Market Analysis for Feb 22nd, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Key Time, Consolidation Continues Into Month End

Copying and pasting a core section from our ES trade alert room’s premarket gameplan report where we demonstrate real-time trades and educational lessons. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. (some key levels have been redacted for fairness to subscribers)

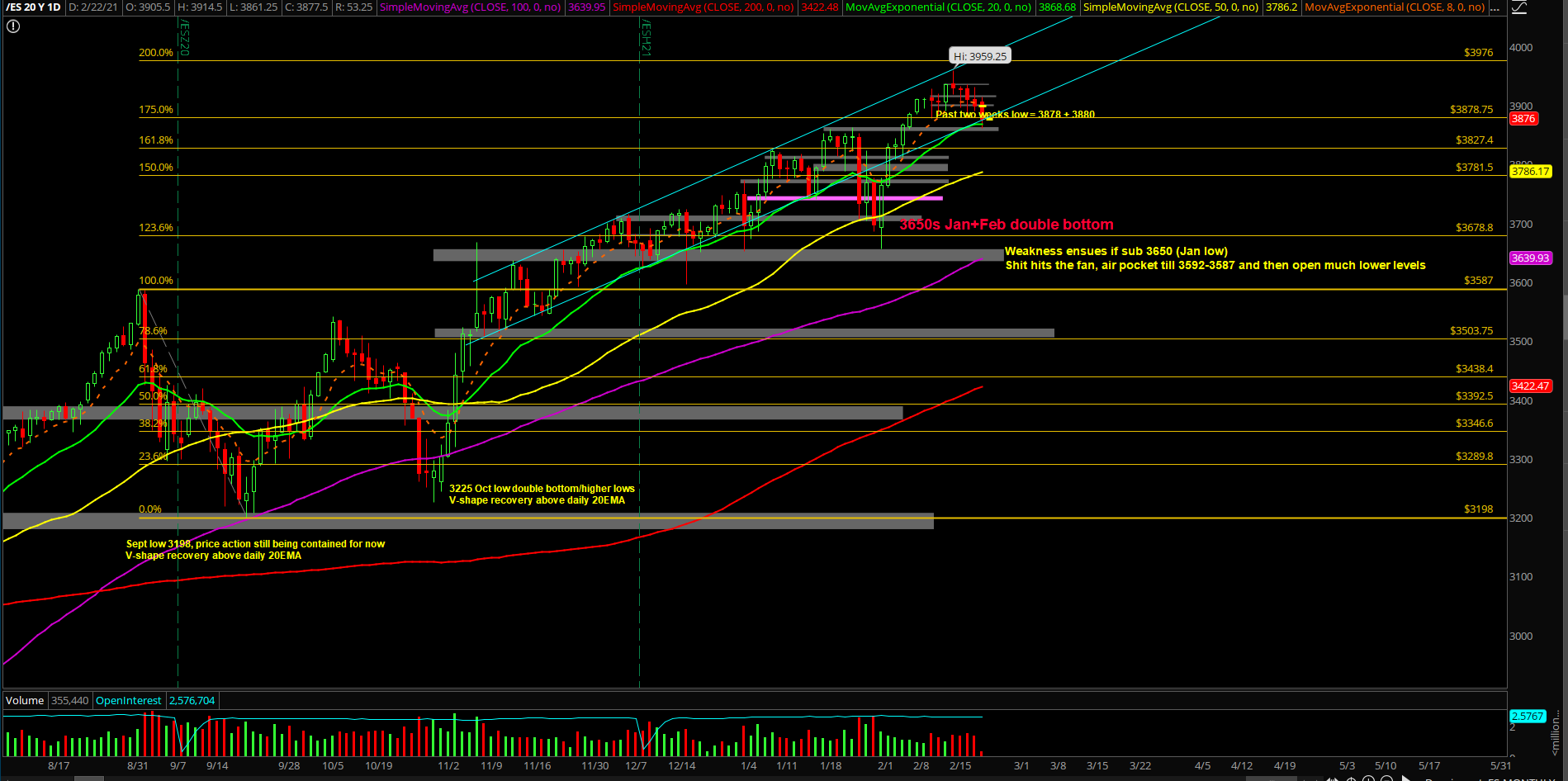

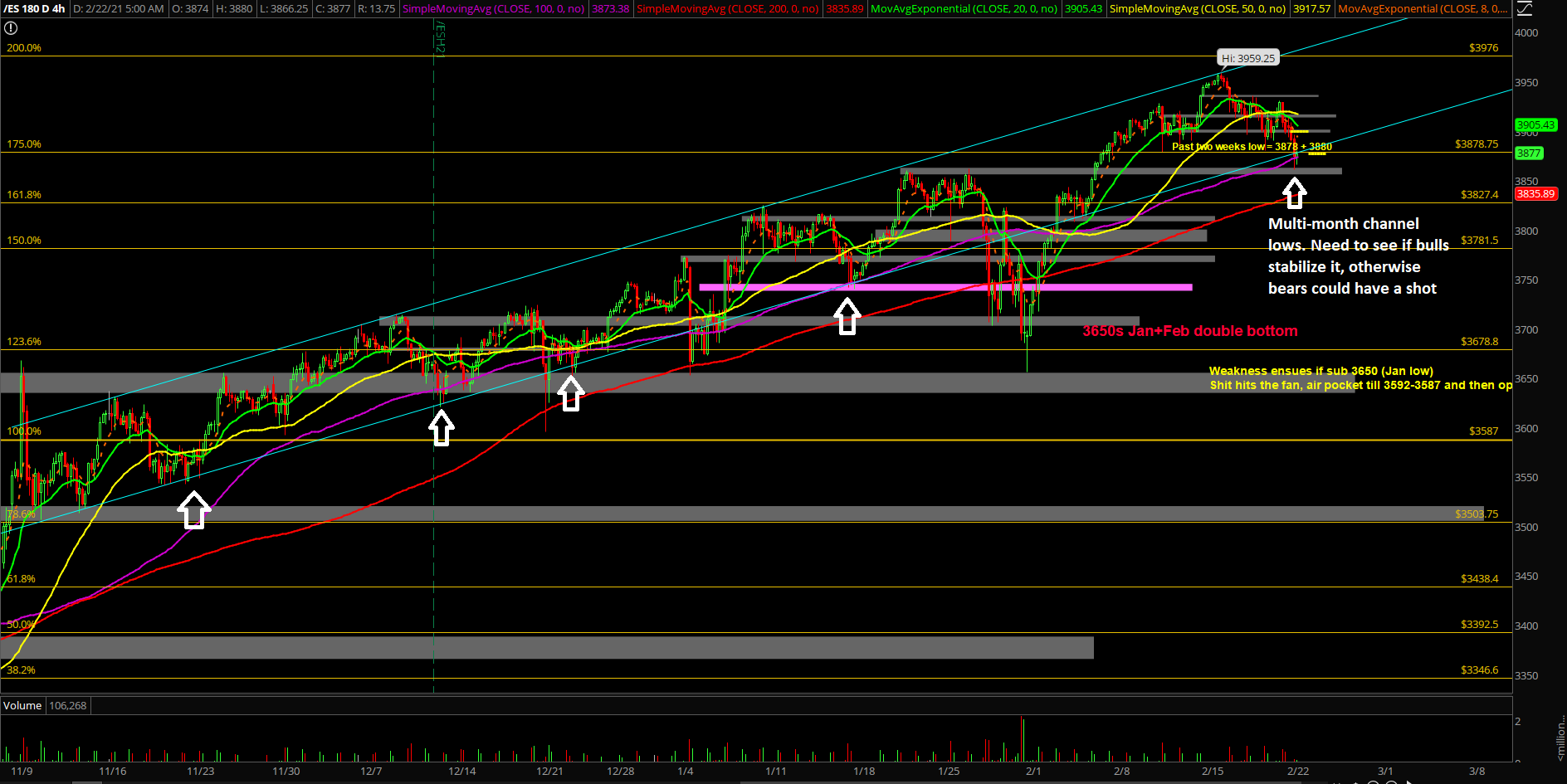

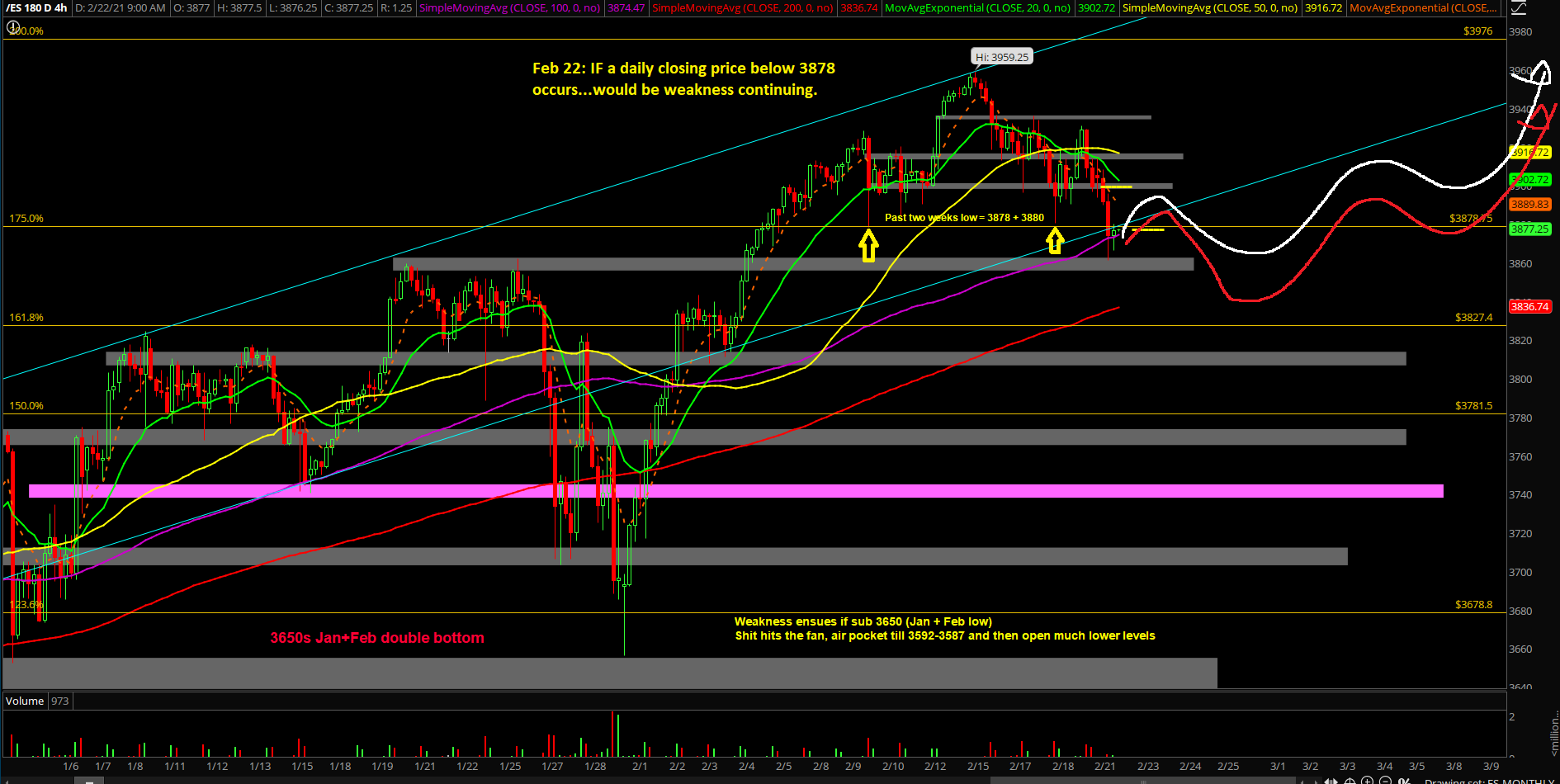

- Today’s daily closing price will be instrumental for both sides, watch whether it’s above or below 3878 (the prior two week’s low area)

- Bulls do not want a close below 3878 to confirm the weakness below 2 weeks’ low and bears want to open up the downside range

- If price stabilizes vs 3860s confluence, then be aware of sticksave potential back into 3880/3900 for the daily closing print (our current bias but need confirmation)

- If decisively breaks 3860s, opens up 3850/3830/3800 immediately. Level by level approach

- Short-term is opening as a gap down from Friday’s closing price. The short-term action is indicating weakness as price action backtesting against a key confluence around 3860s (daily 20EMA + prior all time highs form Janurary).

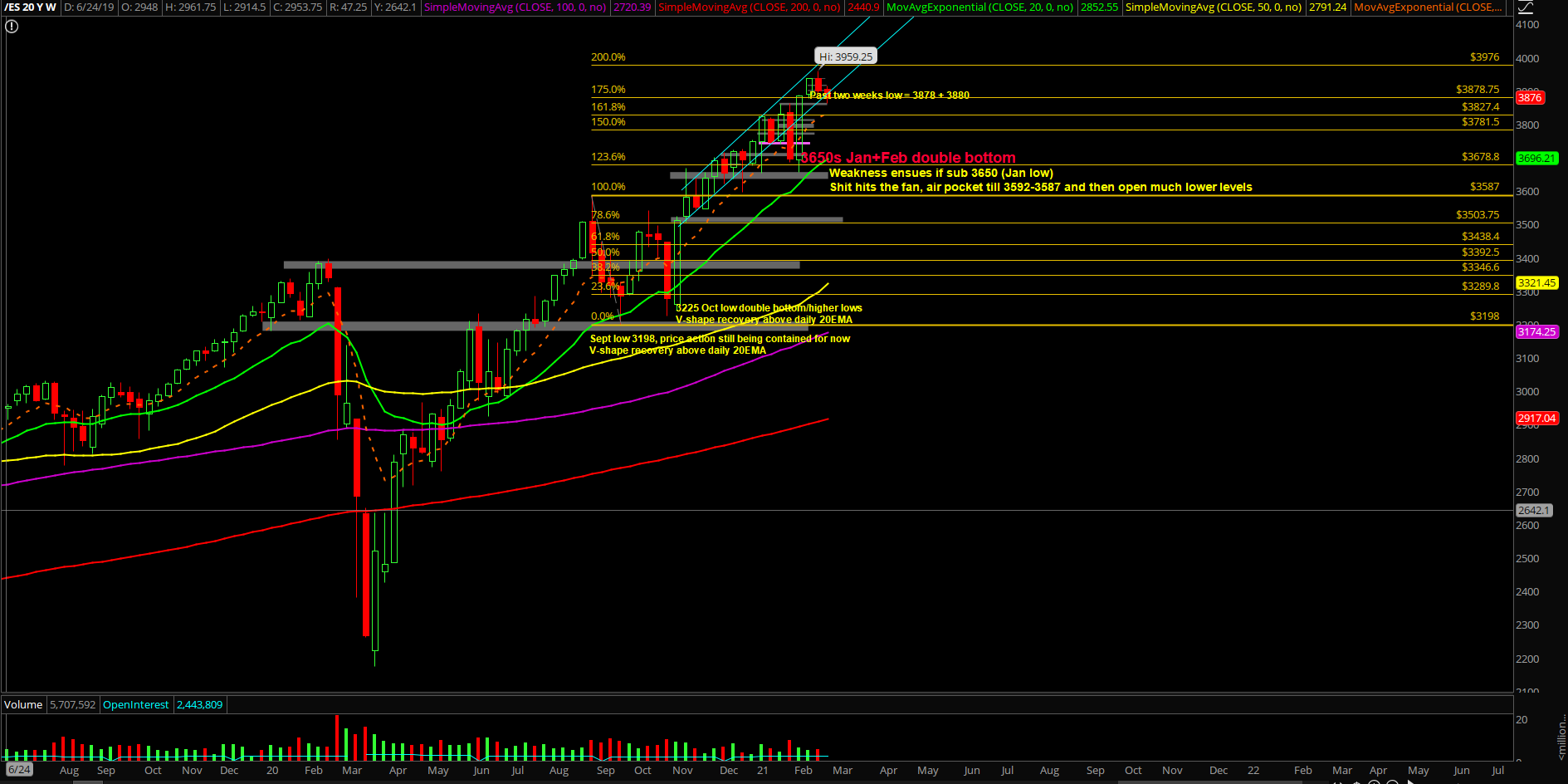

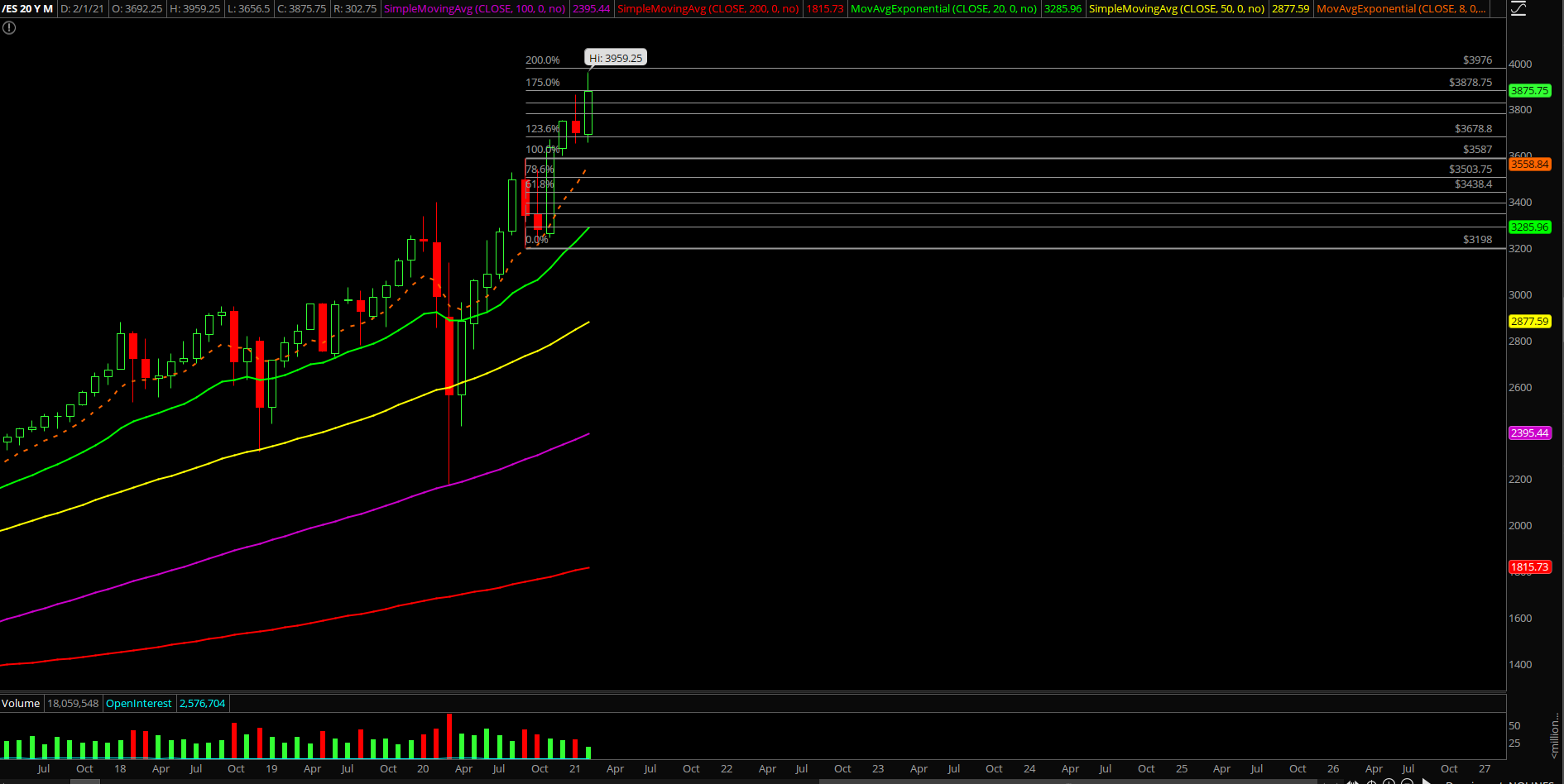

- Today is day 5 of the consolidation/pullback since 3950s all time highs and hovering around the bottom end of the multi-month uptrend channel from November 2020

- The overall context has been an uptrend grind up month that made new all time highs vs Janurary. This week is month end so we’re not expecting anything too crazy unless price action can showcase more downside momentum. Intraday weakness /=/ daily closing print weakness

- The general theme will likely be that the bulls will likely try their best to stabilize into the month end closing print

- We must adapt accordingly if price action remains weak, let price dictate your actions

Additional context from past few weeks remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Janurary lows + Feb lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held