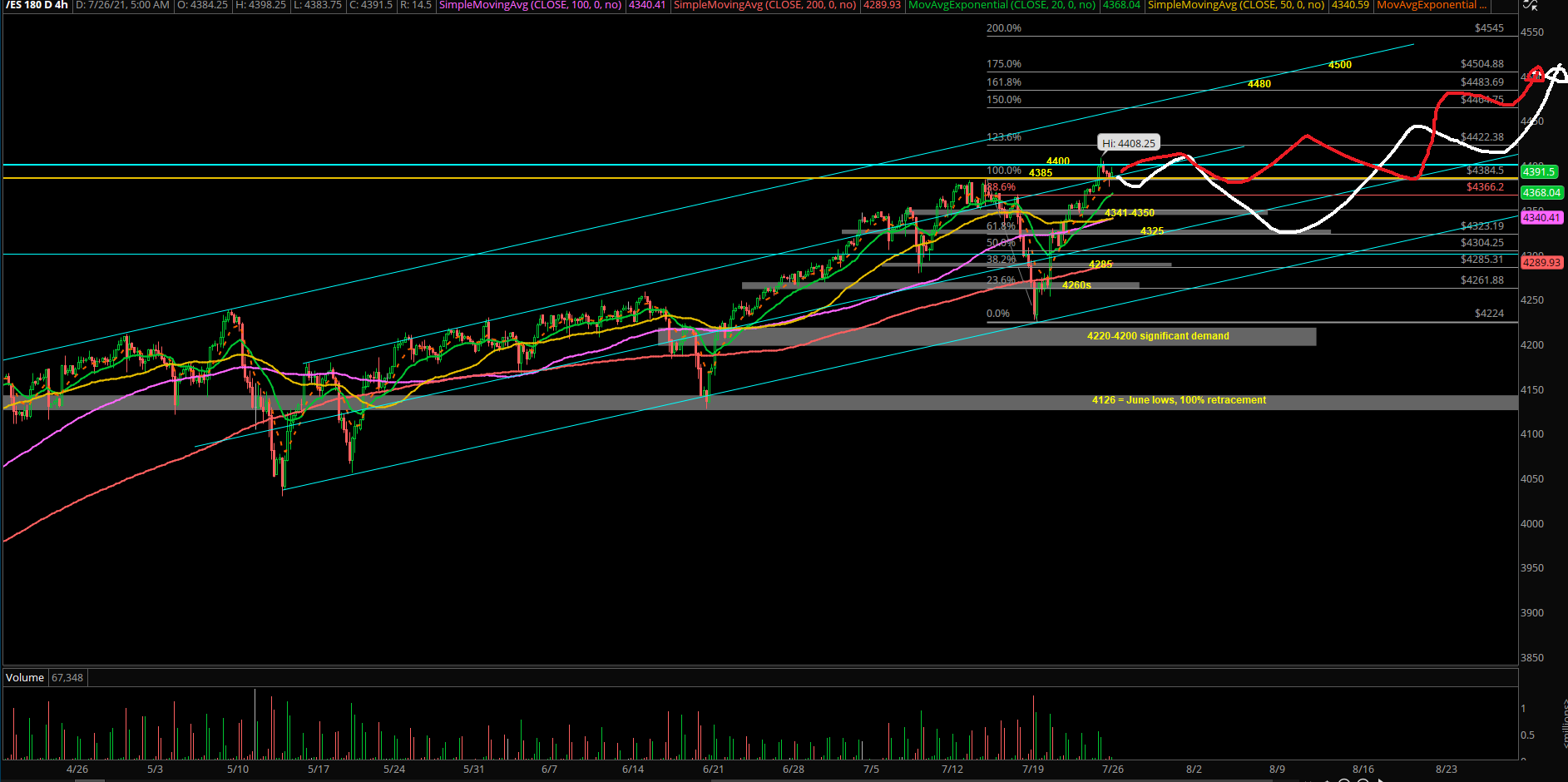

- If you recall, the market followed the 4hr white line projection as the bulls kept the tradition alive for Friday high close.

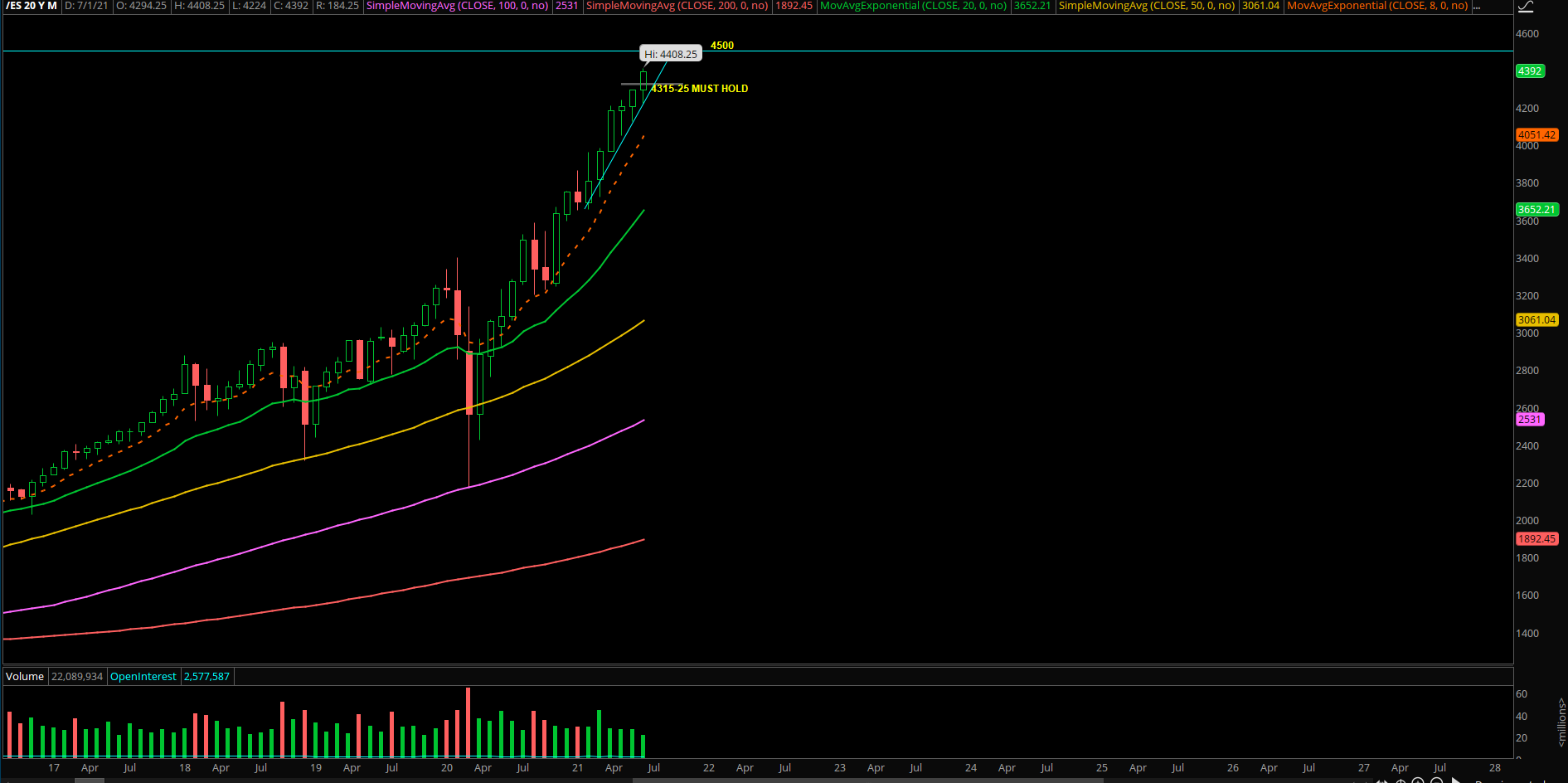

- All short-term targets have been fulfilled. The current structure and price action is working on a grind up breakout context into 4480-4500 as we head into EOM + August. (all dips above 4325 remain buyable, trending support will keep moving higher as higher lows form)

- A daily below 4325 is needed to entice real bears come into the game. Otherwise, market in an accelerated trending phase.

- A stack of megacap+large cap earnings this week so manage overall risk as many of our best in breed stocks are at all time highs already

- Know your timeframes here, fairly methodical lazy river grind up thus far as we expected given the past few weeks of preparation

- We’ve established new 4hr white/red line projections; white>red higher odds for now, same end goals. Adapt with price.

- Bonus area: keep close tabs on RTY and YM as they’ve been doing a multi-month bullish consolidation pattern. RTY tested the multi-month lows area 2100-2080 and produced a temp bottom at 2100 that could be the bottom for the next few weeks to use as a reference point as it gears back into 2300/2350+. Similarly in YM, need to reclaim a breakout of 35k to open up 35.5k/36k+ targets.