Market Analysis for Dec 4th, 2020

E-mini S&P 500 Futures: Keep It Simple Stupid – Cautiously Bullish As Everybody And Their Mother Forced Into Chasing

Thursday’s session played out as a range day that made a nominal new all time highs. It was a range day because it wasn’t a trend day of straight up, up and away. Basically, price action just spiked higher and then swiftly got smacked down towards the overnight lows of 3650s before stabilizing around 3668 to wrap up the daily closing print.

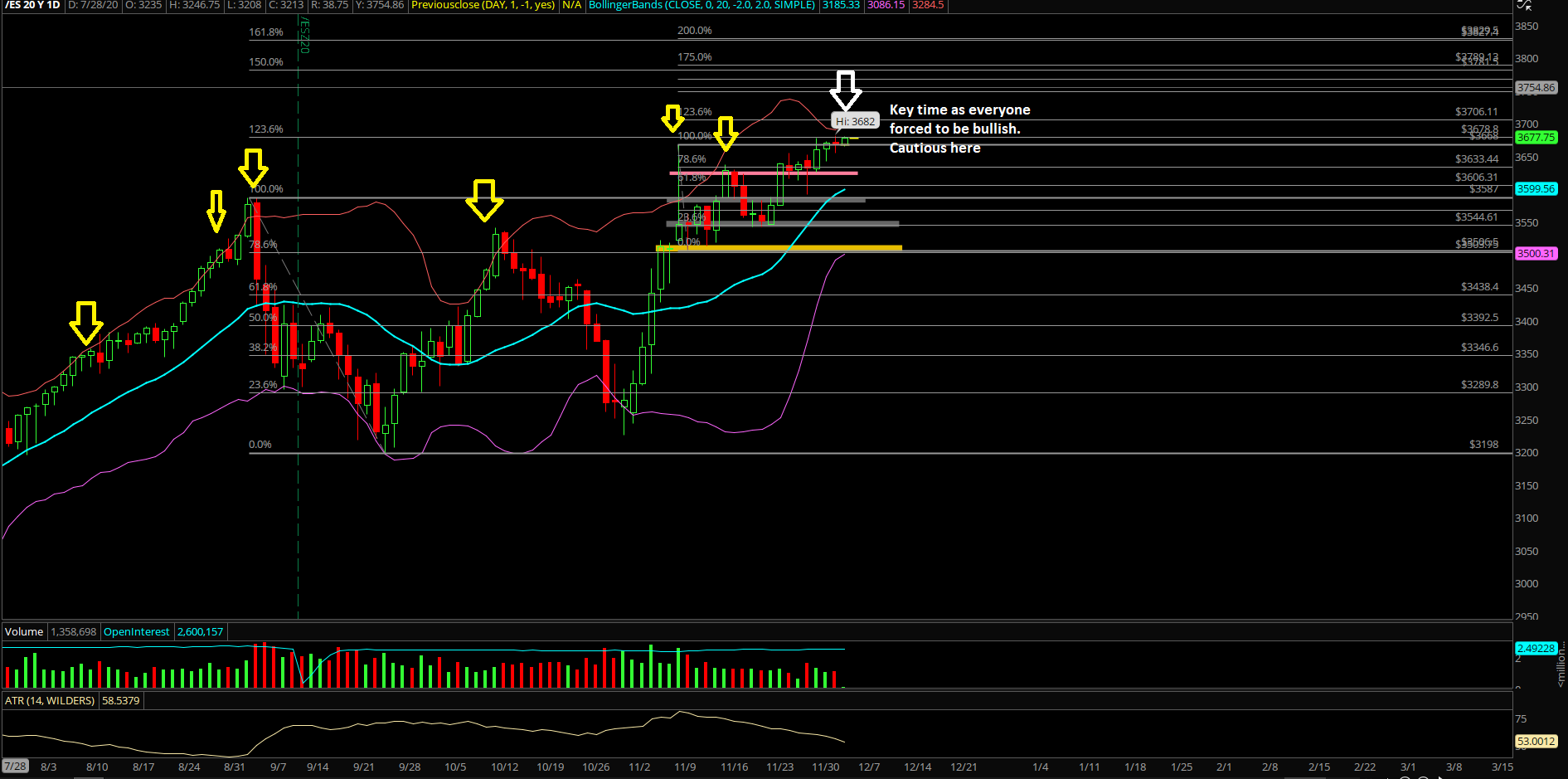

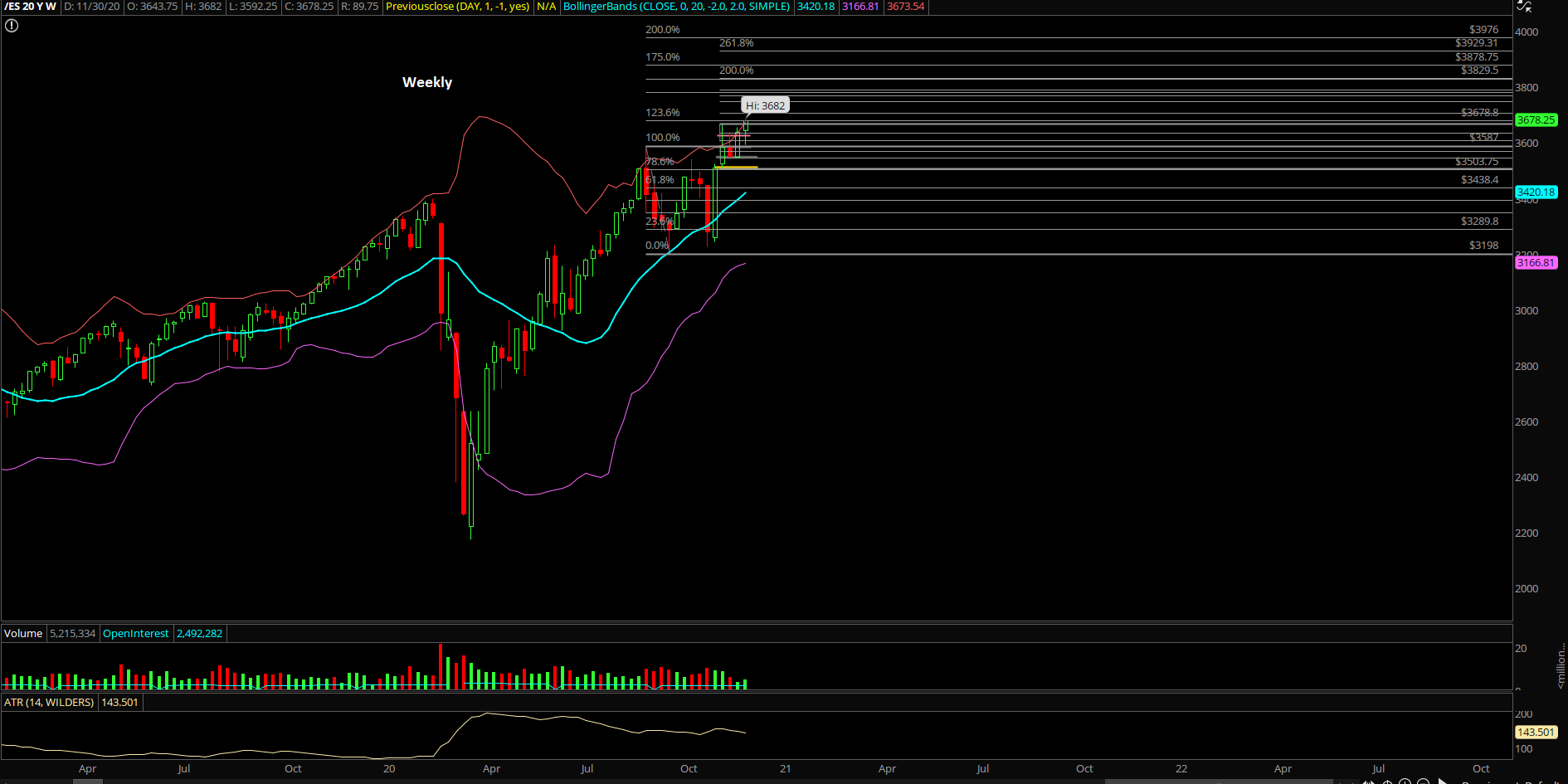

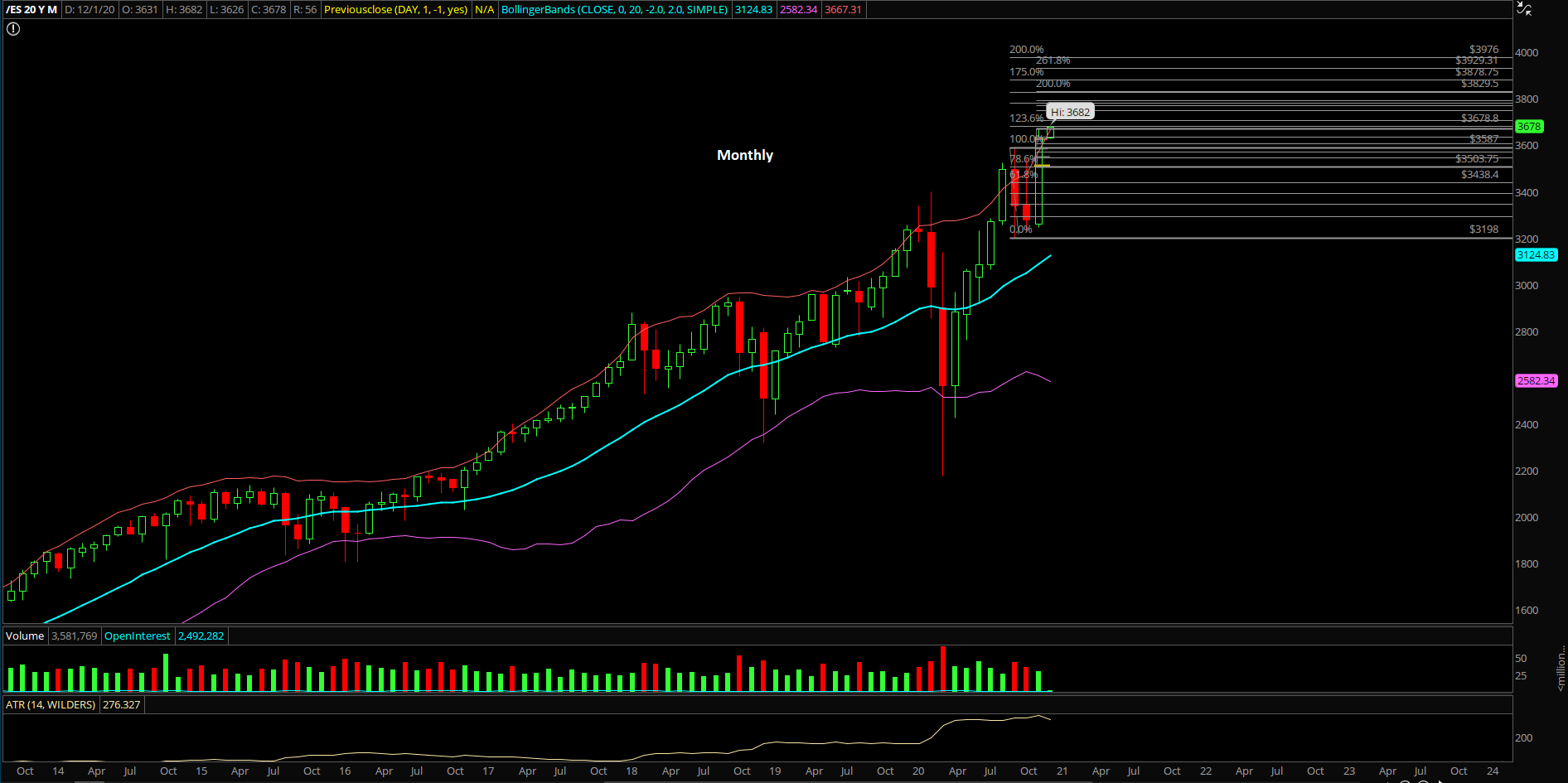

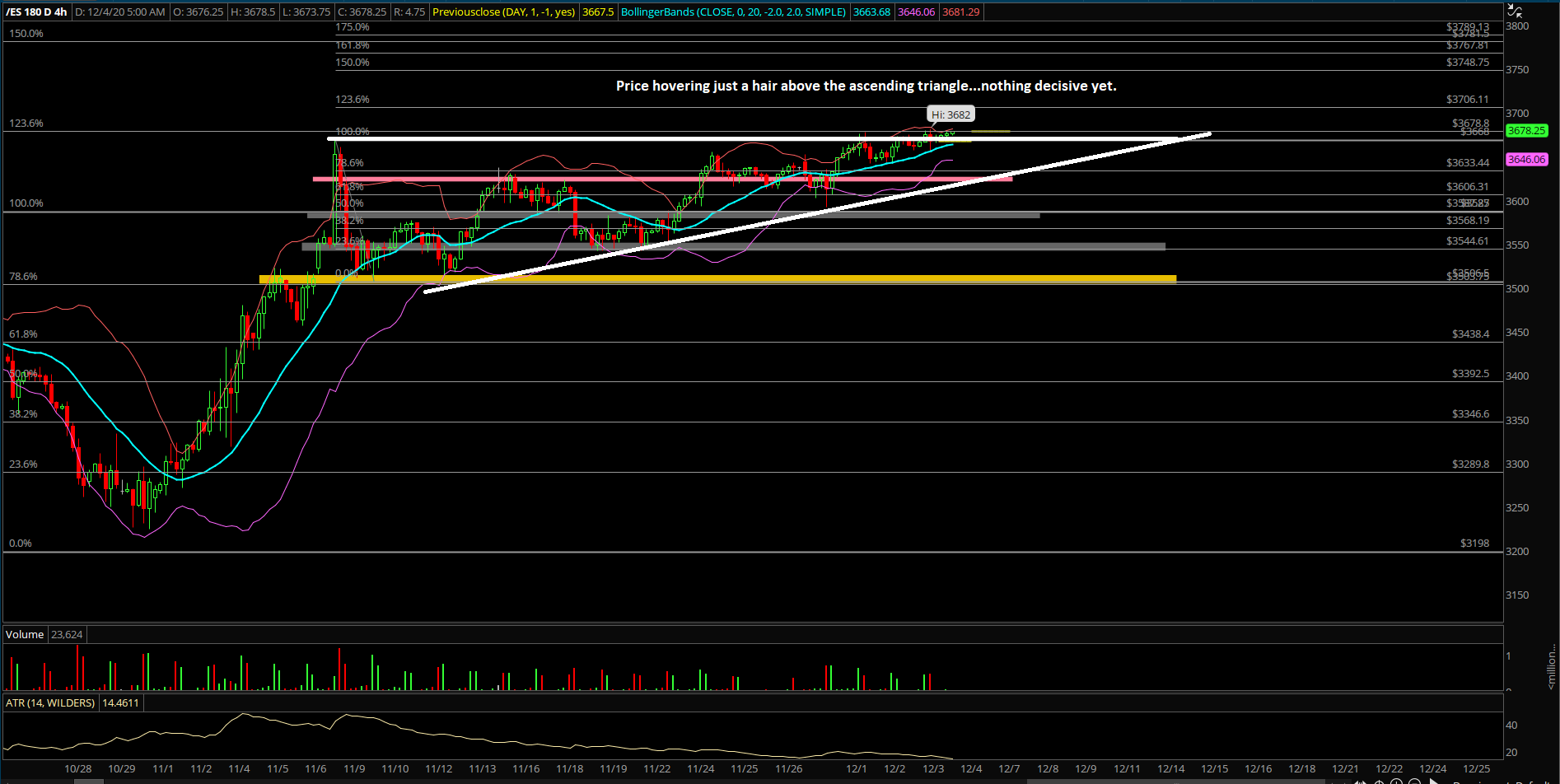

The main takeaway remains the same, bears had lost many crucial fights during the past few days/weeks/months as they just lack follow through and momentum on their side. If you recall, all backtests into the daily 8/20EMA have held and there were no sustained breakdowns ever since the April V-shape recovery. The market is trying its hardest to wrap up this year at the highs or stabilize at the highs in order to enhance the momentum for year 2021. When price action is hovering at new all time highs, it means that the upside is unchartered territory and could extend to unimaginable lengths (theoretically unlimited). Pair this with the fact that NQ/tech getting super coiled in a bull flag/pennant…you have the perfect recipe of a squeeze when above support. As we head into year end, price action is hovering at highs as expected and we’re still expecting a high year end close as we’ve been saying since April-May 2020 reports. (this doesn’t mean the market cannot pullback in between, you must understand and know your timeframes because now we have proprietary signals giving us a warning)

What’s next?

Thursday closed at 3667.5 as a doji indicating both sides are unable to fully commit. Bulls couldn’t close at the day’s highs and bears couldn’t close at the day’s low. Technically speaking, consolidation at highs is favourable for the ongoing bull trend. However, there’s a culmination of things telling us to be cautious here as everybody and their mother have turned into bulls chasing into the expected year end high. This is not the spot to go all in if you know what I mean given the probabilities + risk vs reward.

Copying and pasting a core section from our ES trade alert room’s premarket gameplan report where we demonstrate real-time trades and educational lessons. For additional details/key levels, please read or subscribe to the other report in entirety first to understand context if confused. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. ES Trade Alerts room has been outperforming the S&P benchmark alongside with many competitors as demonstrated with our official 5 year track record on EWT. (some key levels have been redacted for fairness to subscribers)

- Yesterday’s move made a nominal new all time highs, but it was unimpressive because it was just a range day flopping around back and forth that ended up as a daily doji candlestick

- Meaning it was not a trend day up that slaughtered all countertrend traders instead just a range

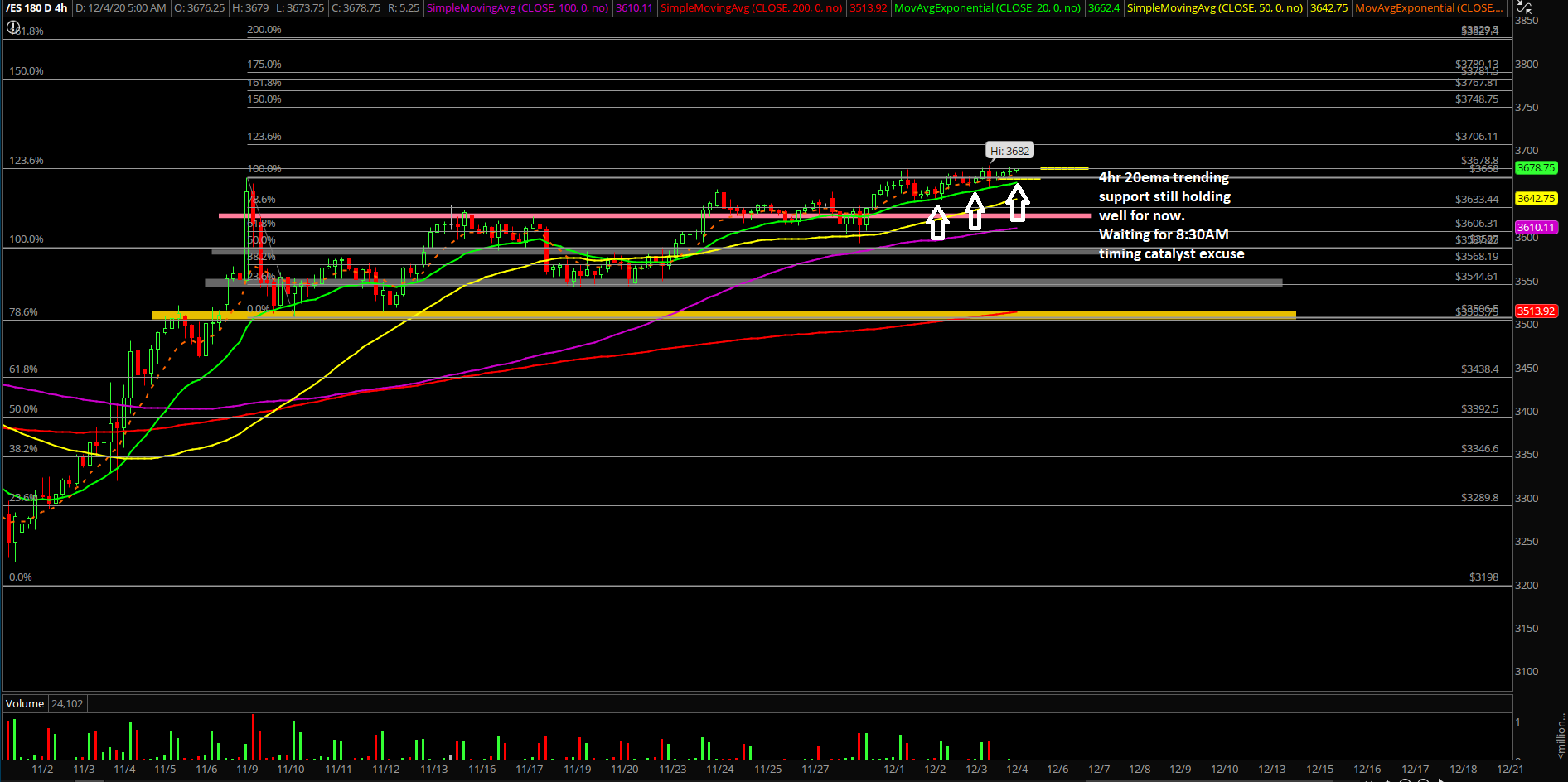

- For the most part, price has hovered around 3670s for the past 3 days and this morning’s 8:30AM jobs report could be the timing catalyst excuse to seal the deal/next momentum trigger. Either price action breaks out into 3700+ per ongoing trend expectations or price action elects to do a false breakout and trap the late chasers/longs with a quick mean reversion downside

- Price action got even tighter/more coiled during the overnight when compared to the prior O/N

- As discussed yesterday, based on our proprietary signals, we have an advanced heads up warning that we need to careful here and adapt quickly if price action confirms/changes in a swift manner

- Essentially, there’s a potential scenario where price action goes for another ATHs breakout into 3700+ and then swiftly reverses back down in order to shake the tree a bit. The price action from yesterday and the overnight action is showing casing signs of distribution combined with the fact that price is nearing extremes such as 2 standard deviation calculations so a quick mean reversion back towards daily 20EMA cannot be ruled out at this point. Obviously, price is the utilimate confirmation but this is just a heads up for traders’ mentality if they see something ‘new’ or something that shouldn’t happen actually occur

- With the caveat out of the way, here’s our actionable roadmap/levels for today

- For today, it is imperative for short-term bulls to keep holding the overnight low of 3665 which aligns with the key level of 3668 and coincidentally it’s also yesterday’s closing print. Ongoing trend week (Monday-Thursday) going for target 3700+ weekly closing in order to seal the deal

- Failing this feat, then yesterday’s RTH low of 3655 comes to mind which would then threaten further lower levels such as 3642/3630 from earlier this week. Level by level approach

- A break above 3677 would confirm that bulls are ready for new immediate all time highs and go towards the 3700+ next immediate target levels

Additional context:

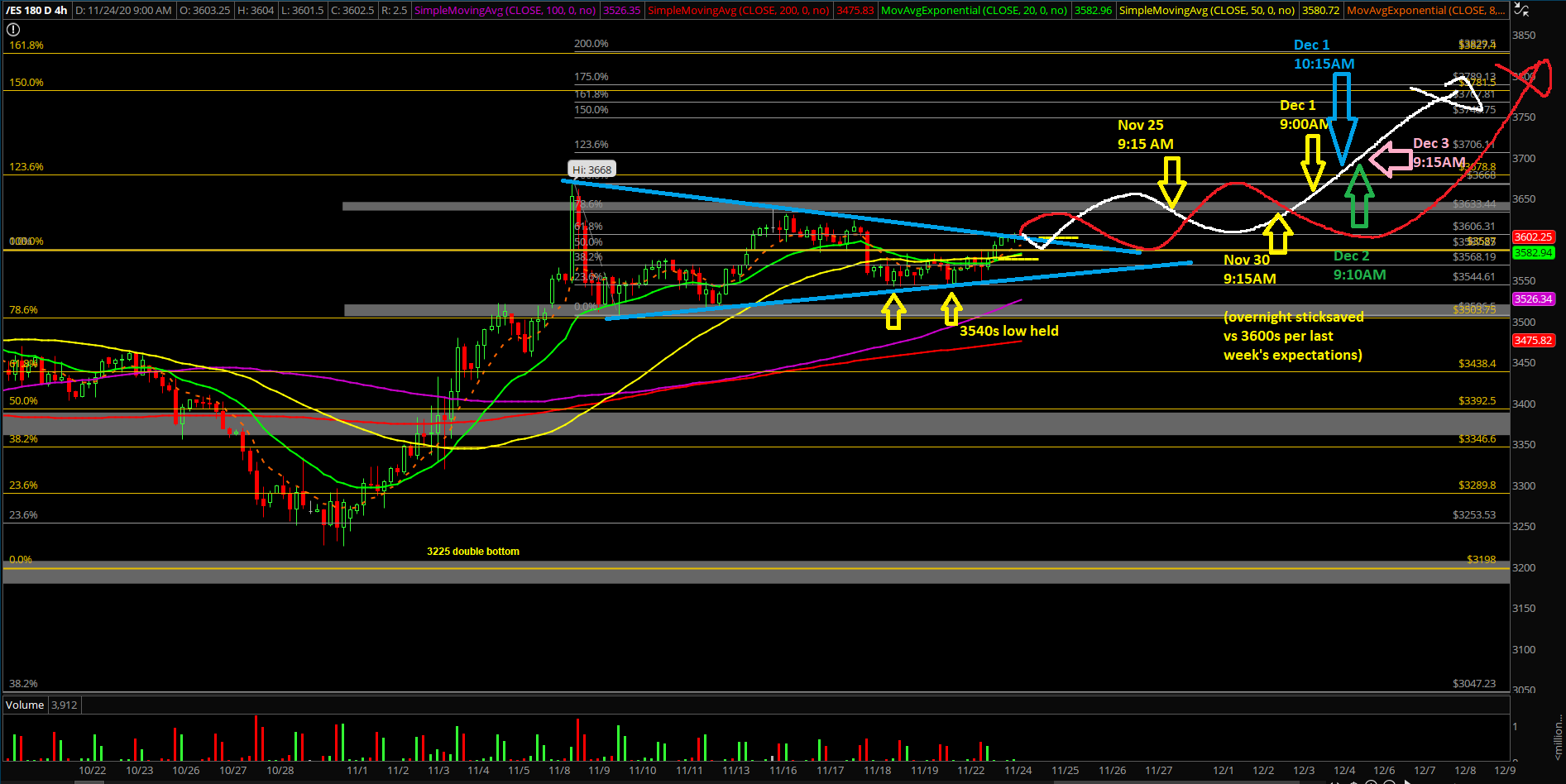

- As we expected and demonstrated in real-time, the bulls accomplished their goal by stabilizing at the November 30th monthly highs. The trend remains very clear as the supports keep moving up. In addition, Dec 1st was an immediate trend day up providing the needed continuation into NEW all time highs

- If you recall, yesterday the bears had legitimate setups during the past few days/weeks, but they failed to show commitment as supports held and all important timeframes are now very bullish

- Price action could not break below the 3542 on 5 separate attempts since Nov 19th. This is putting pressure on the bears as it’s the same old pattern of prolonged bullish consolidation. Price action now hovering 3648 which is under the new all time highs

- Short-term bears are on a timer once again because they had many opportunities to really open up the flush gates but failed miserably again and again. The entire consolidation of the past few days could be classified as a feedback loop squeeze setup and it triggered with an hourly close above 3582 (price is now at 3648 as of writing)

- When one side fails, expect the other side to win it all. The trend is your friend, use it

- Daily timeframe, sticksaved/bottomed against daily 8EMA last week as the bulls remain uber strong by not allowing a precise backtest into the daily 20EMA. Moving averages keep going up as price grind higher slowly

- For reference, as discussed in the past reports; a breakout of the 3587-3198 range = 3589+389 = 3976 (100% measured move target). Market is still at least 300 points away or another 8% away as of writing from bigger picture target

- Please know and understand the timeframes in this report, it is overwhelming, but when/if short-term aligns with bigger picture…it is often a recipe of success. Timeframe alignment 101

- NQ/tech is breaking above the triangle and hovering at all time highs, ready to take over the acceleration as leadership has rotated perfectly

- Just be aware that many bad portfolio managers will continue their dash into trash stocks (small caps) in order to try and chase alpha to make up for their poor yearly performance. See RTY:ES or IWM:SPX ratio. Never underestimate the FOMO ability as people fear for their jobs/likelihood during the 4th quarter. Great outperformance from RTY/IWM thus far