Market Analysis for Feb 3rd, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Bears Extinction, Treating Week’s Low As In

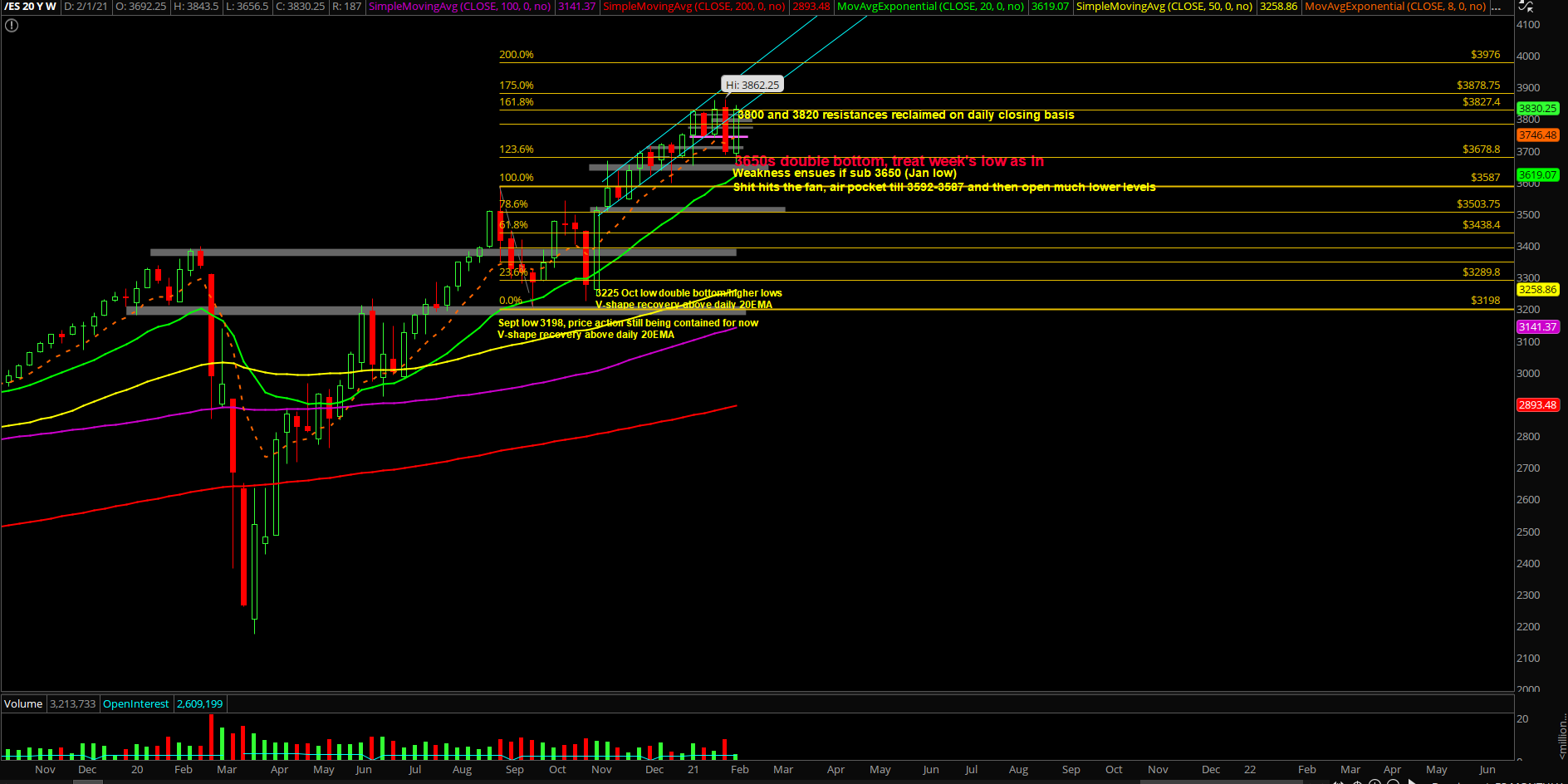

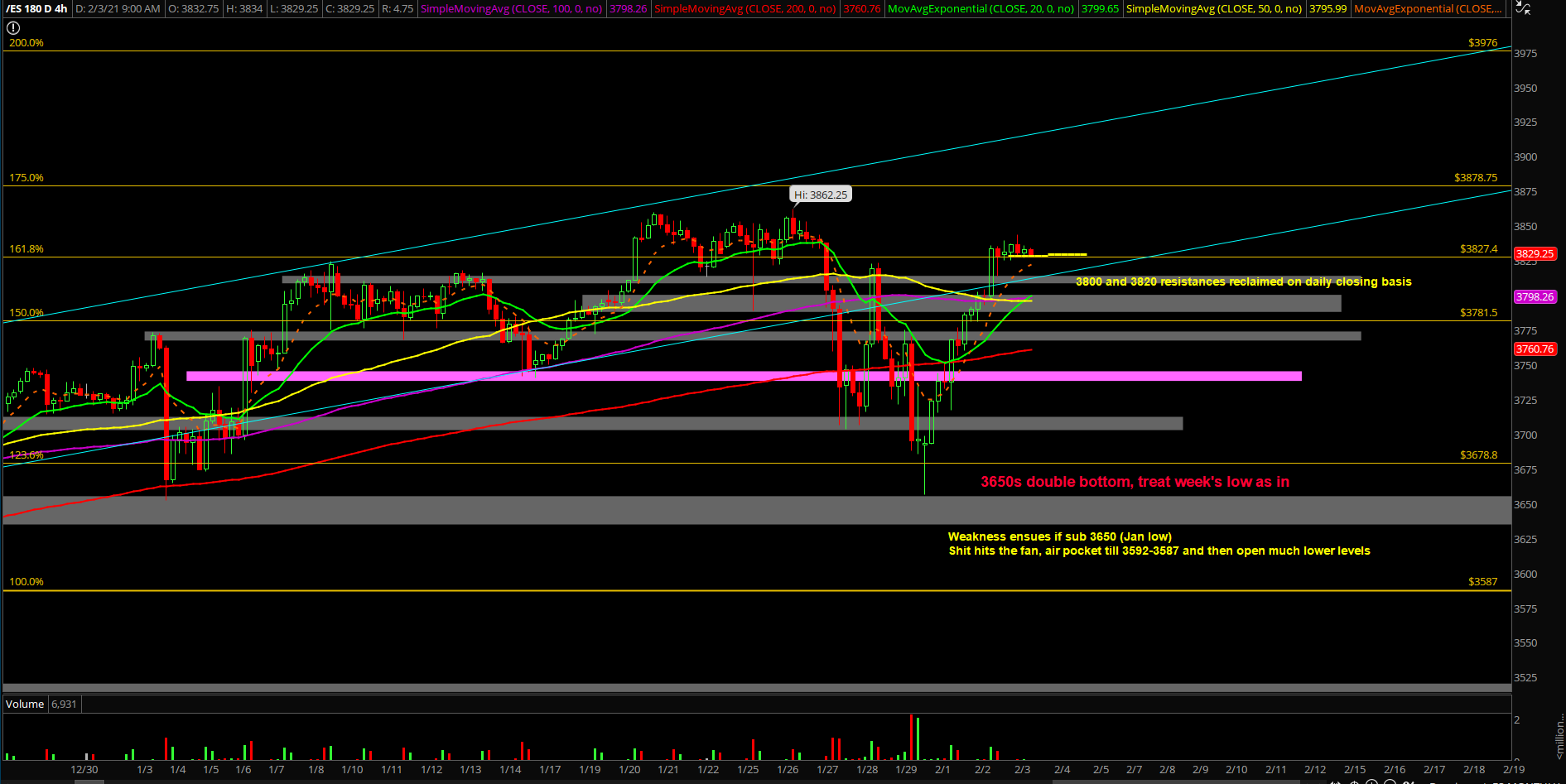

Tuesday’s session reclaimed key resistances such as 3800 and 3820 and price action managed to close above it on a daily closing print. This means that it’s once again a V-shape recovery and the bulls have double confirmed a stabilization event.

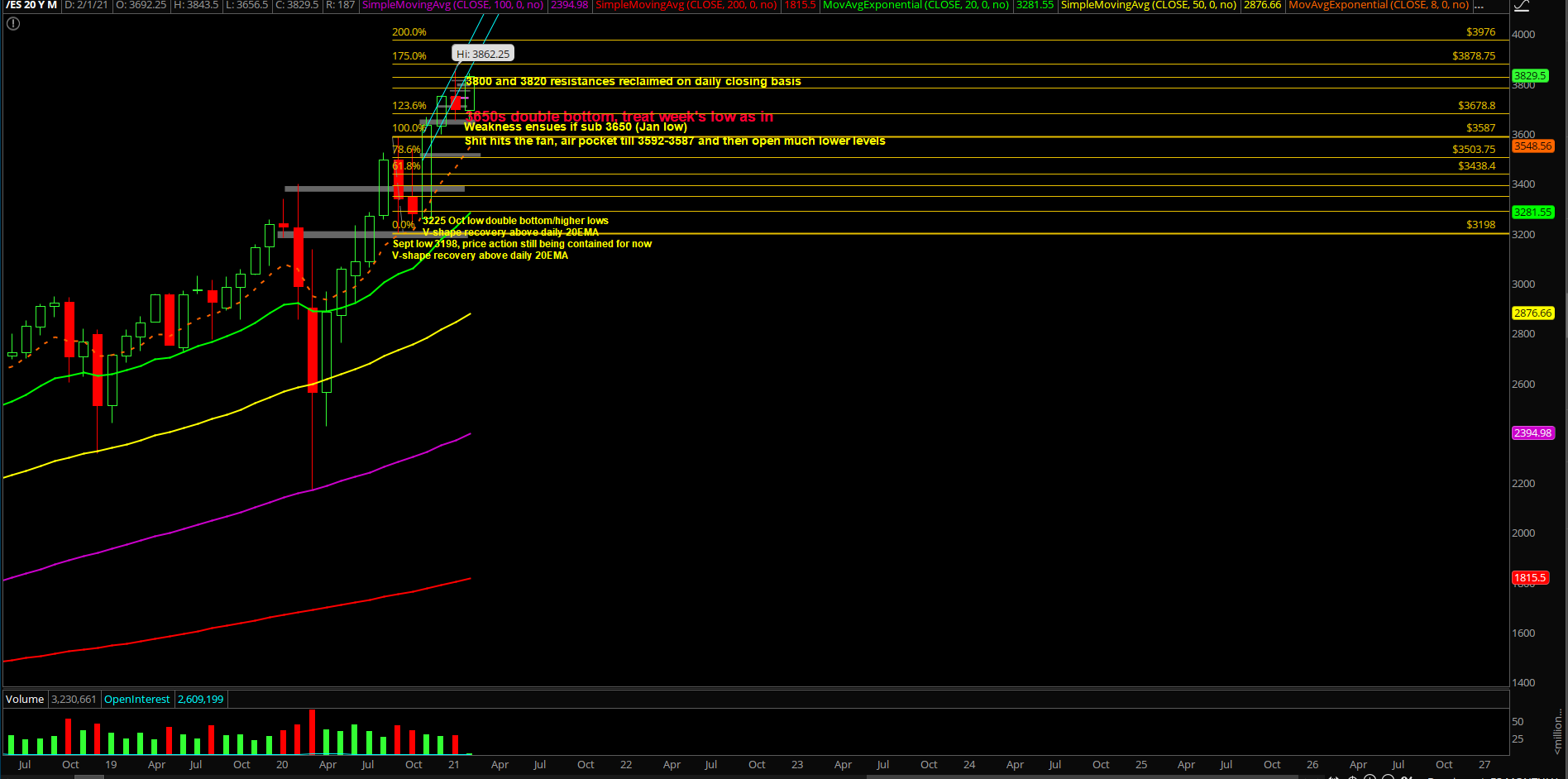

The main takeaway is that we’re treating this week’s low as in from the 3650s double bottom vs January monthly low and that the bull train is likely gearing towards 3976 measured move (derived from many months ago). In addition, NQ/tech is firmly leading the V-shape recovery and sporting the same daily 8/20EMA grind up posture as ES. Keep a close eye on this momentum follow through in the next few sessions.

What’s next?

Tuesday closed at 3828.25 as intraday bears and short-term swing bears failed miserably as they could not disallow the V-shape recovery. It was a gap up and go trend day that closed around the highs of the session.

Copying and pasting a core section from our ES trade alert room’s premarket gameplan report where we demonstrate real-time trades and educational lessons. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. (some key levels have been redacted for fairness to subscribers)

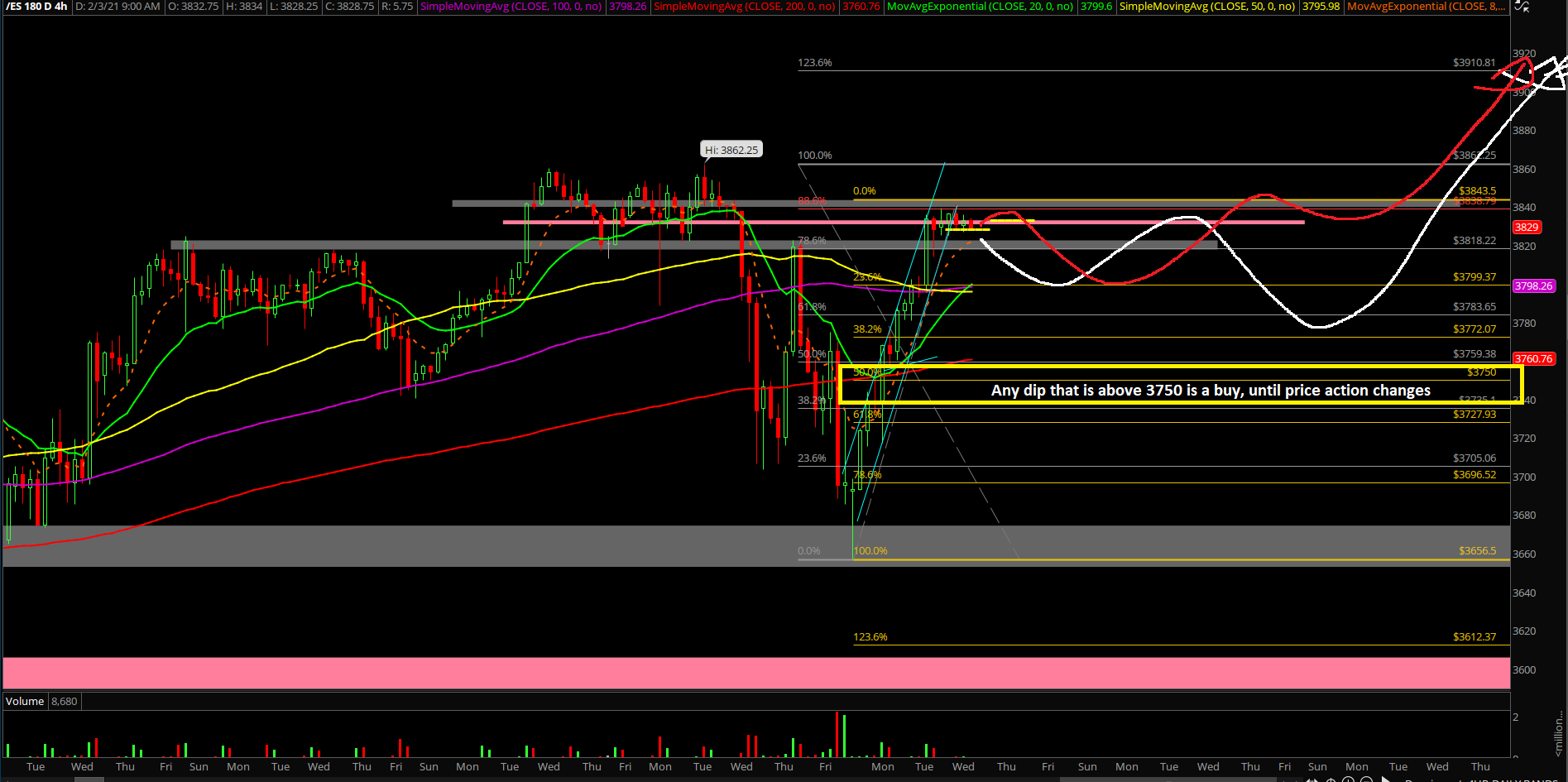

- Price is back to bullish mode as short-term seller/bearish momentum disappeared

- Given the price action clues from Monday Feb 1st, the market has stabilized from key level 3650s, it formed a double bottom into a V-shape recovery

- Market has retraced 88% of the 3860s-3650s range and now looking to reclaim 3860s all time highs in order to accelerate this train into the 3976 measured move target

- If you recall, Tuesday Feb 2nd, the market closed above 3800 and 3820 to double confirm bears are extinct as they could not stop the V-shape recovery. Déjà vu

- Any pullback that is above 3750 is considered a buyable dip, we’re going to utilize key levels such as 3780/3800/3820

Additional context from past few weeks remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Janurary lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held