Market Analysis for Jul 1st, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Resilient Grind, Month + Quarter End Closed At Highs Per Expectations

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers)

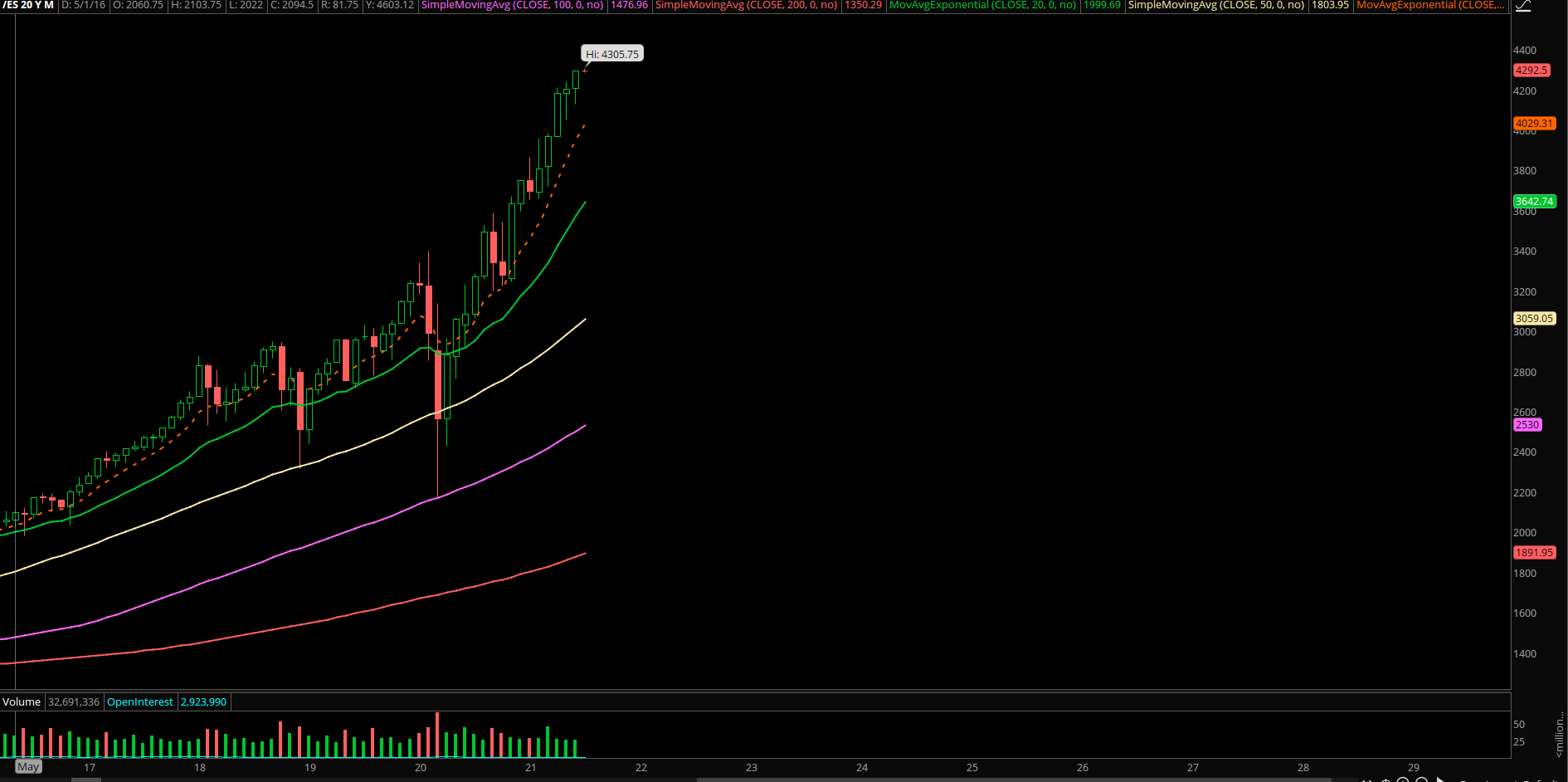

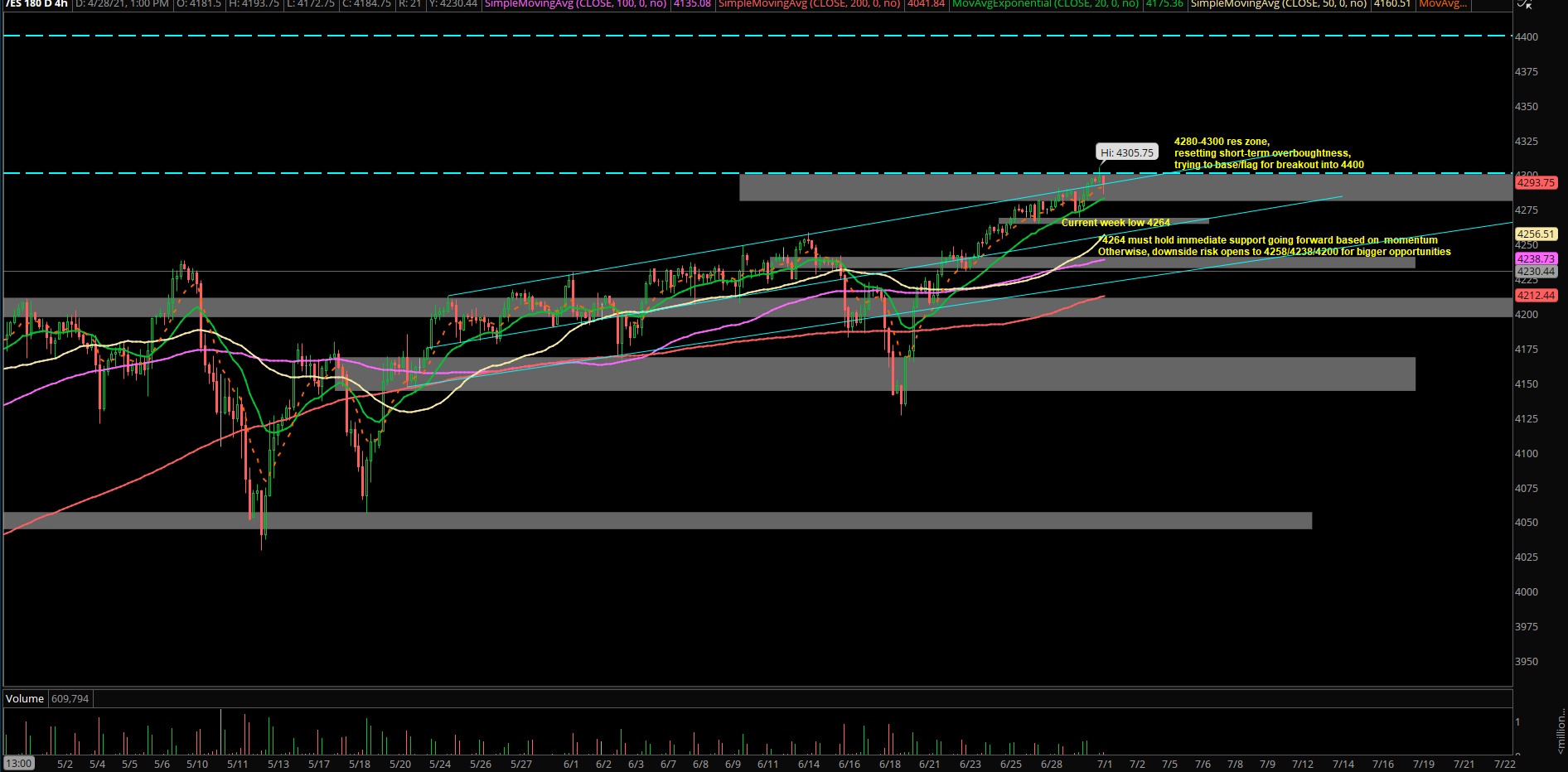

- Yesterday’s EOM/EOQ closed at 4293.5, which was new ATHs. No surprises given the stats + current market environment as we got the afternoon pump into the closing price. If you recall from the prior report, bulls had an opportunity to confirm that the overnight 4269 LOD setup + the trending 4hr 20ema confluence and higher lows set the tone for the day. (play was BTFD in the morning and go for the anticipated afternoon new ATHs ramp)

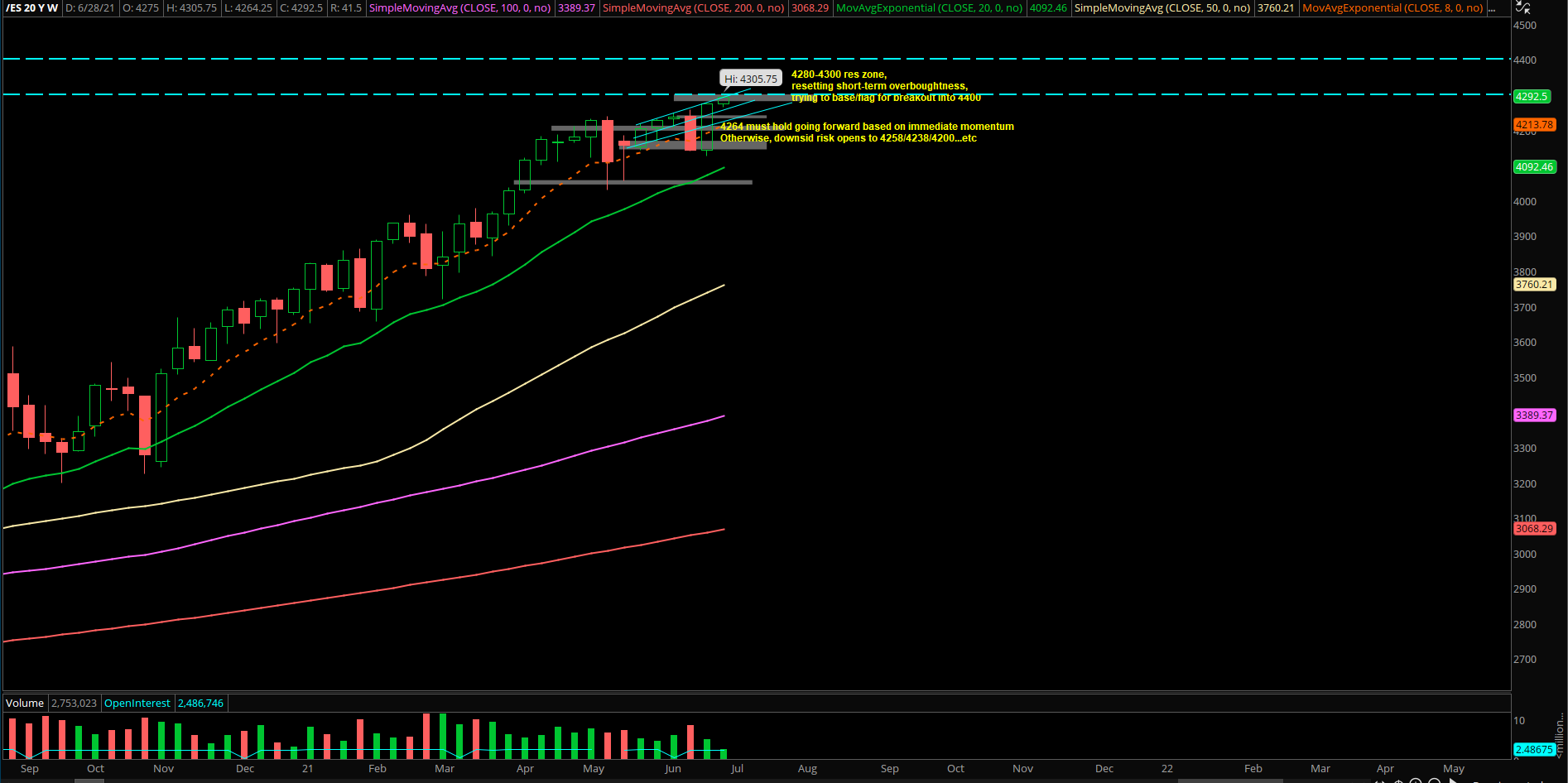

- All short-term targets 4280 and 4300 have been fulfilled and now the market is figuring out whether it’s immediately basing for another ramp into 4400 or needs to take a breather/reset here.

- What we’re uncertain about is whether price action needs a quick reset of 2-3% then continue higher or it keeps doing these shallow 0.3-0.8% dips and grinding higher

- For today, 4305 could be temp top as price action looking to reset/take a breather. Below 4286 would be first sign. (warning: 2nd try here vs 4hr 20ema support area is more dangerous because of stats, yesterday’s 4hr 20ema was bought up after multiple days riding above 4hr 8ema confirming resilient trend). Above 4305 would mean this resilient grind up is still not done because the bigger picture target for month of July is towards 4400.

- 4264 (this week’s low) is must hold support. Otherwise, downside risk opens to 4258/4238/4200

General theme:

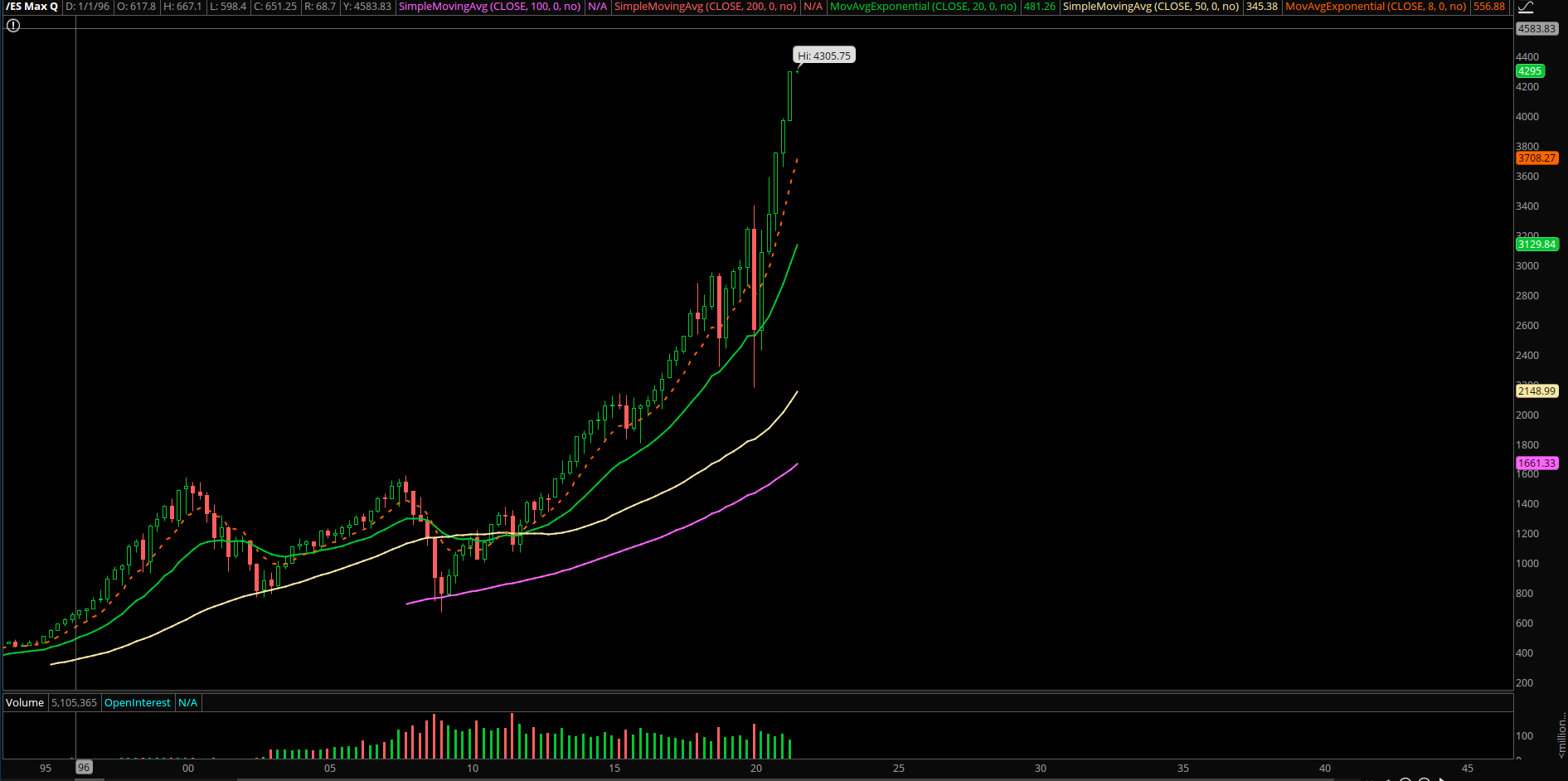

- Heading into July, which is 3rd the strongest months based on returns via past 20 year S&P 500 data. We’re expecting more of the same grind up structure; market is a launch pad towards 4300 and 4400

- Bonus notes: NQ/tech remains the strongest and its outperformance as we expected for the past few weeks/months now. It is holding everything together at the moment alongside with most of our ‘best in breed’ picks’ (shared freebies in private room) continue to outperform the market. Manage risk properly if you are oprating an uber bullish tech portfolio like us. Racket up stops dependent on your timeframes and enjoy the lazy river approach. Easy money for the time being, given nasdaq/tech riding above the daily 8+20EMA strong bull trends.

- If and when tech turns south, it could get real fugly for ES+RTY…more volatility picks up/mood swings. Otherwise, expecting more of the same pattern, resilient grind up towards our 15k target. Level by level approach (as of July, NQ hovering at 14530s with overnight high of 14606)