Market Analysis for May 6th, 2021

ES Educational Snippet

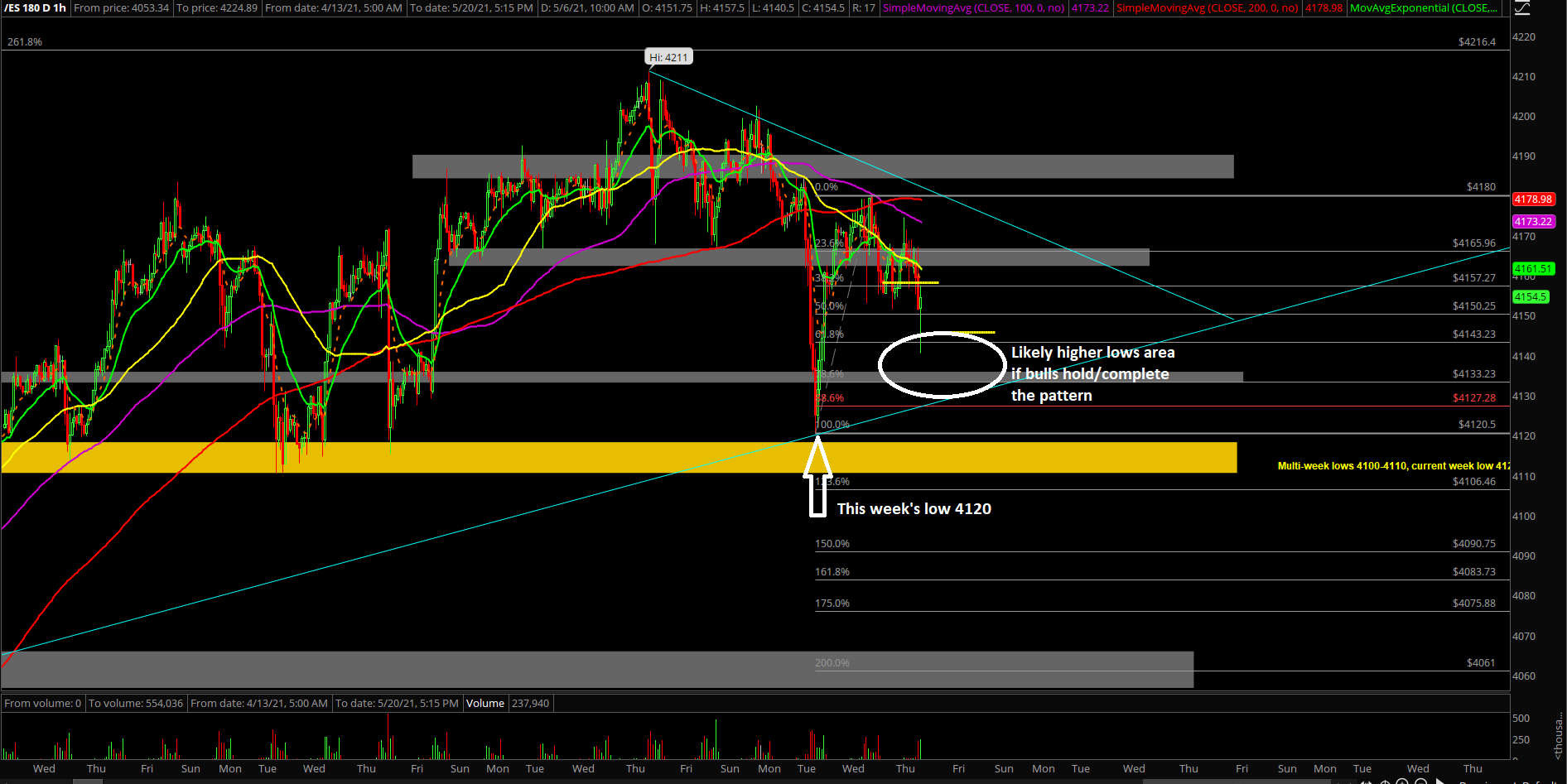

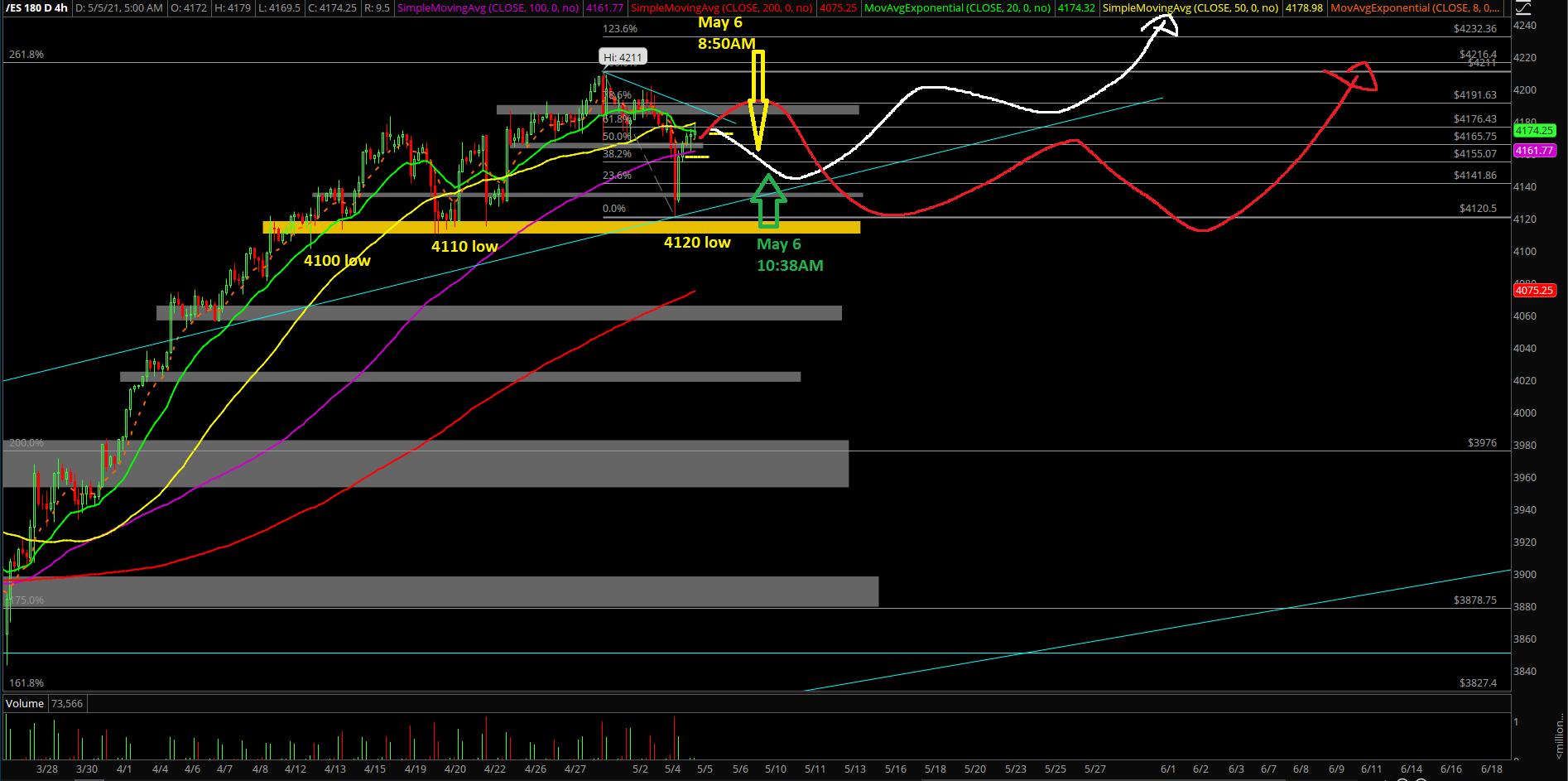

Essentially, our whole gameplan since yesterday was to wait for some sort of higher lows setup given Tuesday's 4120 temporary low/sticksave context. If you recall, we have been treating 4120 as the current low so we have a reference point to trade against...aka what is MUST HOLD and how to gauge momentum. (sideways bullish consolidation setup)

Yesterday, price action only got as low as 4153 and bounced quickly back to 4180 then got smacked down to 4155 at EOD. Not many good opportunities unless you were doing fast scalps.

Now, this is the 2nd time and also the second inside/range day in a row so we may have a better chance as bulls must sticksave around this support area. Otherwise, they face major risk such as letting this week's 4120 go. Meaning if 4120 go...Friday would act as a trend week down setup instead for weekly closing print/attempt.

For reference, our 4127 stoploss is located at 88.6% retracement of this 4120->4180 bounce and it is also a homework key level. All in all, fairly textbook setup for bulls to make their stance/establish a base and we go from there. A confluence of things that align around the same level/area typically means the better the setup.