Market Analysis for Mar 13th, 2020

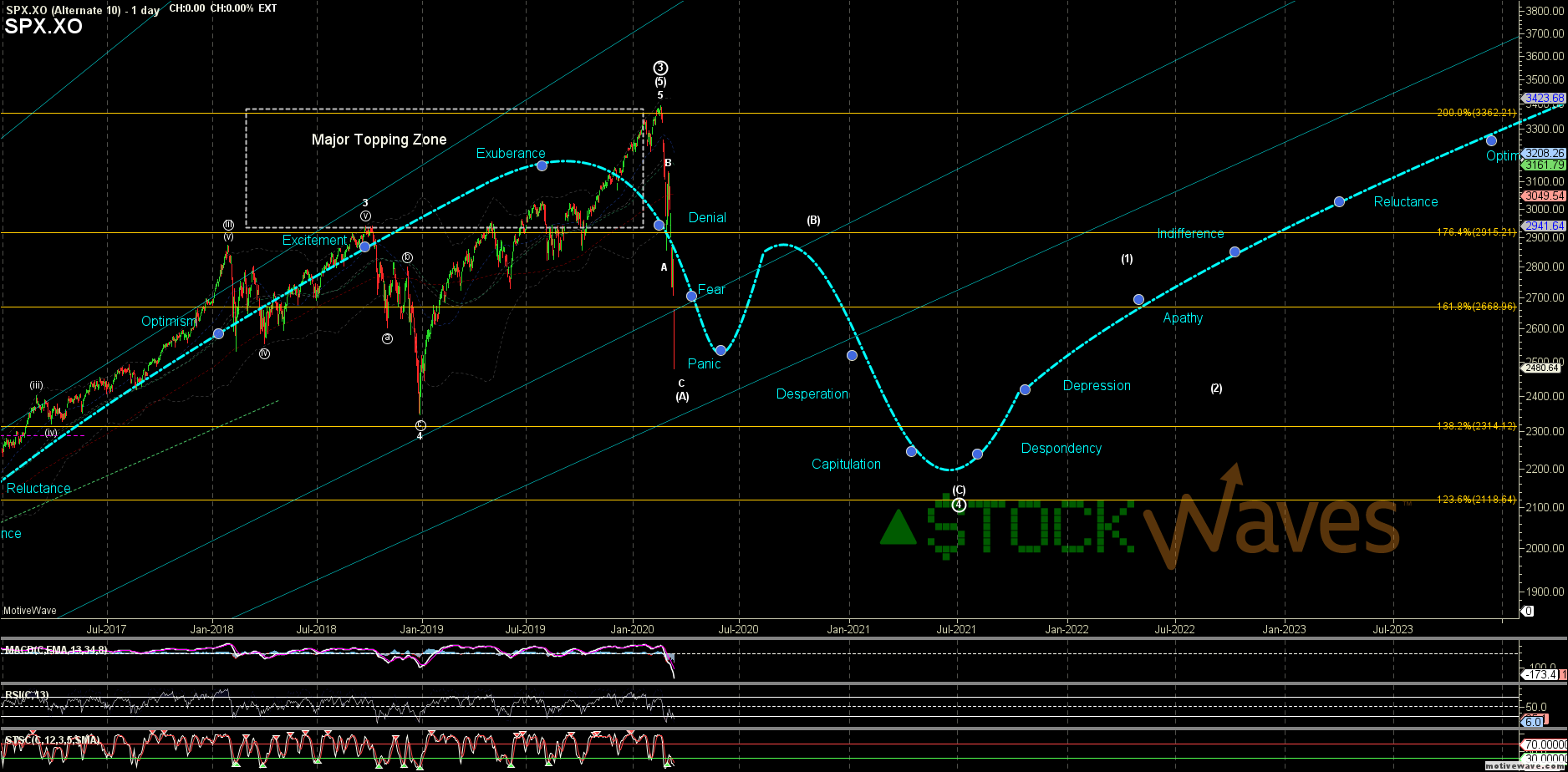

I would like the low to hold in favor of a larger bounce starting that could try to slow things down and in an ideal world might even drag up into the Nov election.

That said, I think we will have many more wild days and +/- 2-3% days might be around for a while. I also think we get some deep fades along the way that retest the lows and keep most "folks" out of the market until closer to a (B) wave top.

I am going to be very open to playing the smaller wave structure as it comes and not being married to any specific subwave count, this is just a general planned ideal road map.

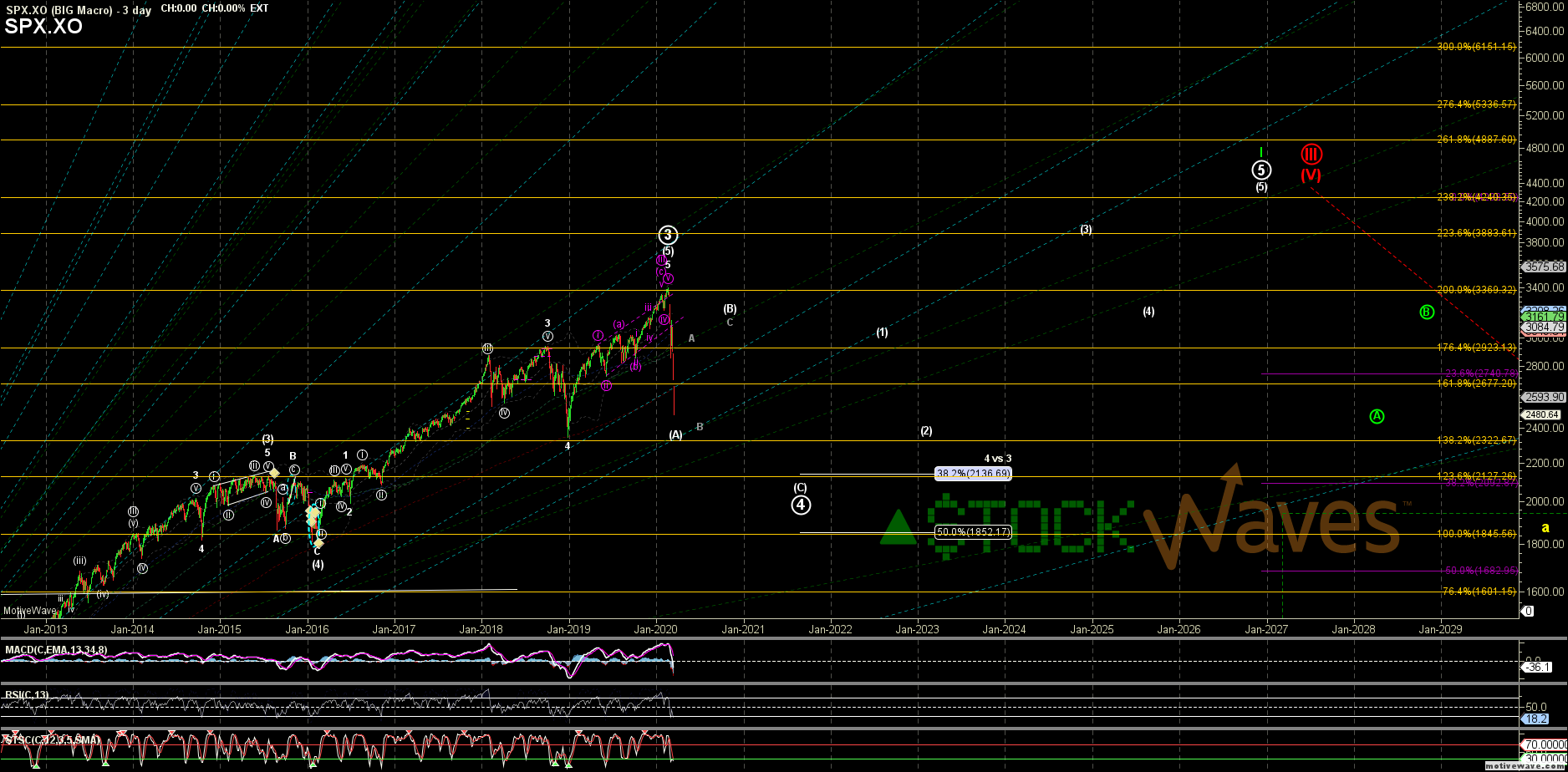

Certainly any break of the low last night now has potential to extend to 2200s next and then likely continued subdivision as a more accelerated count toward 2130 (the orig and still ideal target for P.4) or lower.