2 Dividends That Keep Working For You

Retirees are currently facing financial worries after the events of 2020. Inflation and rising interest rates in 2021 and 2022 have compounded these fears. Goldman Sachs' Retirement Survey & Insights Report 2022 revealed that many retirees are living on marginal retirement incomes compared to their peak earning years. As a result, many retirees are returning to part-time work to pay bills and unexpected expenses. Retirement can be challenging, but it is possible to create a steady source of income through investing in a way that emphasizes generating regular payouts. By following this unique Income Method and building a portfolio that prioritizes income investing, individuals can potentially provide for themselves and their families in retirement without needing to continue working. High Dividend Investing offers access to excellent investment picks that can help make this a reality.

Today, we will examine two exceptional selections from my personal portfolio that will aid in turning this into a reality.

Pick #1: CEQP Preferred Stock - Yield 9.1%

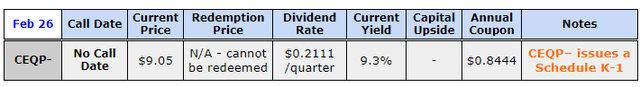

- 9.25% Cumulative Non-Redeemable Preferred (CEQP.P)

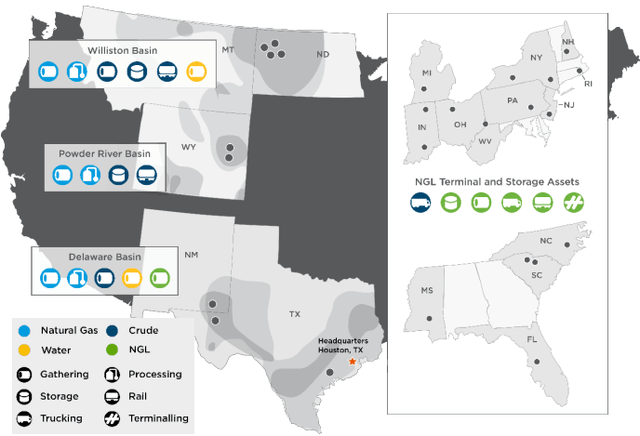

CEQP is a master limited partnership that possesses and manages midstream infrastructure in the Williston Basin, Delaware Basin, and Powder River Basin. The partnership's activities are segmented into Gathering & Processing and Storage & Logistics.

:

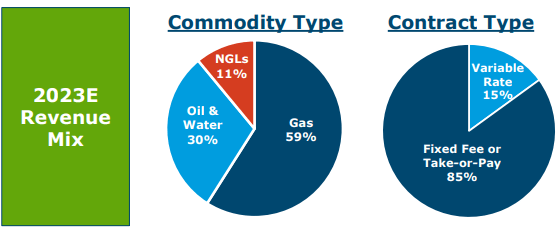

CEQP, being a midstream enterprise, is well insulated from erratic energy commodity prices since 85% of its earnings are predetermined through fixed-fee or take-or-pay arrangements. Based on the company's revenue projections for 2023, its activities are primarily focused on Natural Gas (59%), with the remaining 30% devoted to Crude Oil and Water, and the remaining 11% allocated to Natural Gas Liquids.

CEQP reported adj. EBITDA of $762 million and DCF of $467 million for FY 2022. The company estimates adj. EBITDA to be between $780-$860 million and DCF to be $430-$510 million for 2023, reflecting an ~8% EBITDA and 0.6% DCF growth YoY. Management did not indicate a distribution increase for 2023 but plans to use ~$50 million in DCF after distributions towards debt reduction. CEQP has modest debt levels and guides a 3.9x leverage ratio at the end of 2023, with no near-term maturities until 2025. The company expects capex to be between $135-155 million for FY 2023.

CEQP's distribution will enjoy 1.6-1.8x coverage based on 2023 guidance. Let’s turn our focus to CEQP's cumulative preferred, which enjoys benefits in the fixed-income space.

- A preferred that cannot be called with an "impossible" conversion clause

- A preferred with voting rights

- Penalties for missed distributions

CEQP spends $60 million yearly on preferred distributions and has a coverage of 7.2x at the low end of the FY 2023 DCF estimate, indicating strong distribution coverage. The preferred offers a current yield of 9.3%, making it an appealing investment opportunity.

For long-term income investors, CEQP- is a reliable "Sleep Well At Night" preferred investment, and the current 9.3% yield presents an appealing opportunity to either start or increase one's position.

Bonus Pick #2: PAXS - Yield 12.4%

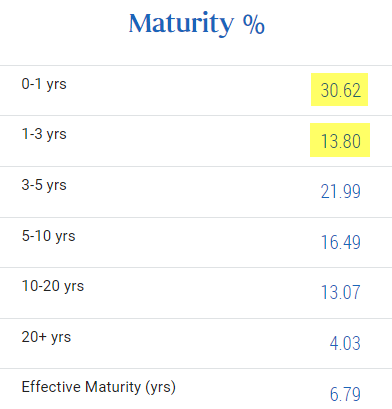

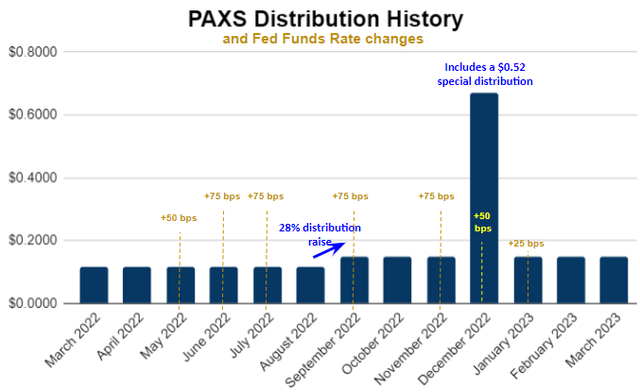

PIMCO's Access Income Fund (PAXS) is a CEF that recently finished its first year on the public markets and is structured to benefit from a hawkish policy landscape that was in place when it was established. PAXS mainly consists of short-term debt securities that can be redeemed and reinvested to generate higher yields, making it well-positioned to benefit if the Fed maintains higher interest rates for an extended period.

PAXS is a CEF that currently trades at a 5.5% discount and could be a good opportunity to generate income in the current bear market. It has been performing well for income investors with a significant monthly distribution increase in September and a large special distribution in December. The CEF may continue to perform well as long as the monetary policy remains hawkish.

PAXS pays $0.1494/share monthly, a generous 12.4% annualized yield. This distribution is covered by the fund’s Net Investment Income from PIMCO’s January UNII report, with 102% YTD coverage

PAXS, managed by PIMCO, is expected to have a portfolio with higher yields as its instruments mature, potentially leading to distribution growth prospects or special distributions for shareholders. PIMCO's long-standing experience in fixed-income securities and track record of generating current income for shareholders makes PAXS an attractive investment opportunity, with a yield of over 12%, especially in the current market conditions.

Conclusion

PAXS and CEQP are both reliable income generators with a history of paying strong dividends. They are great to hold in a retirement account, and are part of the High Dividend Investing ‘Model Portfolio’, currently yielding +9%. This model portfolio includes +45 dividend stocks and security for diversification purposes to mitigate against risk and market fluctuations.