Market Analysis for Apr 10th, 2021

DIY Stimulus Plan - 3 More Dividends To Get Your Income Rolling

Good morning EWT! Together we have been discussing a portfolio to generate monthly and quarterly income. It's designed to capture the thrill of a paycheck hitting your bank account. As the third wave of stimulus continues to roll in from government coffers to your bank account, we want this one-time infusion of cash to become a lifelong benefit.

I've always enjoyed when companies offer a lifetime membership option. If I'm sure I want the membership and will use it, let me lock it down for life. Retirement doesn't offer such a plan, you have to pay your expenses when they arrive, not upfront, normally. This doesn't mean we need to waste a golden opportunity to create a portfolio that pours income into our accounts and lets us convert this one-time infusion into a lifelong benefit.

Focusing on the Income

For this portfolio, we are laser-focused on income generation. This is not to say we wouldn't accept or enjoy capital appreciation - who wouldn't? However, it's not our No. 1 priority. We want the money put into this portfolio to pay us back effectively and quickly. This way we can feel the benefits rapidly without a long delay. When the government announced the latest round of stimulus payments, the IRS was able to rapidly deploy the capital due to its experience with the previous two rounds.

Likewise, we want our hard-earned money to rapidly deploy its benefits back to us for life's expenses or reinvestment. Without further ado, let's jump in.

Pick #1: PCI, Yield 9.1%

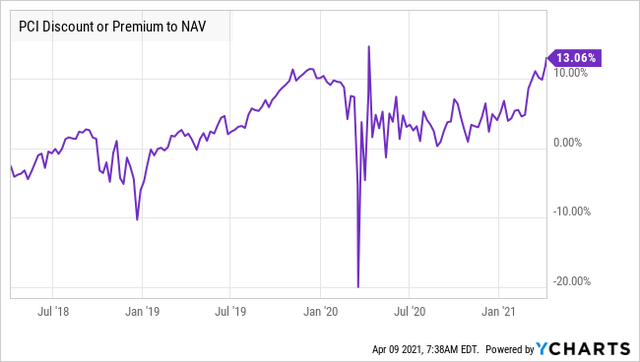

PIMCO Dynamic Credit and Mortgage Income Fund (PCI) yields 9.1% and historically trades at a premium to NAV (Net Asset Value). PCI is managed by PIMCO, and this group invests in the debt markets. PIMCO has a well-earned reputation as a world-class manager, something reflected in its funds.

PCI is trading at a level higher than its NAV, creating a premium to NAV. However, looking over the past three years, the premium to NAV is nearer the higher side of historical norms. And there's a reason for this. The markets are always forward-looking and Mr. Market sees a higher NAV looking forward, so trading at a premium is warranted in this case. PCI is still worth every penny. Other PIMCO funds trade at higher premiums to NAV without any issue.

PCI also offers access to sectors that are hard for retail investors to enter, such as RMBS (residential mortgage-backed securities).

Since March, non-agency MBS has seen a rally but continues to trade below pre-COVID prices. This is despite the fact that mortgages are safer today than they were before the impact of COVID.

In fact, throughout 2020 we saw the housing market strengthening. Housing prices are going up, homes listed for sale are selling extremely fast and the fundamentals are stronger than ever. For the older mortgages that PCI owns, which were primarily originated before 2009, this means that the collateral underlying the mortgage is substantially more valuable than the amount owed. Meanwhile, new mortgages are being originated at interest rates of 3% or even lower. It's a bit silly that older mortgages with 4%-plus interest rates and that are easily below 60% loan-to-value are trading at a discount to face value.

We see PCI as a strong buy still. Don't be blinded by the premiums. These premiums are due to their assets trading at a discount creating an artificial premium to NAV, and the premium will eventually narrow. We see much more upside for PCI.

Pick #2: PTY, Yield 8.3%

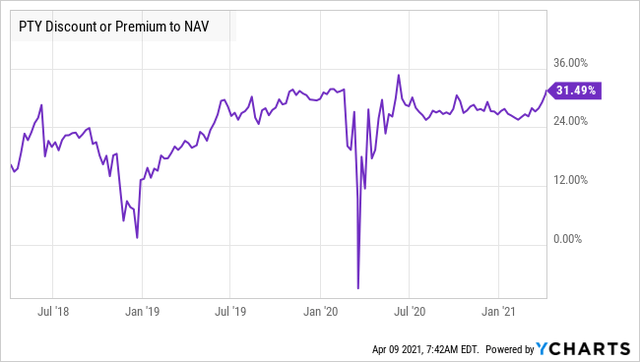

PIMCO Corporate & Income Opportunity Fund (PTY) yields 8.3%. This fund, like the one above, is managed by the legendary PIMCO. It also trades at a healthy premium to NAV.

Like PCI, PTY has traded near this premium for some time. PTY is a hyper-active bond fund. What this means is that it's not a passive buy and hold forever fund. It makes most of its income by trading bonds, so it generates a great amount of money in both good and bad times. PIMCO's team finds undervalued bonds and buys them up to sell later when their price has appreciated. As such, PTY has outperformed the market for a number of years.

This is a case where the quality of the fund is directly related to the quality of the manager. PIMCO is not afraid to take contrarian positions, like buying mortgages at steep discounts during the mortgage meltdown or buying bonds in companies that are in or close to bankruptcy. PIMCO does its analysis and will buy even if the rest of the market is bearish.

Over the decades, PIMCO has been right more often than it has been wrong, translating those contrarian investments at low prices into out-sized profits for its investors. PTY has a proven history of sniffing out the value and we can be confident that it will continue to do so while we collect our 8.3% yield.

I have been holding PCI and PTY in my retirement portfolio for years without hesitation, and I plan to keep holding them until my retirement because they will be some of my more reliable income generators for years to come.

Pick #3: Atlantica Sustainable Infrastructure

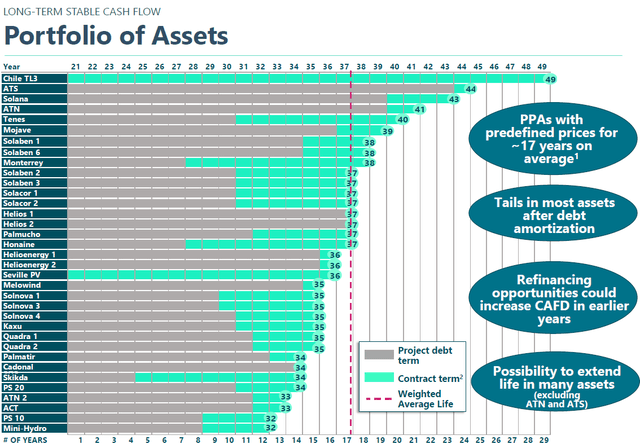

Atlantica Sustainable Infrastructure (AY) is an evolving renewable energy company that offers a growing 4.4% yield. It's on the lower end of our desired range but its long-term value proposition appeals to us. Recently AY saw its share price dip from new highs as a short-term sell-off of renewable energy names occurred. AY has transitioned from a renewable energy company, focused on European solar and wind, to a global sustainable infrastructure company.

Source: AY Earning Slides - March 1, 2020

All of its cash flow is tied to long-term contracts with self-amortizing debt. So you get the excess income while the assets pay for themselves. Recently, AY has moved into transmission lines and power generation in South America, as well as the district heating sector in Canada. It also has moved into the geothermal energy sector in California. These moves position AY to move away from the overcrowded solar and wind renewable energy fields into less busy sustainable infrastructure.

Since Algonquin (AQN) took over as AY's sponsor it has shown strong results and a steadily growing dividend. With AQN backing AY, we expect years of growth and dividend growth ahead, making AY a perfect addition to our DIY stimulus portfolio.

Renewable energy is very hot today, and will greatly benefit as the planet moves towards being more "green." Demand from institutional investors for renewable energy is soaring, and AY is set to be a prime beneficiary.

Conclusion

These three picks will provide you with outstanding income throughout your life. If you're young, let the income be reinvested over and over to create an Amazon-river-sized income flow vs. the stream it was when you started out. For retirees, let these picks be yet another form of passive income in your portfolio. You don't need to squander this infusion of cash from the government on trivialities when you have a golden ticket to create a successful income stream.

You don't have to be stuck in a cycle of endlessly trying to beat the market or beat your bank. Simply setting money aside into three investments, you can develop a great portfolio that pays you reliable and steady dividend income. It will serve you well, and you will look forward to adding money to this outstanding portfolio.

Disclosure: I am/we are long AY, PCI, AND PTY.

High Dividend Opportunities is the #1 service for income investors and retirees. The service offers a "model portfolio" targeting a yield of +9%. To find out more, please click here.