Market Analysis for Mar 4th, 2021

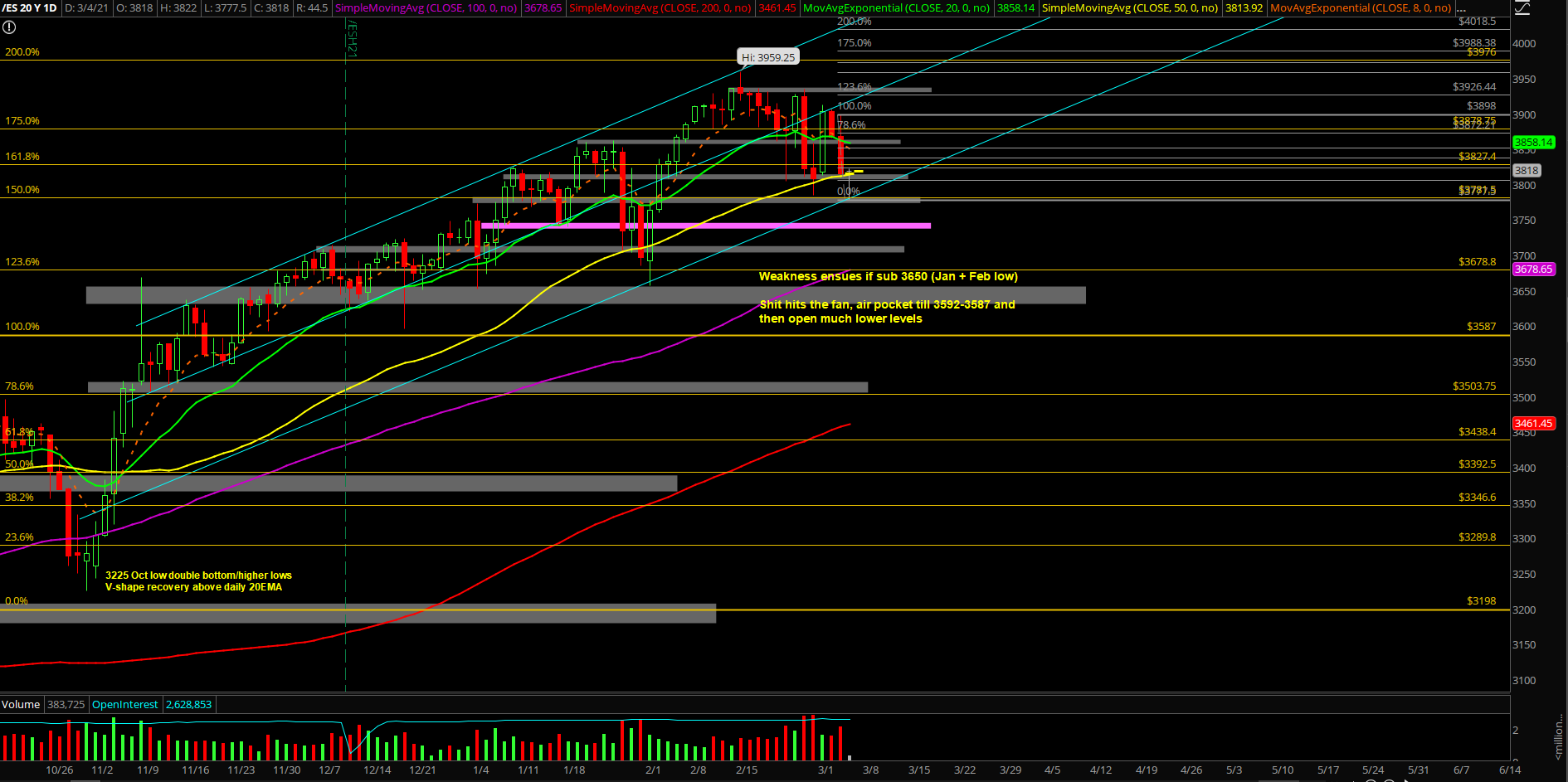

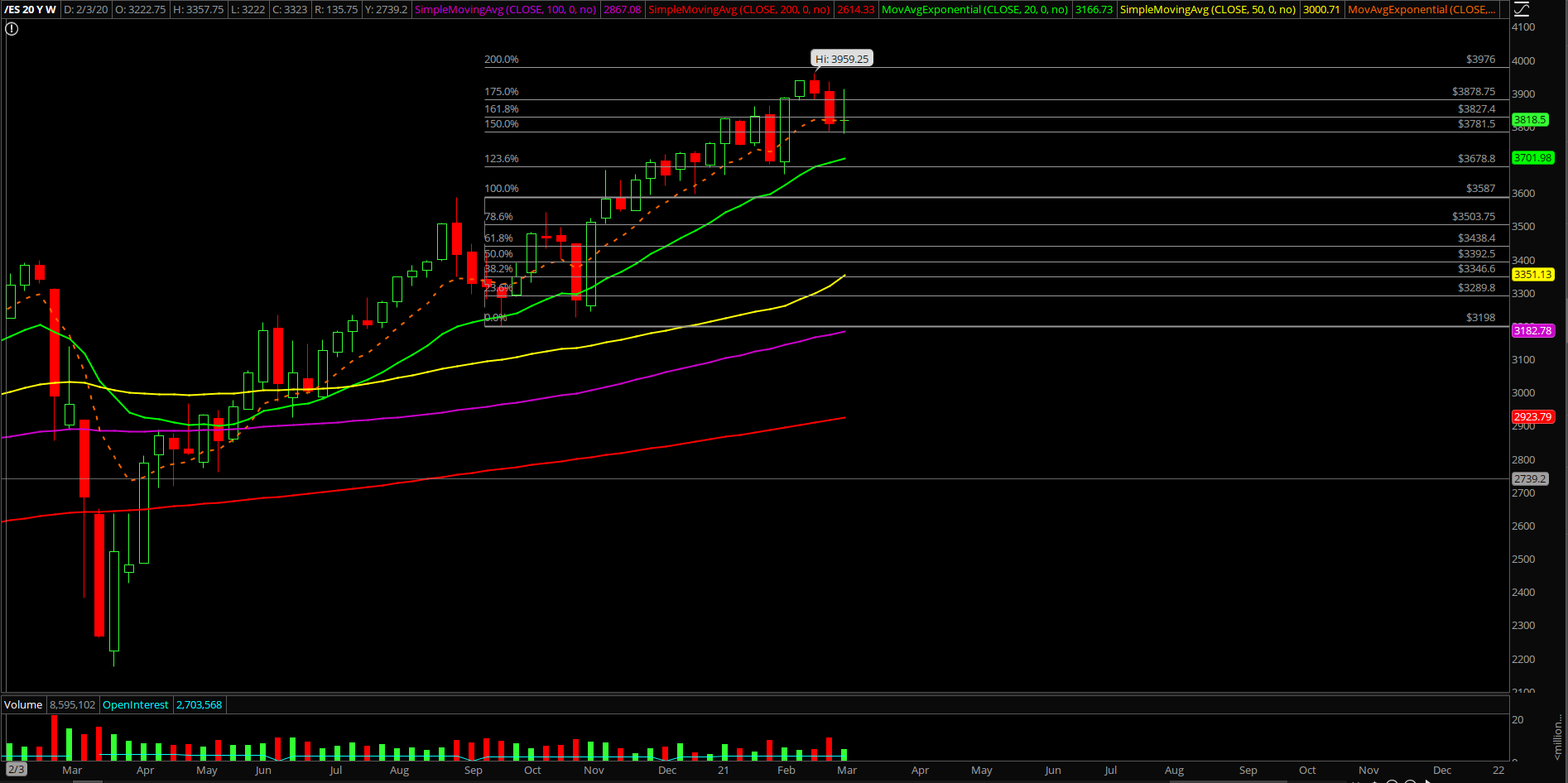

E-mini S&P 500 Futures: Keep It Simple Stupid – Judgement Day

Copying and pasting our ES trade alert room’s premarket gameplan report where we demonstrate real-time trades and educational lessons. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum.

Sharing all key levels here as a 1 time thing given the market at precarious spot. We navigate the markets via a level by level approach tactic and momentum is judged day by day. Let price action dictate your actions here.

Thursday March 4 Gameplan

Did the bulls/bears fail overnight? What is the next highest probability plan

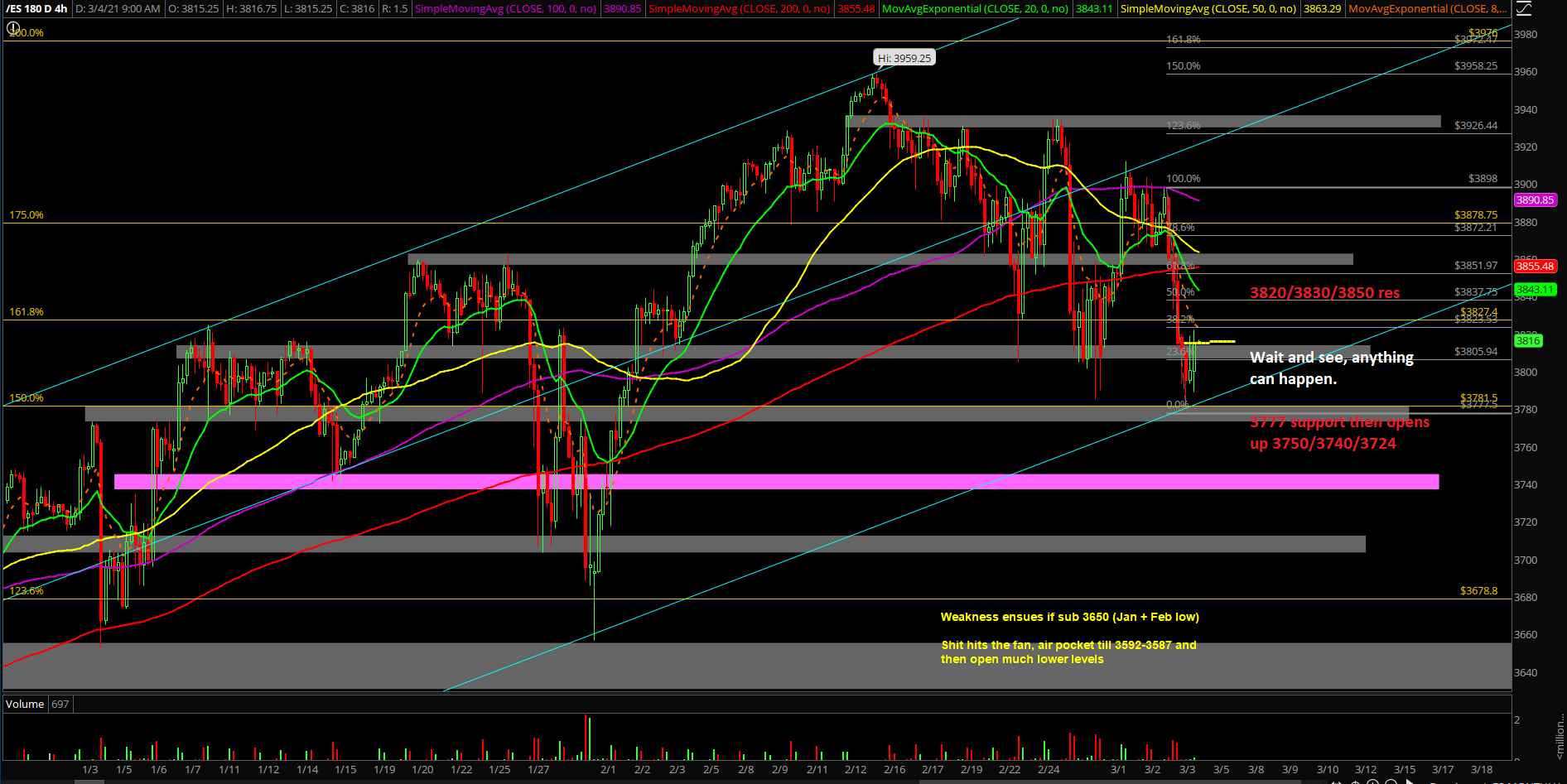

- Overnight bearish consolidation around last week’s low of 3785, O/N range = 3820-3777.5

- Utilizing 3777 and 3820 from overnight to judge momentum after the RTH open

- Determine whether 3777 is temporary bottom to force a quick bounce or does price action sell into strength vs 3820/3830/3850 resistances. We can trade both sides given the volatility

What is the bias/gameplan going into today? Do you see a feedback loop setup?

- Anything is possible here as price action sitting on a precarious place on all equity indices

- Yesterday started off as a typical range day and then price action broke below 3850 key support and selling continued into a massive trend day backtesting towards last week’s low

- For reference, short-term price now is trending below the 1hr 8/20ema and the overall 4hr 8/20ema indicating STFR. ES firmly closed below daily 8/20EMA again

- Traders ought to be careful here as there’s a cluster of confluence again as ES is backtesting the 2 std lows derived the lower bollinger bands + last week’s low

- Below 3777 opens up 3750, 3740, 3724, level by level approach

- Above 3820 opens up 3830/3850/3865, level by level approach

- We’re short-term bearish when below 3830/3850 resistances focusing on STFR, but also aware of violent snapback rallies that occur during a bull market. Be adaptable here as things could go from STFR to BTFD to STFR back into BTFD. Volatility picked up so nimbleness is needed here

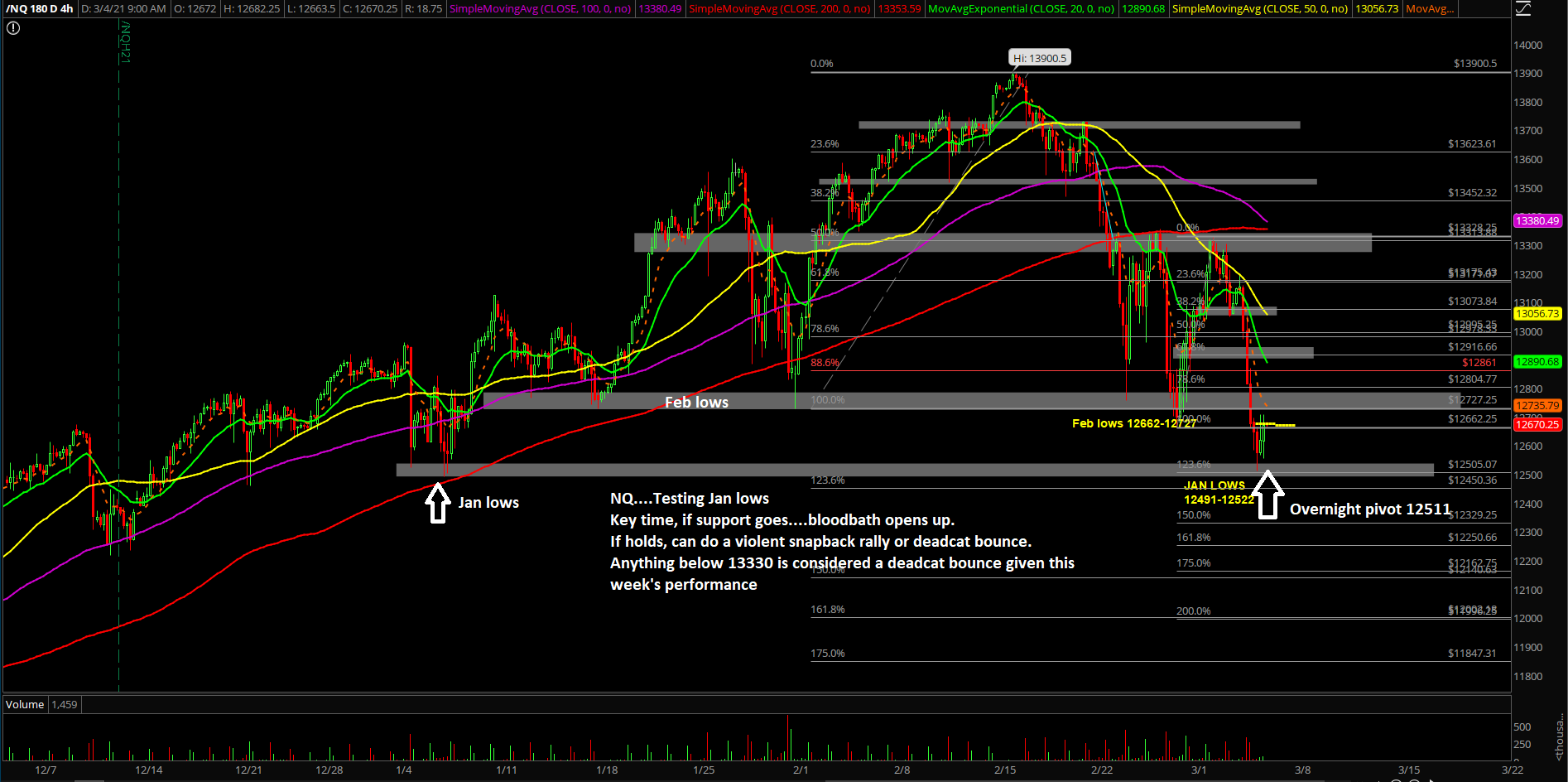

- NQ overnight low 12511 already tested around the Jan 2021 12491-12552 lows and holding temporarily for now and waiting for the RTH open to tell us more

- Today and tomorrow could become a bloodbath so you need to be prepared if support levels keep breaking and casacading down. NQ has led the way down for past couple weeks, if ES catches up into the downside…it will be a vicious cycle of people running for the hills

- Overall, let price action dicate your actions. Have to wait for the RTH open to judge the overnight 3820-3777 key levels/range. Does price sell below 3777, does price reclaim 3820 and backtest into higher resistances such as 3830/3850, or does price just go horizontal awaiting for Friday being the real decision maker

- It’s been a downside trend week thus far, if selling contines, we fully expect bears to attempt to close the weekly print at/around the lows. (remember, Friday usually plays out a continuation model of Monday-Thursday’s strong trend given our stats)

Additional context from past few weeks remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Janurary lows + Feb lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held

What are the key levels to be aware of?

- Resistances 3820, 3830, 3840, 3850, 3865,3878,3885, 3900, 3913, 3920, 3935,3950, 3959, 3976, 4000, 4020, 4025, 4050

- Supports 3800, 3780, 3777, 3773, 3750, 3740, 3724, 3715, 3703, 3700, 3695, 3685, 3676, 3668,3652,3642, 3630, 3620, 3600, 3596, 3592, 3587, 3582, 3575, 3567, 3550, 3542,3515, 3505, 3500