Market Analysis for Oct 22nd, 2020

E-mini S&P 500 Futures: Keep It Simple Stupid – Both Sides Unable To Decisively Win, Pussyfooting Continues

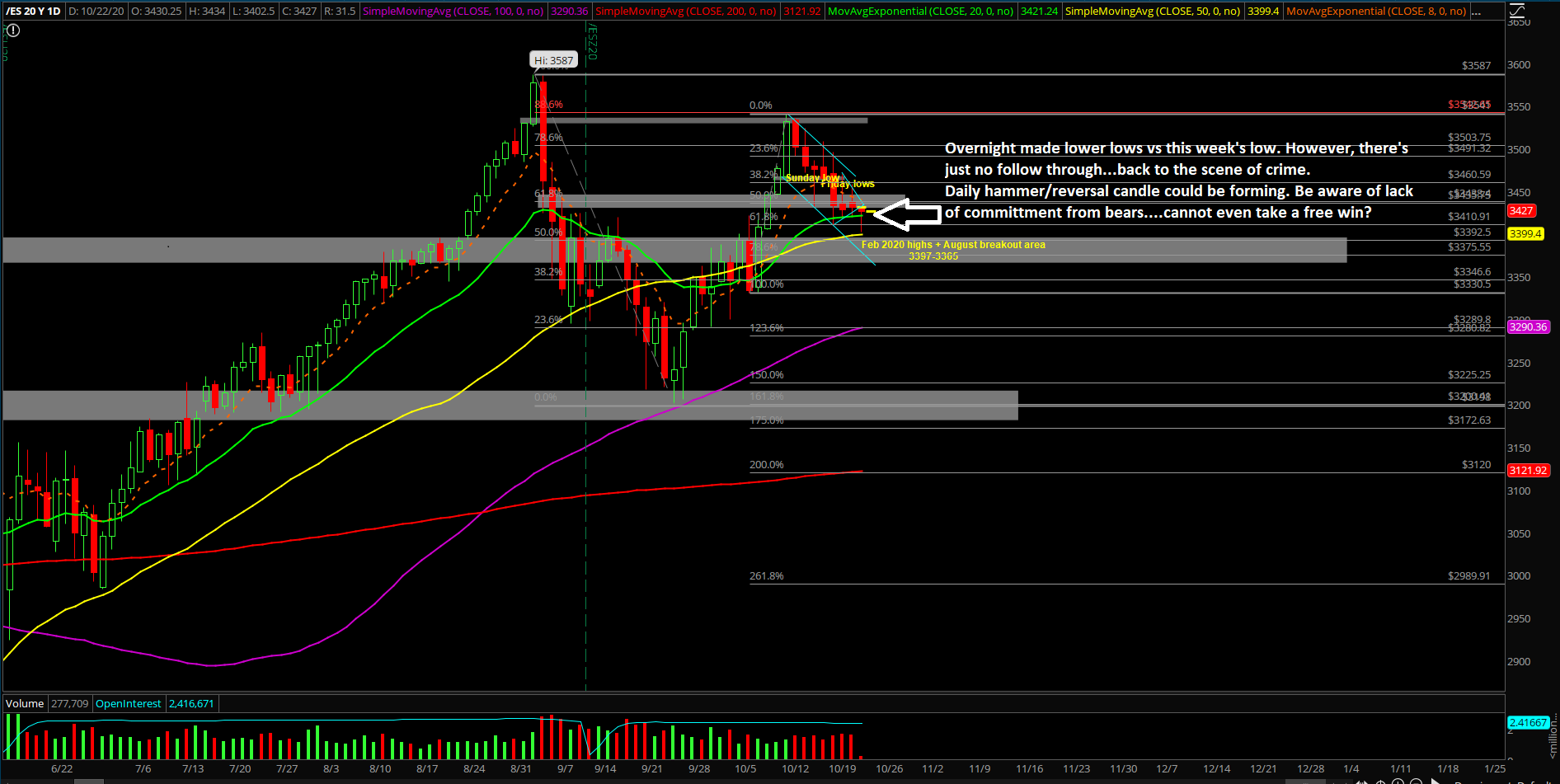

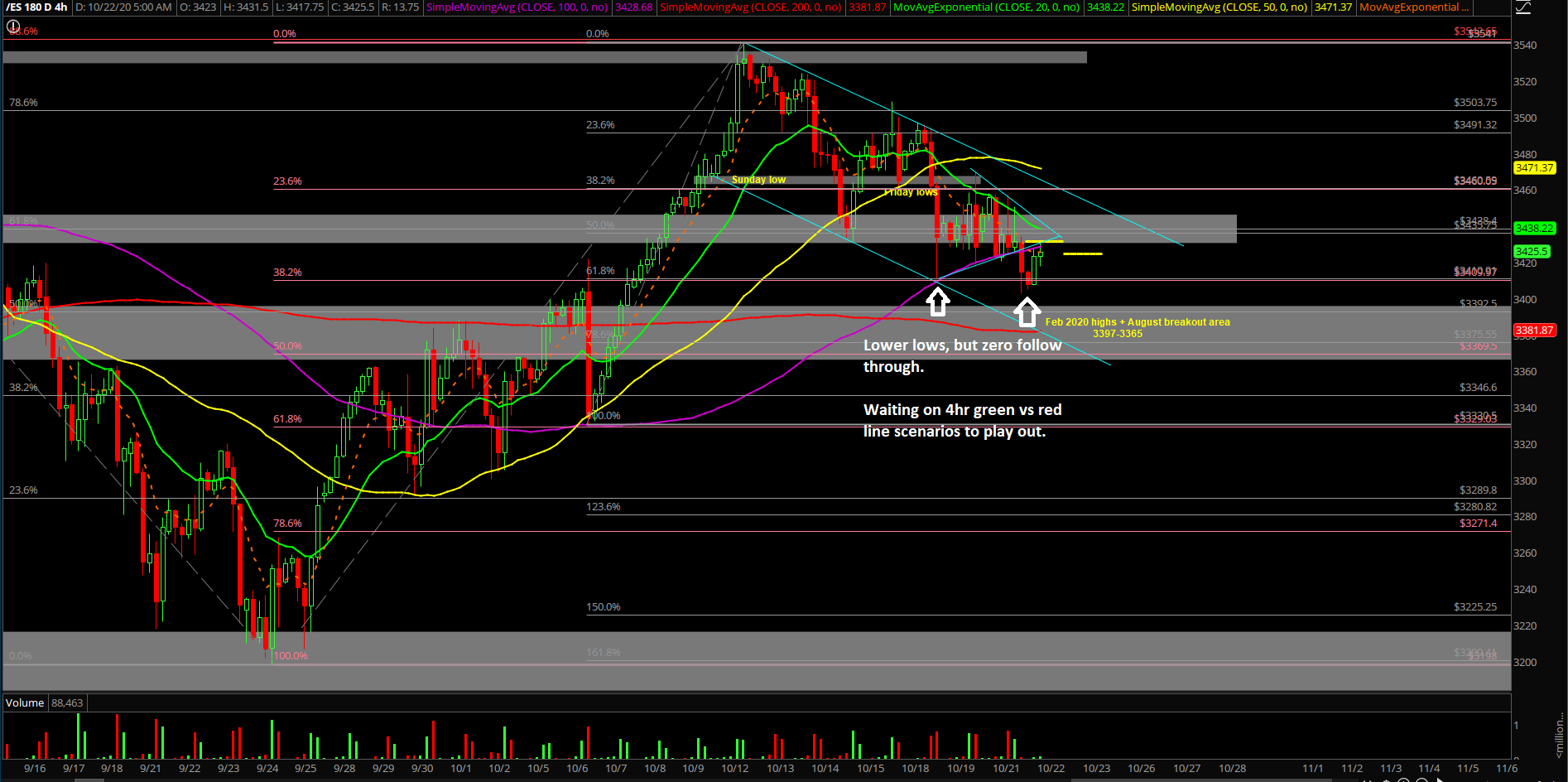

Wednesday’s session was another inside/range day where there were moments of breakout and breakdown attempts, but ultimately nothing occurred during RTH as price closed at the same spot just like the past 2 sessions of the current week. The battle is getting tense because the range has been tightening and tightening so everybody is waiting for the climax/winner. Overnight made fresh lows for this week, but there’s just no commitment with the bears even when they had all the short-term advantages. No follow through as bulls made a line in the sand around 3400s.

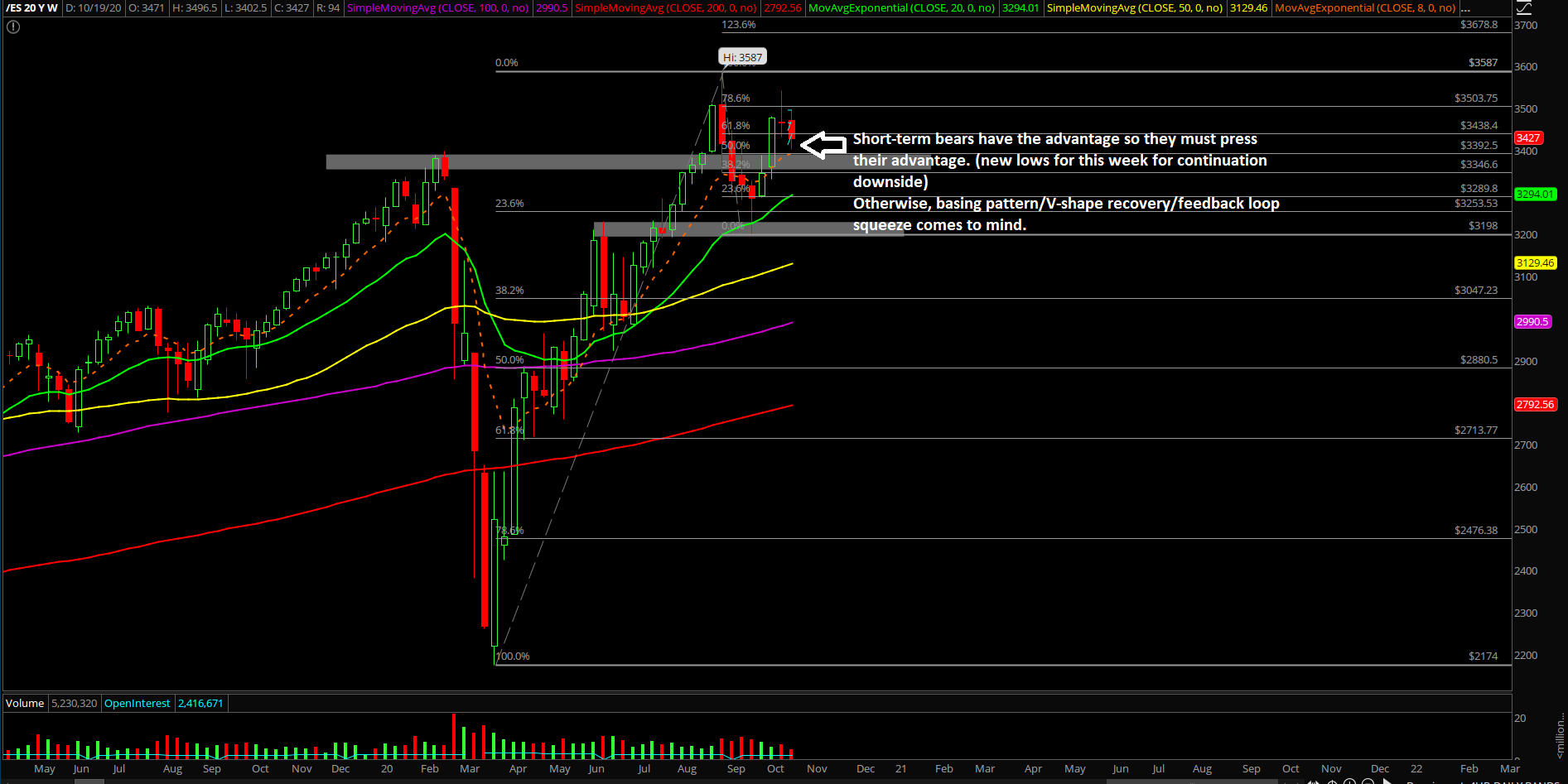

The main takeaway/context for the bigger picture remains the same again given last week’s low could be treated as in. Short-term timeframes back into alignment with the higher timeframes. Repeat existing context: the ES 3198 temporary bottom from Sept 24 could be the bigger picture bottom as we head into the rest of Q4 2020. This is a possibility given that price sticksaved/bottom against a key support confluence and has been building a basing pattern since then. Obviously, the wild card is the upcoming elections and likely the volatility/whipsaw will commence shortly and test this theory. We just have to implant that idea if this year is going for the year end highs closing print again as we discussed a few times since the V-shape reversal from March.

The current wild card is that last week’s high could be potentially considered as a double top/lower high given 3587 ATHs vs 3541 temporary high. It is up to bears to follow through and show additional continuation/commitment to the downside pattern. They are on a timer here and must decisively break below daily 20EMA to disallow yet another V-shape recovery/sticksave vs the main trend of the past few months.

What’s next?

Wednesday closed at 3431.5 and nothing has changed except that there’s one more day of trapped/frustrated traders awaiting for the eventual outcome.

Copying and pasting a core section from our ES trade alert room’s premarket gameplan report where we demonstrate real-time trades and educational lessons. For additional details/key levels, please read or subscribe to the other report in entirety first to understand context if confused. FYI, the ES trade room provides real-time entries and exits with pre-determined stoploss and target levels alongside with real-time lessons on strategy/risk management/psychology/momentum. ES Trade Alerts room has been outperforming the S&P benchmark alongside with many competitors as demonstrated with our official 5 year track record on EWT.

- Past three sessions have closed at the same spot meandering around the 61.8% retracement + daily 20EMA confluence zone of 3410s-3430s. Price action unable to decide a winner yet

- Short-term bears have the advantage from overnight breaking below prior day’s low 3420~ and current week’s low of 3410~ but just cannot showcase a big win at the moment. (they needed to flush into 3397-3365 which is the next significant support zone)

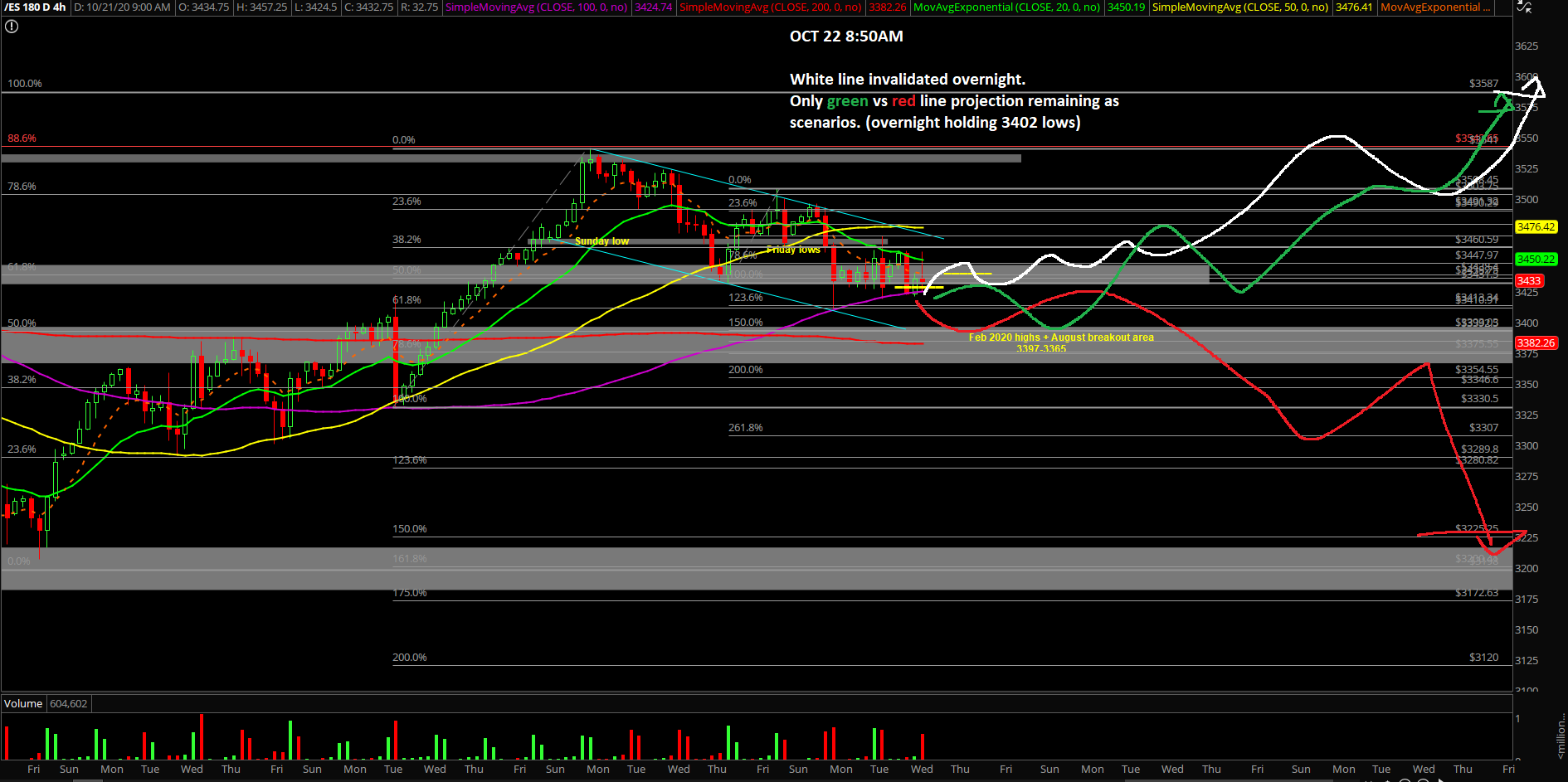

- 4hr white line projection has been invalidated and only green vs red scenarios are left

- All this meandering, consolidation and posturing means that the evil 4hr green line projection that we presented previously need to be treated very seriously. The current overnight low is 3402.50 so it means that price held against the key 3400 round number and also the 3397 Feb ATHs number. In addition, current price is hovering back at 3430s and a daily hammer/sticksave/reversal candle is forming for the bulls.

- If bears cannot strike while the iron is hot after today’s RTH open, there’s 3 days worth of trapped traders on both sides….the feedback loop squeeze would be immense as traders chase the opposing breakout as the breakdown keeps teasing. A feedback loop squeeze would consist of reclaiming yesterday’s high 3458, followed by 3465 and 3485 key levels towards ATHs.

- Conversely, if bears are able to gather a decisive win here, they must showcase that event by breaking below overnight lows followed by a swift continuation into the 3397-3365 zone. For more key specific levels, look at the bottom section of the ES pre-market report from the ES alerts trading room. It is imperative for bears to actually show up and take the win instead of this shake and bake/trappy action because it allows for additional time to setup a basing pattern on the daily charts. A breakdown could open up significant key levels such as 3300/3198.

Additional context:

- Bears are threatening to potentially open up a bigger range which is massive because it spans from 3198-3541, meaning that the lower range is 3198 and current price is resting at 3430s. There’s still 200+ points until the last swing low which is about 6.7% movement. This is all predicated with last week’s weekly doji/potential double top/lower highs and the current breakdown below last week’s low of 3431.50. If you recall, last week’s high was 3541 and the all time highs is located at 3587. It was a decent rejection off of the 88.6% fib retracement + resistance confluence area

- See whether bears/price action is actually able to close below daily 20EMA and sustain below it. Otherwise, the risks are great for yet another V-shape reversal if bears turn back into gummy bears