Market Analysis for Oct 6th, 2020

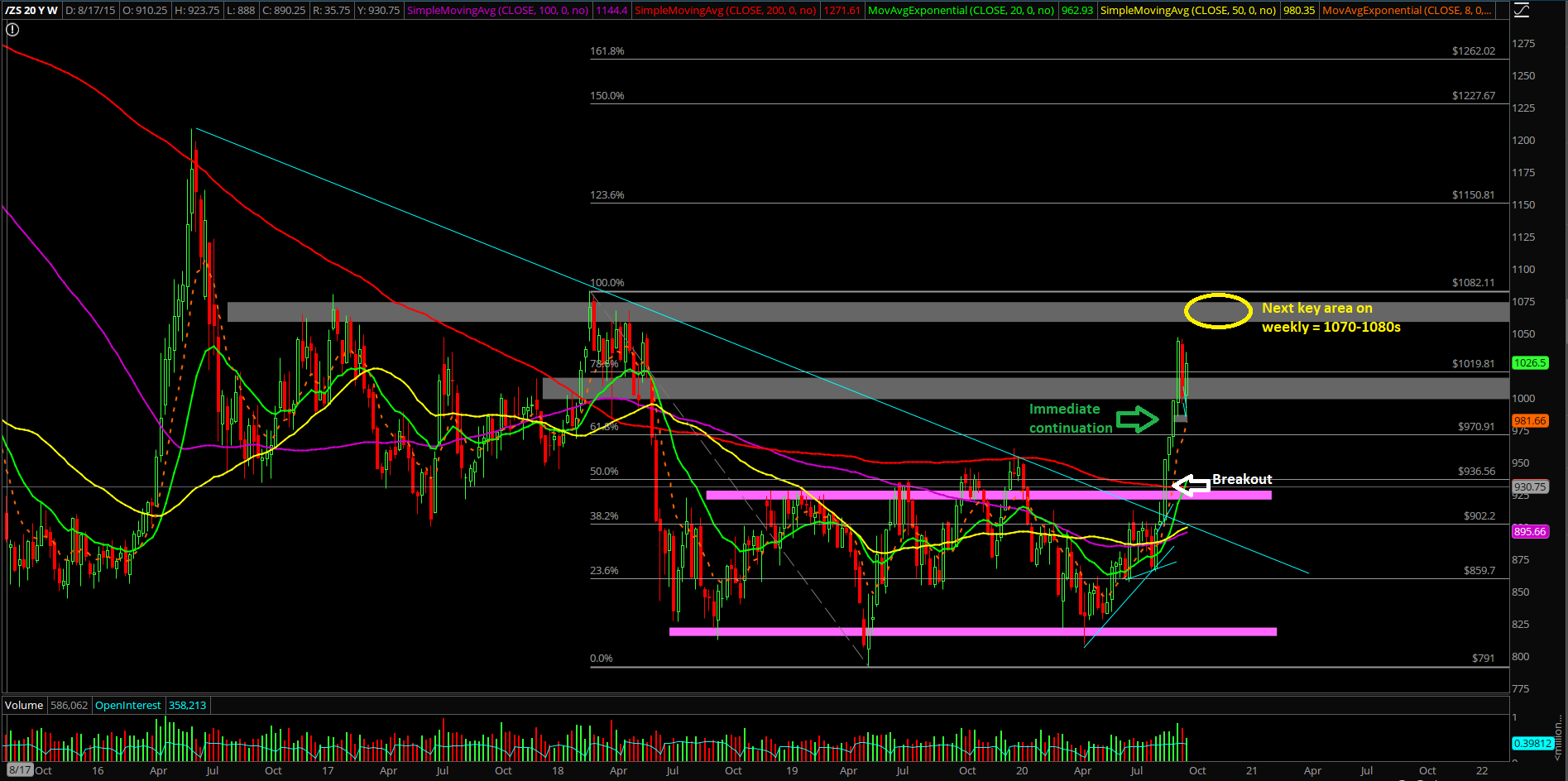

Educational momentum example over the past week on Soybeans/ZS:

We've been all over this name in the past couple weeks as demonstrated in real-time as a bonus from ES trading room. Now, just wanted to share a textbook example of how timeframe alignment, significant trending support confluence + low risk vs high reward playbook could work. See charts below

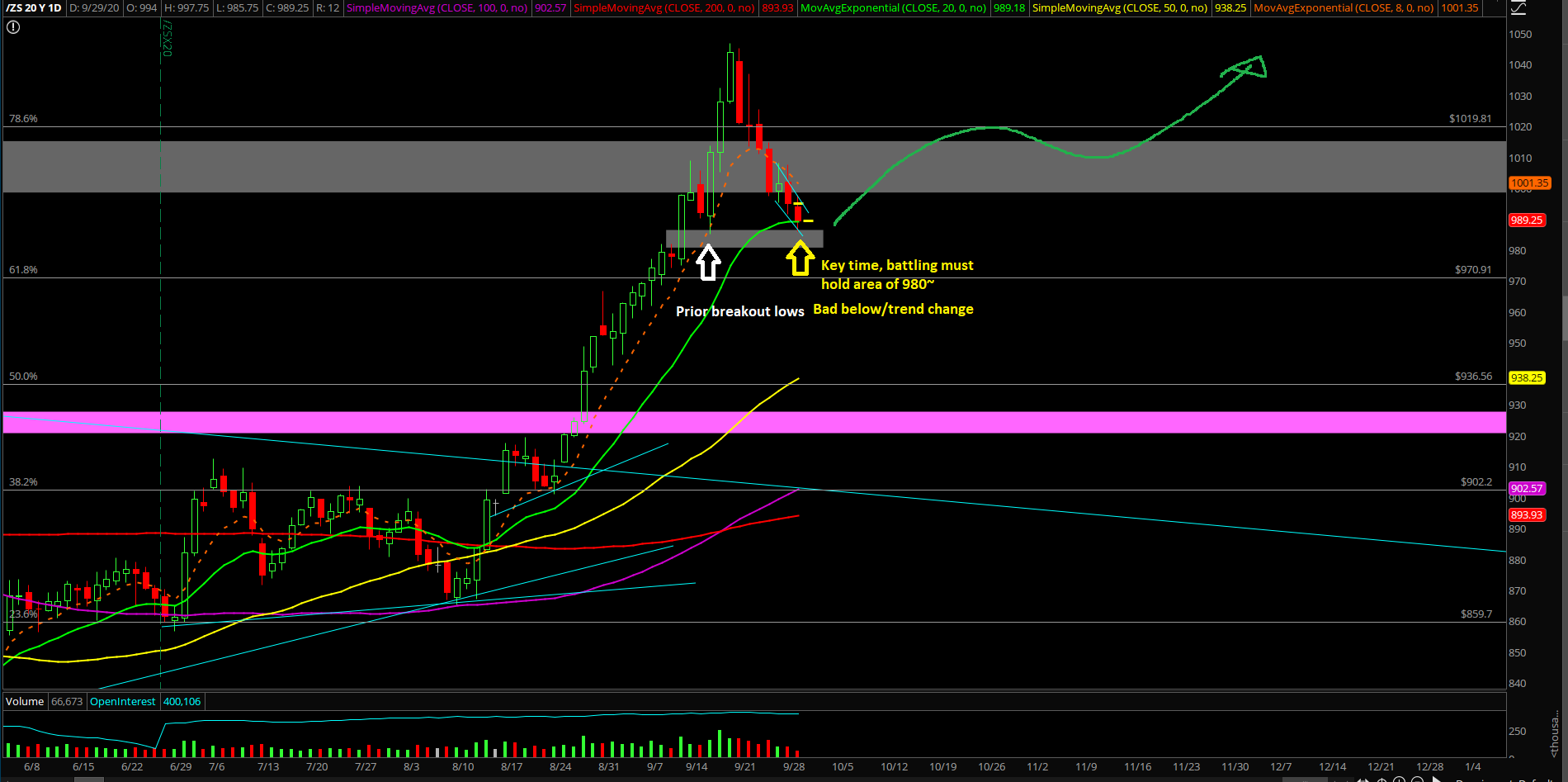

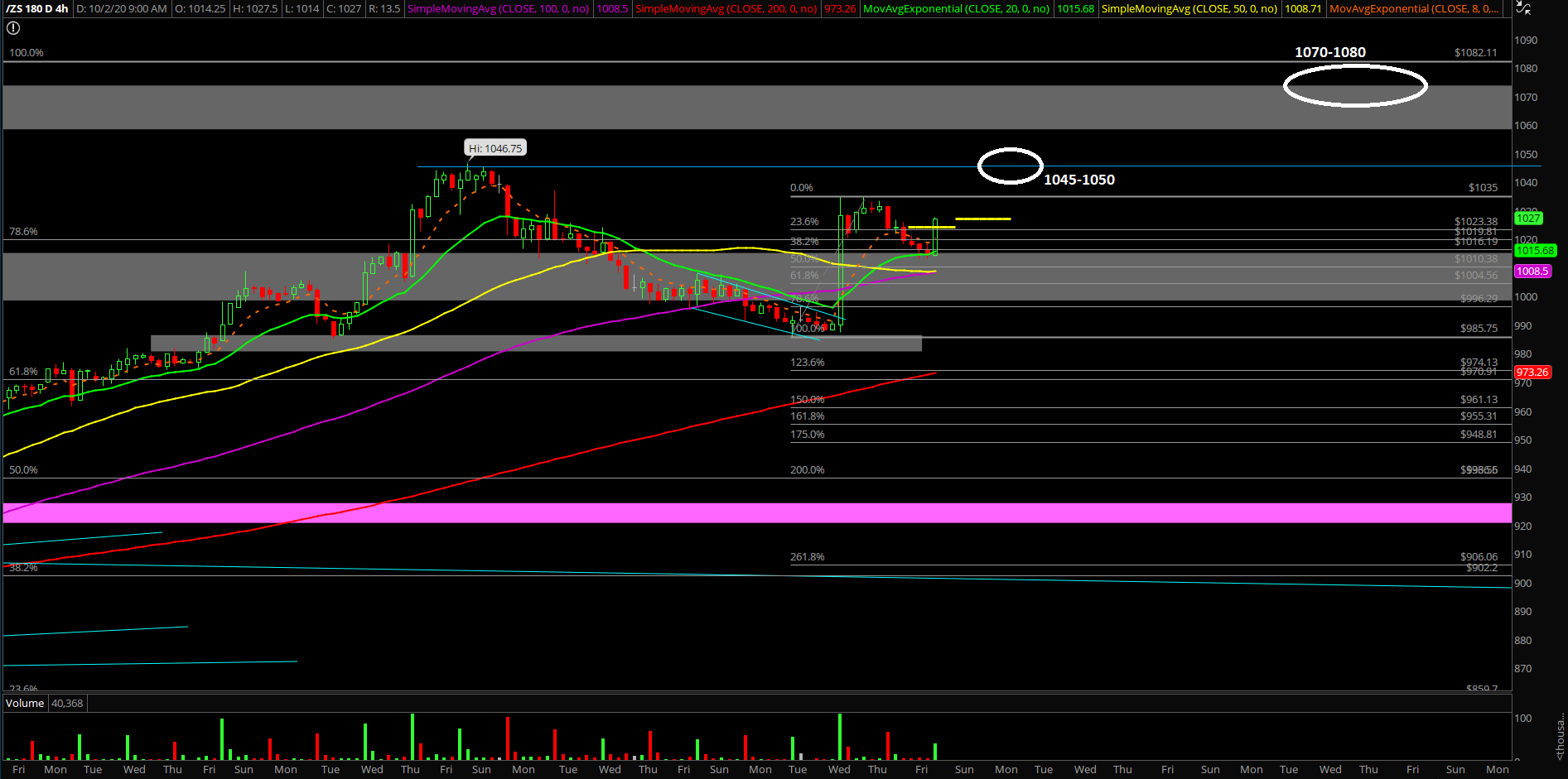

1) Thursday Sept 29...price packtest prior breakout area/utilizing as key support 980s + confluence with daily 20EMA. The chance to ride a bull train setup with a low risk-high reward was established

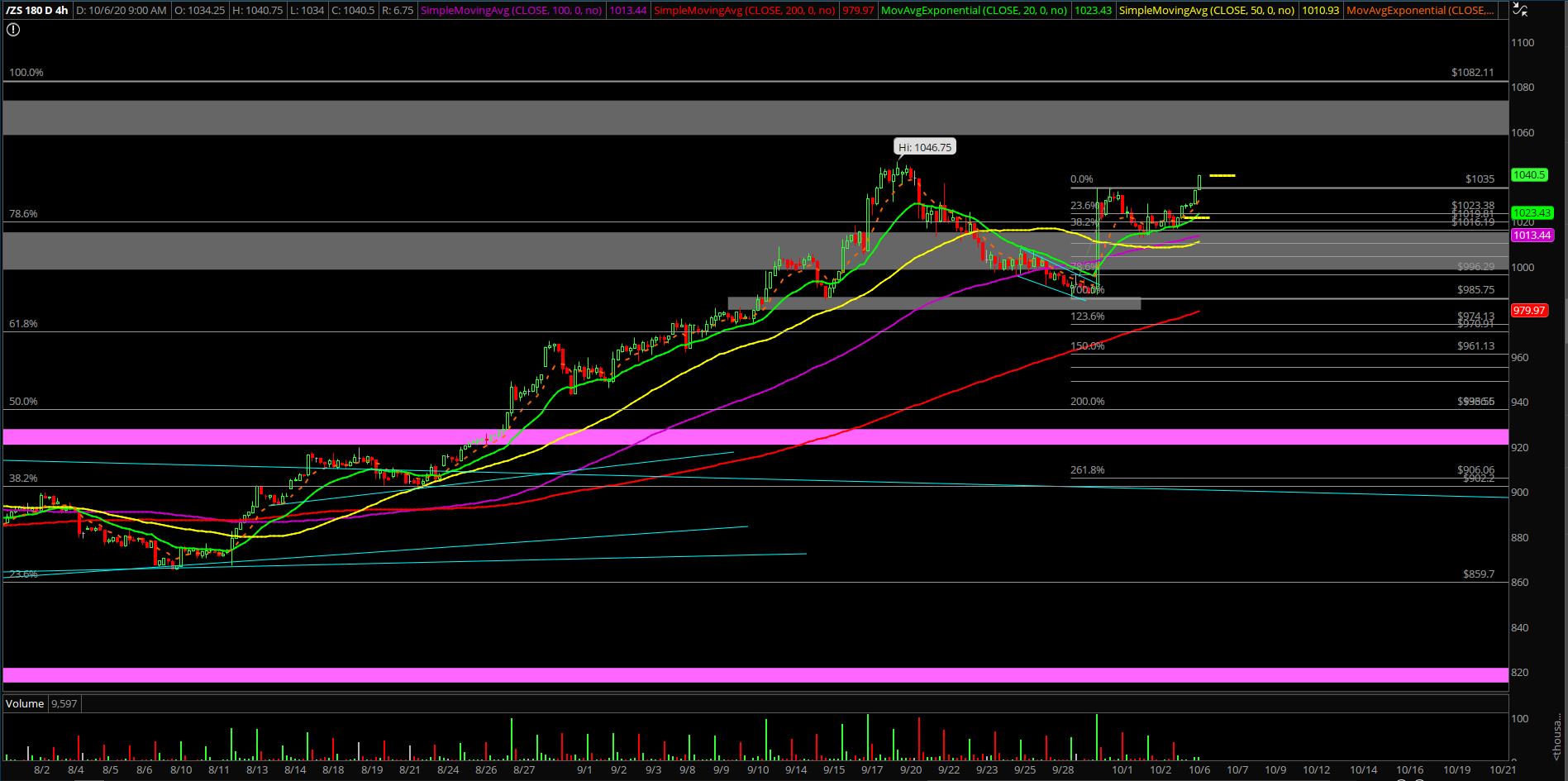

Additional context: daily, weekly, monthly are all timeframe alignment to the upside given the existing trend.

(Initial risk of 10-20 points for 40 points minimum and much higher potential if first target hit.)

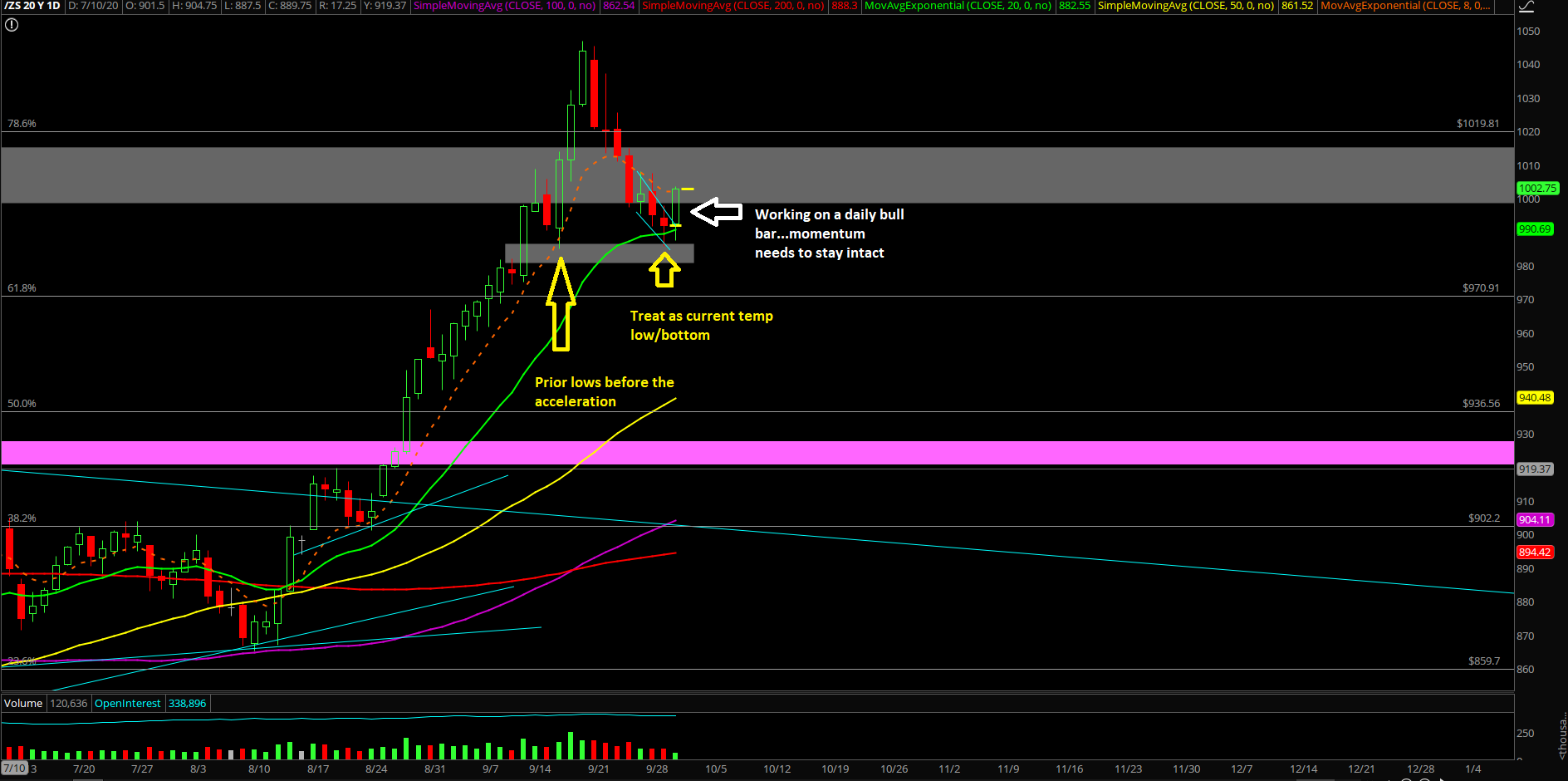

2) Next day Sept 30...price sticksaved off of the 980-990s area and formulated a huge daily bull candle stick indicating support working as intended. Price closed at 1020s highs by EOD, massive daily candle confirmation

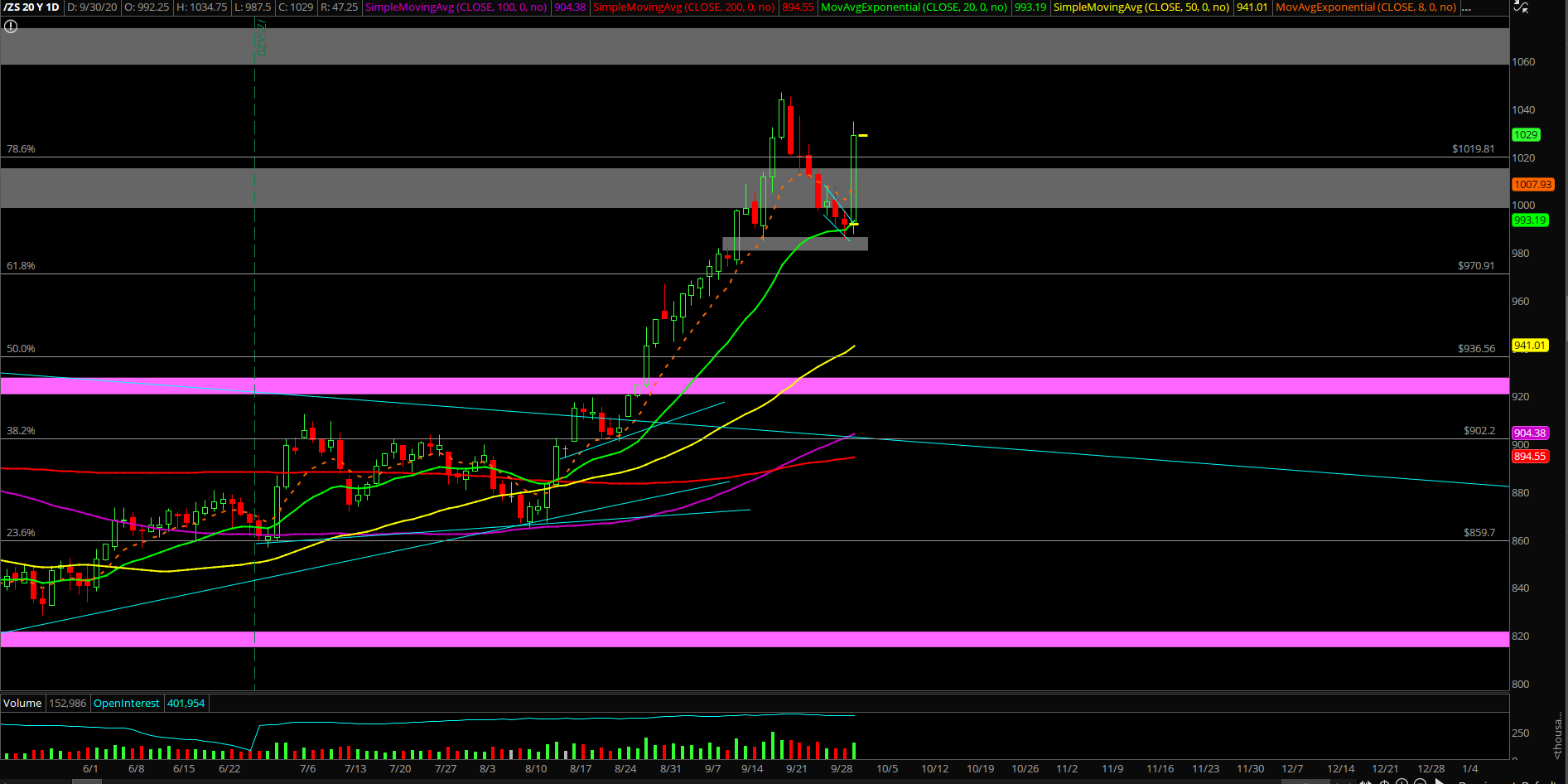

3) Next few days...continuation of additional upside based on higher lows and higher highs