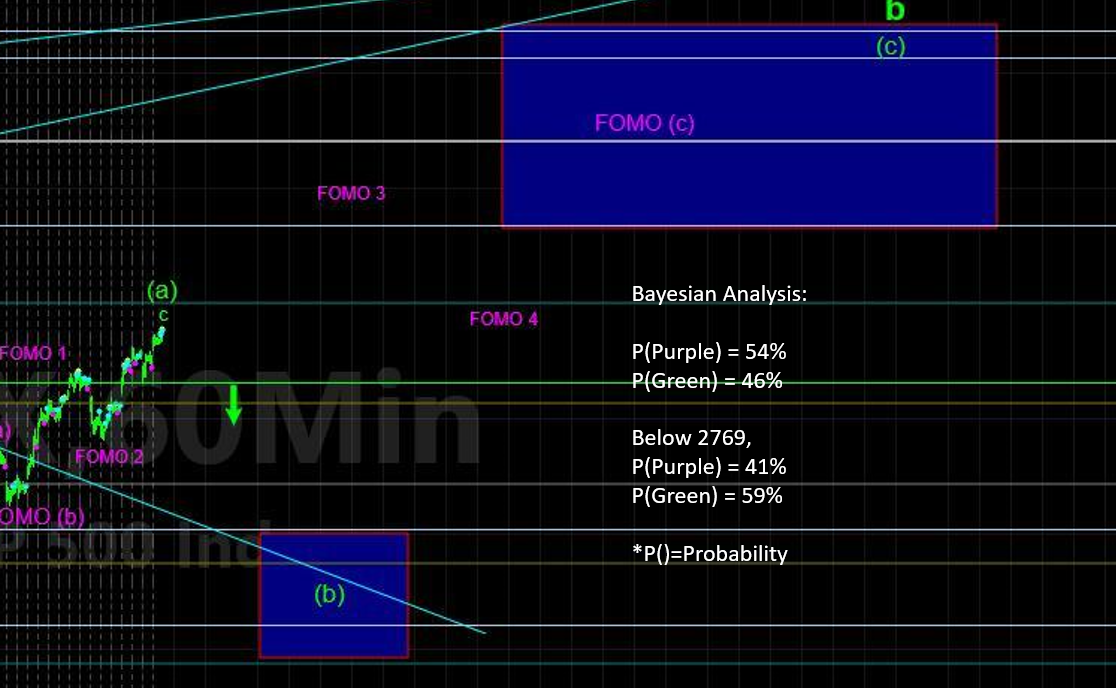

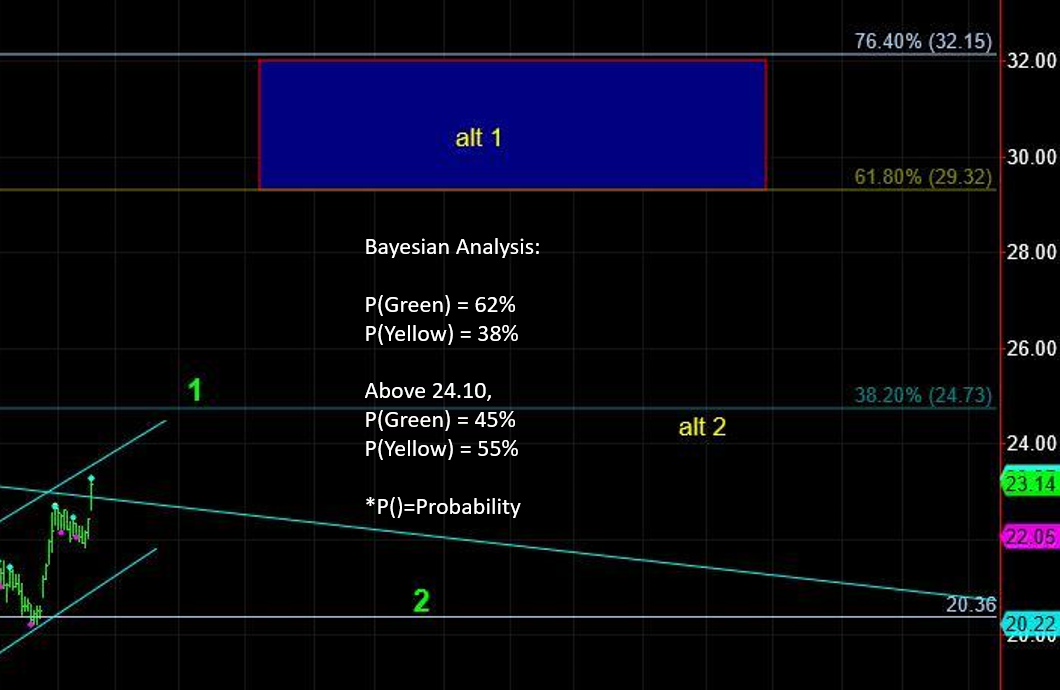

Market Analysis for Feb 20th, 2019

Bayesian Analysis of Avi's Counts

Attached please find Bayesian probability assessments for Avi's most recent SPX, GDX, and USO charts. Avi and I have merged our life passions of EW and Bayesian; and anticipate this service adding value to your investment decision-making.

Probability Rules of Thumb:

Probability between 50-55% = Thanks for the FYI

Probability between 55-60% = Have your trading plan in place

Probability between 60-65% = Get some exposure/begin "averaging-in"

Probability between 65-70% = Have up to 15-50% of your exposure

Probability between 70-75% = Have up to 30-75% of your exposure

Probability greater than 75% = Have up to 100% of your exposure

Background Information

Bayesian methods are used to analyze nonlinear systems and can be found in places such as artificial intelligence, the Google engine, automated cars and trains, and all big data complex analyses. The building block of any Bayesian system are its probability determinations of future, nonlinear paths. For nearly 20 years, I have been researching and building Bayesian decision support systems for governments and companies around the world; to include investment management consulting. To learn more please see the Users Guide in the Bayesian Timing Service (BTS) found on EWT. Or just drop me a message.