Market Analysis for Apr 6th, 2021

Friendly Reminder - Figure Out Your Best Bang For Your Buck

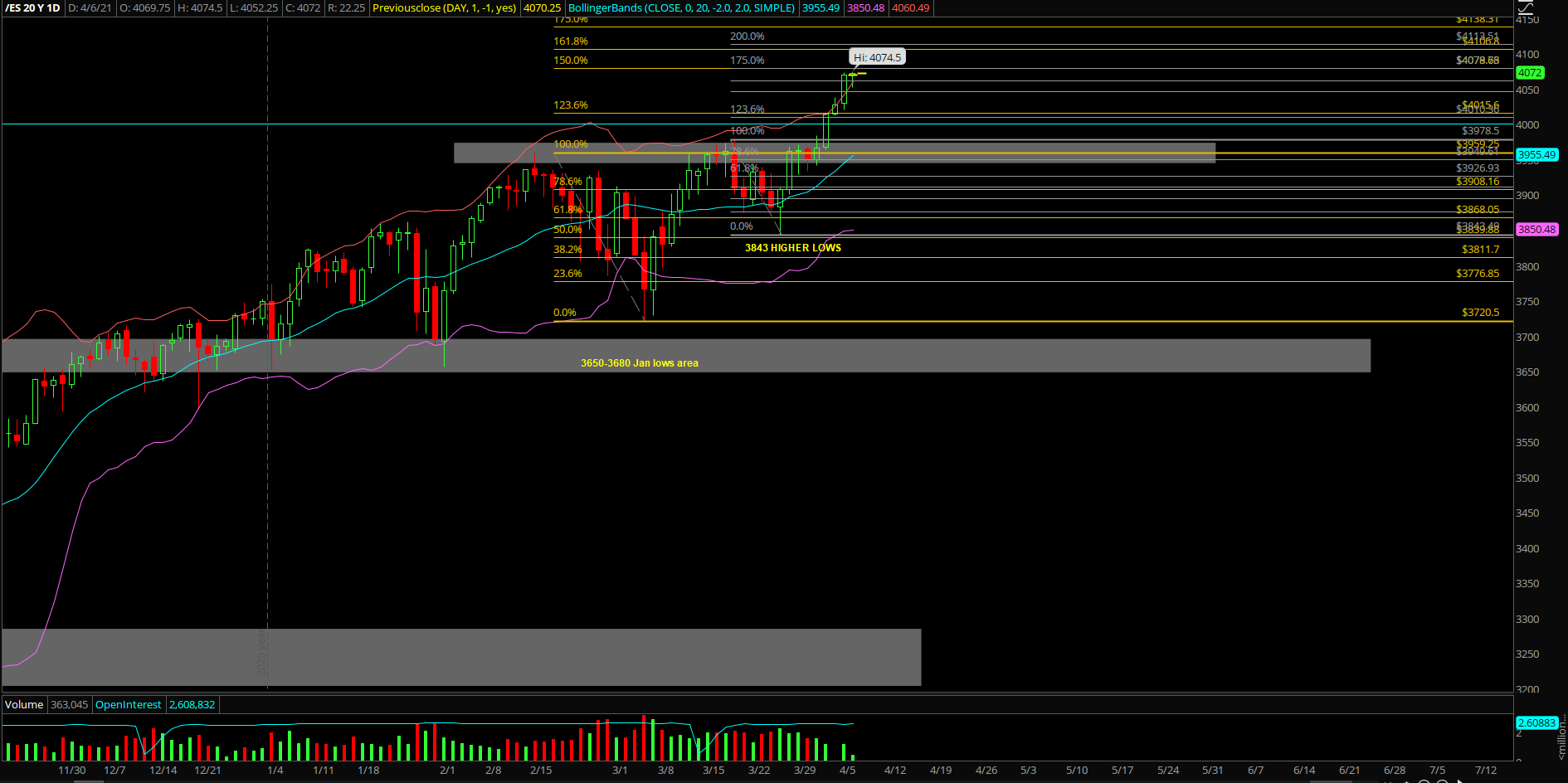

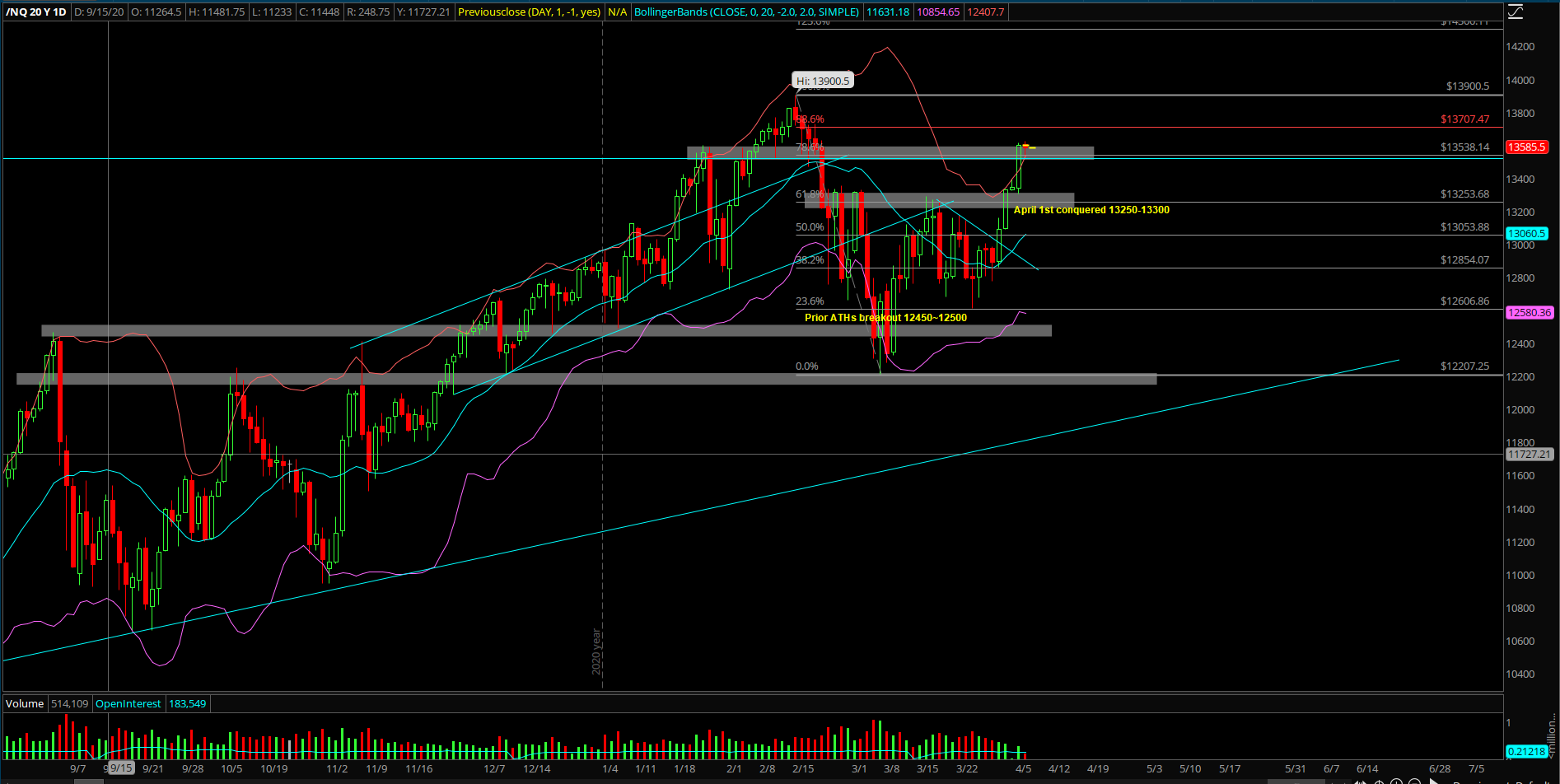

For ES+NQ, short-term a bit extended judging by daily upper bollinger bands and the recent 3 days~ straight up into their respective targets/resistance zones. We're letting it cool down a bit and waiting next opportunities.

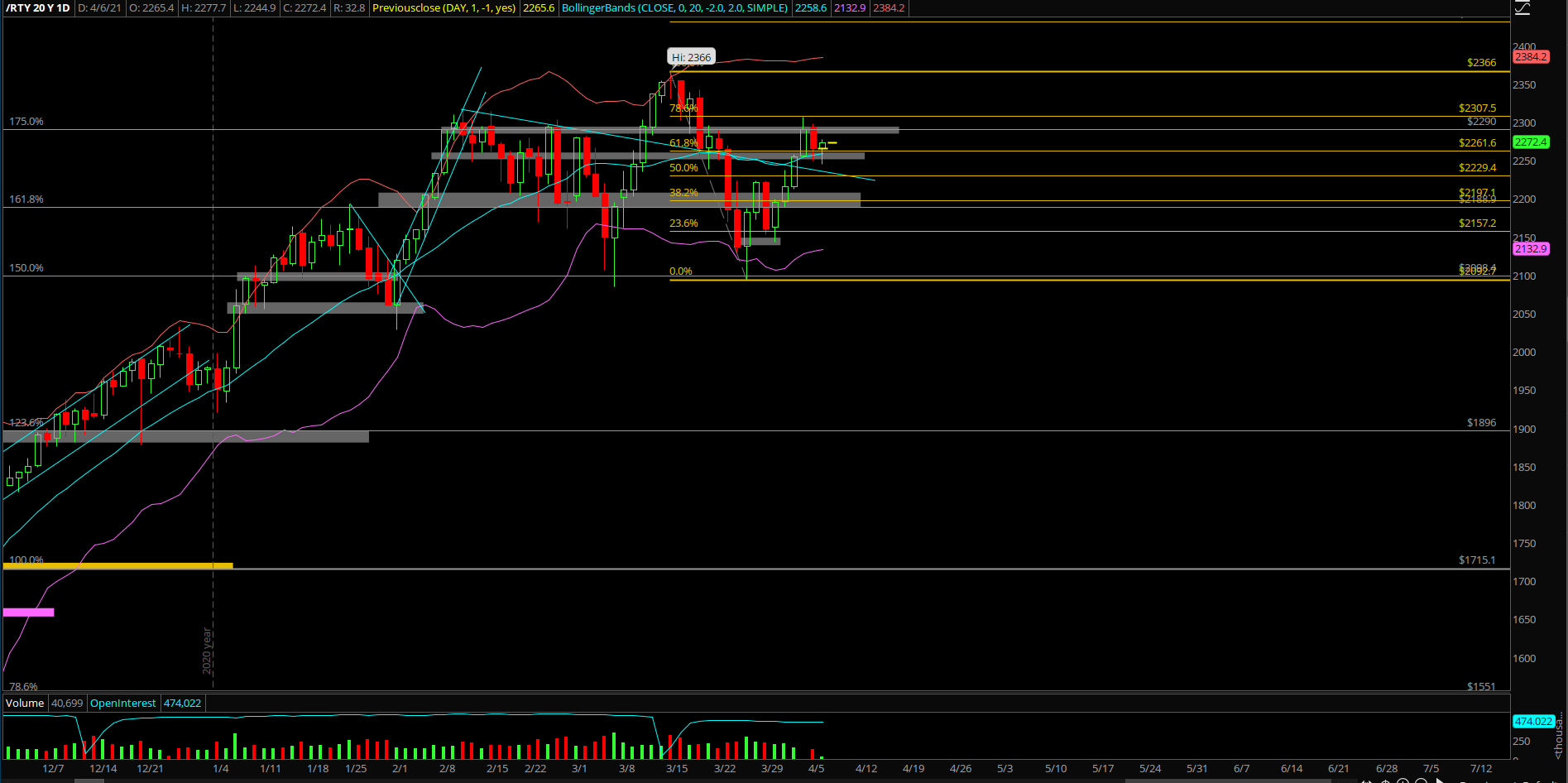

As discussed yesterday, RTY's dip into support zone 2250s-2230s was a decent place to rotate into given our realized gains from ES+NQ's swing low into current highs area.

Small caps could play catch up in the next 2-5 sessions. As of writing, risk vs reward looks more attractive than ES+NQ

Note: extensions are part of the game of a bull market so manage your expectations vs your own gameplan and the accompanying risk vs reward calculations. Remember, I could be dead wrong as always (see March executions)😎

Sharing some more daily charts below...be back later