2 Bargain Picks, One At 8.3% Yield

During my college summers, I took on various jobs to earn money for my tuition. One summer, I worked long hours at a company manufacturing appliance handles. It was fascinating to observe the different payment schedules. Factory workers received weekly paychecks, while office staff were paid monthly. There were playful jokes between the two groups about their spending habits and financial management skills.

In the investment world, payment schedules vary widely. Some investors, known as growth investors, are content to receive payment only when they exit a position. Others prefer investments that pay dividends once a year, quarterly, monthly, or even weekly. Having a diverse portfolio allows me to enjoy different payment schedules, and I use my Dividend Tracker tool to keep track of all my paydays.

Today, I would like to highlight two dividend-paying investments that pay you monthly. These are great to consider for those income investors that like to receive a monthly paycheck!

Pick #1: Realty Income Corporation - Yield 5.1%

Realty Income Corporation (O) is a high-quality REIT specializing in triple-net-lease properties. It is often referred to as the Blue Chip of the REIT sector. As a Dividend Aristocrat, it is known for its consistent monthly dividends, and one that hikes its dividend every year. The company recently announced its Q1 earnings on May 3rd, along with a modest increase in guidance. Realty Income continues its steady growth strategy, which is reflected in its regular quarterly dividend raises.

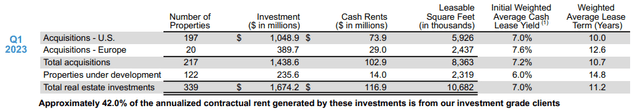

During the quarter, O invested more than $1.6 billion in properties, achieving an average cap rate of 7%. This is higher compared to the typical cap rates of 5-6% seen in recent year.

With an average lease term of 11.2 years, these acquisitions prioritize future earnings growth over immediate gains. Despite having an A-rated balance sheet, Realty Income (O) faces higher borrowing costs with recent offerings at 4.7% and 4.9%, contrasting with its average unsecured bonds below 3.5%.

It's important to highlight that O's $400 million bonds due in 2028 can be called at par value starting January 2024. This gives O the opportunity to refinance at lower rates if interest rates decline, without incurring penalties.

Therefore, while O's 1% AFFO/share growth may seem modest currently, as interest rates reach their peak and start declining, O can refinance its leverage at more favorable rates, leading to interest savings that will positively impact its bottom line.

In the meantime, we can expect Realty Income to continue growing its dividends, along with earnings growths as they have done for decades now.

Pick #2: UTG - Yield 8.3%

Given a possible upcoming U.S. recession, it's wise to increase your allocation to defensive sectors. Utilities offer the following advantages:

Steady earnings growth: Demand for utilities like electricity, natural gas, and water remains strong regardless of economic conditions.

Dividend focus: Most utility companies pay dividends, providing reliable income to shareholders. These non-cyclical stocks, known as "widow and orphan stocks," offer stable cash flows and predictable earnings, attracting risk-averse investors.

Regulatory protection: Utilities face strict regulatory oversight, safeguarding them from competition. They can pass on rising costs to customers with regulatory support. Additionally, environmental legislation influences their growth prospects, with incentives from government bodies.

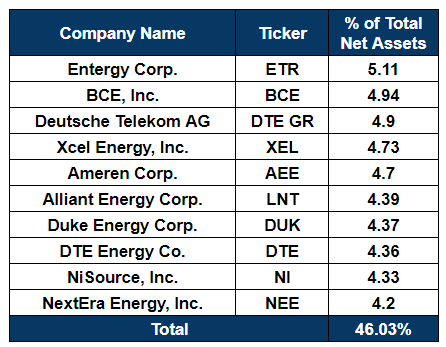

Reaves Utility Income Fund (UTG) is a Closed-End Fund (CEF) that prioritizes current income. With 44 diversified holdings, UTG includes major utility and telecom companies known for their consistent performance.

Despite the current difficult market conditions and rising interest rates, the top holdings of the fund have demonstrated resilience and even improved profitability in recent years.

UTG provides monthly distributions of $0.19 per share, resulting in an annualized yield of 8.3% based on current prices. It's important to note that UTG is actively managed, and we can expect the management to strategically adjust positions to generate returns for investors.

Conclusion

As an income investor, what I truly appreciate is the consistent stream of payments I receive. It's a pleasure to collect dividends multiple times a week, as companies reward me for owning their shares. In times of market volatility, having a steady cash flow entering my bank account makes my life easier. Other income investors will agree that having a reliable income stream helps navigate turbulent market conditions, regardless of portfolio value. Monthly income helps you weather all market dips: I keep collecting my income while the market recovers.

With investments like UTG and O, we can enjoy a consistent income from high-yield opportunities. This allows income investors to diversify their holdings and receive substantial income month after month. It's not necessary to put all your eggs in one basket or rely solely on