Market Analysis for Mar 1st, 2021

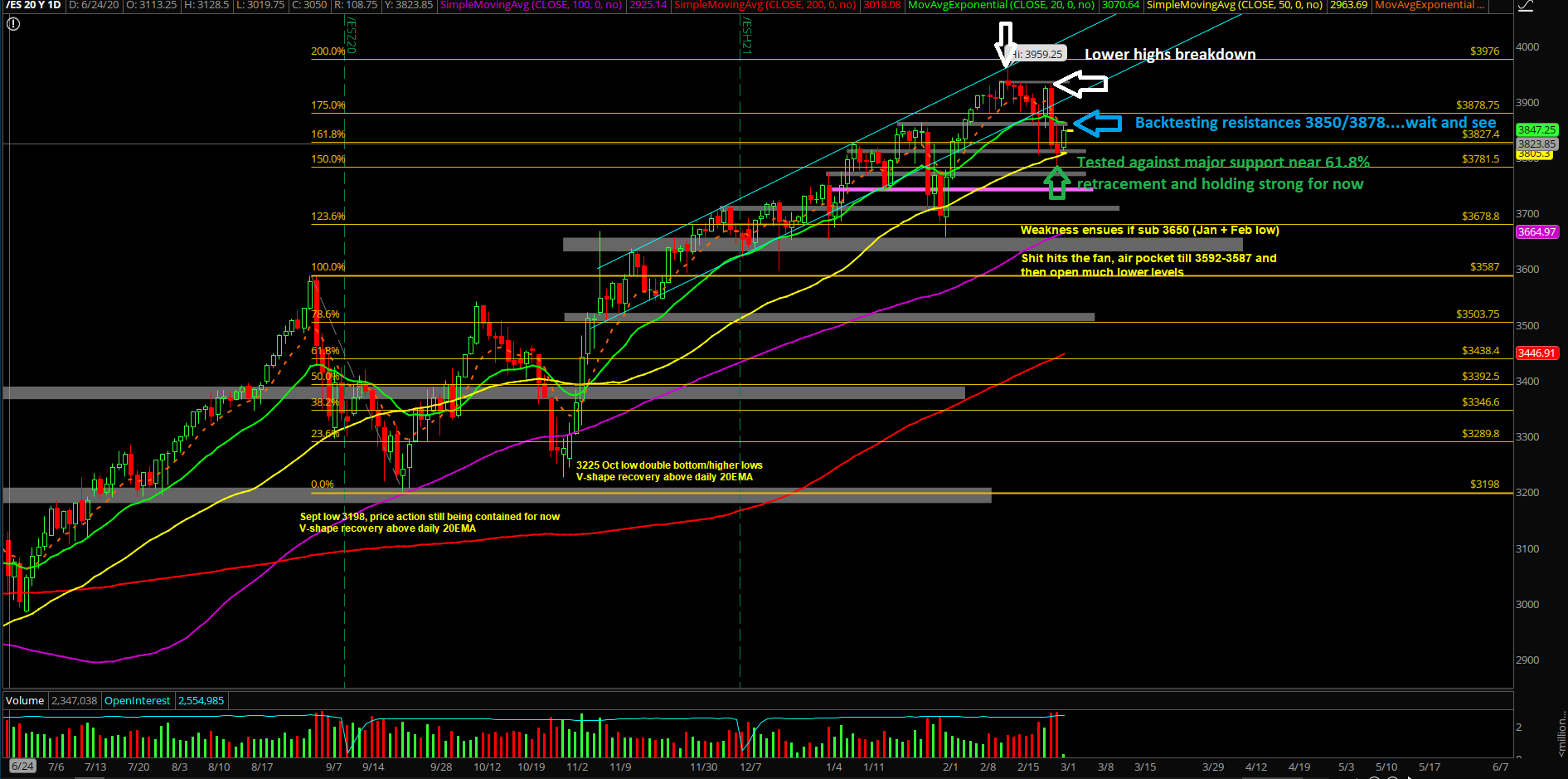

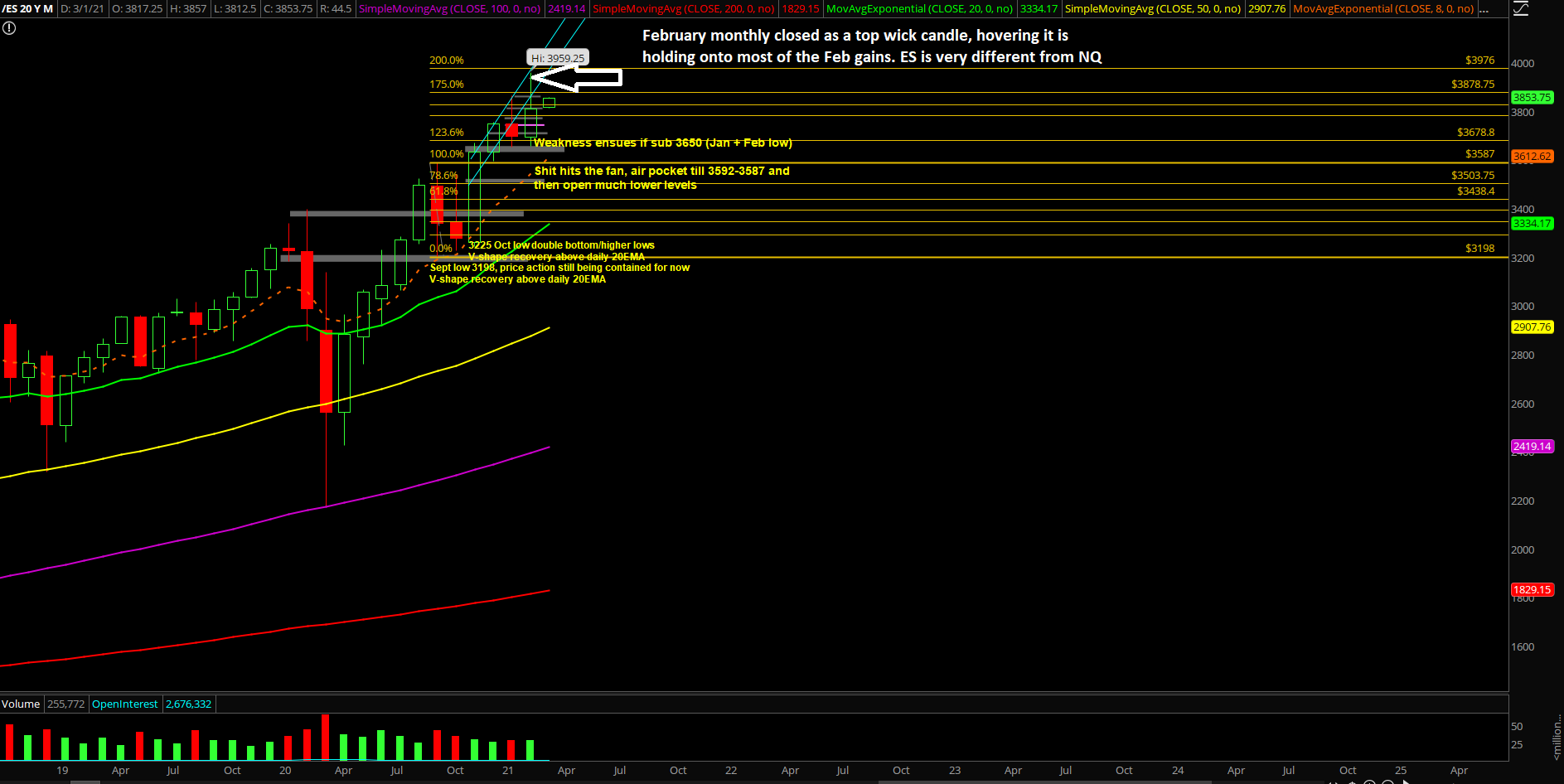

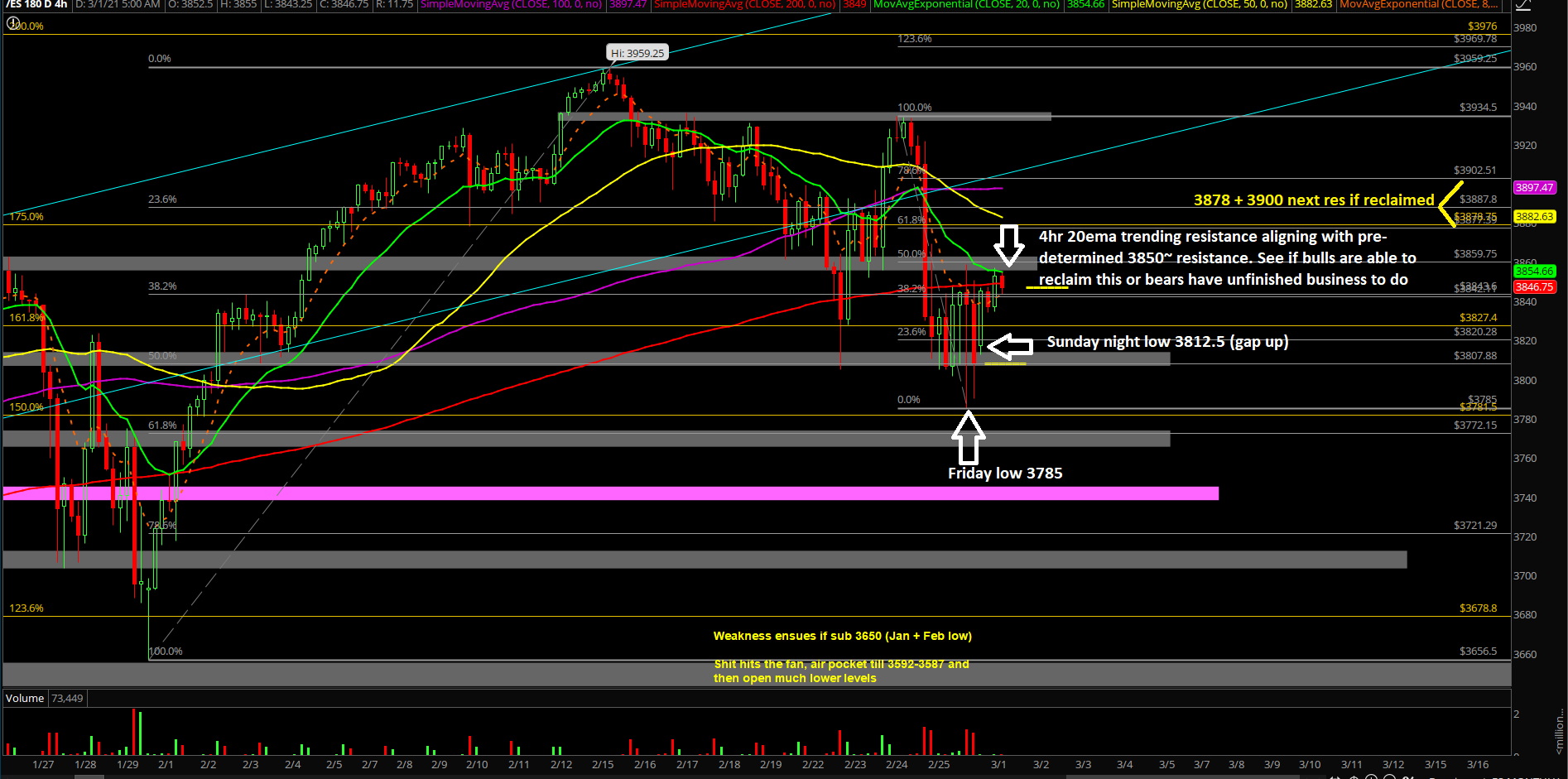

February was a grind-up month that closed around the midpoint of the monthly range indicating that price action needed some healthy digestion/consolidation in order to refuel the bull train to eventual higher highs. 3959.25-3656.5 was the overall monthly range on the Emini S&P 500 (ES) as price closed up at 3807 on Friday Feb 26th.

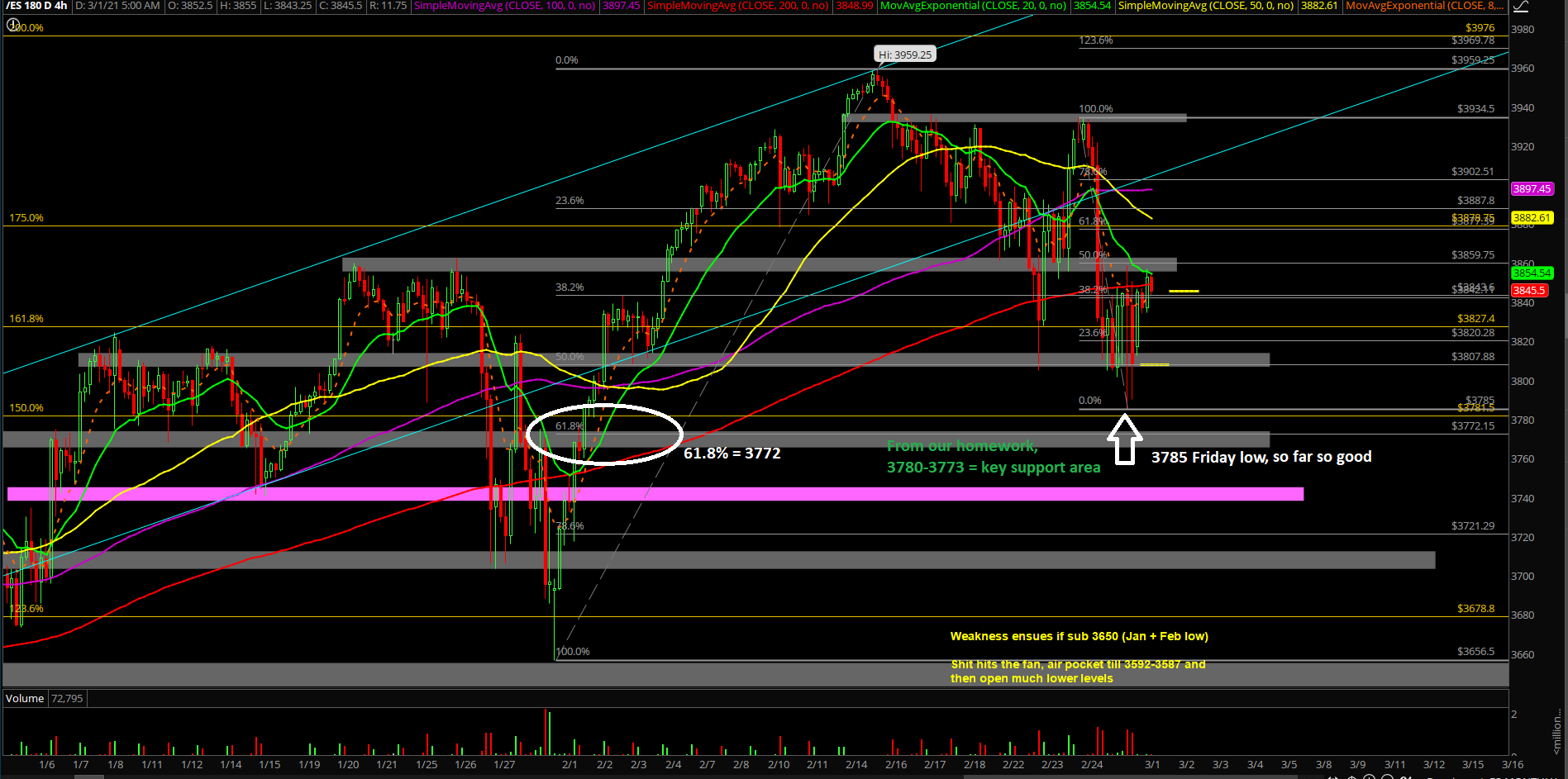

The main takeaway is that we’re still navigating this important short-term battle within the context of the longer bull trend. Short-term price action still remains bearish given that price are below our key resistance levels such as 3850 and 3878. However, we’re closely monitoring the potential massive feedback loop squeeze setup that bulls are trying their counter assault from Friday’s low of 3785. The next 2-3 sessions could potentially give us significant clues on how the rest of March will go. Will the low of the month be established or will bears obliterate that idea? Find out soon with the train conductor.

What’s next?

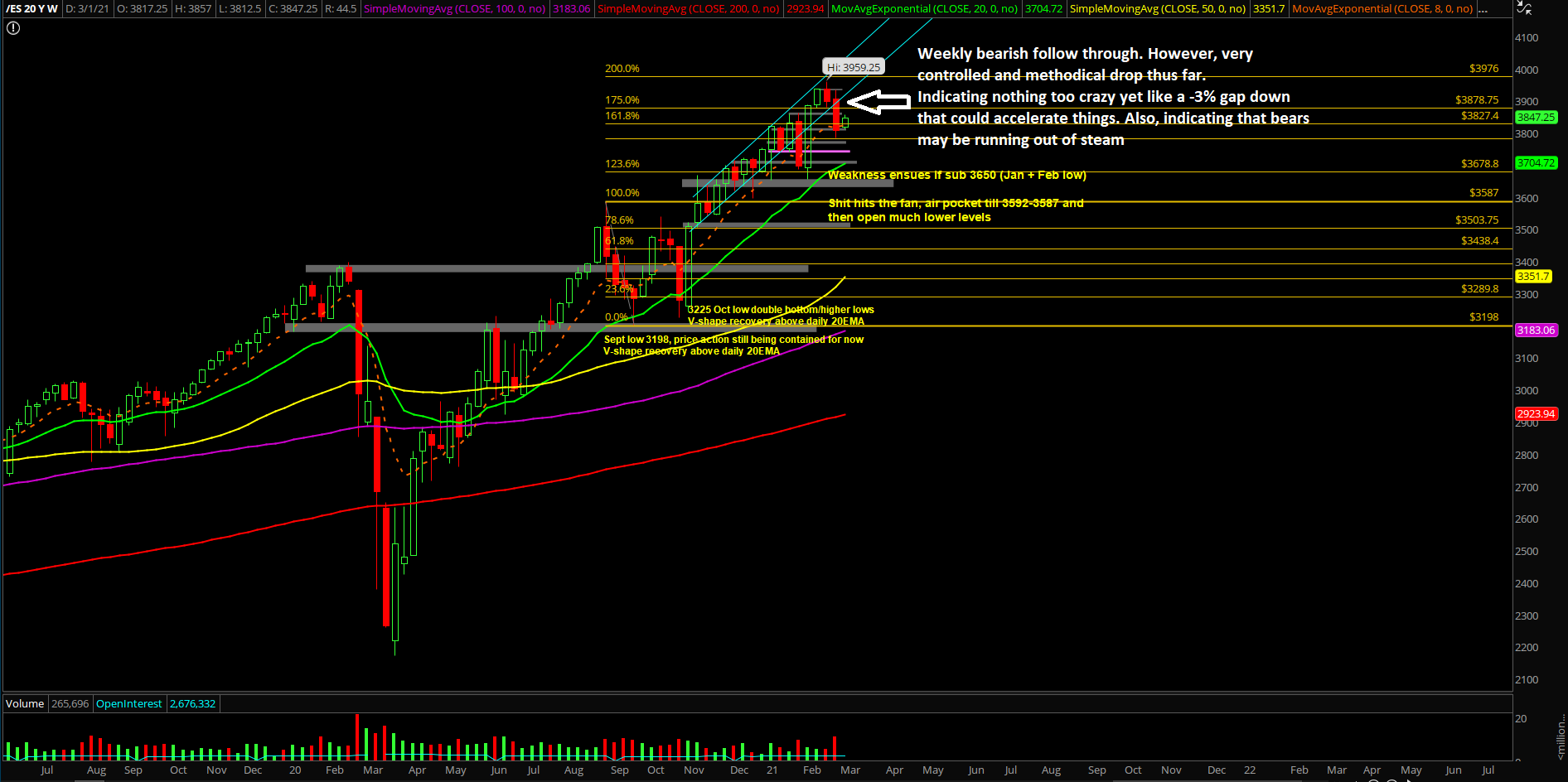

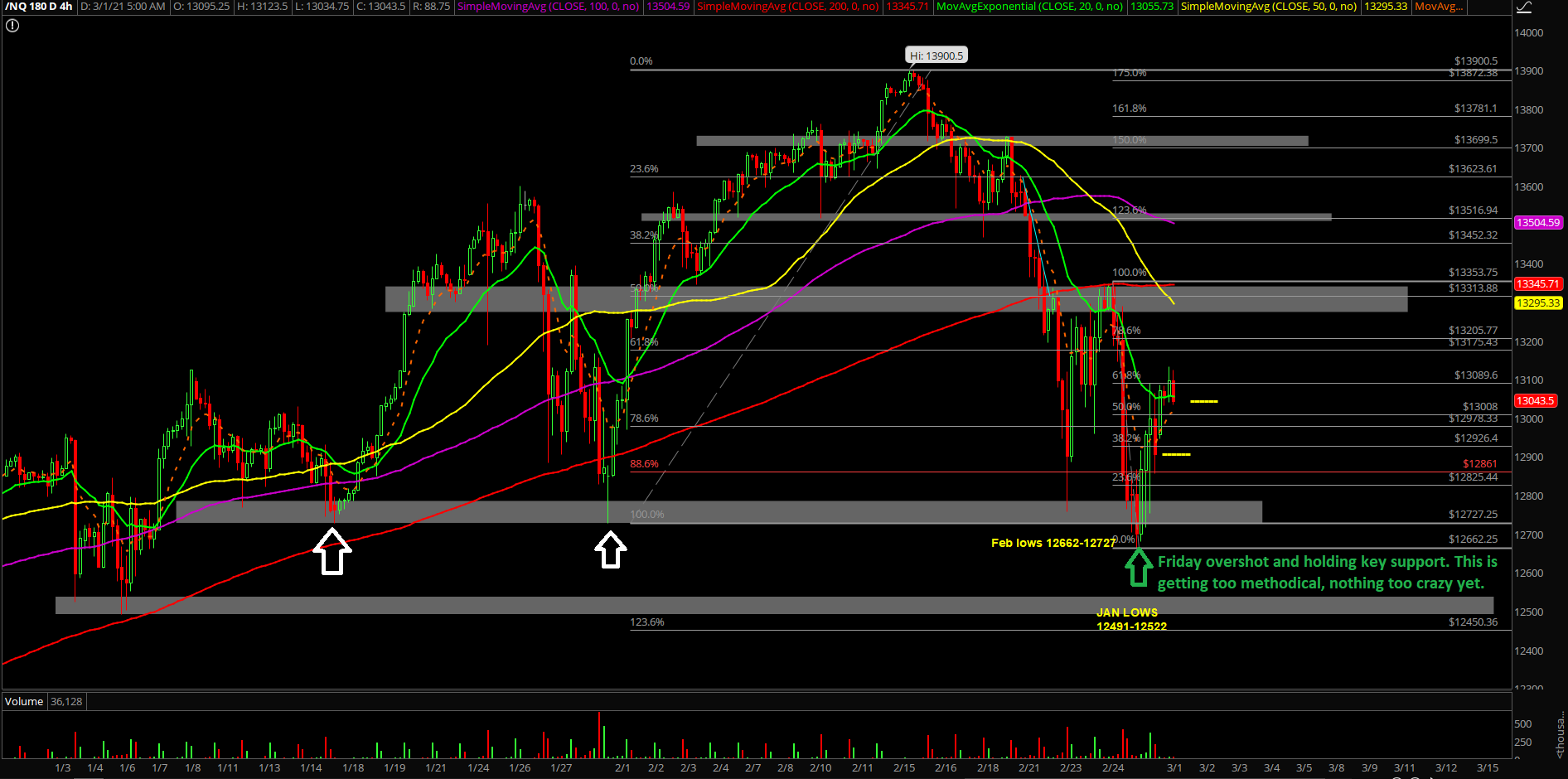

The end of Feb closed at 3807.75 on the ES, below some key resistances such as daily 8+20EMA indicating short-term bearishness. However, the pullback/backtest into support for the past 2 weeks has been quite methodical and controlled. This means that bears are not doing anything that is damaging to the intermediate or macro timeframe charts.

Summarizing our game plan:

- We’re short-term bearish and intermediate bullish as ES decisively closed below 3850 and 3800 on Friday. However, we could also clearly see that bears are failing to do any real damages.

- This also means that short-term trades could switch from looking at STFR setups to BTFD really quickly. In addition, swing traders will likely be looking for long positions as the potential low of this month could be in or in the making already (insane risk vs reward if so)

- Short-term price action is in a holding pattern and there’s a potential large feedback loop squeeze setup that has been building since Friday’s low of 3785. Need a daily closing print above 3900 to really double confirm things. Above 3900 would be a lethal blow to bears as they only got as low as 3785 on their last assault of February.

- For reference, ES price action has held vs the (3772) 61.8% fib retracement of the 3959.25-3656.5 range (all time highs vs Feb lows).

- This early week could determine a lot of things such as whether the low of the week is in or not; one scenario is that early week confirms some sort of temporary low that could act as the low of this week and that could extend into the low of the month…etc. Another scenario is that bears have unfinished business backtesting some more major supports of January monthly range

- Given last week’s price action, this backtest/pullback has been quite methodical and it’s looking like bears are starting to run out of stamina. Bears couldn’t make the lethal blow with a Sunday night gap down that they needed to even when they had the advantages of the previous daily+weekly+monthly closing prints around like lows. Pullback has been too methodical.

- Going into this week, we’re expecting some sort of a solid bottom to form in order to get this higher timeframe bull train back towards 3976/4000 targets again. Wait and see for confirmation.

- Obviously, a break below 3800 followed by last week’s low of 3785 would confirm that bears are still unfinished with the downside