Market Analysis for Mar 18th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Rejected vs ATHs Again, Don’t Get Complacent Part 2

Copying and pasting a section from our ES trade alert room’s premarket gameplan report. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. (some key levels + strategies have been redacted for fairness to subscribers)

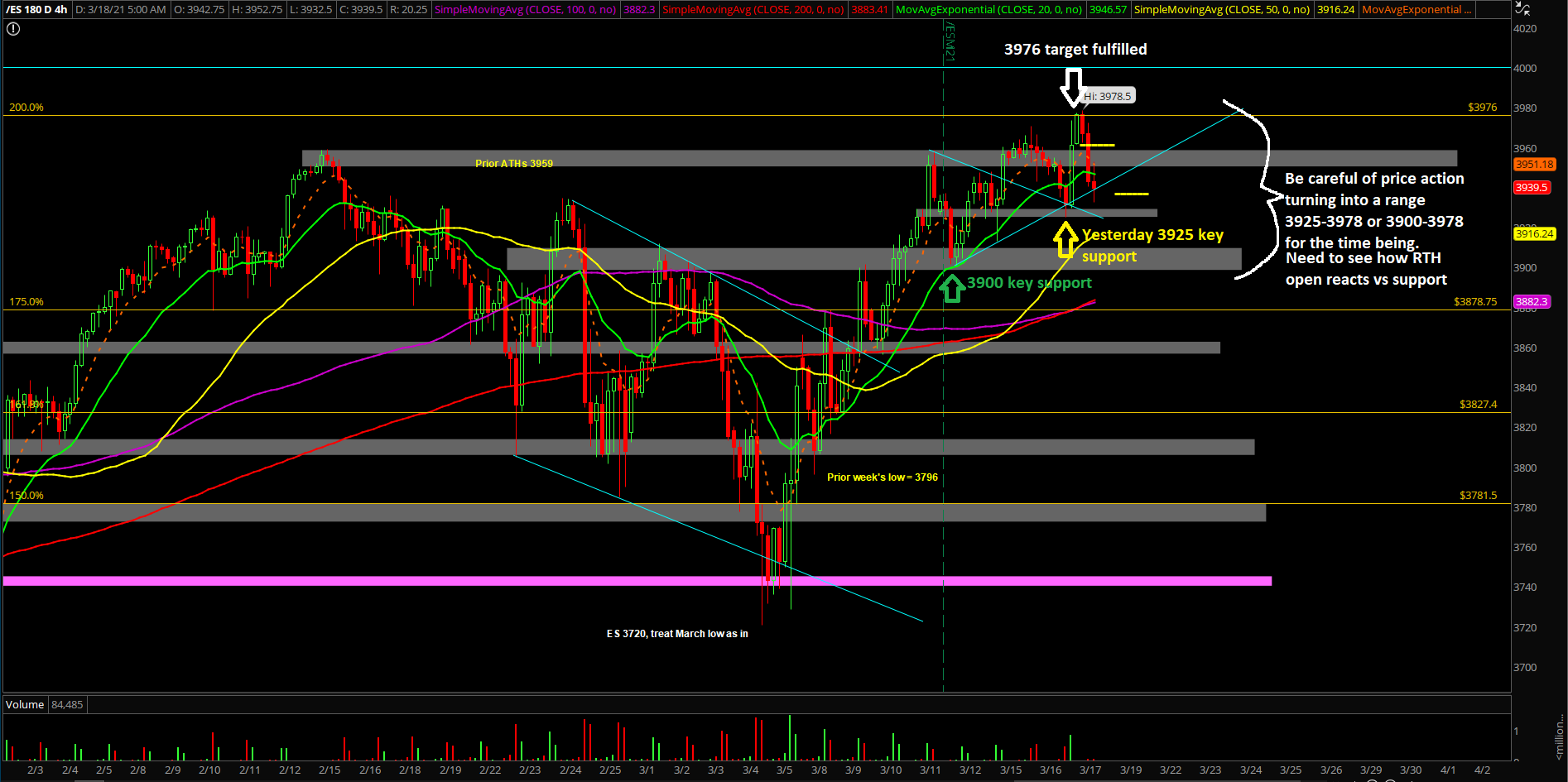

- Treating 4hr white line projection as played out, now rangebound bias 3925-3978 or 3900-3978

- 3976 target from months ago was fulfilled, but O/N price action is acting weak because it’s not sustaining above the usual trending 1hr 20ema/4hr 20ema after making new ATHs

- Lots of overlap so the risk of price action not getting into ES 4000 for rest of week is real

- Both ES+NQ keeps getting at their respective 3976/13250 targets/resistances for past 2 days

- Utilize yesterday’s low of ES 3925 to gauge short-term momentum, bullish when above

- Otherwise, 3900/lower key levels open up to offer the market some healthy digestion/consolidation after 8 days of higher lows and higher highs

- We need to be careful of a temporary top/deeper retracement as it’s been 8 days of HLs+HHs in case the overnight ES 3978 becomes the temporary top for the next few days

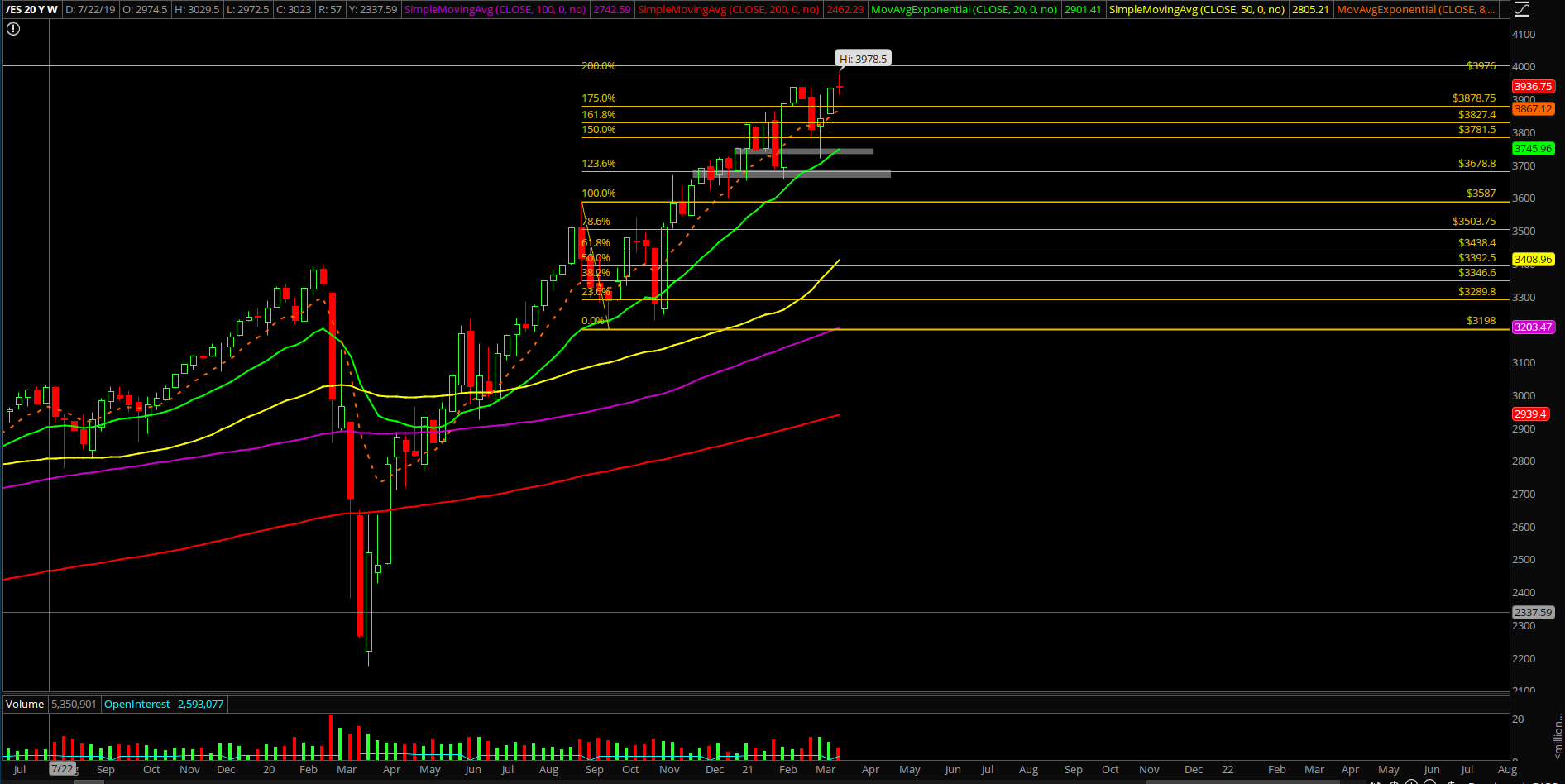

- If you recall, the second week of March’s bullish continuation structure confirmed the 3720 low of March. As discussed, we’re treating the first week of March as the foreseeable low

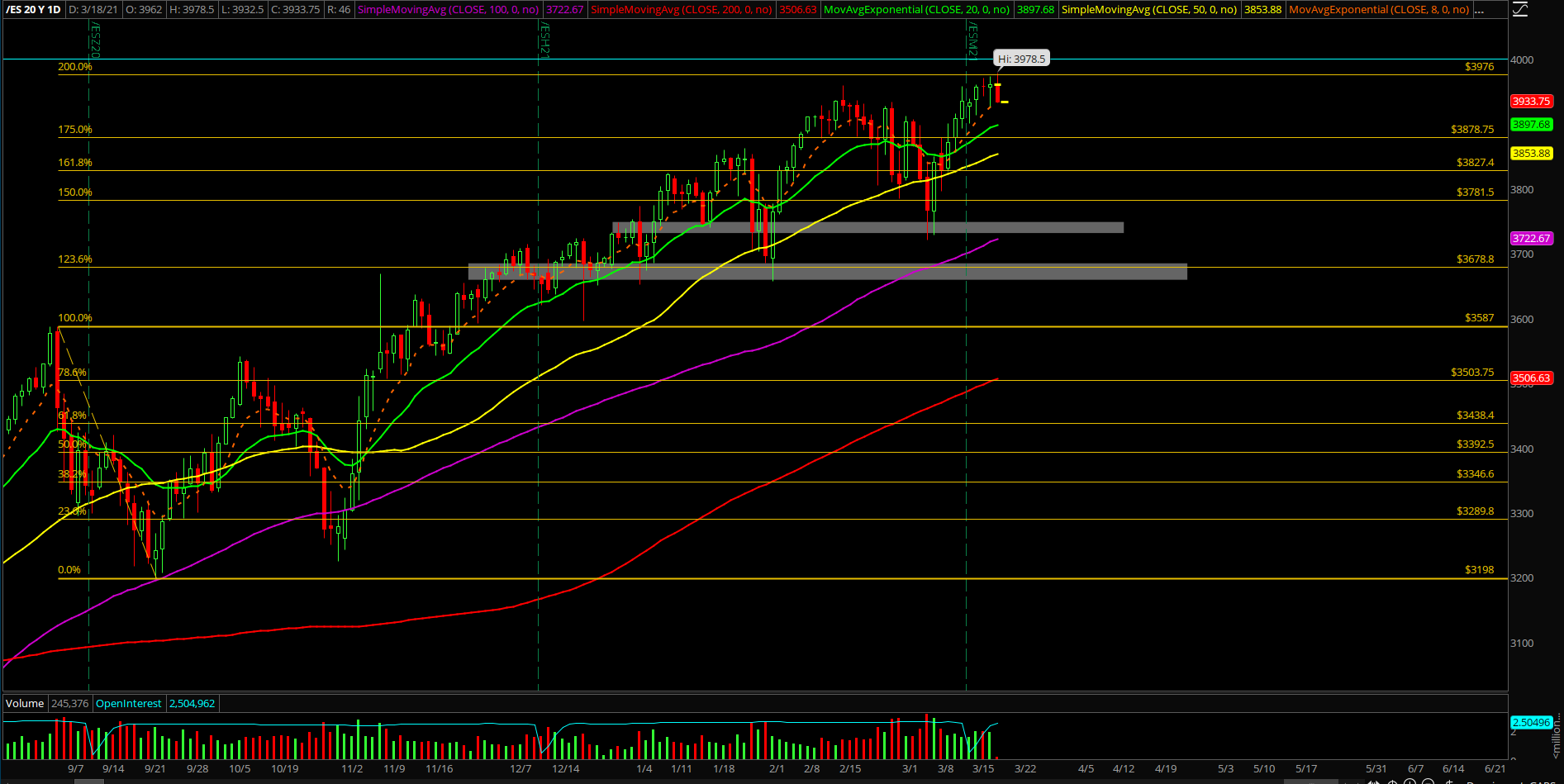

- Daily timeframe: yesterday’s ‘hold half and go’ setup played out accordingly as price action made higher lows at 3925 vs Tuesday’s low of 3913. This means that 3925 is pivotal for today

- Weekly timeframe: last week’s low was 3796; we expect bulls to hold above 3800 at all times

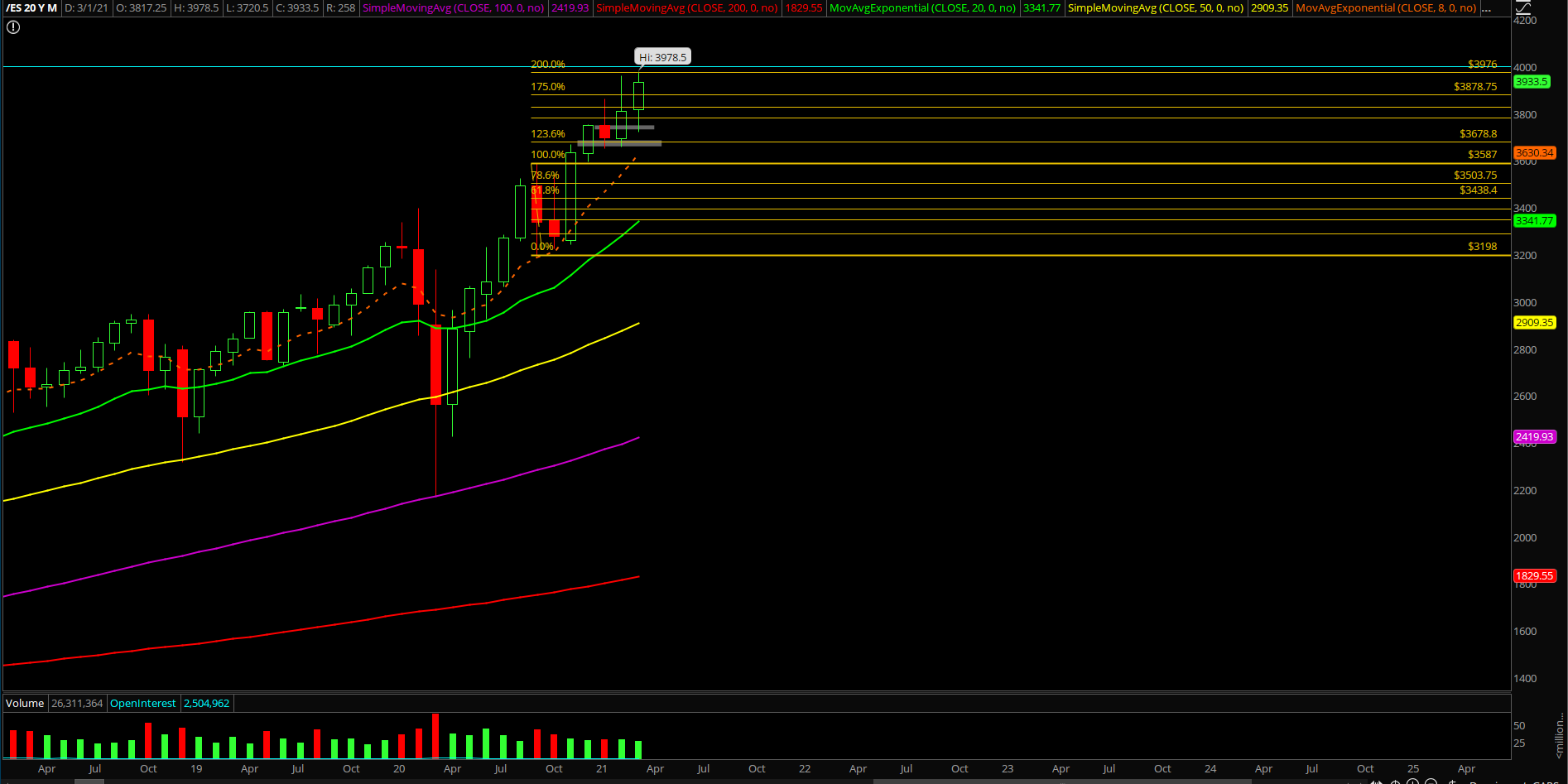

- Monthly timeframe: we’re expecting bull train to continue towards 3976/4000 targets into end of Q1 as the low of March is likely in from 3720 given the context+trend. At this point, there should be no breakdown below 3720 as higher lows and higher highs structure take place

- 3976/4000 on-trend targets need to be fulfilled in the coming days before we include the next high probability setups, level by level approach. Know your timeframes here

Additional context from past few weeks remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Janurary lows + Feb lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held