Market Analysis for Mar 31st, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid –Quarter End Closing, Gummy Bears Served On A Silver Platter

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. (some key levels + strategies have been redacted for fairness to subscribers)

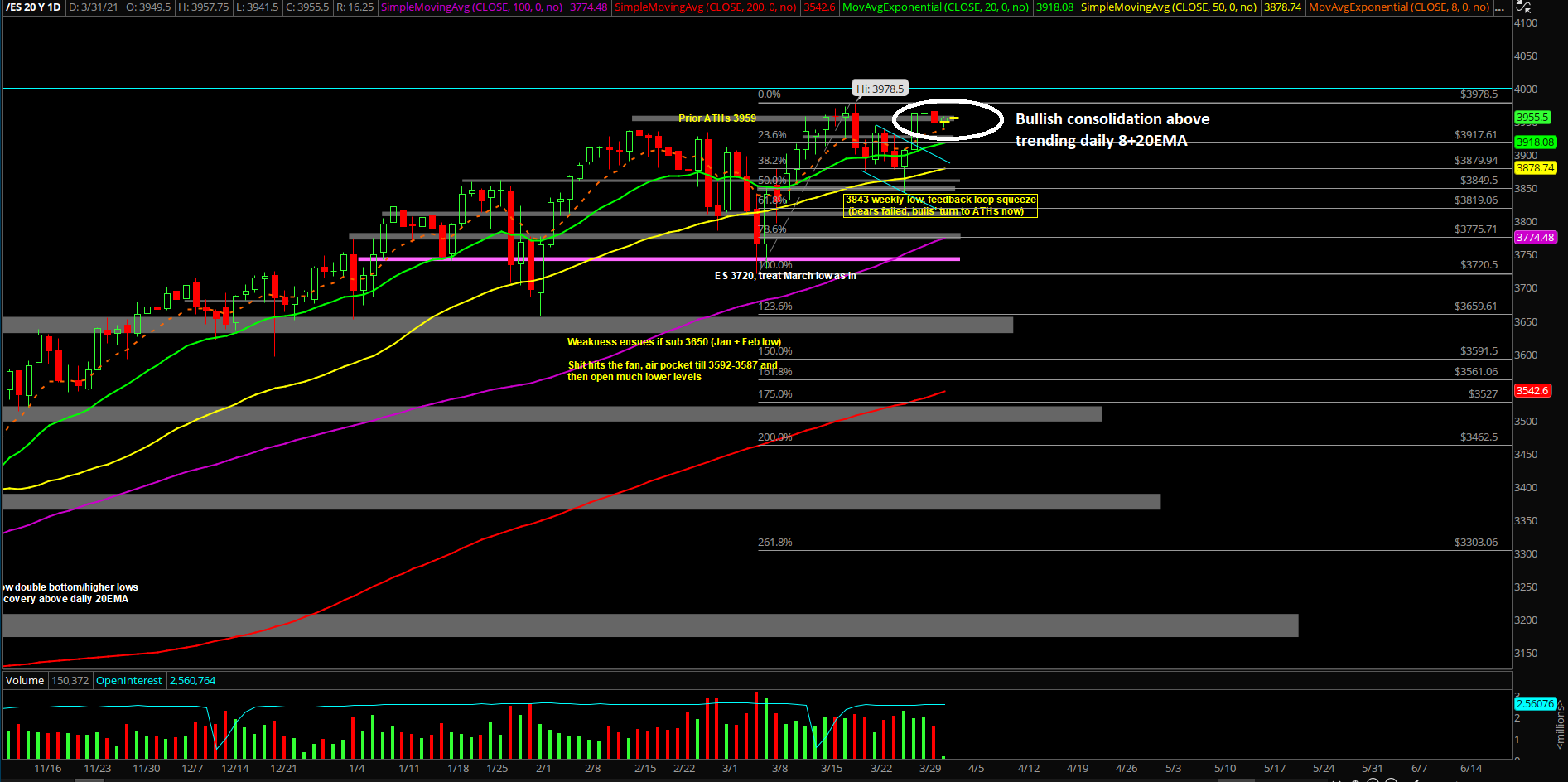

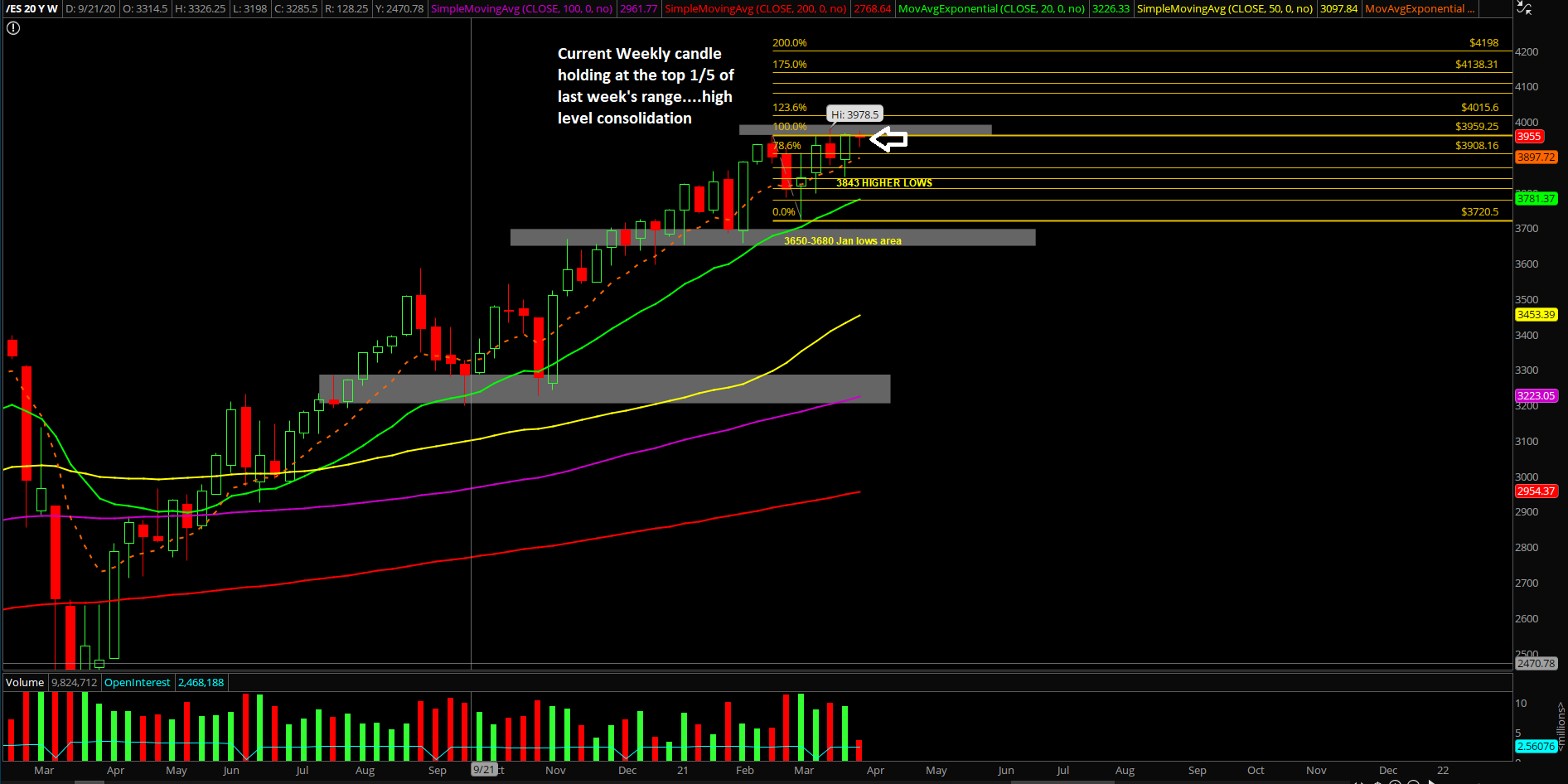

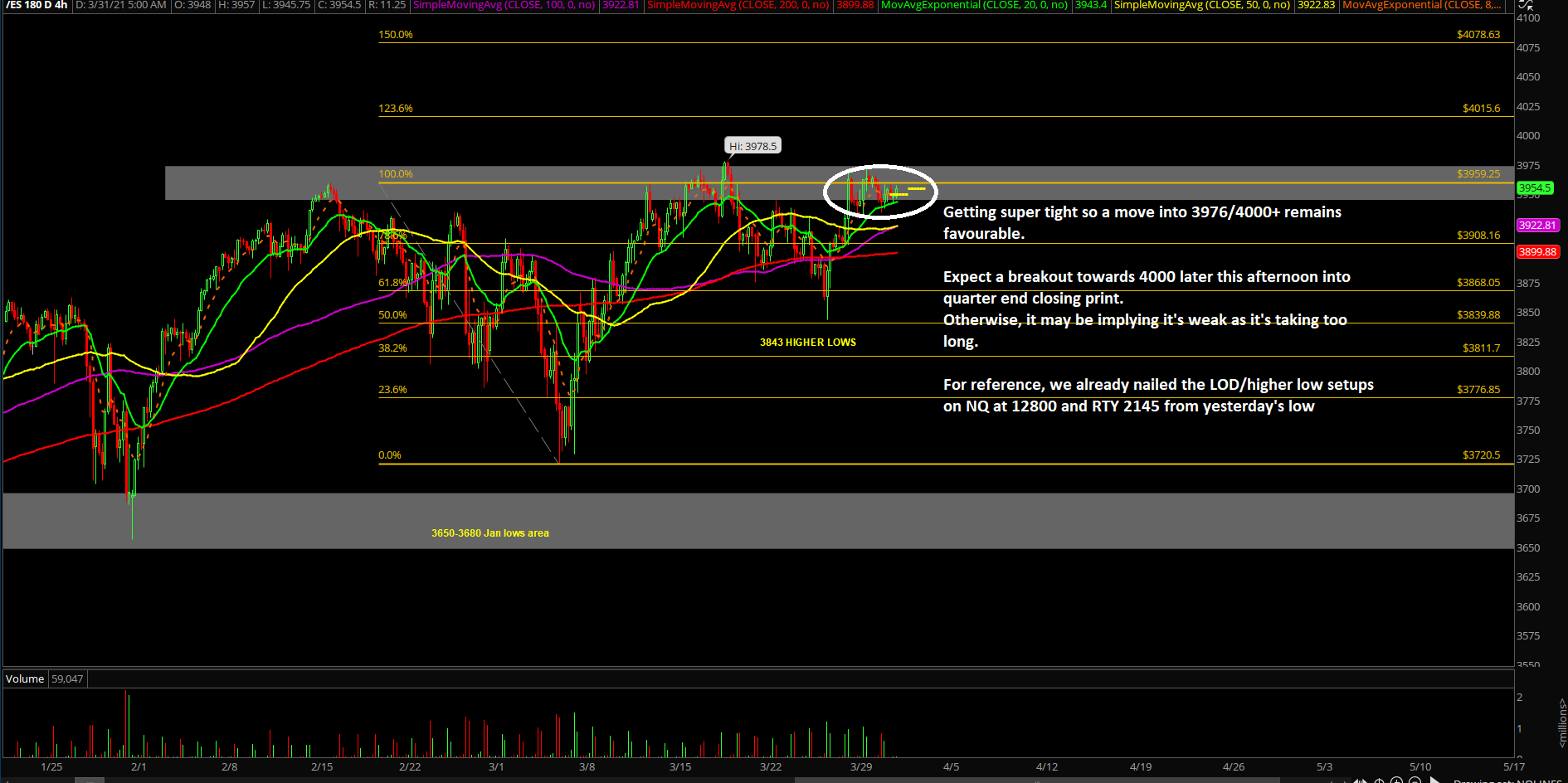

- Tuesday closed at 3949.5 as another inside day within Friday’s range, the high level consolidation pattern continues

- For reference, we already nailed the higher low setups on NQ at 12800 and RTY 2145 from yesterday and accumulated bullish positions across the board

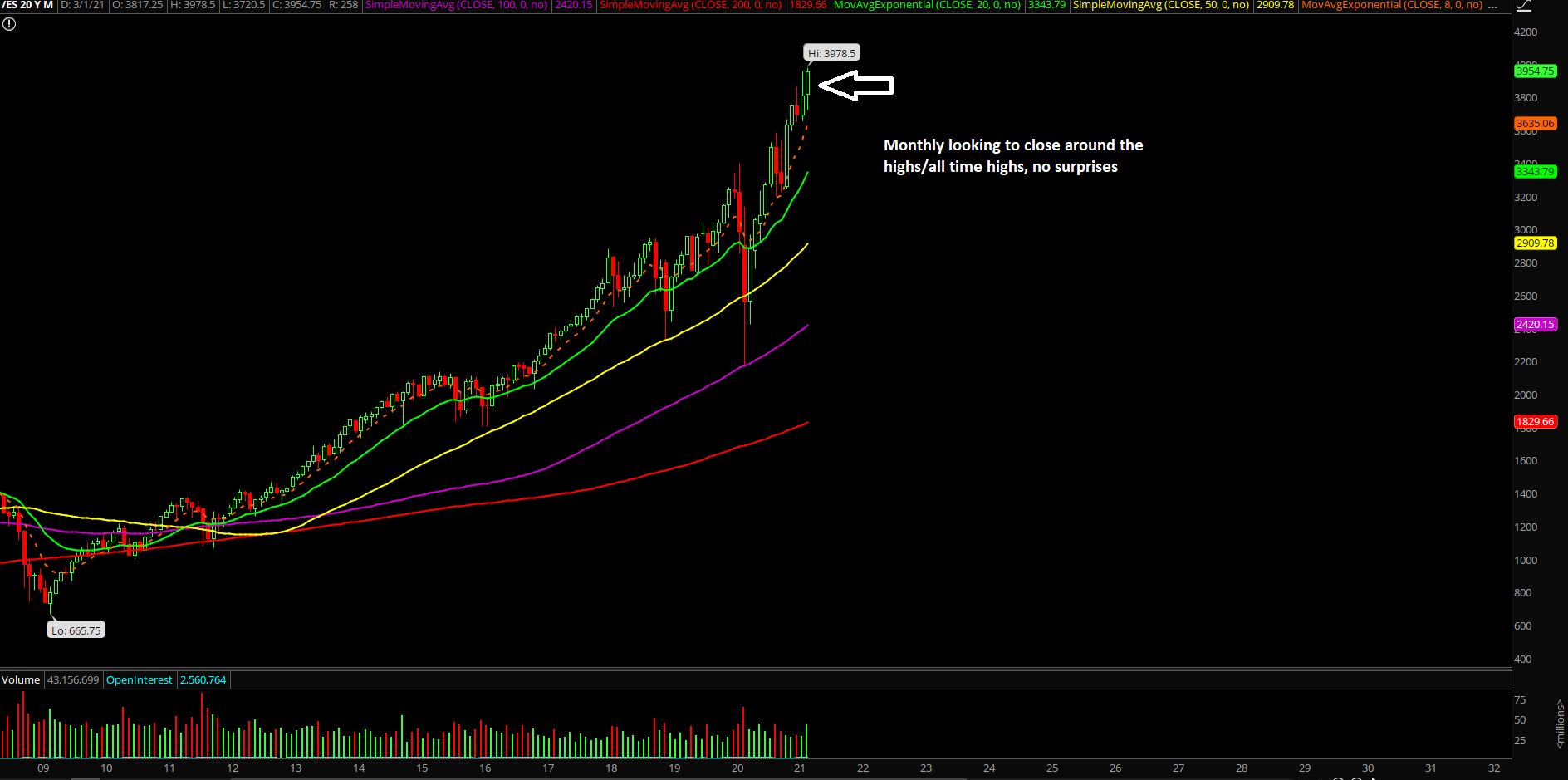

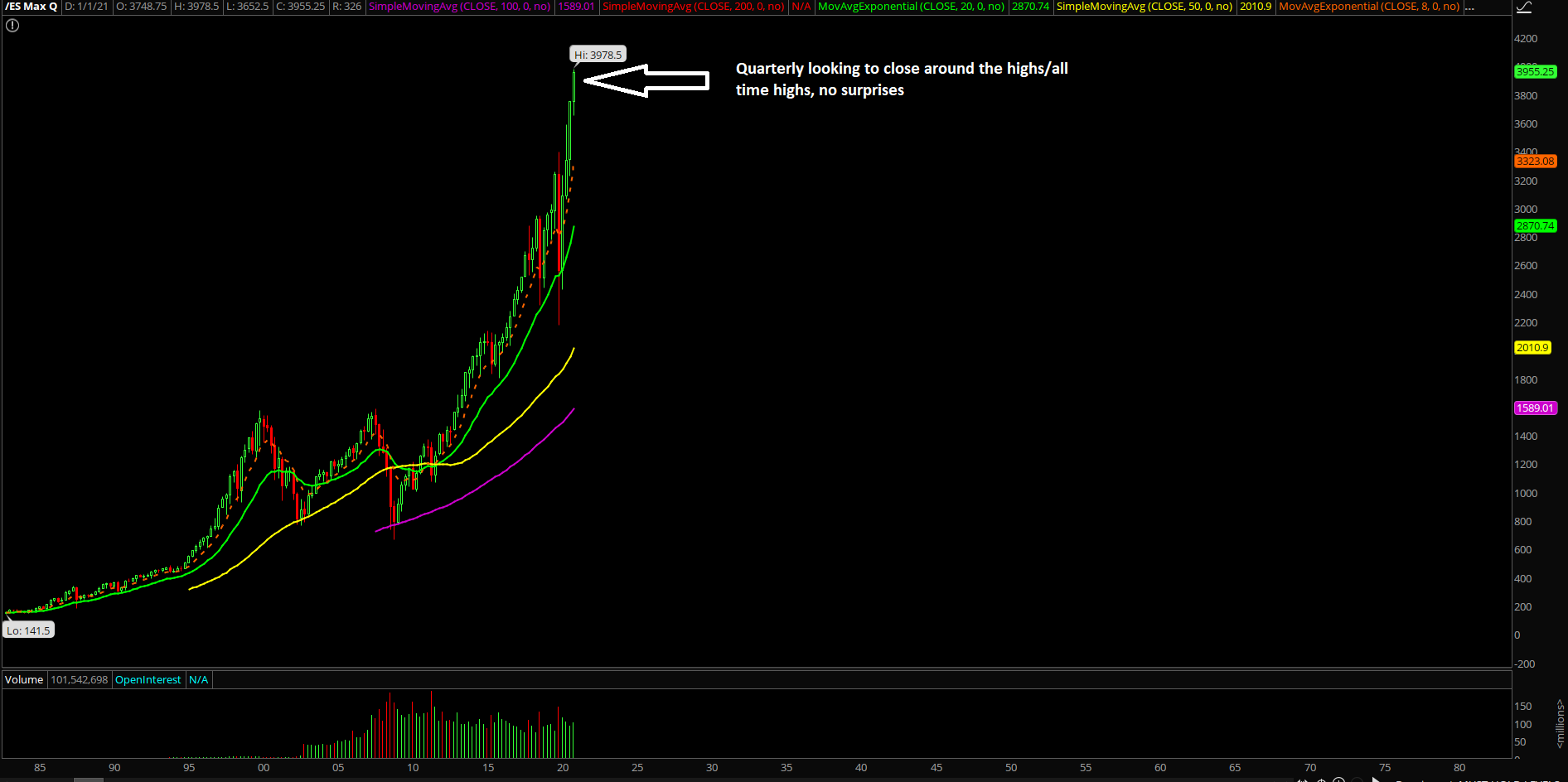

- This means that bulls/buyers have bears/sellers/gummy bears served on a silver platter going into month+quarter end closing print and into bullish seasonality of April. (new all time highs is just an inch away for ES plus the help of the NQ+RTY siblings)

- Conversely, if bulls fail to do anything today then it may imply that it’s quite soft/weak and this may be a false breakout/distribution pattern. It’s been 2 inside days in a row already within Friday’s massive bullish breakout daily candle.

- Bullish when above the 3925-3935 key support zone with 3976/4000+ targets being in play

- If below 3925-3935, opens up 3900/3885 being at risk again….consolidation/weakness/whipsaw

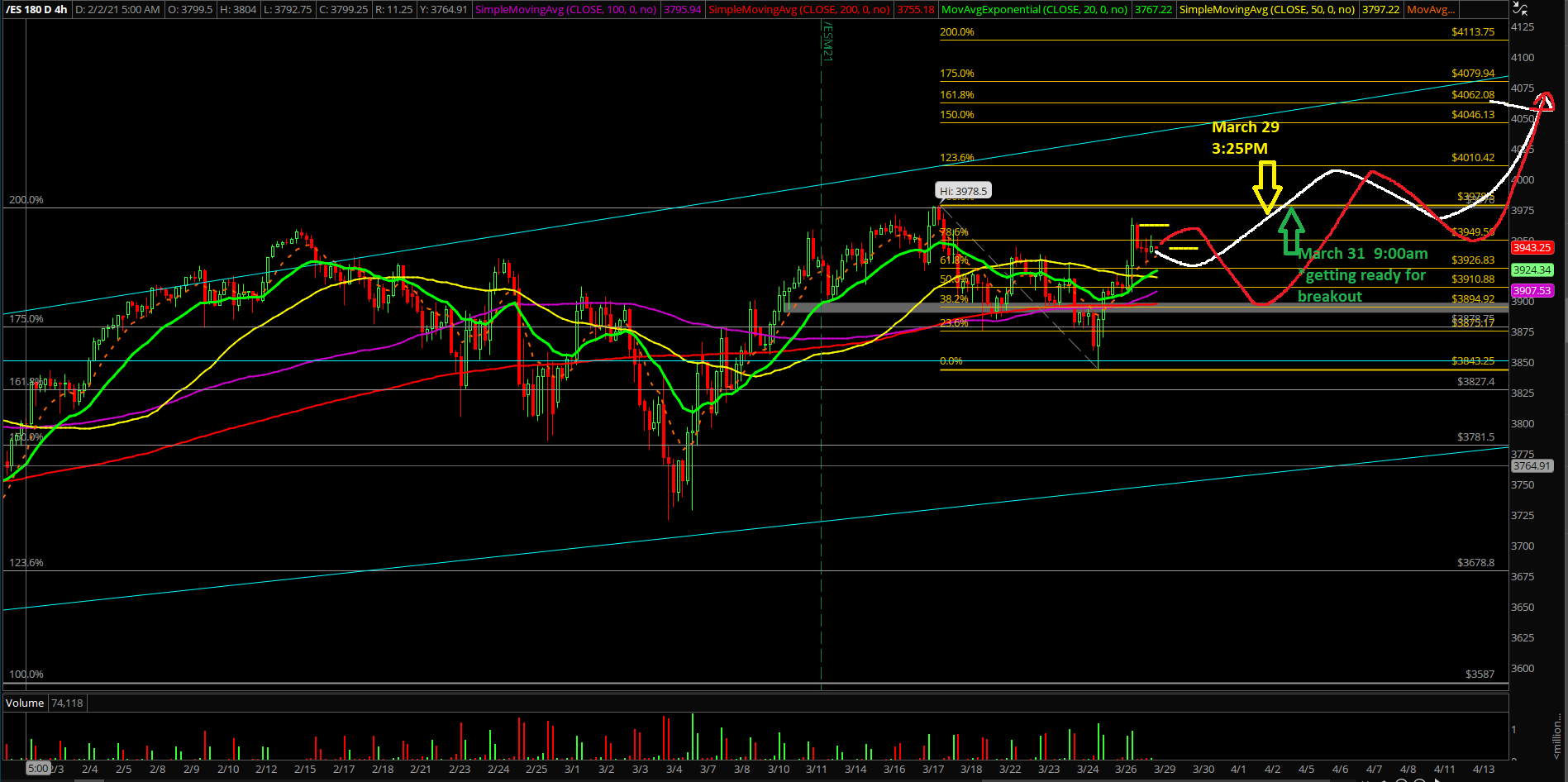

- 4hr white line projection primary, 4hr red line = alternative. Same end goal 4000+, valid when above supports

- Today is EOM and end of Q1, see if bulls/buyers make a statement by parking price at new all time highs to entice more strength for April 2021. Note: S&P 500 seasonality is quite bullish for the month of April; 80% gain frequency with average of +2.5% from past 20 years data. We’re expecting new ATHs soon if so.

Additional context from past months remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Janurary lows + Feb lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held