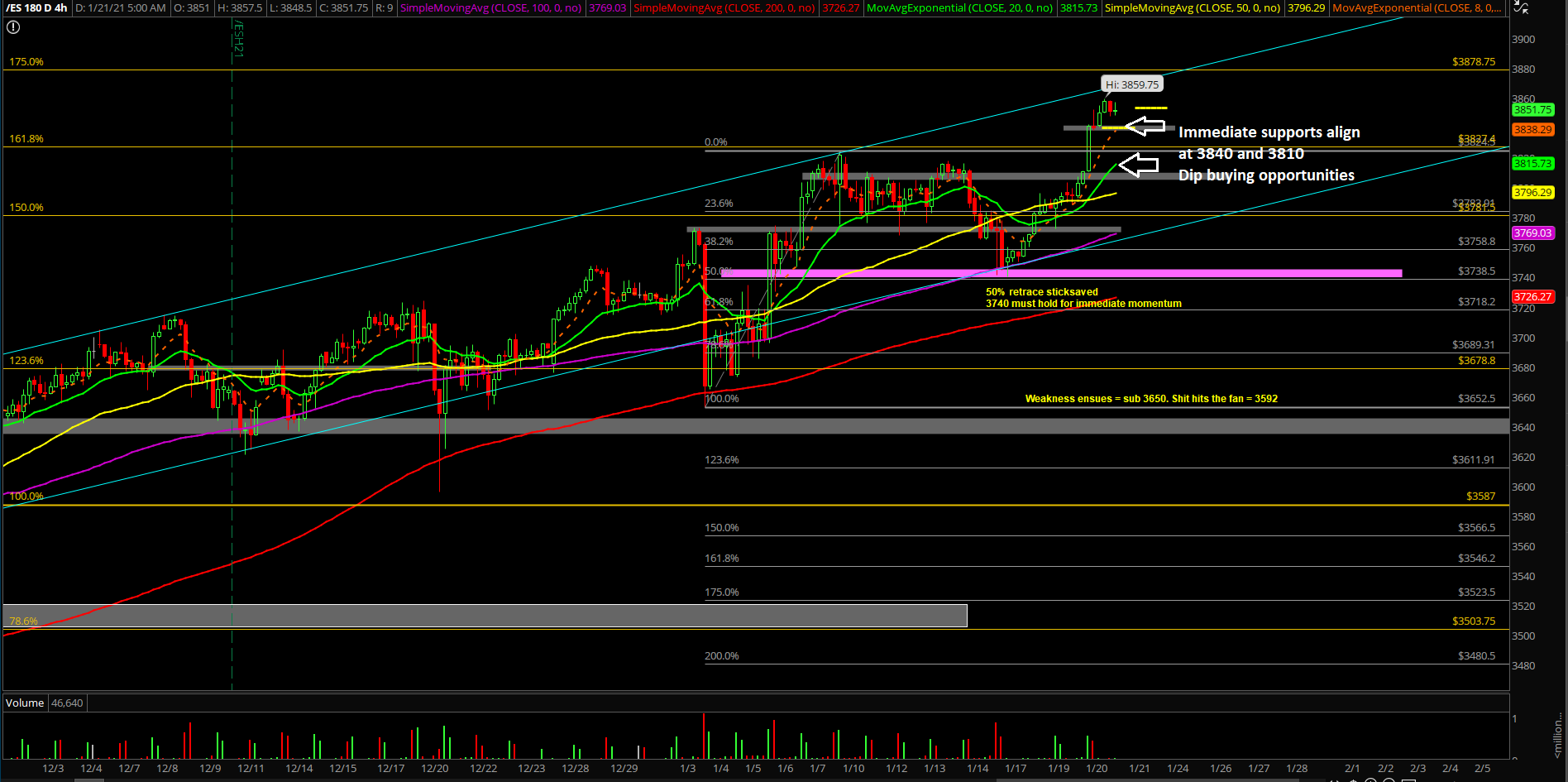

Market Analysis for Jan 21st, 2021

E-mini S&P 500 Futures: Keep It Simple Stupid – New ATHs Fulfilled, Trend Week Follow Through

Sharing the entire pre-market game plan report from Ricky’s ES Trade Alerts room for today only. No key levels have been redacted in this report unlike the usual KISS reports. Level by level approach. Know your timeframes. Enjoy!

Thursday Jan 21 Gameplan

Did the bulls/bears fail overnight? What is the next highest probability plan

- O/N high level consolidation indicating the train is taking a breather, O/N range = 3859.75-3840

- Focus on dip buying opportunities for rest of this week as it’s been a typical trend week. If you recall, upside trend weeks tend to go for the weekly Friday highs on a closing basis; high win rate

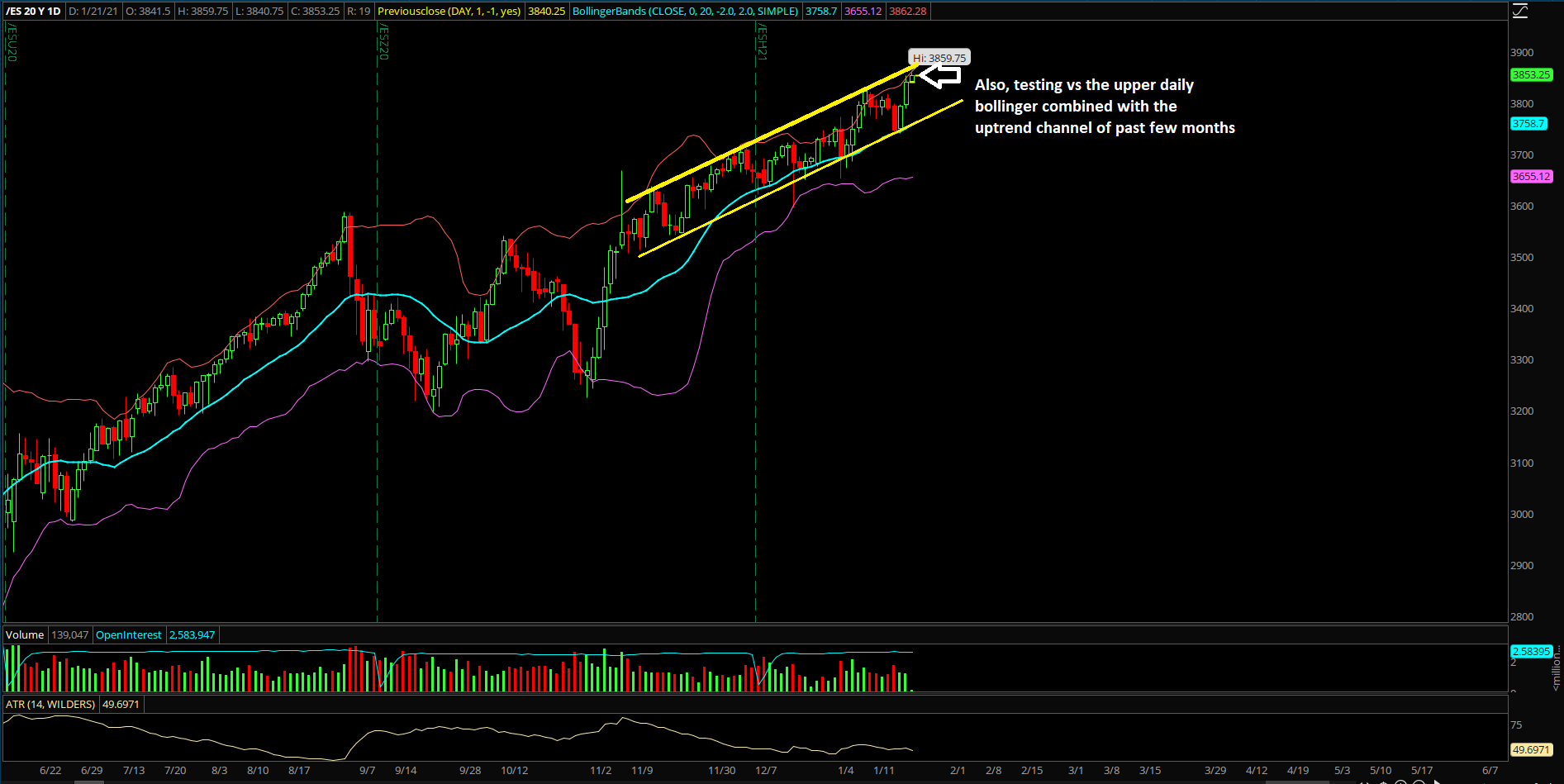

- This also means that the rest of the week, watch for the 4hr 8/20ema trending supports that align with our support levels will be important

What is the bias/gameplan going into today? Do you see a feedback loop setup?

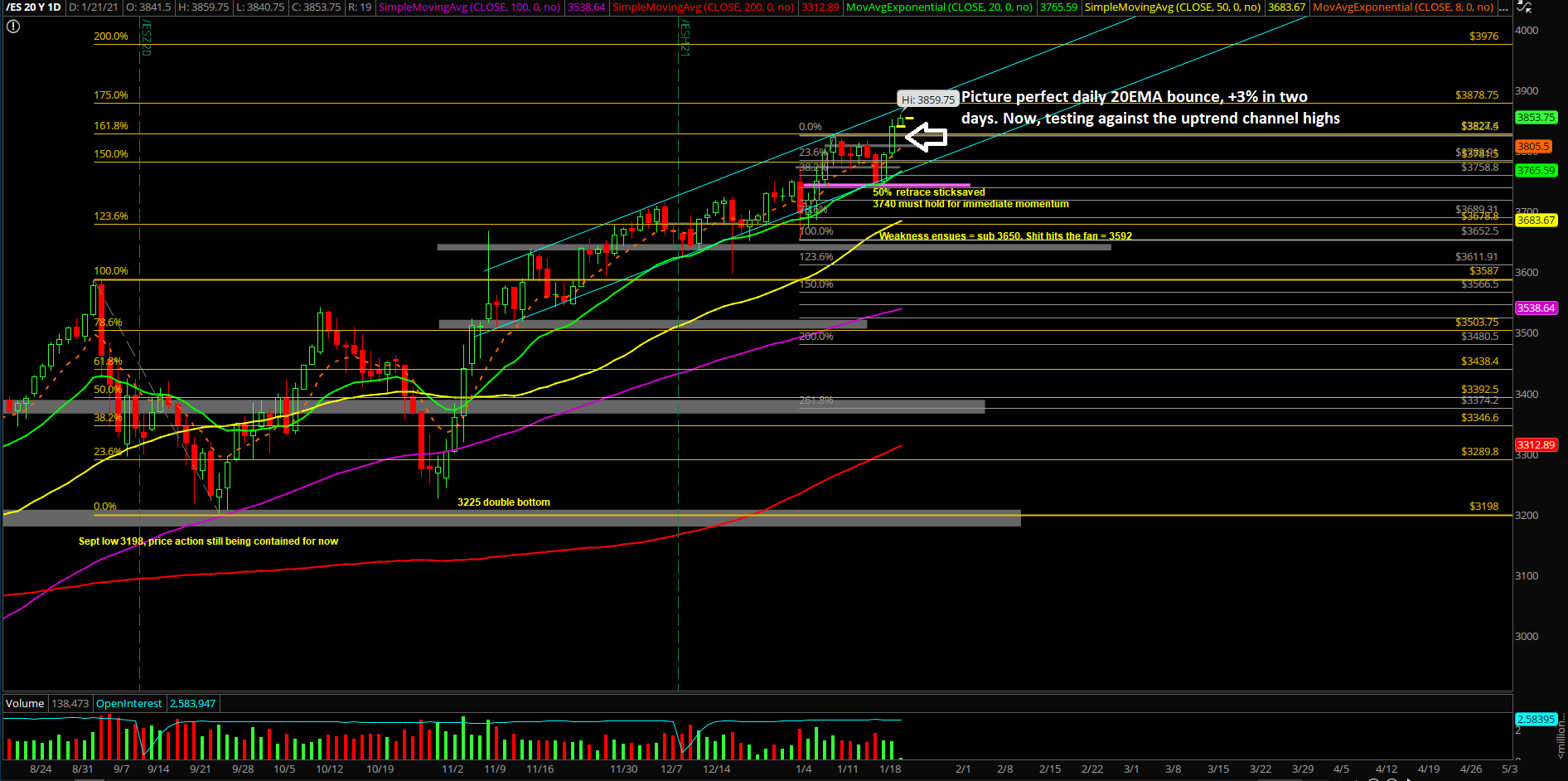

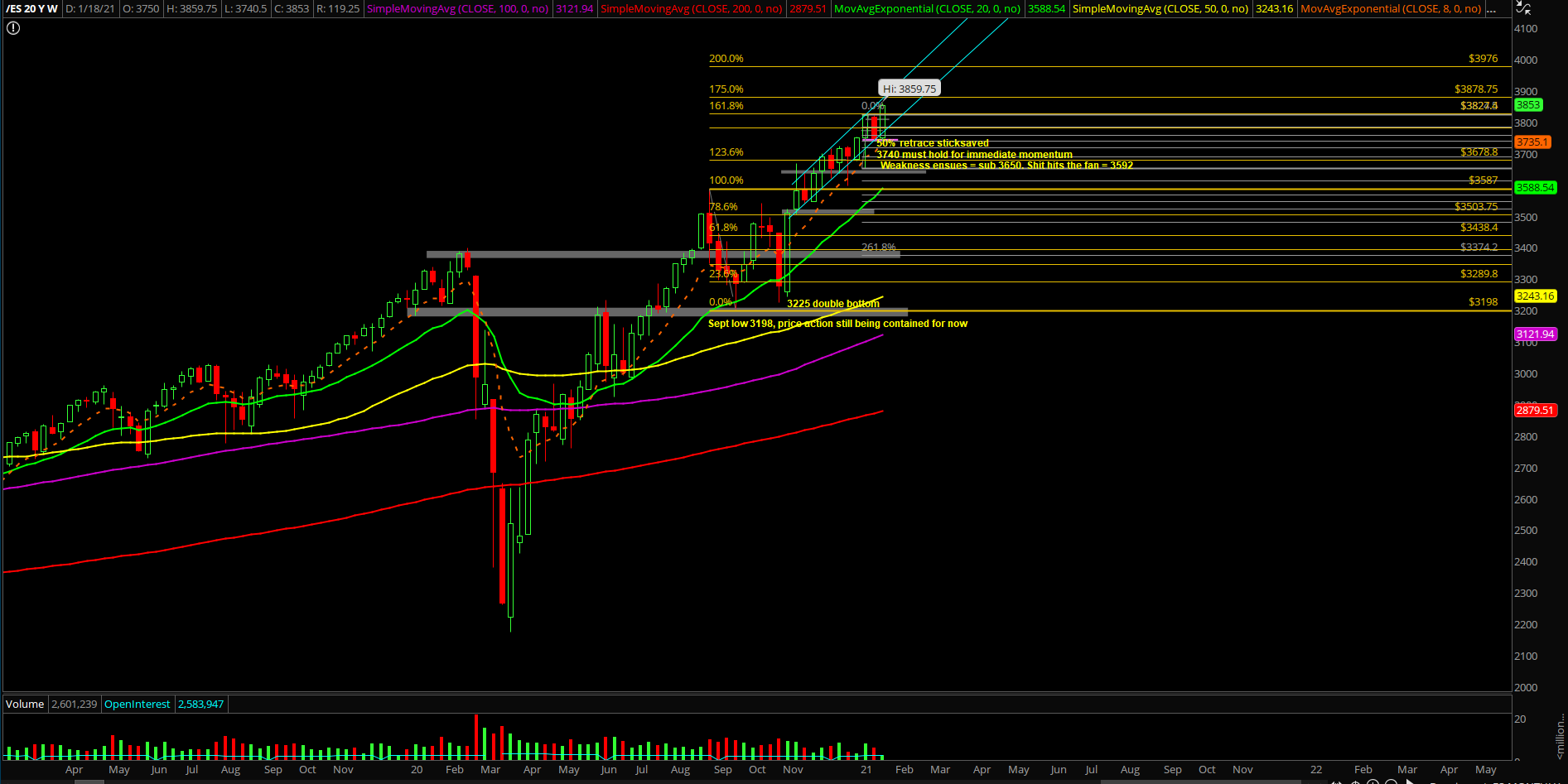

- Last Friday, the market backtested into our 3740-3750 key support zone to shake out some weak hands, which represented the daily 20EMA trending support combined with the 50% fib retracement area of the entire rally from 3652.5-3824.50 (first week of Jan’s range)

- Price action +3% with a quick V-shape bounce into new all time highs as a trend week up

- Rest of the week will be focused on dip buying opportunities given the statistics of Friday highs during a trend week

- Immediate supports have moved up significantly, located at 3810 and 3840 (former level represents yesterday’s RTH low area, very important for immediate momentum purposes)

- Just be aware of some likely consolidation for this morning/today as internals and moving averages need to catch up a bit. Look at the 4hr 8/20ema + our pre-determined levels for confluence

- A sustained break above overnight high of 3859 would confirm 3878/3900 as immediate targets

- We’re still treating 3740 as low of the week. At this point, there should be no breakdown below this number given the trend week + powerful daily 20EMA bounce+ new all time highs being established. Otherwise, stay clear and objective

Additional context from past few weeks remain mostly unchanged (copied and pasted):

- The shit hits the fan (SHTF) level has moved up to 3650 from 3592, a daily closing print below 3650 is needed in order to confirm a temp top setup/reversal for the daily+weekly timeframe. (Current Janurary lows)

- A break below 3650 would be a strong indication of weakness given the multi-month trend of being above the daily 20EMA train tracks. For reference, the first week of 2021 (Jan 4th) bottomed out at 3650s vs the daily 20EMA/major support confluence area and then swiftly made new all time highs per our expectations as support held

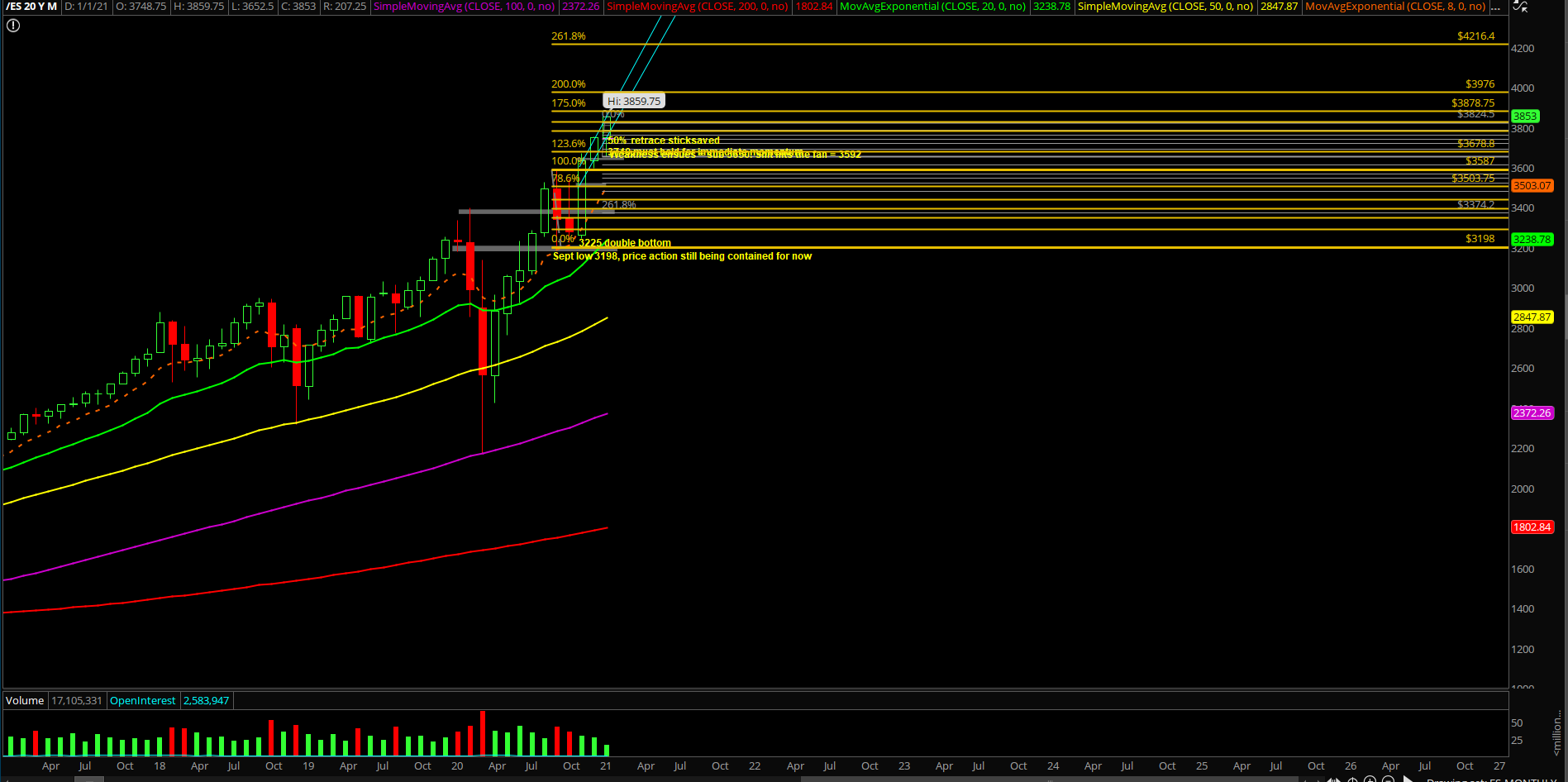

- For reference, as discussed in the past reports; a breakout of the 3587-3198 range = 3587+389 = 3976 (100% measured move target).

- As of Janurary 21, market is still at least 100 points away or another 3% away as of writing from bigger picture target. (price +7.3% since the 3587 breakout thus far)

- Please know and understand the timeframes in this report, it is overwhelming, but when/if short-term aligns with bigger picture…it is often a recipe of success. Timeframe alignment 101

- NQ/tech backtesting against its trending support area which coincides with the prior breakout area. Will need to monitor how NQ keeps holding 12400-12500 in order to ramp higher or need to backtest lower levels. As of Jan 7, NQ continues to hold as Jan 6th low = 12491.25 by forming the low of the week and NQ doing another round of rotations. See if next few days NQ able to lead again once it finishes taking this time to digest. As of Jan 13, NQ outperformed during end of last week into new all time highs as expected and now doing a healthy consolidation alongside with ES. As of Jan 20, the healthy consolidation/backtest into trending daily 20EMA held and the market has rotated higher towards the prior all time highs

- Just be aware that many bad portfolio managers will continue their dash into trash stocks (small caps) in order to try and chase alpha to make up for their poor yearly performance. See RTY:ES or IWM:SPX ratio. Never underestimate the FOMO ability as people fear for their jobs/likelihood during the 4th quarter and beyond. Great outperformance from RTY/IWM thus far

- As of Jan 20, 2021, RTY is up another + 16% since Nov 30 when we formally published RTY into our reports to showcase additional setups and the fact that it doesn't take a genius to generate alpha in a bull market… amazing outperformance since March 2020 low.

- Very easy if you have a system in place as you’re only piggybacking off of the institutional + price momentum like we’ve shown in our trading room in real-time via many asset classes such as stocks , commodities and US index futures by generating excessive alpha vs the market benchmark of S&P 500

What are the key levels to be aware of?

- Resistances 3850, 3859, 3878, 3900, 3925, 3950.….. 3976

- Supports 3840, 3830, 3825 3810,3800, 3785, 3773, 3768, 3750, 3740, 3724, 3715, 3700, 3695, 3685, 3676, 3668,3652,3642, 3630, 3620, 3600, 3596, 3592, 3587, 3582, 3575, 3567, 3550, 3542,3515, 3505, 3500