Market Analysis for Jul 14th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid –Immediate Supports Holding Strongly For Now

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers)

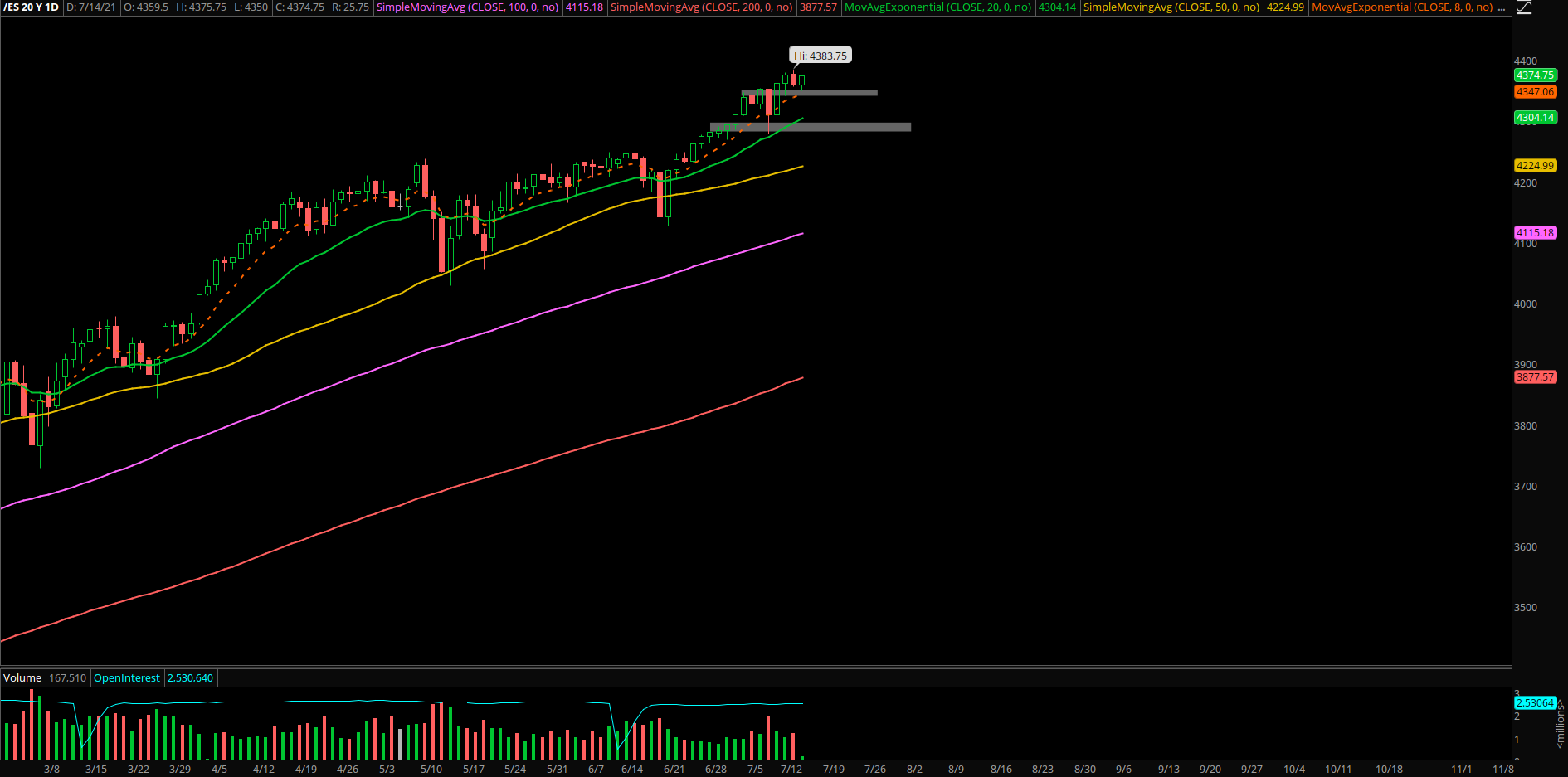

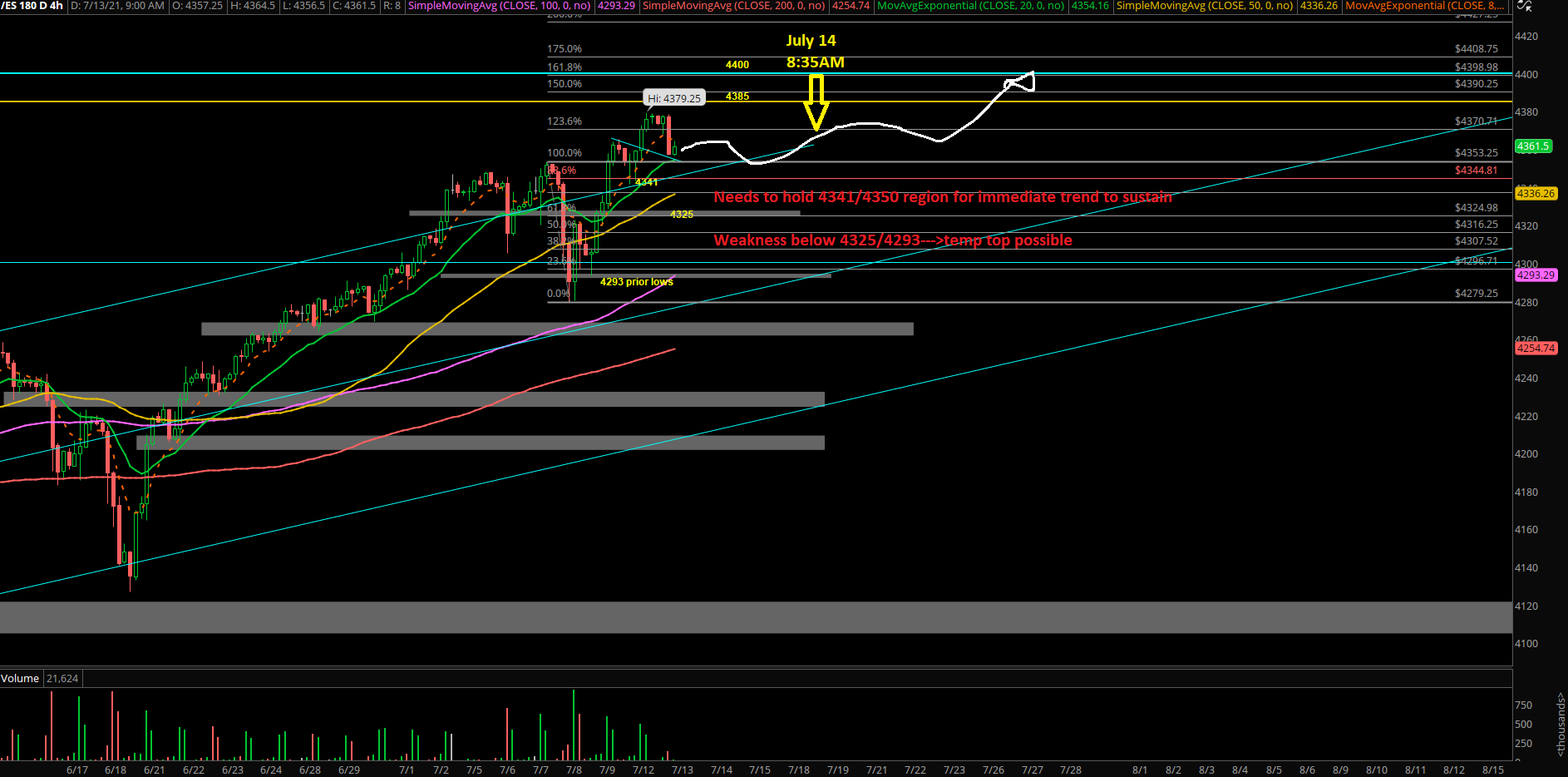

- Tuesday closed at 4359 around the low of the session, but still above our 4341/4350 key immediate supports. Market is still trending above daily 8EMA, meaning it’s still very resilient and powerful on all these shallow dips

- If you notice, most of the dip action has been occurring during the overnight period recently and last night was no exception as it found a footing vs 4350 key level

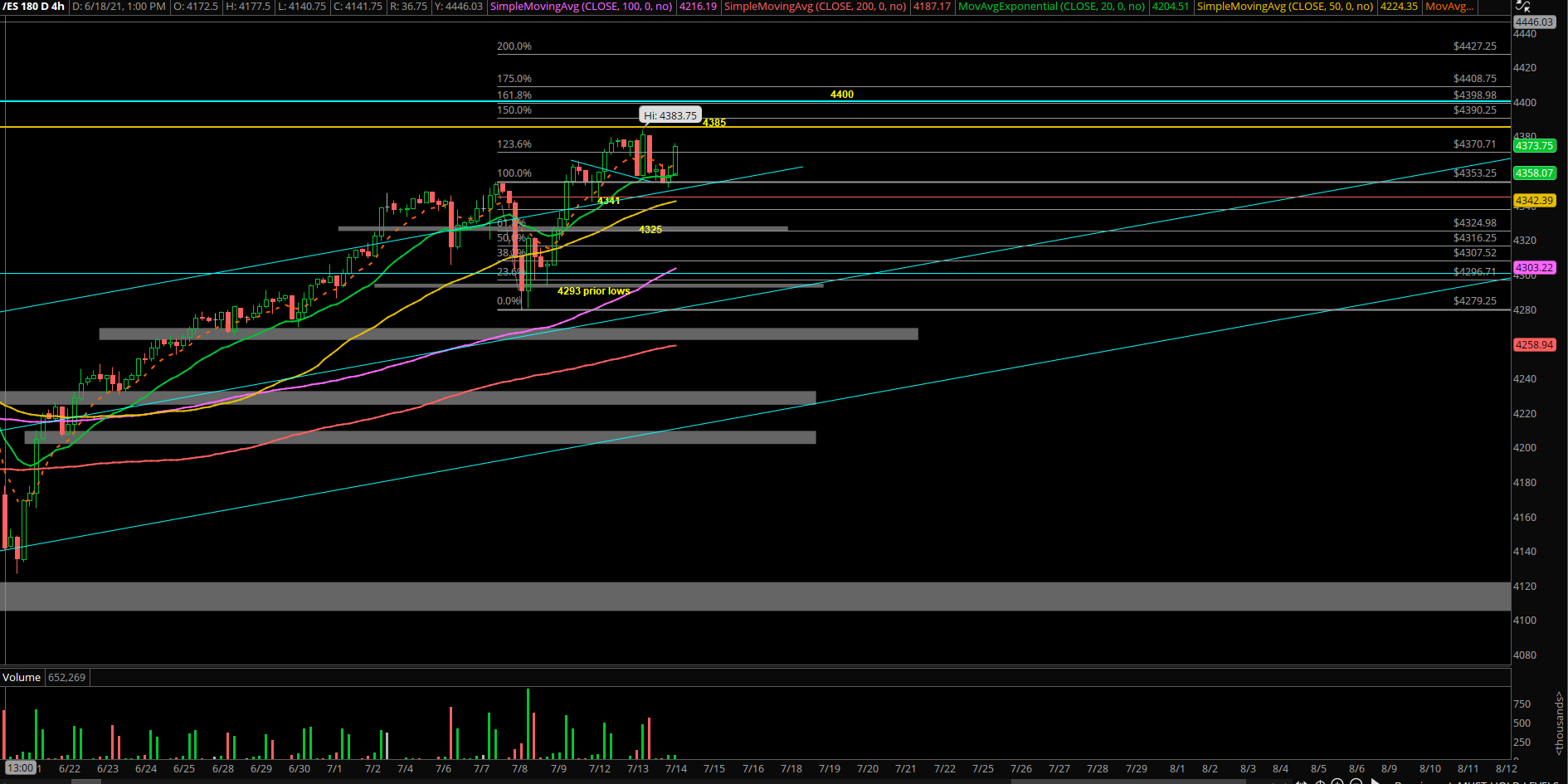

- For now, price action is following yesterday’s 4hr white line projection as the market bottomed vs where it needed vs 4350/4341 region

- Immediate trending supports remain the same at 4341/4350 respectively for intraday dip opportunities. Monday’s low of 4341 should be utilized as short-term momentum strength/weakness as market continues to grind towards 4385/4400 continuation targets

- A break below overnight 4350 would be first warning sign as bulls could be exhausated followed by 4341. Then, more downside risk towards 4325/4293. A daily close below 4293 would likely mark a temporary top

- As discussed yesterday in our service, with ES close to 4400 + NQ 15k targets, it’s very important to manage risk exposure and trim positions/take profits accordingly. Eg. a few of our ‘best in breed’ stocks are at or nearly fulfilling respective targets. Doesn’t hurt to take profits at/near pre-determined levels. Then, rotate accordingly, raise cash and keep compounding gains %

- Know your timeframes and system here, whether you are a scalper, swinger or a little bit of both, this environment is still about shallow dips and trying to hang on for dear life

General theme (unchanged past few days):

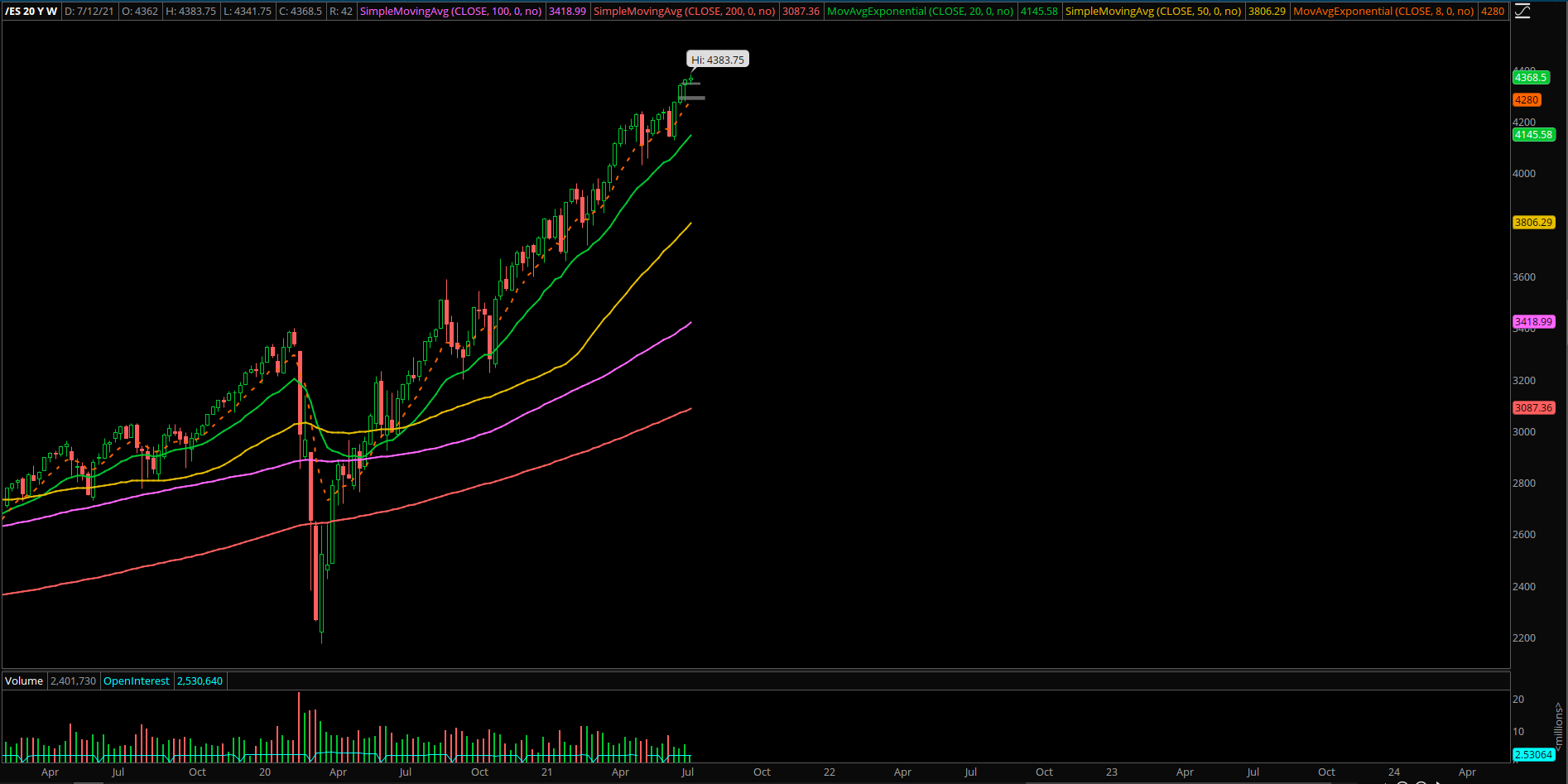

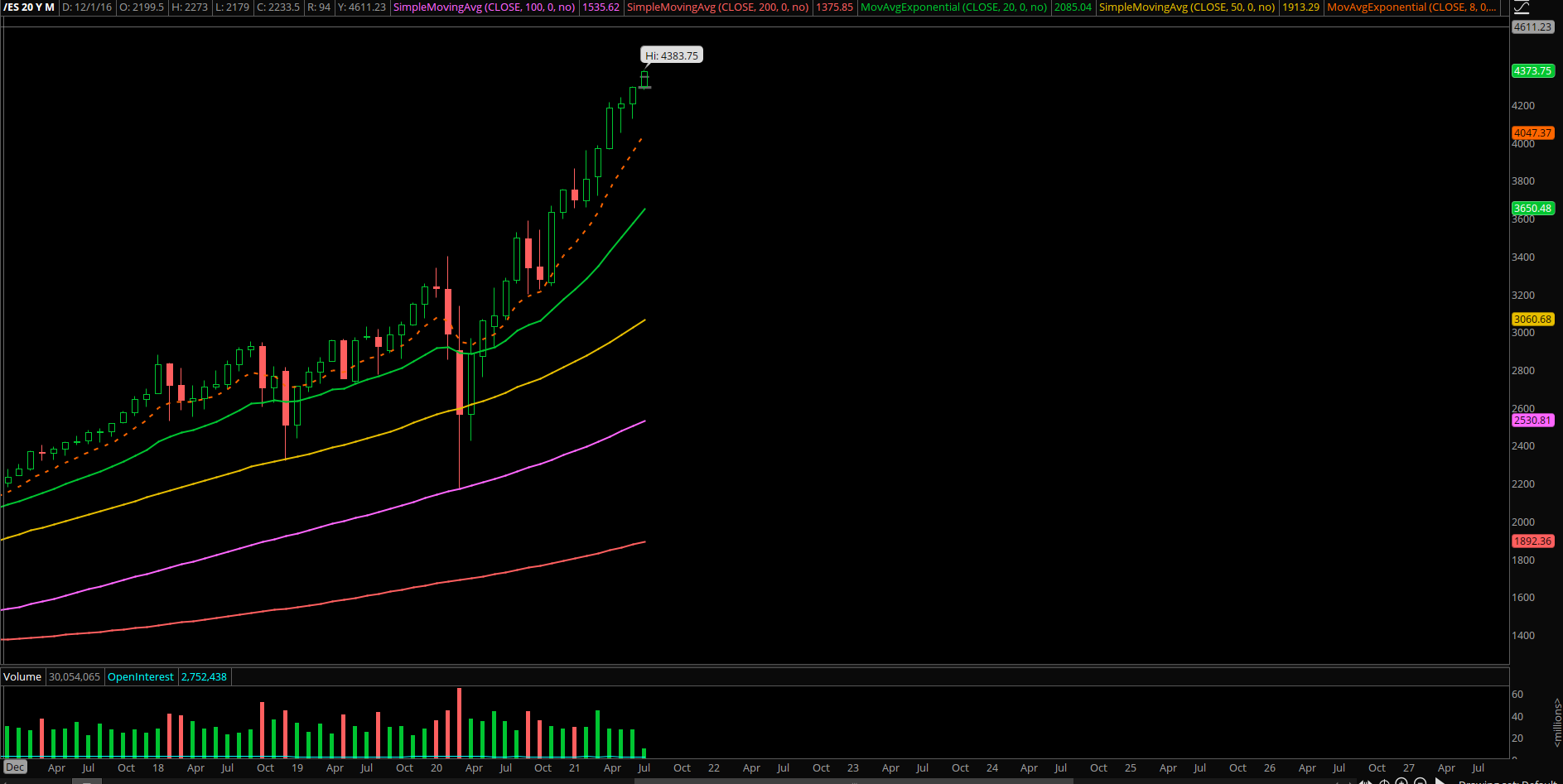

- Heading into July, which is 3rd the strongest months based on returns via past 20 year S&P 500 data. We’re expecting more of the same grind up structure; market is a launch pad towards 4300 and 4400

- Bonus notes: NQ/tech remains the strongest and its outperformance as we expected for the past few weeks/months now. It is holding everything together at the moment alongside with most of our ‘best in breed’ picks’ (shared freebies in private room) continue to outperform the market. Manage risk properly if you are oprating an uber bullish tech portfolio like us. Racket up stops dependent on your timeframes and enjoy the lazy river approach. Easy money for the time being, given nasdaq/tech riding above the daily 8+20EMA strong bull trends.

- If and when tech turns south, it could get real fugly for ES+RTY…more volatility picks up/mood swings. Otherwise, expecting more of the same pattern, resilient grind up towards our 15k target. Level by level approach

- In addition, we’re seeing some rotations into RTY and YM, keep close eyes on their respective multi-month bullish consolidation pattern turning into breakout setups. RTY needs to conquer 2285 decisively to open up 2300/2350+. YM needs to conquer 35k to breakout into 35.5/36k. Otherwise, be aware of the ‘false breakout’ turning into larger bull traps/consolidation patterns