Market Analysis for Oct 21st, 2020

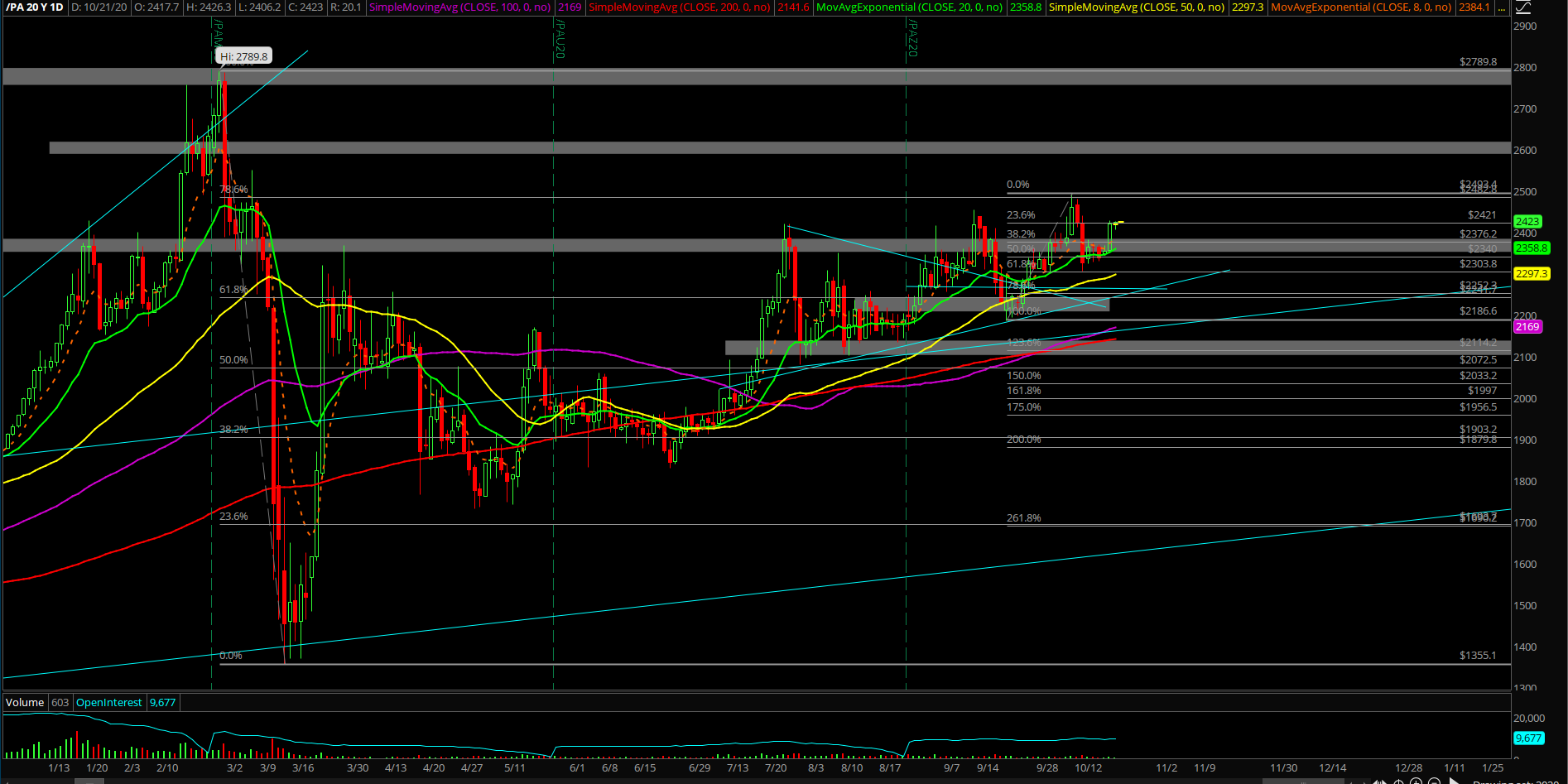

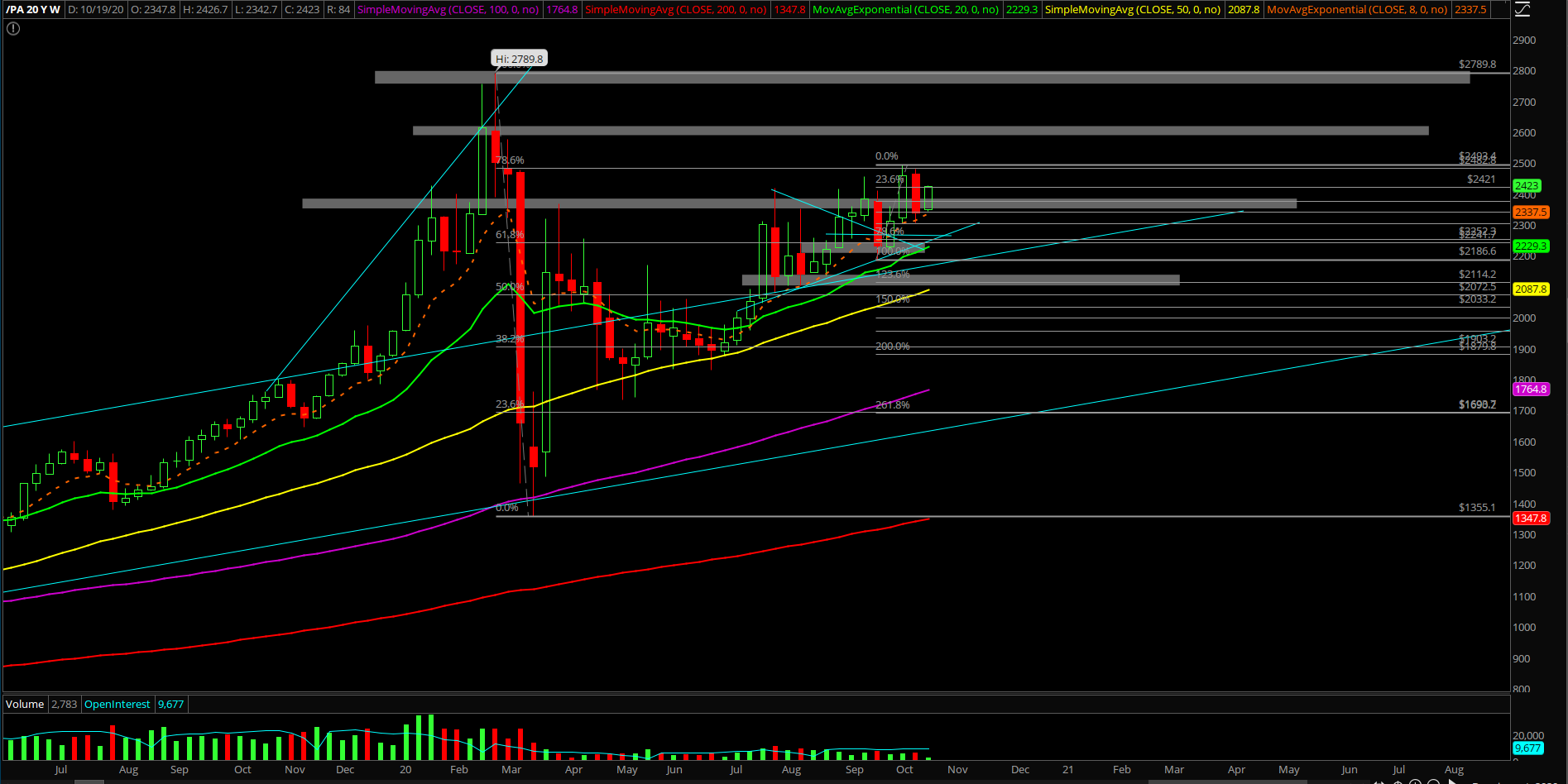

Palladium/PA train ride: 🚂 🚂 best in breed of the best in breed as I discussed...

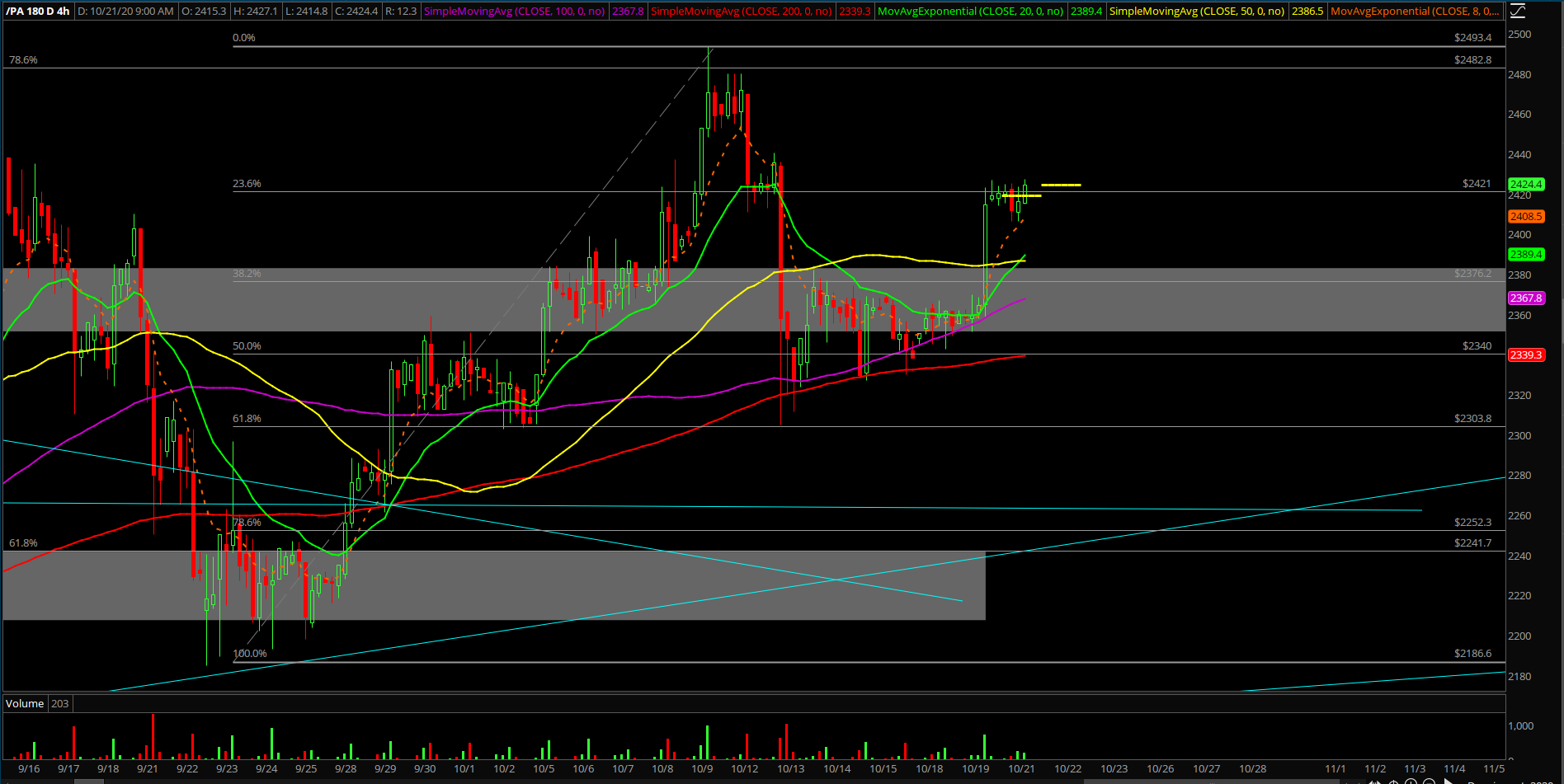

At this point, YOU SHOULD NOT MISMANAGE any trailing stops. It should be tightened up to a bare minimum breakeven as price is +90-100 points from entry point area of 2320s-2340s. Remember, this thing is $100 per point per contract. Now, sitting at 2427

As of writing, we're up close to $10k per contract already and sitting tight with stops underneath yesterday's low of 2350s in order to manage ongoing risk. Waiting for 2480-2500 target reaction to see if it hits, then re-evaluate and project another target. Level by level approach

Note: It is doing an accelerated breakout formation riding off of the daily 8EMA and 4hr 8/20EMA right now. (it should not go back down, otherwise something else happening in regards to IMMEDIATE momentum)

Even if you are not participating, I hope you are learning with the execution from a sim/practice account. Doesn't matter if you miss this train ride cuz it's the foundation of understanding what Ricky is doing...he is piggybacking off the main trend and leveraging the on-trend setups in order to outperform and produce significant alpha. Learn to leverage these key setups in various instruments in the future, it's all the same things across the board...