2 Great Yields To Buy And Hold Forever

2 Great Yields To Buy And Hold Forever

Investors, even those who claim to have a long-term mindset, can be shaken by strong emotions, which can cause misunderstandings and poor decision-making. To be successful in investing, it's important to maintain a long-term perspective.

However, finding a stock that can be held indefinitely requires careful research and consideration, as there are many risks that can arise over time. It's important to avoid panicking over short-term challenges while remaining vigilant for signs of poor management or structural issues.

Our focus is on identifying simple, dominant business models with strong staying power and a proven track record of creating value for shareholders.

Life is like a snowball. The important thing is finding wet snow and a really long hill. - Warren Buffett

Today, we will share two stock picks that are well-positioned to weather interest rate cycles, inflationary pressures, and economic fluctuations, making them ideal for long-term investors.

Pick #1: BCX – Yield – 6.1%

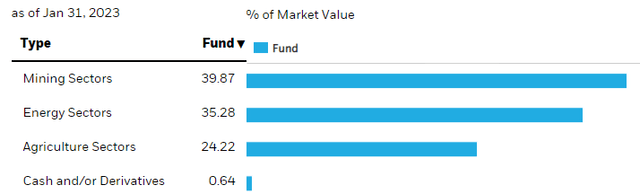

BlackRock Resources & Commodities Strategy Trust (BCX) is a closed-end fund, or CEF, that invests in commodity stocks. Its holdings fall into three major commodity-sensitive sectors: mining, energy, and agriculture. Source.

BCX website

In these sectors, BCX invests in the largest names. 94% of its holdings have a market capitalization of over $10 billion.

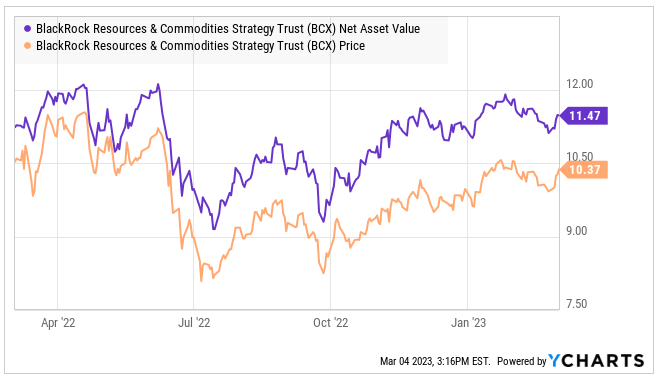

Since then, BCX's price is below the NAV (net asset value), there is an opportunity to seize!

Data by YCharts

When you look at the company level, these companies are doing very well. They are reporting high earnings and bright outlooks.

Pick #2: UTG - Yield 8.2%

Public utilities have a regulated structure where rates are established so that the utility can profit and generate a return on their investments. This enables them to be very consistent generators of cash flow, even in recessionary times.

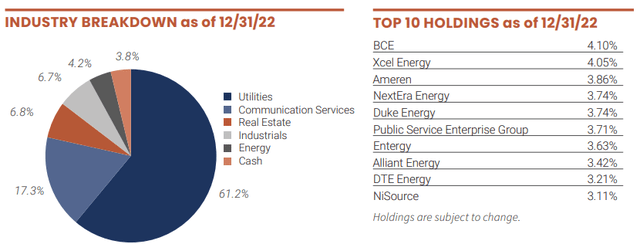

Reaves Utility Income (UTG), a Closed-End Fund with diversified access to North American utility companies, provides investors with both a diversified portfolio of utilities and a dependable cash flow. UTG's portfolio holds 46 companies, including some of the largest utility and telecom companies in the U.S. and Canada. Source

UTG Portfolio

UTG produces a monthly payment of $0.19/share. Its current distribution is around twice the original monthly distribution of 9.67 cents the fund paid in March 2004. The current distribution has an annualized yield of 8.0%. As explained earlier, these distributions are yours to keep, spend, or reinvest.

Since its inception in 2004, the fund has modestly grown its NAV (Net Asset Value) while nearly doubling the distribution! Annual NAV growth averaging 2.05% isn't much, but it is growing, showing that the distribution has been fully covered.

Because it concentrates on utility and infrastructure investments, UTG is well-positioned to earn its distributions during recession pressures. As long-term income investors, we will happily sit back while getting paid to wait for the market to realize this.

Over the last four years, the source of UTG's distributions has averaged 69% long-term gains and 30% qualified income. UTG does not utilize Return of Capital ('ROC') to make payments. Data Source: UTG Distributions

Conclusion

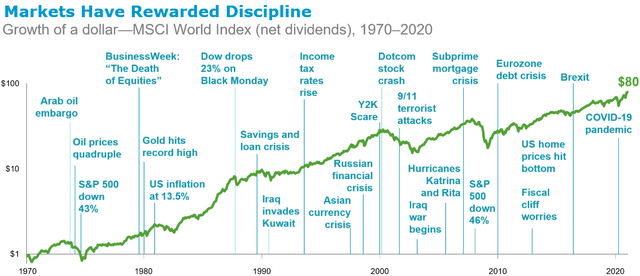

Investors who prefer to do-it-themselves often look for stocks that can be left alone to grow without constant attention. This aligns with the idea of passive investing. Warren Buffett has long promoted the buy-and-hold approach, which he used to build an enormous portfolio through patience and determination.

As he famously stated, "Our favorite holding period is forever." Despite occasional bearish news, Mr. Market's emotional swings have ultimately rewarded those who stay disciplined over the long haul. Source

Market Share Growth DEO (Dimensional Fund Investors)

We are identifying the potential cornerstones for our diversified long-term income portfolio and seek businesses that can continue executing "forever" despite external pressures. We have two picks you can buy and kick back while they continue creating returns for the future.

We're pinpointing the key elements of our varied, enduring revenue-generating portfolio and searching for companies with the ability to thrive despite external challenges. We have a couple of selections for you to invest in and relax while they generate returns for the long run.

HDI, described as the 'Must Own' Service for Income Investors and Retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.