Market Analysis for May 4th, 2020

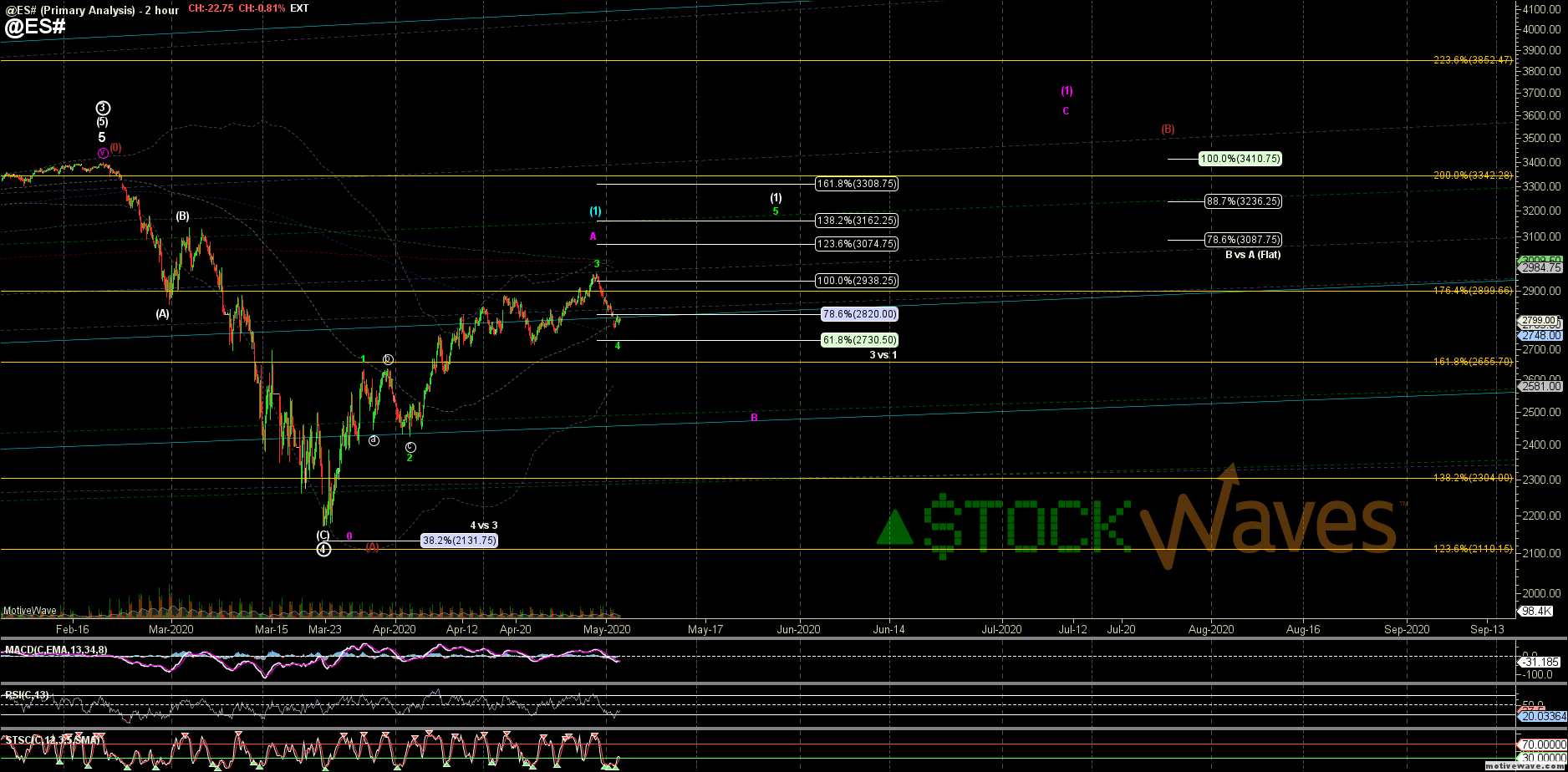

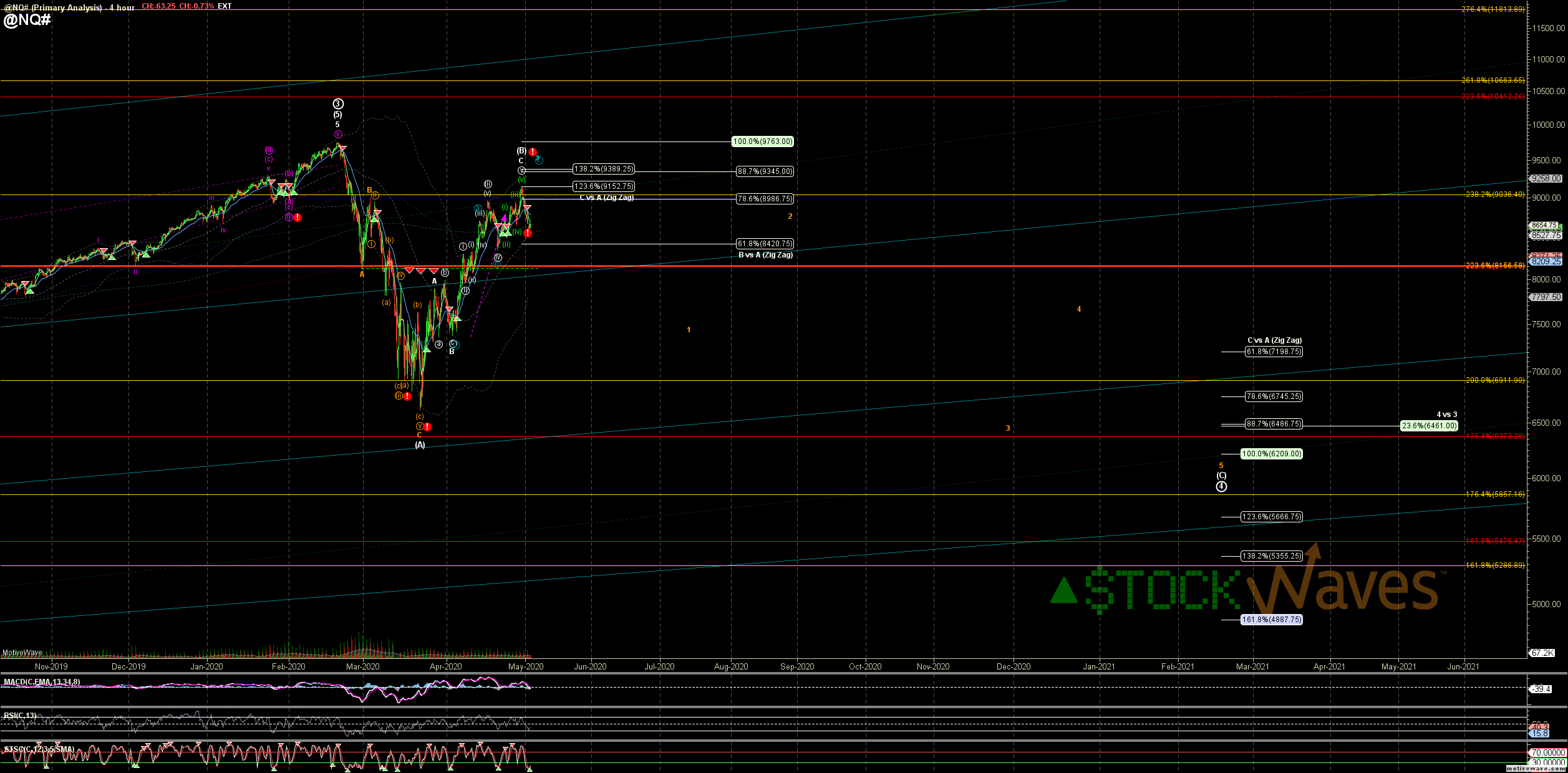

While I have cautioned about the potential ABC up in NQ past the 78.6% retrace and a similar ABC up is countable in ES/SPX (since it failed to hold the (iv) of c of 3 in the 2860 region) IF we were to see a (C) down I think:

1) it could easily be an ED and drag out with lots of steep bounces starting with an abc for 1.

2) it could easily fail to make a new low under March.

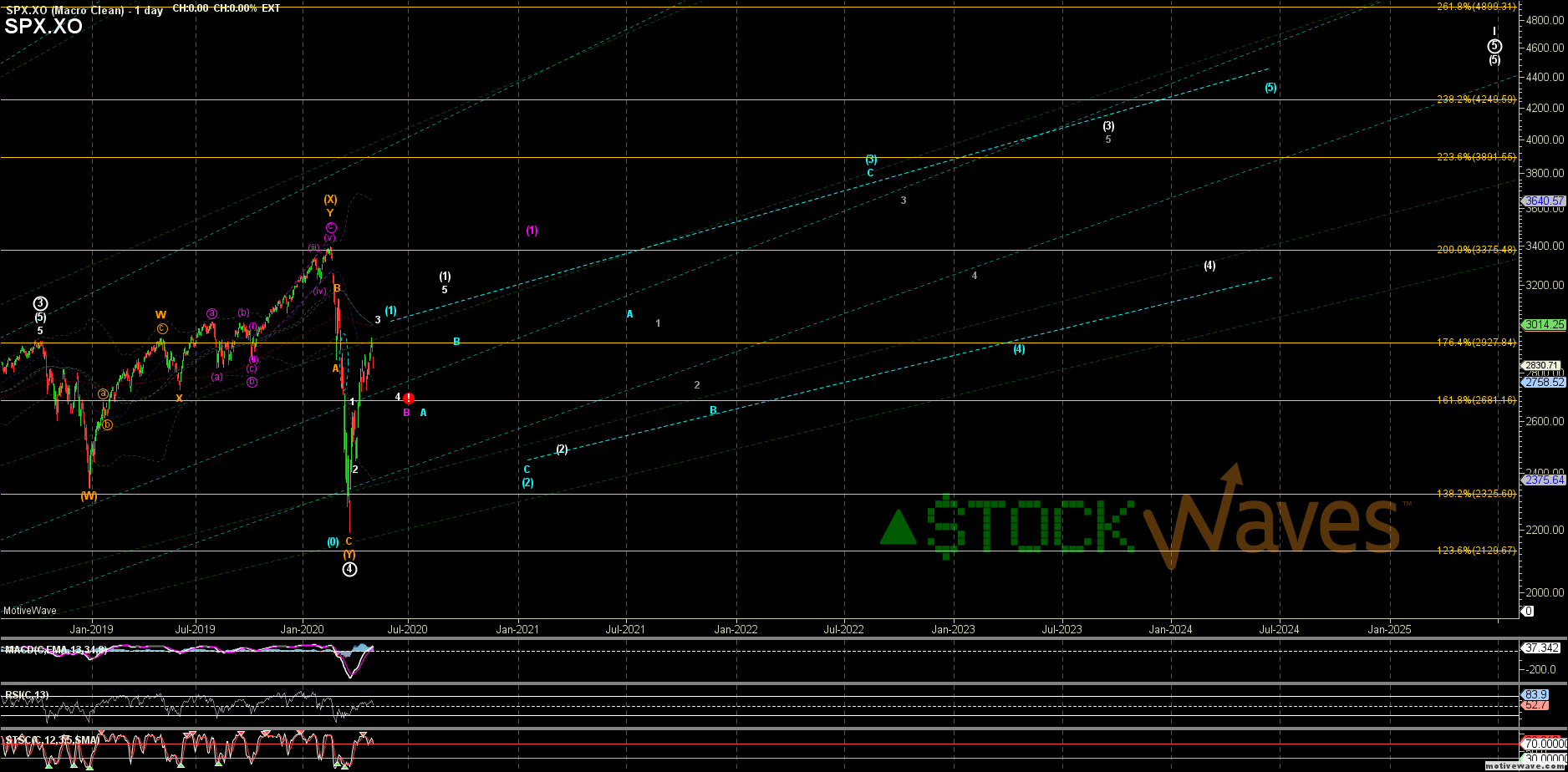

I am also still very willing to give the March low (certainly in the S&P) the benefit of the doubt that it was the end of P.4. Many ind names and sectors count this way either as all of a sharp P.4 from extended P.3s int o 2019 or 2020 or as the wider flat from 2018. So I am open to other ways this P.5 can start, and an ABC up is possible to count as a wave (1) in an Ending Diagonal. IF however we are getting an ED for the entire P.5, my preference would be that this is only abc up for a purple A of a much larger ABC for (1). In that case the 2600s would be ideal support for a purple B and the C of (1) could take up back toward the 3300s. But we have to consider the potential that this was all of (1) or even the dreaded (B). If so then we could see a larger correction toward 2500 or deeper where the abc to ~2600 is just the A/a.

In the short term I am looking for at least an attempt at a corrective bounce toward 2900-2920 resistance. Until that it taken out it will carry a nano label of "(b)".

*What about 5up already? It is possible at a glance to see S&P as 5up from March, but as we were following the internal structure along the way the subwaves do not agree and neither do Fibs. Still there are many outside this sight who causually glance at charts and care/know nothing of proper subwave structure and Fibs... they might see 5up. Either way we are looking for a corrective move toward various supports and bounces toward resistance and will take note of smaller degree structures in either direction that look more impulsive.