(b) Wave Continues

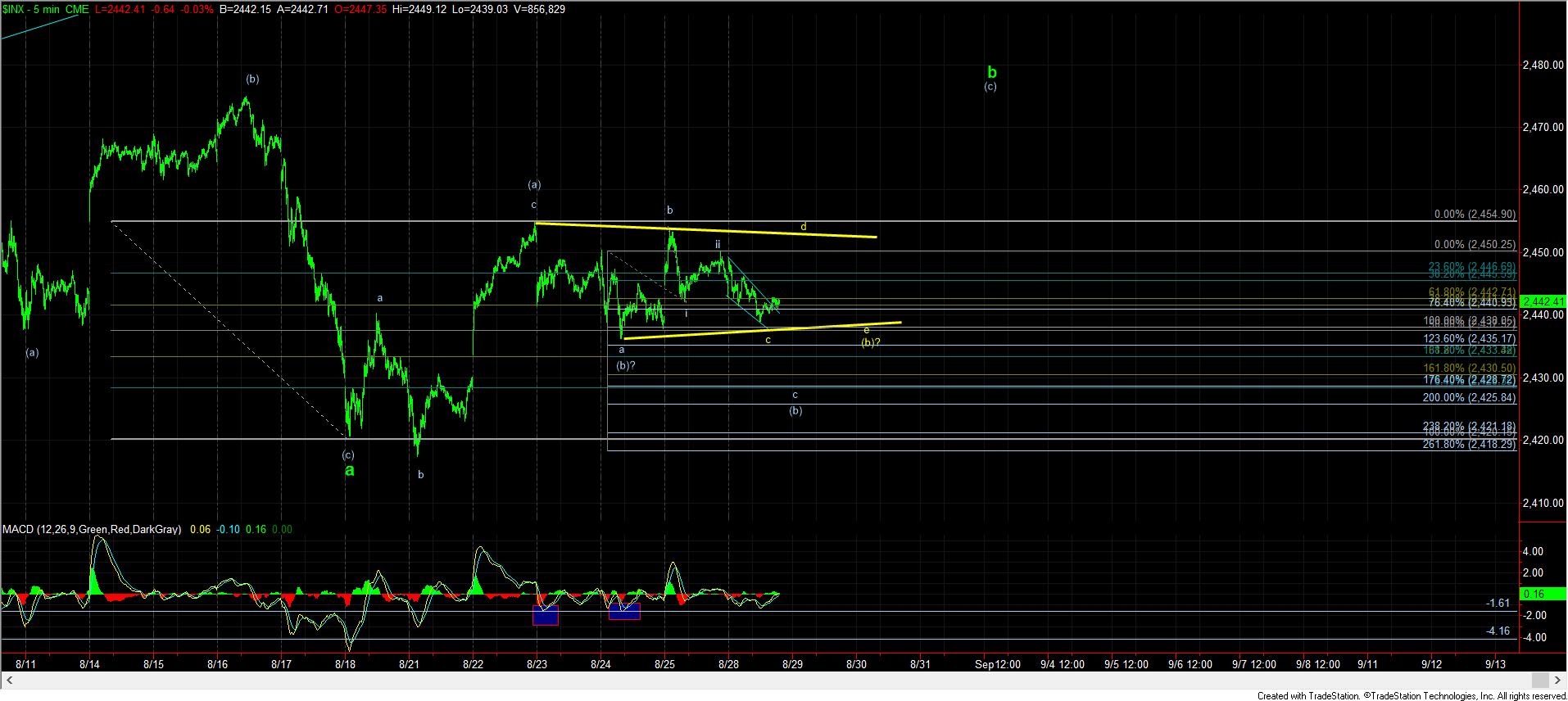

There is nothing that says “whipsaw” more than a (b) wave triangle within a b-wave. And, that may very well be what is currently playing out in the SPX.

When we closed on Friday, the market had a set up to drop towards the 2425SPX region for a deeper (b) wave pullback. However, we have been overlapping in the move down today, which is more strongly suggestive of a triangle playing out than it is a deeper (b) wave drop.

But, as I have warned so many times, these corrective structures can take many twists and turns, and, for that reason, I do not see any high probability trades to be had in the short term, just yet. While my bigger perspective is clearly looking much lower in the coming weeks, the short term is not offering anything of high probability set-ups just yet.

What I will say would be a high probability set ups is if this (b) wave triangle in yellow plays out over the coming day or two. You see, triangles are one of the best trading cues one can see in the market. Triangles often are the consolidation before the final move in the current wave structure, as they occur in either 4th wave consolidations, or b-waves. In our case, it would be a (b) wave consolidation. That means that a drop in the e-wave can be a long trade, while using a stop just below the c-wave of the triangle. Any break down below the c-wave of the triangle would invalidate the triangle pattern, and be a very clear sign that something else is playing out. So, (b) wave triangles are truly wonderful trading cues, which offer low probability set ups, and high probability overhead targets, which are where (a)=(c) (in our case, the 2465-2475SPX region).

For now, 2437/38SPX is the support for the c-wave in this triangle. A sustained break below 2437SPX would suggests we are in an ending diagonal targeting the 2425-30SPX region for the more expanded (b) wave. Moreover, we would need to see a sustained break of the 2430SPX region to open the door to the purple b-wave having topped, and us heading down to the 2380-2400SPX region sooner rather than later. But, I see that as a lesser likely scenario at this point in time. But, being within a 4th wave, we need to make sure we understand the signals the market may give us before they actually occur. So, I like to be prepared.

At the end of the day, I still think the market is trying to set up to attack the 2470SPX region before we test the 2380-2400SPX region. And, as I noted, we would need to see a sustained break of 2430SPX to increase the probabilities we are going down sooner rather than later. But, please always remember that we are within a market environment that can provide further whipsaw, so please do not trade this region in an aggressive fashion, or you can find yourself losing a lot of money during this whipsaw action. It is best to wait for the better set ups rather than chasing price up and down and getting stopped out many times.