Will XIV Ever Move Below 100 Again?

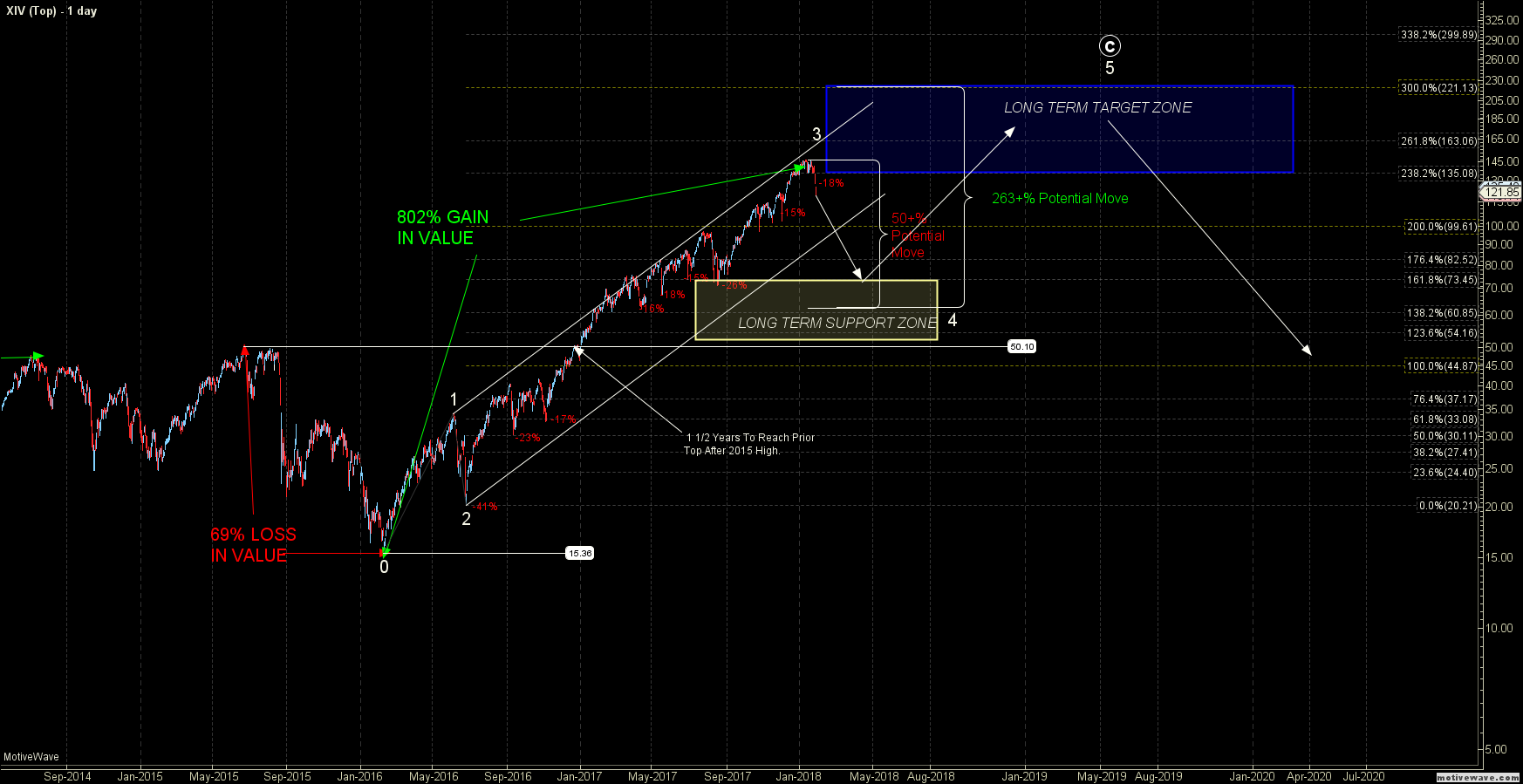

When the XIV was near its highs I was asked in the VIX room if I thought the XIV would even get back under 100. My short answer to this question was "yes". In my longer response, I posted the chart attached to this thread as a visual aid showing some of the historical action on the XIV.

With today's break of support as I have been noting for several weeks, I am now leaning towards this having already topped in the larger degree wave ((iii)) on this chart. At today's LOD we are already down 18% which is the largest percentage drop we have seen in the XIV since August of last year. From here I will be watching to see if we can fill out a larger degree five-wave move to the downside which will give us further confirmation of a top being in place.

My longer term support zone on the XIV is down in the 73.45-54.16 zone, however, I will note that I would prefer to see this hold the upper end of this zone if we are indeed going to hold the larger wave ((iv)). This upper end of the support zone is also where the fourth wave of one degree lower also bottomed which is a typical spot to return to in EW. Now keep in mind a move down to the 73.45 level represents a 50% move down off of the highs and a move well under 100. As extreme as a 50% plus drop is, after experiencing an 802% move up off of the 2016 lows this is the type of action we do have to expect to see upon corrections.

Finally, once this does bottom in wave ((iv)) there still should be ample opportunity to get long the XIV for one more move back higher over the top of wave 3 into the long-term target zone which I still have at the 135.08-221.13 zone. If we can hit this long-term target zone off of the lower support then this still represents a move of 100-200 plus percent. Of course, if we can get a full five down we should have some exciting trading opportunities to the downside but the longer term upside targets off of support should also present us with a very nice long term swing.

The XIV it is tracked and counted in great detail on every timeframe over in the VIX room. A 15 Day Free Trial to the VIX service at EWT is available with no credit card required for registration.