Market Analysis for Feb 11th, 2021

Good morning EWT, we are making progress on preparing for our official launch of HDO which will occur next week! Current EWT members who sign-up the first week will get a discount. Additionally, next week StockWaves will release their first report of our previously announced collaboration.

Below is a report that I co-wrote with Seeking Alpha contributor Long Player on one of my favorite mid-stream companies.

I Am Buying the Dip: Enterprise Products Partners

Co-produced with Long Player

* Note that EPD issues a K-1 tax form.

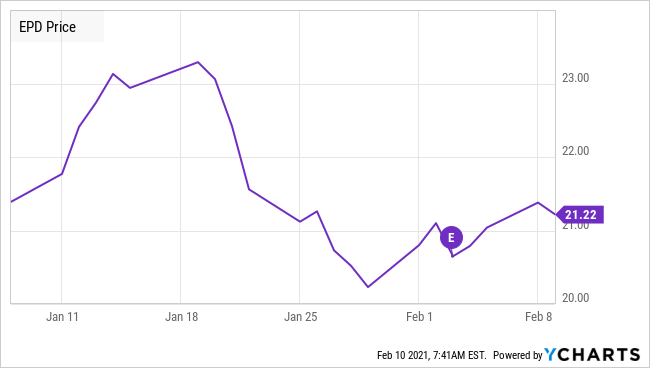

Enterprise Products Partners, LP (EPD) has long been one of the safest of midstream companies to invest in. The stock has been seeing a strong recovery since the 2020 crash. The current yield is at 8.4%.

Just recently, EPD reported their earnings and on the surface they looked disappointing to some investors due to misguided focus on earnings per share.

The stock has pulled back over 12% recently, and did not recover much following the earnings report. I will explain why the dip is a buying opportunity!

The 4th Quarter Earnings Report

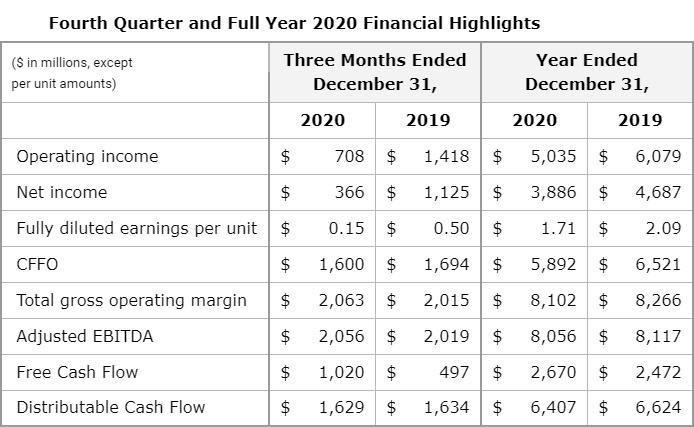

EPD reported their earnings on February 3rd. The business itself appears to be pretty healthy.

The primary reason for the earnings decline was a write-off of goodwill. Cyclical companies generally make very conservative assumptions during industry downcycles as evidenced by the coronavirus demand destruction. Investors should note that Adjusted EBITDA actually crept upward despite this challenging fiscal year. Cash flow did decline, but a fair amount of the cash flow decline was due to working capital needs. Increasing working capital needs can be a precursor to a recovery of the business.

The distribution was just increased in January, and the debt was reduced. The share repurchase program has been active. The 8.4% yield has a payout ratio of 60%. It is fairly conservative by most standards.

More importantly, "free cash flow" has expanded as the need to invest in growth projects has ebbed. This bodes well for further common unit repurchases and debt repayments until industry activity catches up with the excess capacity prevalent throughout the industry.

In short, EPD had a decent year despite the coronavirus challenges throughout the year. The distribution was increased 1% beginning in the new fiscal year to keep the string of distribution increases alive. The distributable cash flow figure shown above clearly demonstrates room for more distribution increases in the future when Mr. Market decides to reward such increases.

The misguided focus on earnings per share provides an opportunity for investors to get in after the recent price drop. Fundamentals were decent as shown above. The write-off of goodwill did not represent a change in earnings power, and is a non-recurring expense. Therefore the recent dip in the price of the common units represents a great buying opportunity. The economic recovery from the coronavirus presents another growth opportunity, which will drive profitability and share price higher.

Resiliency During The Pandemic

The share price has suffered during the pandemic. Mr. Market put all of the sector in the doghouse, including high quality ones. What is important for investors to note is that EPD's earnings throughout this period were little impacted, because it has a strong, resilient business model.

It is no surprise that EPD share price has been seeing a strong recovery. The company has just increased its distribution, reduced its debt, and has been repurchasing its shares. EPD's management is the best and most conservative in the midstream sector. This distribution increase and share repurchases are a vote of confidence about their earning strength and future outlook. The immediate dip following earnings was also unjustified. Even following the rally from their lows, those shares clearly have a way to go just to get back to historical levels as seen in the chart below.

Significant Growth Ahead

Natural gas technology exists to replace higher-polluting competitive products like coal and crude oil. The result is that many coal-fired electric generators are converting to natural gas. Similarly trains and ships now run on natural gas because it is cheaper and reduces pollution. Natural gas is the logical next step in reducing pollution and it is winning over converts without the need for tax incentives or other government intervention.

Furthermore, natural gas and related liquids ('NGLs') are raw materials for some very fast growing industries. These products are used in manufacturing, medical tubing, heating, car tires, detergents, plastics, and other manufactured products such as food packaging. You can't make roads, roofing shingles (asphalt), plastics, home heating, and a whole lot of other things we use in our lives without the byproducts of NGLs and natural gas. The world today is focused on electric cars as part of the "green revolution". But these cars need power, and so far the best source to power these cars is through power plants running on natural gas.

In the case of these materials, there is little to no replacement processes available.

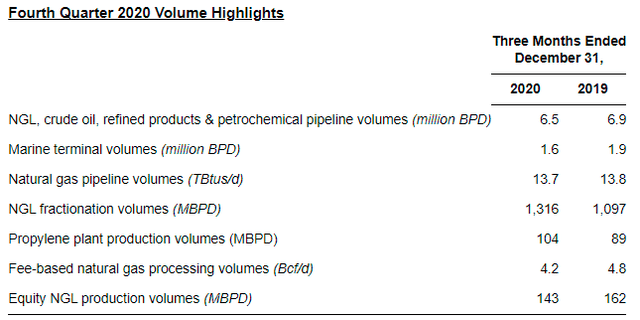

Source: EPD 4th Quarter 2020, Earnings Press Release

EPD's two businesses with the most growth are NGL Fractionation Volumes and Propylene Plant Production volumes. Both have connections with the very healthy plastics market (among other uses). Both are likely to experience significant growth for years to come. As a result, EPD will likely expand about 5% per year long-term. This investment offers an excellent total return seldom seen for such high quality companies.

Location, Location, Location

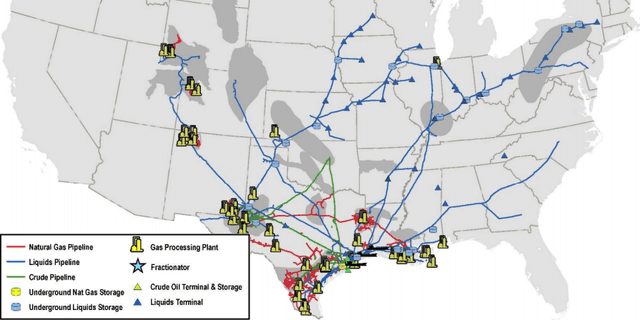

Much of this partnership is well-located in the state of Texas.

Source: EPD December 2020, Investor Presentation

Two of the most cost competitive basins in North America are the Eagle Ford and the Permian. This company clearly has ample exposure to both. Furthermore, the pipeline system allows this company to at least hook up to other basins in North America as changing market conditions would demand.

The excellent location means that any excess capacity will not last long. As opposition to new pipelines continues to build, existing pipelines will become much more valuable. They will also be the key for the energy independence of the nation. The company also has access to export facilities and so will benefit as U.S. exports of natural gas continue to grow.

Investment Grade Credit Rating

EPD is unique in the sector because of its investment-grade credit. Management has a track record of maintaining a solid balance sheet in good and bad time. Long term debt is among the lowest levels of any major midstream company that I follow. Currently leverage is at 3.5 times EBITDA, with plenty of liquidity available. That conservative debt policy is expected to remain for the foreseeable future.

The +8% Distribution

The +8% yield has a payout ratio of 60%. It is fairly conservative by most standards. This ratio is likely to become more conservative in the future as growth resumes in 2021. Management is likely to continue repurchasing common units and retiring debt until the market responds positively to increasing distributions

Yet the evidence of common unit repurchases demonstrates that more money is available for distributions when the mood of the market changes. The continuing operation of newly completed capital projects will add still more money available for potential distribution increases in the future.

Valuation

The recent enterprise value of EPD floats in the $75 billion area. That is a little more than 9 times the value of the EBITDA for the current fiscal year. A far more reasonable valuation of the company would be an enterprise value in the 12 to 15 range for a multiple of EBITDA.

In the meantime, the 8.4% yield is above what most investors make in total returns over the long term. Any capital appreciation and distribution increases would be icing on the cake. In the past the yield on the common has been closer to 6%. Should the previous history prevail, EPD shares need to appreciate to $30 without taking into account any distribution hikes. This would provide a 40% upside from the current price.

High Insider Ownership

Management has a substantial interest in the continued success of the company. Unlike many other in the midstream sector, this one is organized for partners to elect the board of directors. This provides direct accountability to shareholders, a huge advantage over most listed companies. The management of the company owns 32% of the shares, which is significant. Senior management clearly owns enough shares to control the company.

Such high insider ownership makes management interests aligned with those of shareholders. So far, that has resulted in a very profitable yet very conservative approach. Shareholders should expect that to continue in the future.

Conclusion

There are many things to like about EPD:

It is one of few midstream companies with investment-grade ratings.

Has a resilient business model with significant growth ahead.

Their distribution policy is one with a record that matches many of the dividend kings.

Management is the best in the midstream space.

The distribution increase last month provides confidence about the future prospects.

The payout ratio of 60% is among the lowest in the industry.

The share repurchase was a smart move. It is due to the low share price, thus increasing shareholder value. This money can be used to raise the distribution in the future.

High insider ownership.

Don't be misguided by the recent earnings report. They were very solid. Every dip in the share price of EPD is a buying opportunity. Enterprise Products remains an industry leader. Such leaders are seldom on sale. At today's prices, EPD offers a 40% upside potential, in addition to the 8.4% yield. I am buying the dip for this high yielder. You should too!

* Note that EPD issues a K-1 tax form.