Market Analysis for Jun 22nd, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – 100% V-shape Retracement, Gummy Bears

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. We specialize in quick intraday alpha setups and short-term swings with duration of 2-5 days and occasional 10-15 sessions holding period (some key levels + strategies have been redacted for fairness to subscribers)

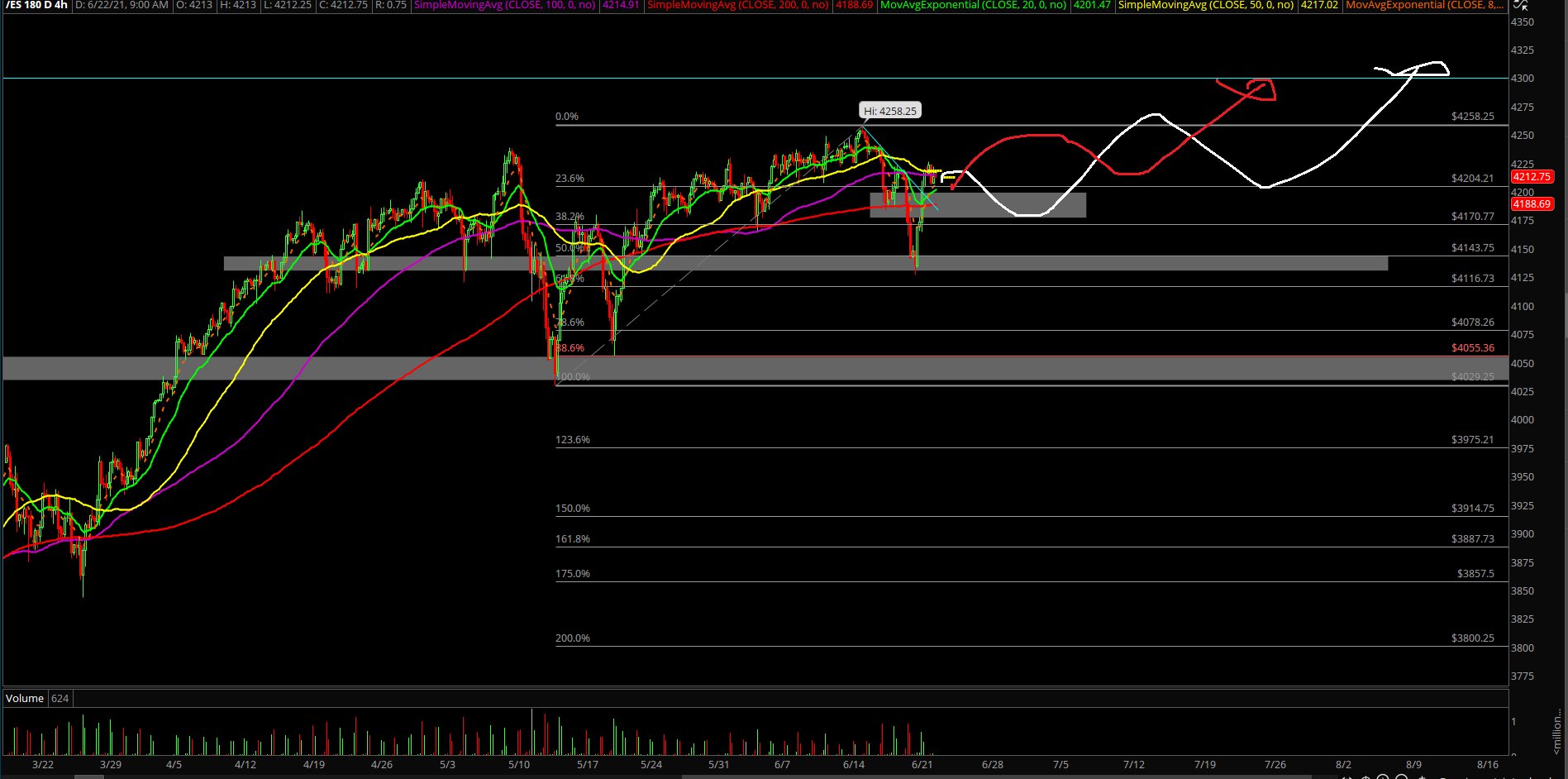

- Yesterday was a +2.2% day from 4126 overnight lows to 4219 highs so expect some sort of inside/range day consolidation for price action to build a strong base and ramp later this week.

- Plan for rest of this week is to watch if bulls/buyers remain this strong given the 100% recovery of Friday’s entire 4220-4140 range as bears got trapped and rolled again

- Bulls must hold 4165 on any pullbacks in order to build a base into new ATHs 4300, given the fact the context of the V-shape recovery and new bears got trapped

- Traders could look for applicable higher low opportunities in the 4178-4200 region

Note: NQ/tech remains the strongest and its outperformance need to be watched closely. It is holding everything together at the moment alongside with most of our best in’ breed stock picks’ (shared freebies) continue to outperform the market.

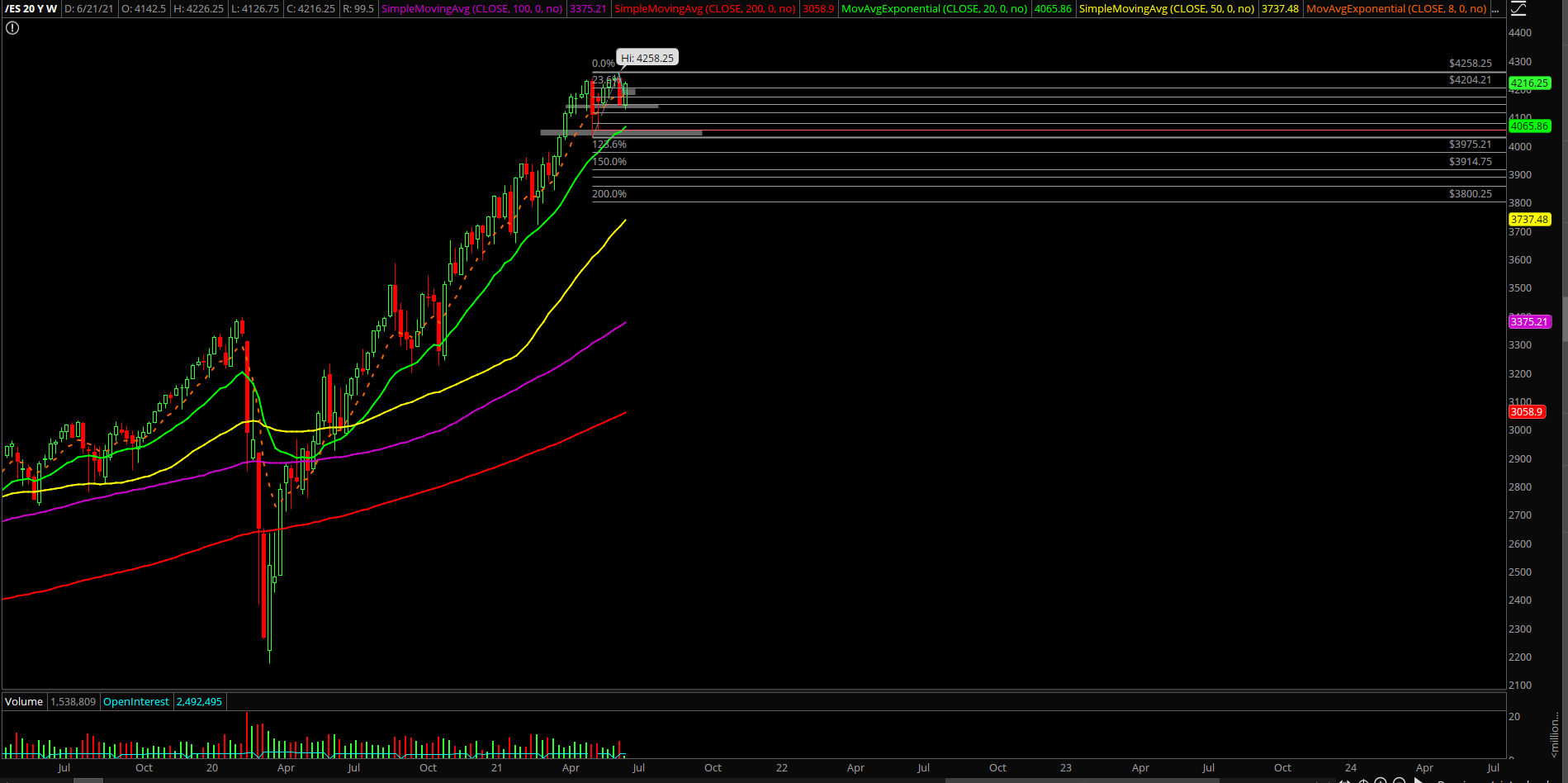

If and when tech turns south, it could get real fugly for ES+RTY…more volatility picks up/mood swings. Otherwise, more of the same pattern, grind up and into year end towards 15k target

- Overall, trying not to get complacent or lazy here as the multi-week grind up has structured everybody and their mother to aggressively BTFD vs the first support levels. We trade the levels here, but don’t marry your gameplan if things change, must be adaptable. Warned many times about hedging vs weak S&P 500 seasonality over the past 3 weeks

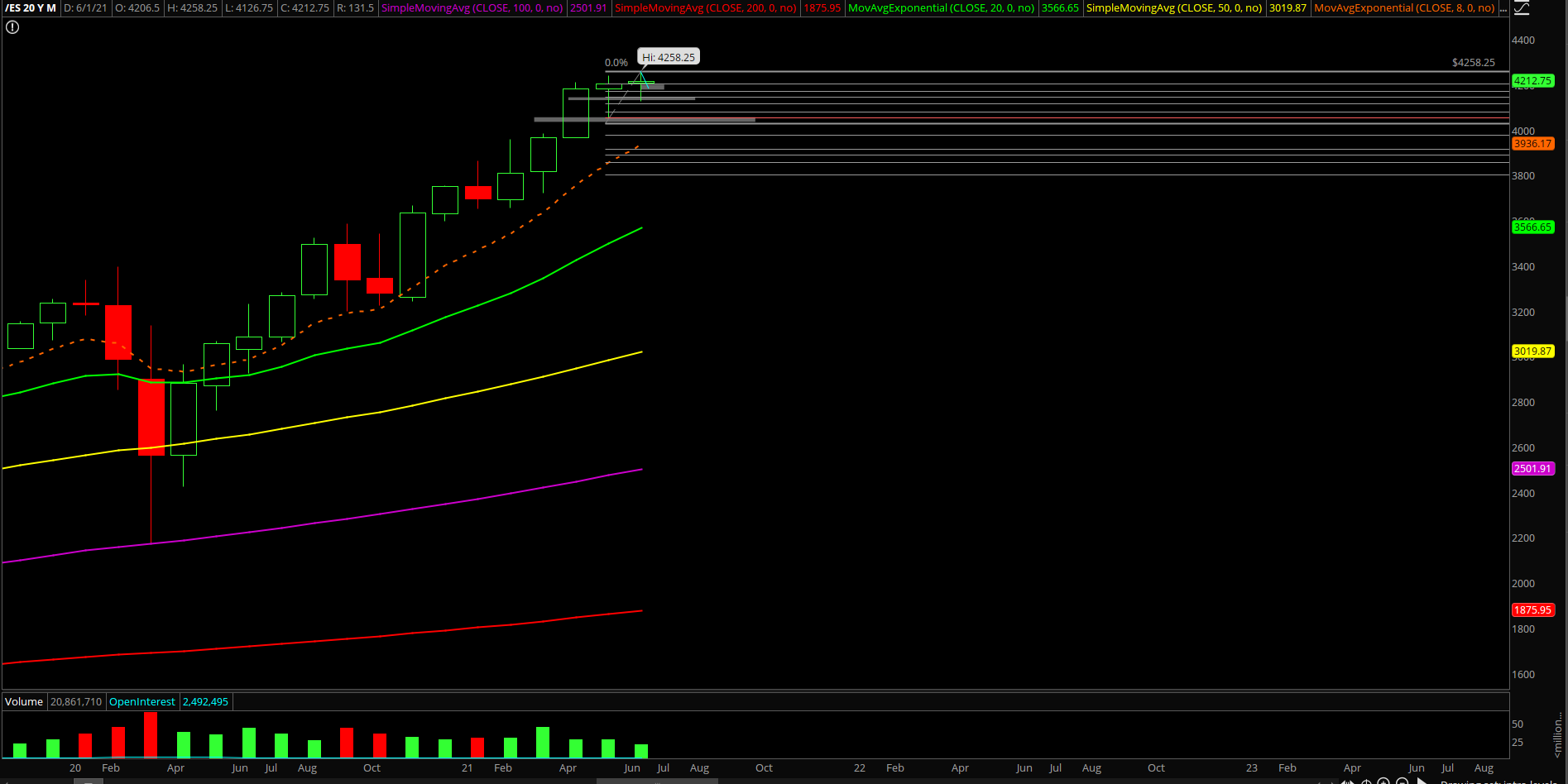

Additional context from past months remain mostly unchanged (copied and pasted):

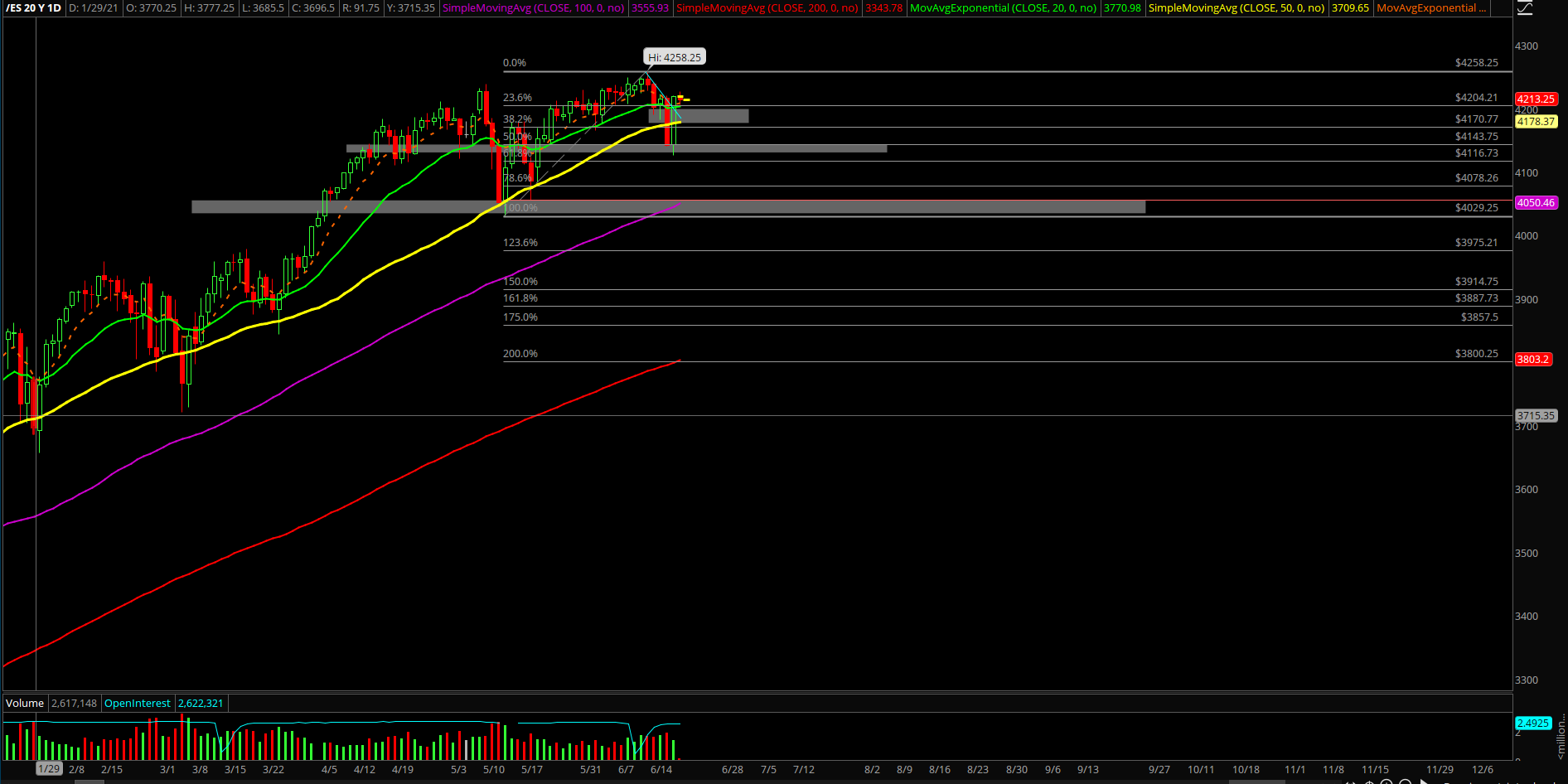

- The shit hits the fan (SHTF) level has moved up to 3965 from 3650, a daily closing print below 3965 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (the current April 2021 lows which was the breakout acceleration point of the past few weeks)

- A break below 3965 would be a strong indication of weakness given the multi-week trend of being above the daily 20EMA train tracks. For reference, the first week of April, the price action has accelerated on top of the daily 8EMA to indicate that the bulls are in full control and continuously making higher lows and higher highs every couple sessions bottomed

- Different timeframes in this report so it may be overwhelming, make sure you know which timeframes you are participating and adjust gameplan + execution accordingly