2 Big Dividends For A Rich Retirement

2 Big Dividends For A Rich Retirement

We frequently believe that those who are considered "wealthy" are wise with money. That is untrue. Millions have been wasted by numerous athletes, celebrities from the sports world, lottery winners, and trust fund kids.

If you want to resemble wealthy people, imitate what they do. Some of you might be perplexed right now. So many of us mistakenly think that being wealthy and being rich are the same thing. Owning assets that provide income in excess of expenses qualifies one as rich. Being an excellent athlete can make you wealthy. The owner of the team, though, is the affluent one.

Becoming wealthy is not my aim. My objective is to acquire assets that generate revenue and use that income to purchase further assets that generate income. I can live the life I want by increasing the passive income that my assets produce. This is why at High Dividend Opportunities, we focus on recurrent dividend income from stocks, preferred stocks, and bonds.

Dividend stocks can give you access to passive income, regardless of whether you are starting off with the most recent Powerball windfall or small funds you stashed away by working hard and living within your means. Reinvest some of this passive income, and the power of compounding will work in your favor. Observe as your revenue stream develops into a torrent of payouts.

Pick #1: OXLC - Yield 15%

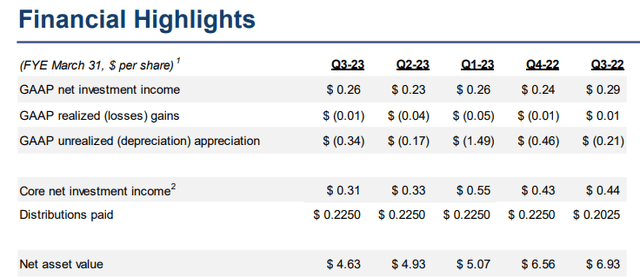

Oxford Lane Capital (OXLC) reported Q4 earnings on the 27th of January and continues to have a very well-covered distribution.

OXLC covered its dividend on a GAAP basis by around 115% and on a core NII basis by 137%. Source.

December 2022 Presentation

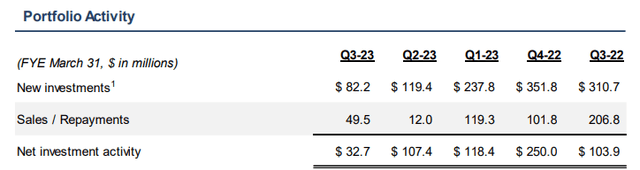

OXLC reinvests and raises new capital to invest in CLOs – raising its portfolio by $32.7 million.

December 2022 Presentation

This is a slower pace than we saw earlier in the year. Year-over-year, OXLC increased its CLO equity portfolio at cost by 36%.

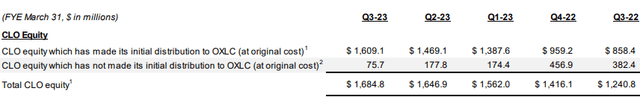

December 2022 Presentation

Note that NAV is primarily influenced by the fair value of CLO equity. CLO equity is illiquid, and only $100 million was traded in December. With a lack of trades, the value of equity positions did not climb in concert with rising loan prices. Although over time, we can expect the two to be strongly correlated. In fact, OXLC estimates NAV rose to $5.02-$5.12 by the end of January. That is an 8-10% increase in just one month!

Simply put, buyers of CLO equity pulled back at the end of the year. A lack of demand causes prices to decline. It is important to remember that OXLC's investment plan has never been to sell CLO equity at a higher price. OXLC's primary strategy is to buy and hold until maturity. OXLC's returns are not a function of how popular CLO equity is and how much others are willing to pay for it. OXLC's returns are dependent upon how many borrowers will pay off their loans.

CLOs continue to experience historically low levels of defaults, with only 11 loans defaulting in 2022 for a default rate of 0.68%.

The Federal Reserve and rising interest rates are to blame for the price changes considerably more so than repayment worries are. OXLC is currently disbursing a sizable dividend and, and we expect it to benefit significantly from rising rate environment. We love OXLC with its great dividend income of 15%!

Pick #2: EPD - Yield 7.5%

Enterprise Products Partners (EPD) is one of the highest quality publicly traded midstream MLPs. The company operates a massive network of over 50,000 miles of pipelines in addition to several storage, handling, and processing facilities for NGL, crude oil, natural gas, petrochemicals, and refined products.

Almost every human-made artifact around you that you can see, feel, and touch is most likely made of petroleum products. In fact, 96% of all manufactured goods use petrochemical feedstock. EPD is a crucial player in this business by offering secure transportation, storage, and processing of these materials. (Source: November 2022 Investor Presentation)

EPD maintains an investment-grade balance sheet with one of the lowest leverage ratios among its midstream peers (3.1x leverage as of September 2022). 93.2% of the MLP's debt carries fixed interest rates with a 4.4% weighted average cost of debt and an average maturity duration of 19.7 years.

EPD has been an excellent dividend steward, with 25 years of growing annual distributions. The MLP maintains 1.8x distribution coverage and is well-positioned to continue raising the payments to shareholders. We are encouraged by EPD's high insider ownership, as management owns 32% of the outstanding shares. This means the interests of management are closely aligned with those of the shareholders, and we can expect strong dividend stewardship going forward.

With EPD in your portfolio, you can sleep well at night knowing a massive network of vital physical assets is being monetized to produce your paychecks and that there is no competitive disruption in the foreseeable future.

Conclusion

Our Income Method can assist you in achieving a retirement where you can enjoy an exceptional level of income for years to come, while also mitigating the risks of any single investment. Our portfolio is currently generating +9% yield by being opportunistic when the market drops, or simply by identifying future winners.

Imagine having a powerful income stream that covers your expenses and grows your net worth rapidly, creating a retirement that is truly worth dreaming about. The longer the stream flows, the greater the potential for your net worth to expand its borders. With our Income Method, you can make this dream a reality!