Market Analysis for Jan 29th, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – Could Bears Finally Win The Fight Or Another Trap?

Sharing the entire pre-market game plan report from Ricky’s ES Trade Alerts room for today only. No key levels have been redacted in this report unlike the usual KISS reports. Level by level approach. Know your timeframes!

Did the bulls/bears fail overnight? What is the next highest probability plan

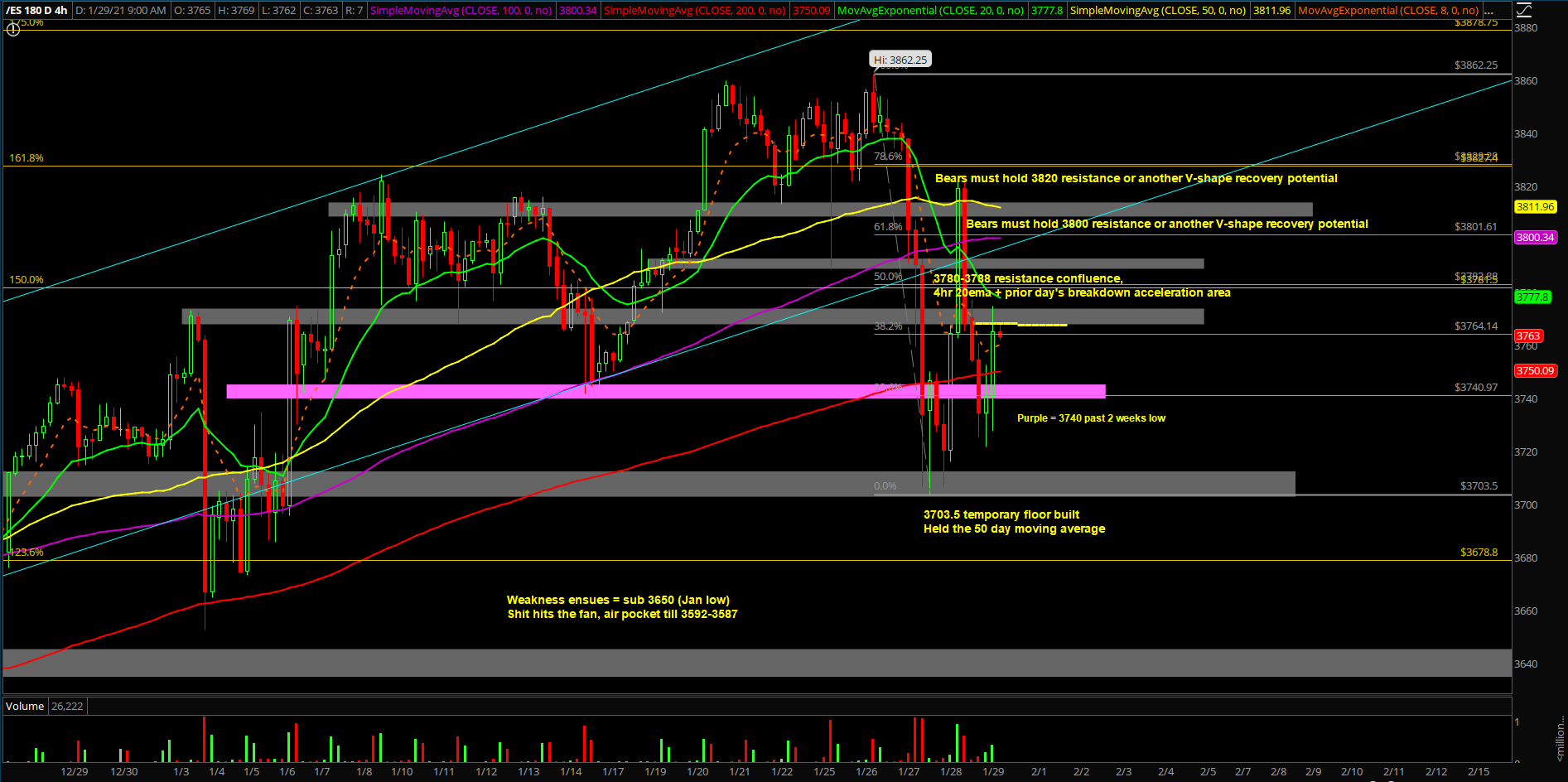

- Overnight consolidation pattern as it made lower highs and lower lows on the lower timeframe charts but it is still within an inside day range of Wednesday range of 3853-3706.5 and Thursday’s range of 3823.5-3703.5

- O/N range = 3777.25-3721.50 and market is opening around flat vs yesterday’s closing price

- We maintain neutral to bear bias for the short-term given Wednesday’s clue and Thursday’s confirmation of volatility are here to stay for the foreseeable future

- We’re short-term neutral to bearish so our focus would be finding lower high/short opportunities vs the key resistances until price action proves otherwise. Be mindful that it could be an inside day before next week’s potential larger range/weekend gap risk

What is the bias/gameplan going into today? Do you see a feedback loop setup?

- As discussed previously, short-term intraday momentum has turned from BULLISH to NEUTRAL/BEARISH for the first time in months given Wednesday Jan 27th. The market is telling us that it is important to trim some profits on key stocks for this rotation and re-evaluate/re-strike at a later date until price action stabilzes along side with volatility

- If you recall, Jan 27 price action on a daily timeframe closed decisively below the daily 20EMA trending support for the first time in months

- This means that it’s not an even BTFD trending environment unless ES recovers 3800 and 3820 quickly to confirm a V-shape recovery of sorts on a daily closing price basis

- We do not know if this does a V-shape recovery or there’s a day 2 or day 3 downtrend into much lower levels. We must be nimble and adaptable now that we do not have the luxury of just riding above the daily 8/20EMA for the past few months

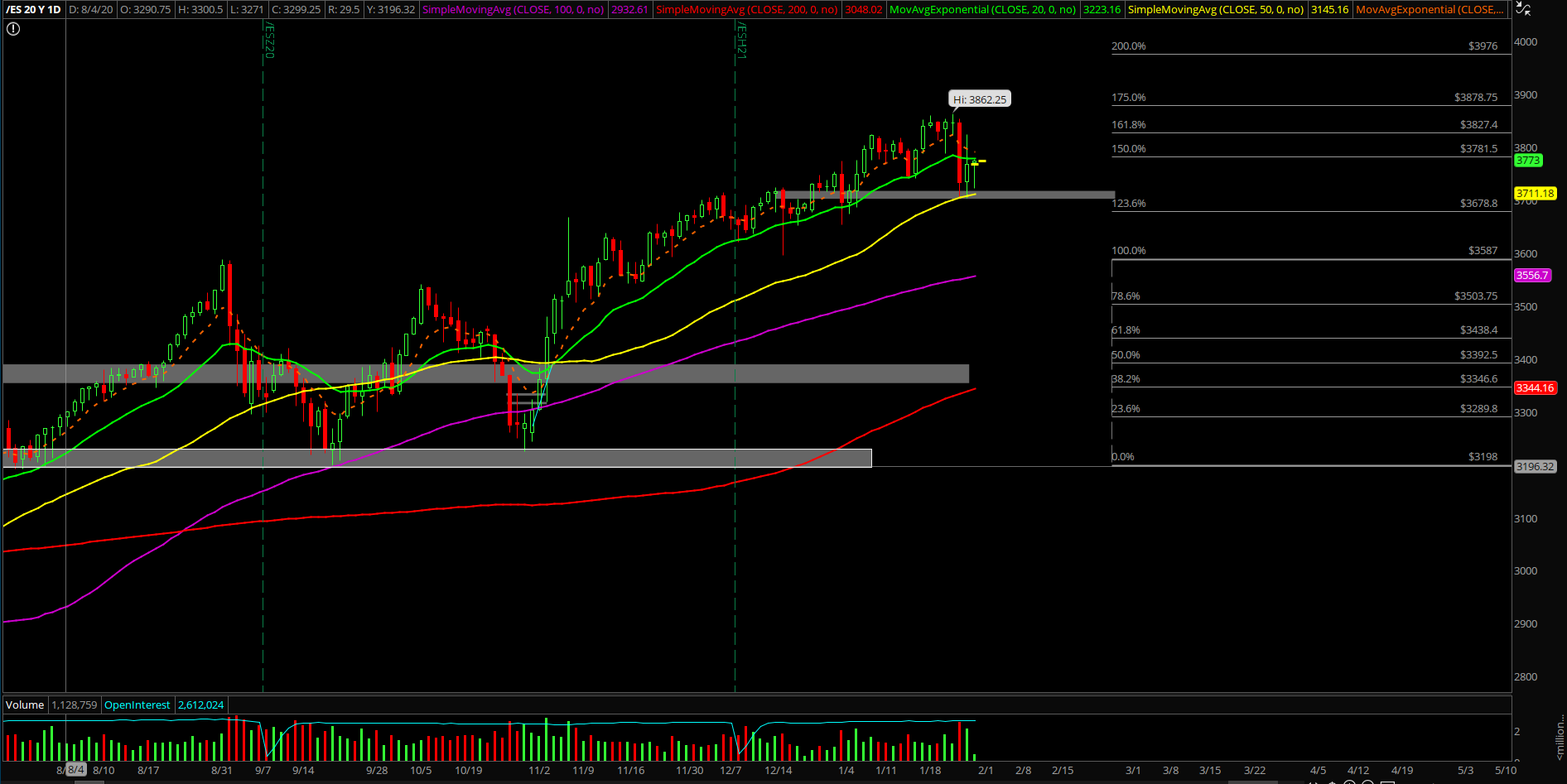

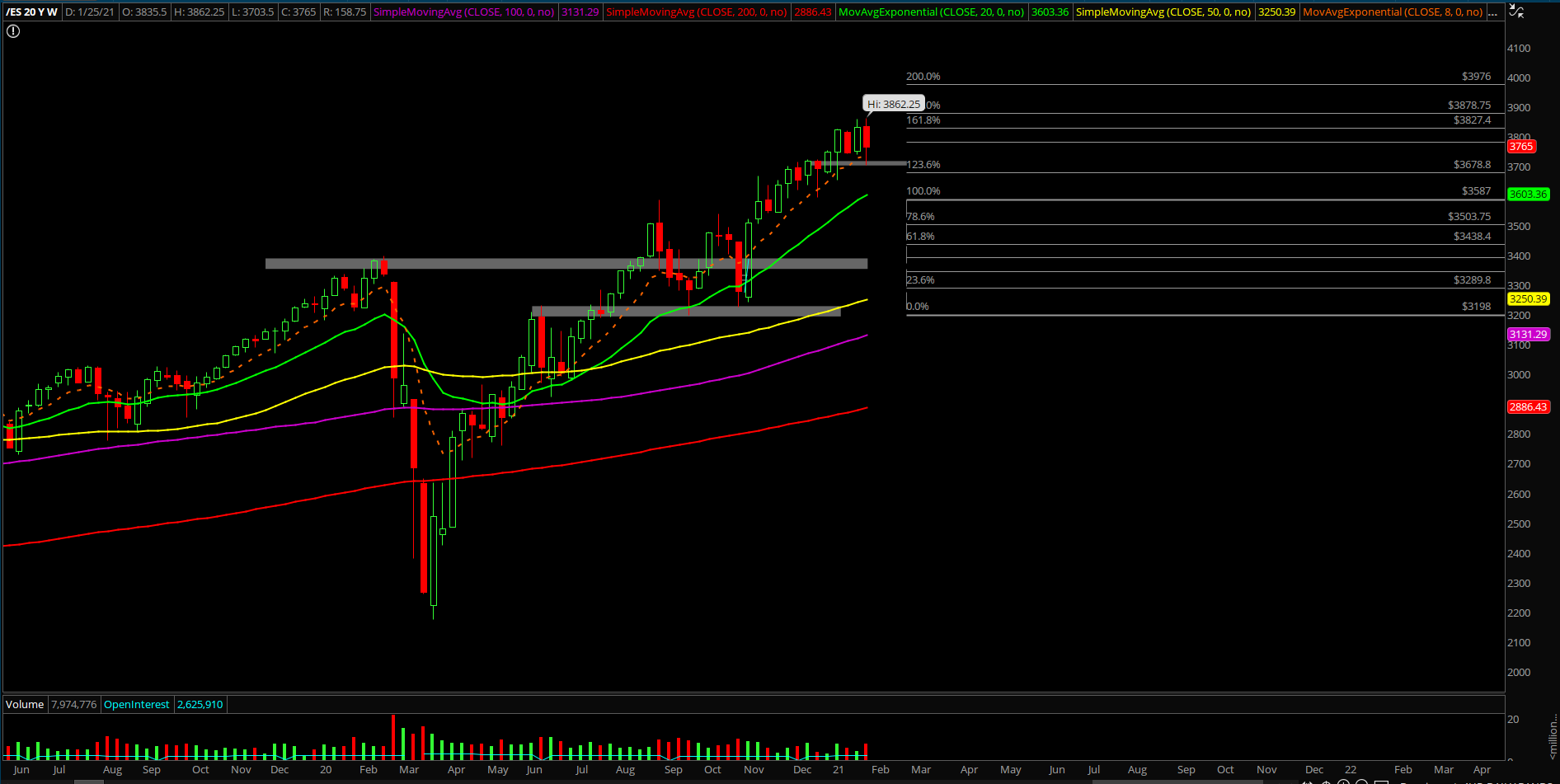

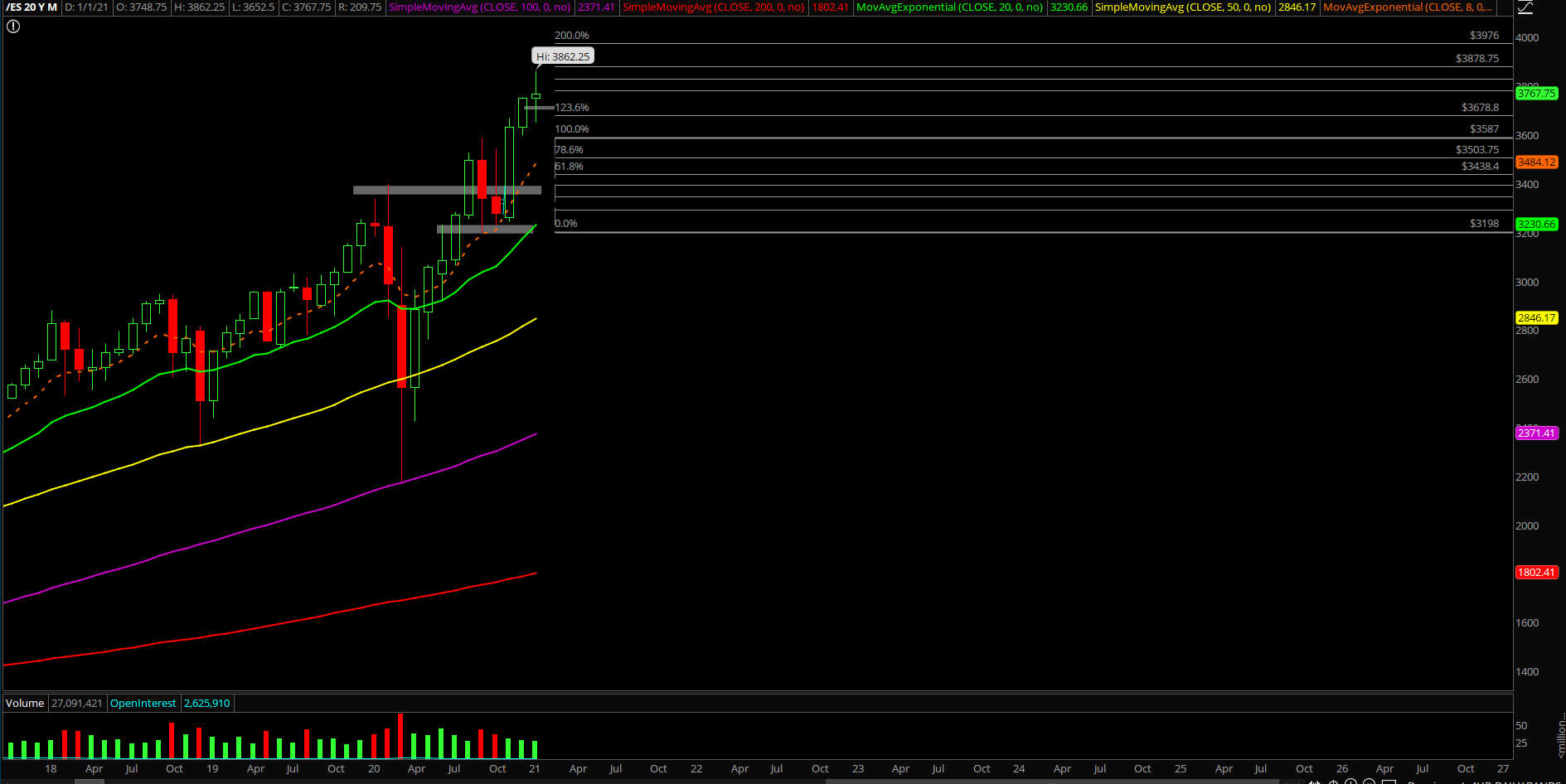

- For example, during Sept and Oct 2020 the market broke below the daily 20EMA for a 1-2 weeks and then eventually recovered in a swift V-shape or double bottom scenario into new all time highs. Could this pattern keep repeating? Of course, but at this moment in time, we need to let the price action dictate our actions as no one has a crystal ball here

- For today, the key resistances are 3780s and 3800 for bears to form a lower high setup and then try and break below 3720/3700 again to open up 3680/3650.

- FYI, 3650 has been our shit hits the fan level for a few weeks and it is also the current Jan monthly low. A stampede for the exits would likely get triggered if broken, at least for short-term purposes

- If 3780s and 3800 get reclaimed, the would bulls need to stay above them on a daily closing basis to enhance the odds of a basing setup on the daily timeframe. Meaning bears failed their attack once again and price action would be shaping up a double bottom or a V-shape recovery vs the daily 20EMA overshot area

- In addition, today could be another inside day and then we have a weekend gap down risk if resistances keep holding given this week’s context and setup so traders need to be nimble and adaptable here as things change under the surface

- As of writing, it’s very unlikely for the bulls to wrap up this week at the weekly highs because it has not been a trend week up

- The bears are threatening to close below 3740 which has been the past 2 weeks low to open up flush gates to the downside

What are the key levels to be aware of?

- Resistances 3780, 3785,3788,3800,3820, 3830, 3840, 3850, 3862, 3878, 3900, 3925, 3950.….. 3976

- Supports 3773, 3768, 3750, 3740, 3724, 3715, 3703, 3700, 3695, 3685, 3676, 3668,3652,3642, 3630, 3620, 3600, 3596, 3592, 3587, 3582, 3575, 3567, 3550, 3542,3515, 3505, 3500