Market Analysis for Feb 1st, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – First Day of February, Temporary Stabilization, See If It Sticks

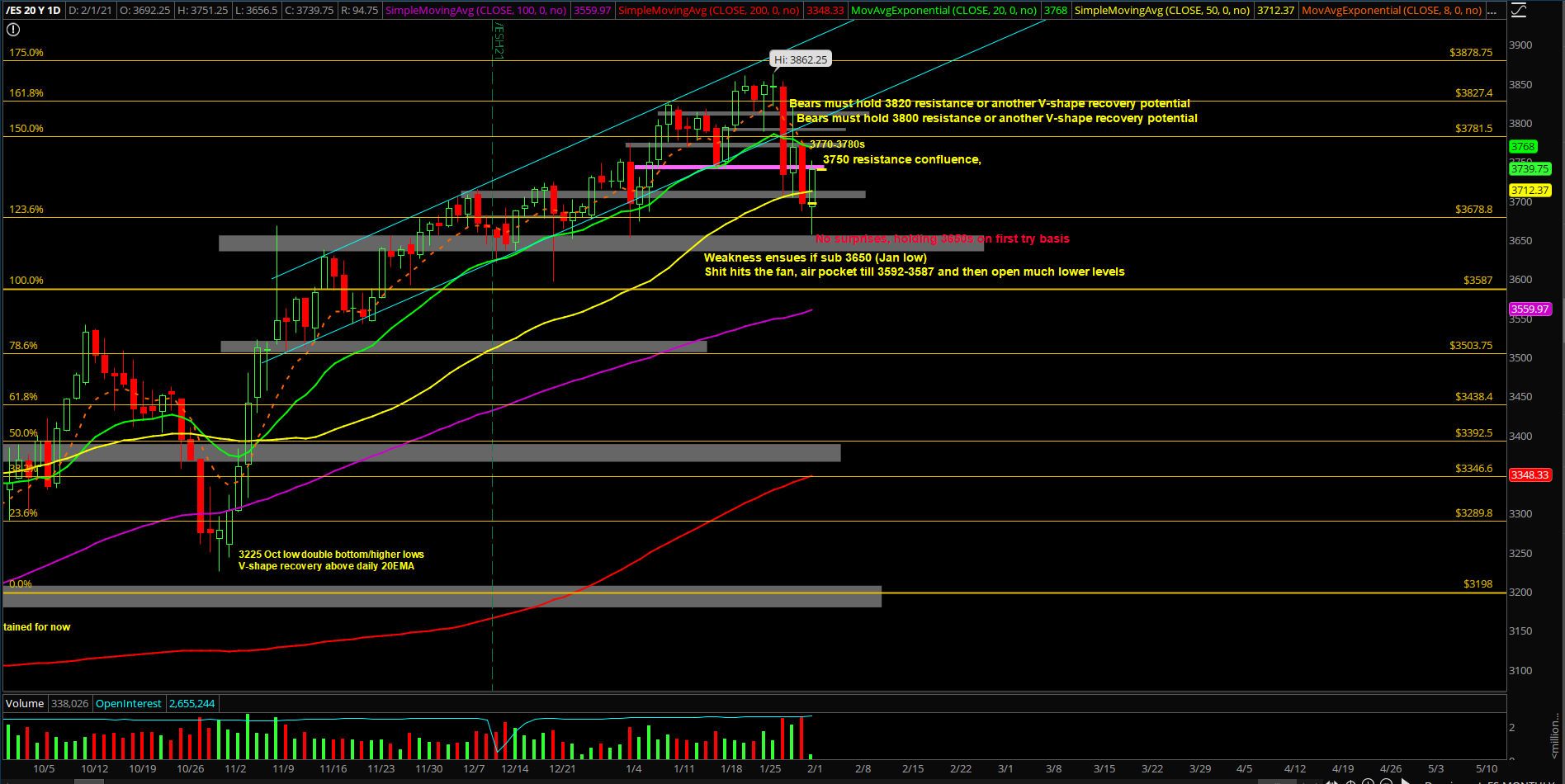

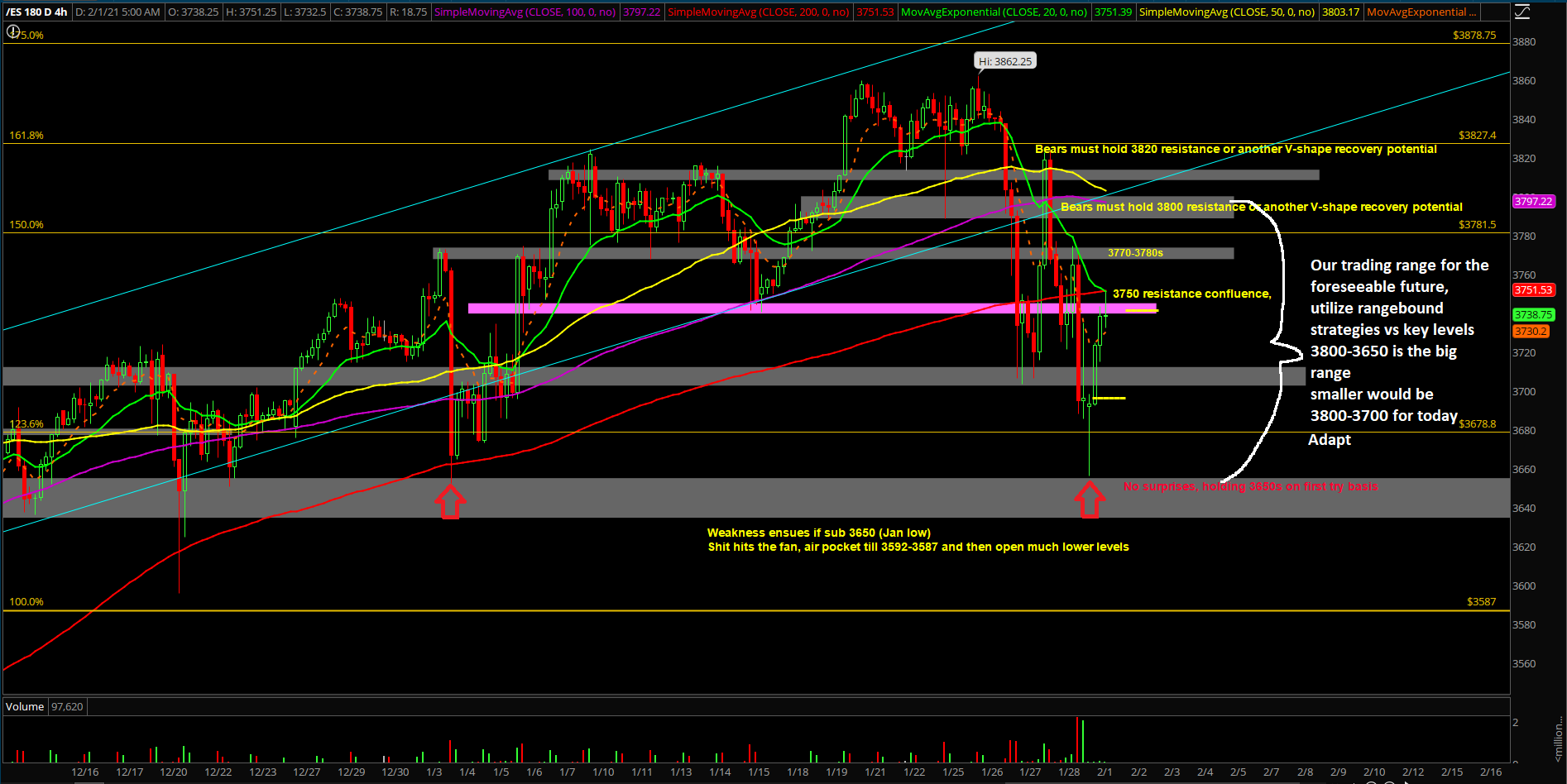

The last week of January played out as a surprise vs the initial expectation going into month end. If you recall, the trend had been upside grind for the entire month of Janurary going up into the final week. Then, on Wednesday Jan 27th, the market gave us big clues that something was amiss and traders needed to be adaptable. The daily price action broke below the daily 8+20EMA trending supports for the first time in months so it was day #1 and the biggest clue. As discussed, we trimmed a lot of profits across the board in order to stay cautious and re-evaluate because there’s a clear shift on momentum. Price action confirmed this sentiment during Thursday Jan 28th with the inside day and inability to get back above daily 8/20EMA and then the Friday Jan 29th follow through to the downside.

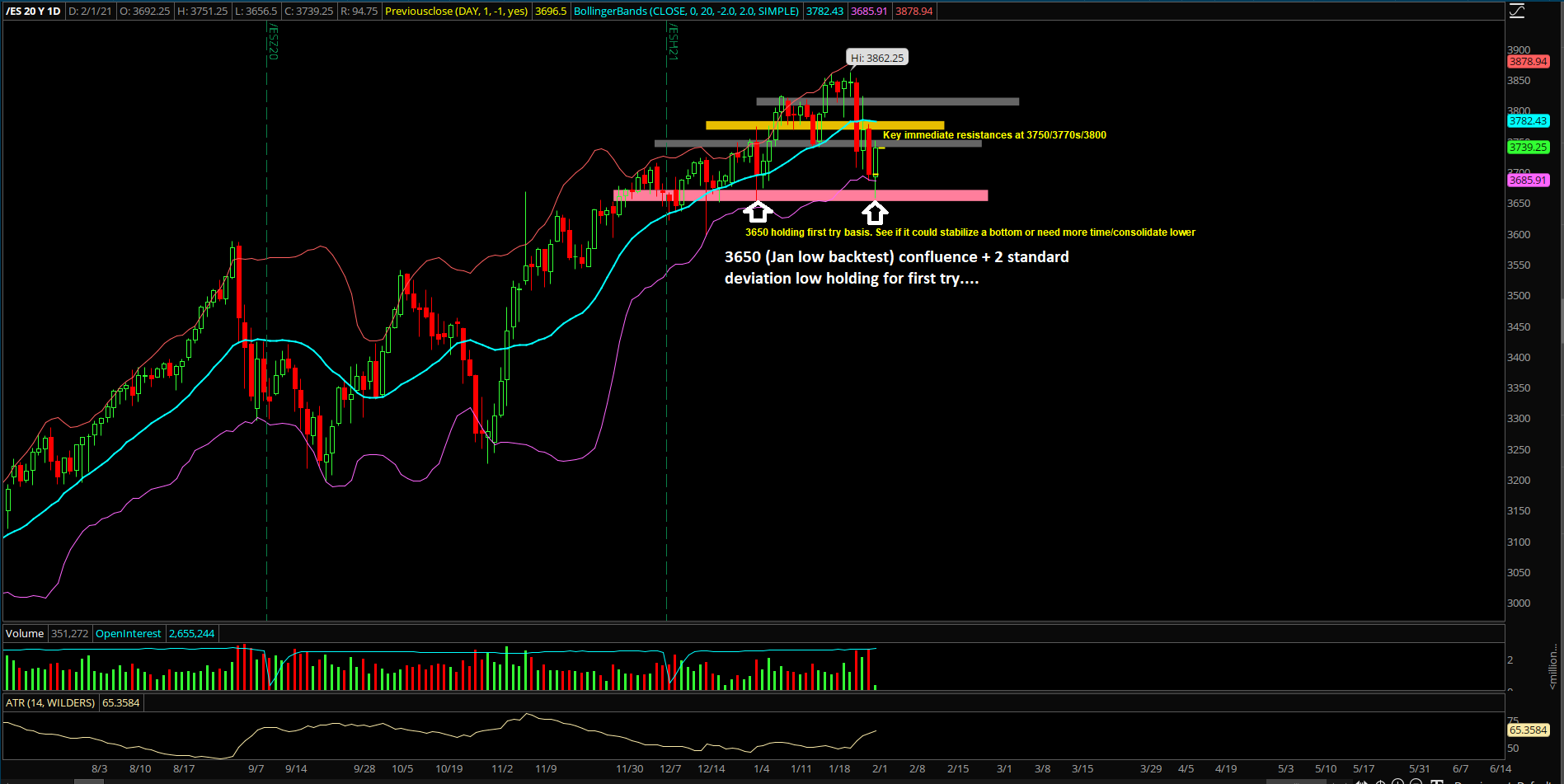

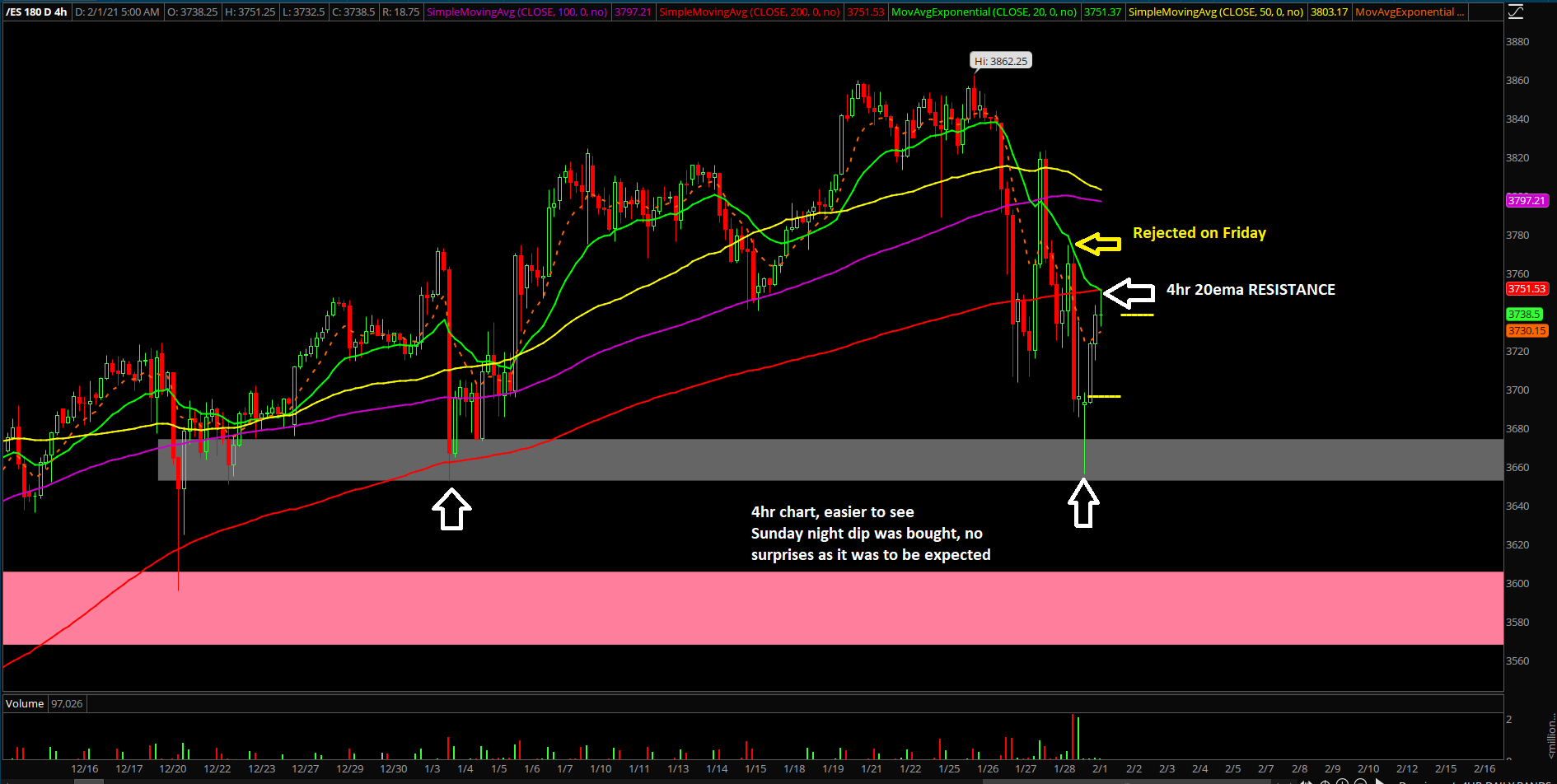

The main takeaway is that this is healthy because it allows the market to reset and take out some novices and shake the tree a bit. It clears out the newish traders that keep on buying calls and getting paid easily for the past few months. It ain’t gonna be as easy and simple as that going forward. At least not until price action confirms the stabilization/higher lows. During the Sunday night, the market heldv s 3650s and formed a temporary double bottom setup. This was no surprise because we’ve been saying the 3650 has been a key level for the past few weeks. It is the confluence of the January monthly lows.

What’s next?

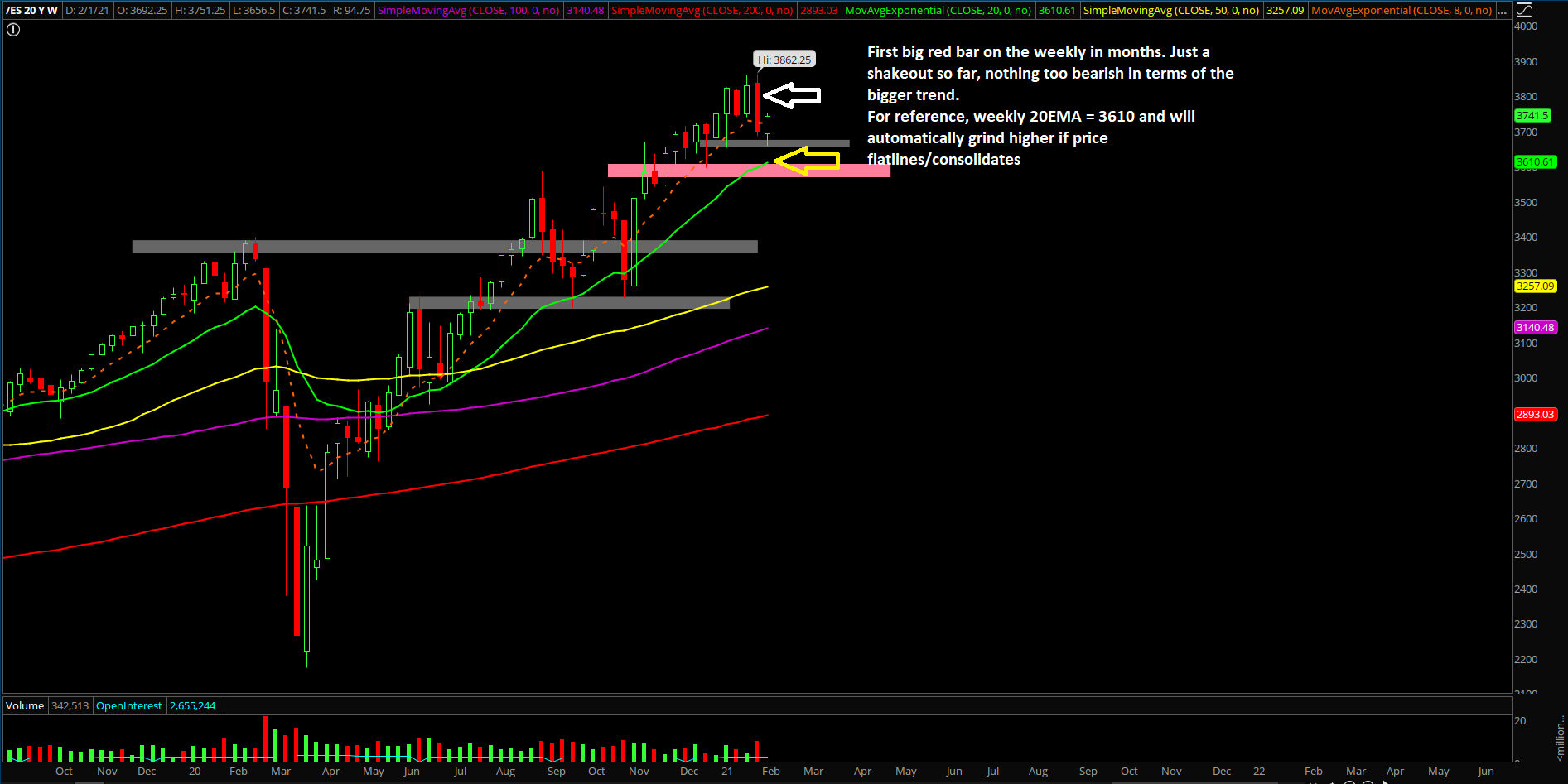

Friday closed at 3696.5 around the lows of the week as price action gave all of the January grind up gains movement. The market retraced about 1.4% Janurary vs the prior month.It is quite easy to see on the weekly chart by filtering out the noise as the market is clearing out some hands.

Copying and pasting a core section from our ES trade alert room’s premarket gameplan report where we demonstrate real-time trades and educational lessons. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. (some key levels have been redacted for fairness to subscribers)

- As discussed previously, short-term intraday momentum has turned from BULLISH to NEUTRAL/BEARISH for the first time in months given Wednesday Jan 27th. The market is telling us that it is important to trim some profits on key stocks for this rotation and re-evaluate/re-strike at a later date until price action stabilzes along side with volatility. We trimmed some of profits on many leading stocks last week and now waiting for the best bang for our buck

- If you recall, Jan 27 price action on a daily timeframe closed decisively below the daily 20EMA trending support for the first time in months. Followed by Jan 28 inside day and then Jan 29 follow through towards the downside 3700/3680/3650 targets

- Now, the easy part has played out and we must watch for the next stabilization confirmation. Whether price action already double bottomed at 3650s or need one more trip towards 3610-3600 weekly 20EMA confluence area or something more

- Again, this is a day-by-day market now as price action remains below the trending daily 8/20EMA resistances so we gotta be nimble and adaptable with the adjusted volatility

- This is going to be a large rangebound market for the forseeable future, treat as 3650-3820 bigger range and smaller range 3700-3800. Know your timeframes as this is being treated as a shakeout on the weekly chart before price action could confirm a stabilization event to move into new all time highs again (3900+)

- Mainly watching 3750 key level this morning, above opens up 3770s-3780s then 3800

- Below opens up 3700 gap fill also known as Friday’s closing print and then see how gap fill reacts

- Both sides are tradeable in this overall range as volatility creates many great opportunities

Additional context from past few weeks remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Janurary lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held