Market Analysis for Jan 21st, 2021

Focus On Being The Best At Your Strategies/Niche

I shared snippets here and there since last year on generating alpha on top of the basic trade entries in my room but it's really the same concept in a momentum based market

Essentially, in boils down to on-trend price action environment and leveraging/piggybacking the risk vs reward ratios. For example, a strong trend like the past few months/years and especially during the trend's acceleration phases such as V-shape bottom vs support, daily 8/20EMA add-on buys, all time high breakouts....etc. Doesn't matter if you do it via ES futures or something crazy like the ultra high beta TSLA stock.

You could generate a lot of alpha after factoring in your timeframes/risk personality, then all you need to do is figure out the low of the day/low of the week setup. (bull trend, surprise surprise, vice versa when in bear market) If you are able to catch the low of the week setup early onto a week or potentially even the month...it will be make your life much easier.

Which leads to keep adding more size vs each higher lows setup if you want to generate exponential alpha (def not for everyone as you need a lot of practice and getting your ass kicked, medium-high risk as you risk a lot of paper profits) Adding into a winning hand/position becomes easy because you want to be able to move the initial risk/stop orders to breakeven or near breakeven dependent on how good/great of the average cost entry.

eg. you caught the low of the day and if there's a accompanying setup on the timeframe alignment approach...then you let it develop to see if it becomes low of the week or possibly the low of the month.

Then, each day after... you could use standard rules such as 'hold half and go' or gap up and go setups to judge the ongoing momentum. Hold half and go refers to whether price action holds around the 50-61.8% retracement of a breakout move or the range of the prior chart timeframe you were working with.

In this approach, the initial trades is utmost important because it heavily relies on leveraging your paper gains and building a monster position from it as the train provides numerous on-trend setups. Again, assuming you caught one of the low of the setups early onto a move. Then you question yourself, does the low of the day keep holding so that price action continues higher....etc. Next day, does the low of prior day keep holding so that I could focus efficiently on the next higher lows setup?...etc. Rinse and repeat

Basically, all I'm trying to say is that you gotta find a strategy that you like that fits with your overall risk appetite and then become great at it if you want to generate massive amounts of alpha.

Things that make yourself sick to the stomach or cannot sleep being up/down during the night...don't do it as it's clearly not for you. Don't try to get filthy rich quickly either (1-2 years). Bad mentality and terrible approach that will likely lead you with nothing or worse...if you go on margin. It didn't work out for me and it didn't work out for the 1000s bodybags either. We got limited time on Earth, but trading/investing also takes time to master and learn. We gotta keep learning as there's no perfect strategy or perfect stock or perfect setup. Don't waste it sweating on the markets, it's only money, not all of life. We can leverage money and create and enrich others in order to enjoy life.

I'm rambling on but remember, there's many ideas make money in this market. No need to be jack of all trades until you at least master one strategy that can generate you insane amount of money. Or until you get lonely from trading by yourself and want to showcase and educate others how to outperform.

For instance, you could take the framework of my basic momentum strategies and then modify it like some comrades in the past learned a solid foundation, pick it into their own tools box and left to do other great things (algos, mechanical systems, discretionary...etc )

Stay objective and listen to the price action and riding the train till the market proves us wrong. It gets easier from here. Obviously, I'm not saying my approach is not for everyone or the best, but it works for me and my risk portfolio and it's what I learned how to do well.

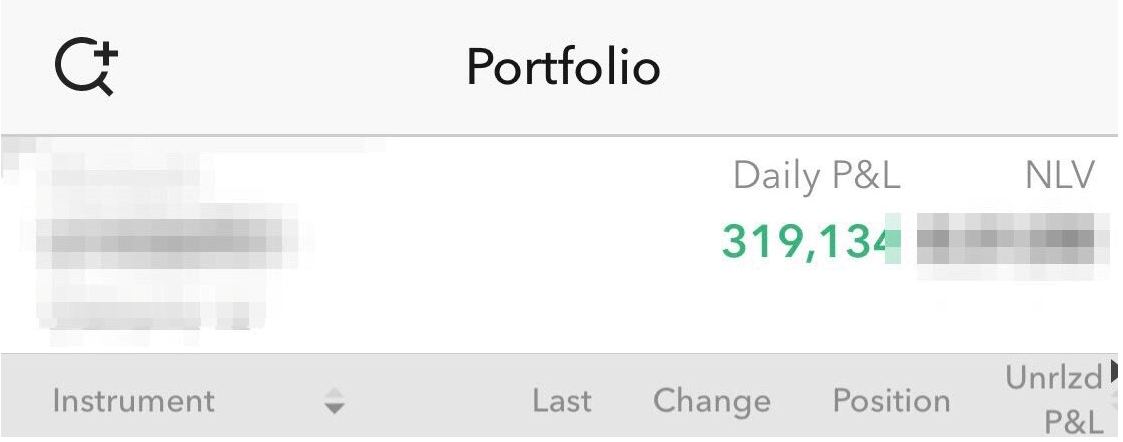

Let this inspire you on working on your own niche. From one of the best train conductors I know riding the train👇