You News, You Lose!

I am still amazed at how many investors still follow the news for investment decisions. No matter how many studies that are published which suggest that news is not what drives markets, people are still glued to the news and expect they can outperform the market based upon the substance of news events and economic reports.

Within this article, I will cite a number of those studies. But, I want to be very clear up front as to how I view news and economic reports. While I view the news or the economic reports as being a potential catalyst for a market move, the direction of the market move is often opposite of what one would have believed based upon the substance of the news or economic report. And, I will provide a number of examples in this article.

In fact, on Friday, President Trump posted on Truth Social that an 80% tariff on China "seems right." That is a 45% reduction in the tariff rate currently being imposed on China. And if you would have asked investors the day before what the market would do if Trump would announce something like this, I would imagine at least 99% would respond with the belief that the market would rally by at least 1%, if not significantly more. But, have you looked at how the market closed on Friday? The SPX closed 4 points in the red.

Yet, most of you that follow the news will simply ignore this fact, and will blindly move on to the next news event to guide your investment decisions. Maybe we all need to start looking at these events from a more reasonable perspective and we can use history and various market studies as our guide. At the end of this article, you can then make your decision as to whether following the substance of news events or economic reports is advisable for your investment decisions.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news . . . explains only about one fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.” They also suggested that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years’ worth of “surprise” news events and the stock market’s corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

“Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

Now that I have provided you with some of the studies which should enlighten your thinking, let me provide you some specific market examples which should explain my perspective a bit better.

After writing publicly for over fourteen years now, the most common comment I have seen to my articles suggests that once a major news or fundamental event occurs it would completely invalidate my analysis, as the market will certainly move based upon the substance of that news or fundamental event.

When I challenge these commenters to provide me just one event in recent history that proves the market changed direction based upon a news event, the most common example provided is the 9/11 attack during 2001. So, let’s take a moment to perform a simple exercise. In fact, I have offered this challenge to thousands of people, and not one has been successful in passing this challenge.

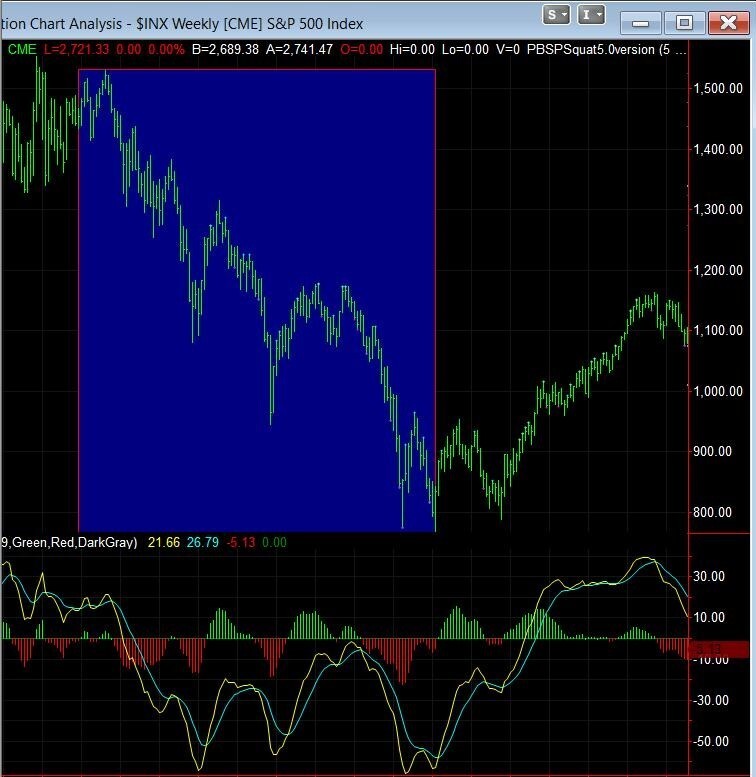

Since most everyone views the 9/11 event as the most significant event of our modern times, I am sure you would have no problem picking out on a chart where this occurred. I mean, if the most significant event of our lifetime had an equally impactful effect upon our markets, as almost everyone assumes it did, then it should be quite easy to pick it out on the following chart.

Now, if you think you have identified the obvious point on this chart where the most significant event of the last 70 years occurred, let’s see if you are right?

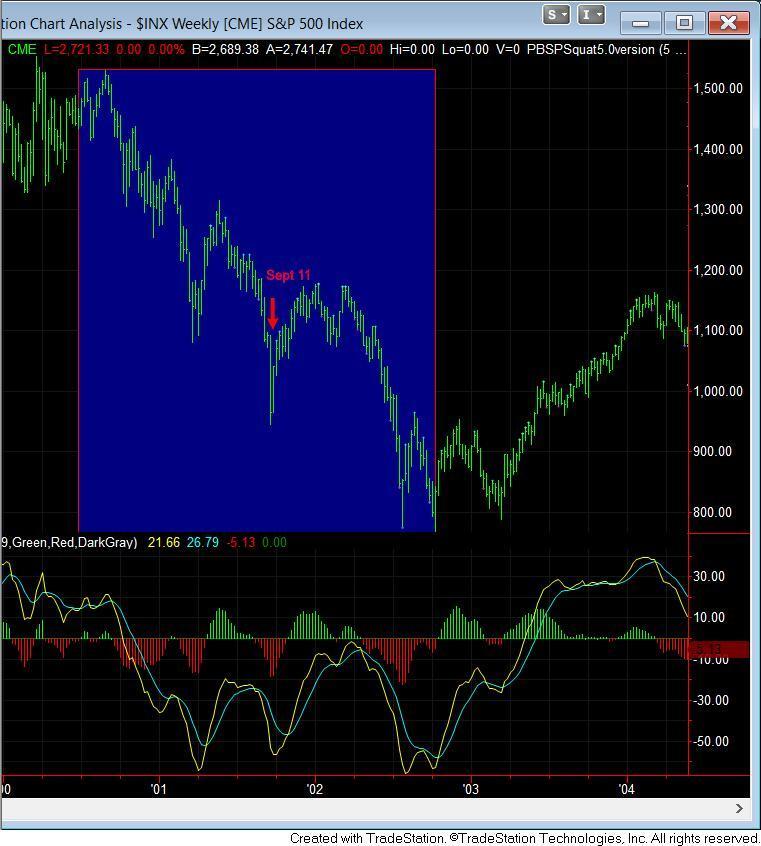

I am quite certain that most of you probably thought that it occurred near one of the peaks of this chart, and caused the entire decline seen on the chart. But, as you can see, we were already in a multi-year decline when 9/11 occurred, and we were closer to a bottoming in the market than a top. Moreover, take note that there were even larger drops seen during this downtrend than the one "begun" on Sept. 11th.

In fact, the market bottomed the week after the 9/11 event, and then rallied to a level 10% higher than where we were right before 9/11. Maybe we can actually say that 9/11 caused the selling capitulation we often see at a bottom to the market, and then caused a 20% rally? Well, the facts support such a conclusion, even though the predominant presumptions about how major news events affect the market do not.

Let’s now move on to March of 2020 – The Covid Crash. For those that remember that period of time in the market action, as the market was approaching its bottom, the worst of the news reports included world-wide economic shutdowns, record level unemployment rates being reported, and some of the highest death rates being reported.

Yet, at the time, I emphatically noted to my clients that I was a buyer of the market as we were approaching my target in the 2200SPX region. Needless to say, even many of my clients thought I was crazy. Yet, the market bottomed at 2187SPX (13 points off my target), and began one of the strongest rallies in market history. I think this picture taken from Jim Cramer’s Mad Money at the time probably explains my point best:

In fact, when I presented my view of a bottom in the 2200SPX region in a public article, and also explained that I expected the market to at least double from there, the following was a comment I received from another analyst at the time:

“Here is the 2200 exactly that you said the S&P would bottom at before taking the trip back up to 4,000... What do you want to bet the ECONOMY is going to pull it down a lot further and that 4,000 is a lot further away than your charts ever said... my own resolution is that this market has a lot further to fall because it is now following the economy, which it long divorced itself from; whereas Avi doesn't believe the economy ever means anything to stocks and has told me so several times last year... So, you have that common sense view, or you can believe Avi's chart magic will get you through all of that and is right about a big bounce off of 2200 all the way back up to 4,000.”

Let’s use one more recent example that many of you may remember – the bottom to the market on October 13, 2022, which ended a 10-month decline in the SPX. On October 11, just two days before the CPI number was announced, Bloomberg ran an article entitled, “JPMorgan Says Too-Hot CPI Would Put Stocks at Risk of 5% Tumble.” And, they were not the only one.

Then, on the morning of October 13, the CPI report outlined that inflation was much hotter than expectations. And, while the market did drop pre-market, the day ended quite differently. In fact, by the time we closed, the market rallied almost 6% off the morning lows. And, boy, did it leave people scratching their heads. I saw quite a few comments on various public articles such as the following:

“Am I the only one wondering what the heck is going on with this market? I feel like it makes no sense anymore.. Today made NO sense.”

In fact, in a Barron’s article later that day, the author outlined the common feeling in the market that day:

“It was a massive rally, and one that came out of nowhere. And it’s left market observers like yours truly wondering what the heck just happened. There wasn’t any new data, no headline-making speeches, no event that occurred just after the open to spur such a move. It literally came out of nowhere—and left us grasping for possible reasons. “Today’s market reversal was a head-scratcher,” writes Oanda’s Edward Moya. And he’s not wrong.”

Within my update to my clients the night before the CPI report was announced, I outlined my views regarding the rally I was expecting to begin in the near term.

“Thus far, the market has made several attempts at hitting the blue box support region on the 60-minute SPX chart. And, each time, divergences continue to grow. And, if you look at the 5-minute SPX chart, there is still opportunity to actually strike that support below as long as we remain below the smaller degree resistance noted. . . But, I think we will likely be much higher than where we stand today as we look out towards the end of October, or even into early November, depending on how long it takes the market to bottom out, and how fast the rally I expect takes hold.”

Not only did we not get a bullish catalyst to begin the rally we saw off those lows, but we got a bearish catalyst in the CPI report. Yet the market moved in the exact opposite manner everyone expected due to the hotter than expected inflation report.

In fact, before the market opened on Thursday morning, and as it was hovering near the final lows of that correction, I sent out an alert to our clients at 8:56AM, noting my expectations for a bottom being struck and noting that “[t]his should now be the selling climax that completes the downside structure.” The market bottomed within half hour of my alert and began a 6% rally that day. Moreover, this marked the conclusion to that 10-month market slide in 2022.

For those of you that are still using the tariff news as your guide for market movement, consider that the market was up around 1% a few weeks ago despite China’s announcement that it will not negotiate with the United States. Again, if I would poll investors at the time, 99% would assume the market would be down “bigly” on that news. And, as one of my clients posted in our trading room yesterday:

“And lest we forget, Joe Biden slammed the Chinese with a wide array of tariffs just this past September, a move that was met with complete silence from the same people who have claimed that the most recent tariffs from Trump would surely destroy the U.S. economy . . . And what did the SPX do after Joe's tariffs were announced? It went from 5400 to 6100 in two months...”

So, allow me to provide you with two quotes from books I strongly recommend that are quite on point regarding this issue:

“Observers’ job, as they see it, is simply to identify which external events caused whatever price changes occur. When news seems to coincide sensibly with market movement, they presume a causal relationship. When news doesn’t fit, they attempt to devise a cause-and-effect structure to make it fit. When they cannot even devise a plausible way to twist the news into justifying market action, they chalk up the market moves to “psychology,” which means that, despite a plethora of news and numerous inventive ways to interpret it, their imaginations aren’t prodigious enough to concoct a credible causal story.

Most of the time it is easy for observers to believe in news causality. Financial markets fluctuate constantly, and news comes out constantly, and sometimes the two elements coincide well enough to reinforce commentators’ mental bias towards mechanical cause and effect. When news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanics paradigm in finance never seem to see or care that these glaring anomalies exist.” – Robert Prechter. The Socionomic Theory of Finance

“Contrary to the rules of philosophers of science, who advise testing hypotheses by trying to refute them, people seek data that are likely to be compatible with the beliefs they currently hold. The confirmatory bias [of our minds] favors uncritical acceptance of suggestions and exaggerations of the likelihood of extreme and improbable events . . . [our minds are] not prone to doubt. It suppresses ambiguity and spontaneously constructs stories that are as coherent as possible.” Daniel Kahneman – Thinking Fast and Slow

With my perspective being that market sentiment is what drives markets and drives investor interpretation of the news and economic reports, many people continue to argue with me that something has to change market sentiment, like a news event or some economic news, for the market to change direction. Yet, I continually answer them that it is simply a reaction within the human biological condition.

Once sentiment reaches an extreme in one direction, there is only one way left for it to go. And, that is how we get sentiment changes, which lead to market directional changes. It is actually the social mood of market participants, en masse, which direct investor’s interpretation of the news events or economic reports. And, that is how one can more reasonably understand why a positive report can seemingly cause a negative reaction (or vice versa), as the underlying market sentiment was not in line with the substance of the event or report.

So, while the news can be a catalyst for a market move, the substance of that news will not necessarily be indicative of the direction of the market move. If you are going to be intellectually honest in your market views, then you must recognize how similar news events or economic reports have “caused” opposite reactions in the market. And, the manner in which we should view the news or economic reports provides for a much more consistent and intellectually honest perspective of our financial markets.

In fact, recent studies have shown that markets may actually be driven endogenously rather than the common perspective of it being exogenously driven.

In a paper entitled “Large Financial Crashes,” published in 1997 in Physica A., a publication of the European Physical Society, the authors, within their conclusions, present a nice summation for the overall herding phenomena within financial markets:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.”

As many of you may know, I operate a market analysis service for over 8000 clients, with 1000 of those being money managers all over the world. To each I have offered a challenge to turn off the news, and not a single one that has taken me up on that challenge over the last 13+ years has come back to tell me they have done worse in their accounts by doing so. In fact, these are typical of the feedback I have received from thousands over the years:

“Prior to finding Avi I would attempt to trade and learn about the markets by reading articles on seeking alpha and following the news. Luckily I only did this for a few months. But during that time, articles and news would say the market went up or down because of X. But then when X would happen and the market didn’t go up or down, but did nothing or the opposite, they would write that it must have been “priced in.”

To me it was obvious that this cannot be correct. You can’t have it both ways! I felt like Mugatu in the movie Zoolander when he says, “Doesn’t anyone else notice this?! I feel like I’m taking crazy pills!”

Thus, it was easy *for me* based on that background to accept that the news doesn’t matter and the markets reflect sentiment. Perhaps others come to EWT with not quite the same background so it is harder for them to “make the jump.” I rarely share this story with these specific details, but I thought it might be helpful to some of those who are still tempted to believe that the news causes anything in the markets.”

“Best 4-5 years of my investing life. No TV news, no Cramer, dropped all of the other services that got me no where.”

“I stopped following the news shortly after joining this service back in 2019. Since then I trade the charts and do much better than ever before. Not only do I have a better understanding of where we are in a cycle, I certainly have much more quality time with family and friends cause I don’t have to sit in front of a screen or watch my phone 24/7. Thanks Avi”

“The news is mostly entertainment and manipulation and propaganda...when you turn the volume down (or even off), you begin to see and understand true market patterns and processes. My timing of buy and sell decisions has improved tenfold on a news-free diet.”

“I don’t know how, after all these years, people still don’t listen to you. They still think the news is controlling the direction. And just in 2024 we have had so many examples of the same news leading to both rallies and drops. A few years back you wrote somewhere that people should stop even listening to the news for their trades. I listened to you. Since then, my gains have been much better.”

“I really started paying attention to your analysis in 2020 when at the depths of the Covid crash you were outlining a path to new ATH with pretty high confidence. And then you have called the smaller time frame moves as well. It's just hard to argue with this method. The results are what they are. So, I have basically turned off every other analyst as they have been exposed as noise. Keep it up. I appreciate what you have here.”

“I stopped watching the news in 2021 after coming here and after 25 years of trading. I have had my best 4 years of trading in my life. I just think back to how much of my life I wasted focusing on the wrong thing. I just wish everyone fully understood the power it gives you as a trader.”

“I've told countless people about Avi calling for a meltup in stocks in 2017. This was before the 2016 election and Avi made it clear it didn't matter who won, you need to follow the charts. Even more impressive, the 2020 Covid drop to SPX ~2150 was on his charts in the fall of 2019 before Covid had entered the minds of anyone. Before people knew what Covid-19 was, the C-wave drop was there, and you can go back and look at the posts from 2019. Follow the charts, not the news.”

Based upon the market studies and actual market history, you may want to consider taking the same challenge. (smile)

If you would like a more in depth discussion of this topic, feel free to read the following 3-part series of articles I penned a number of years ago: