Yet Another Round Trip

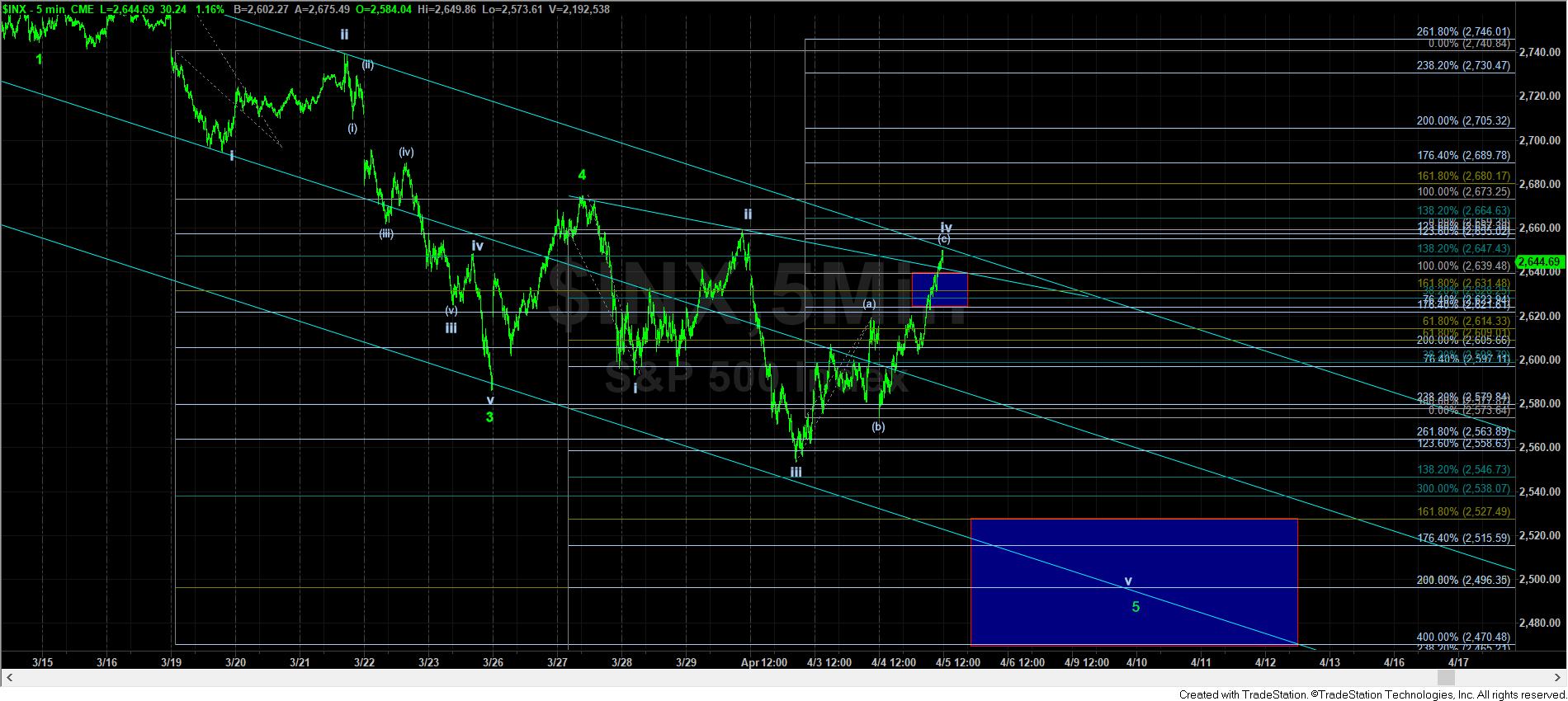

And, the whipsaw continues. With the overnight action getting everyone extremely bearish this morning, I posted an update a little before 7am this morning when we were near the lows in the futures noting that we will likely see a bounce. Moreover, I even noted the potential that the bounce would take us back up towards the 2600+ region in the market.

We certainly got that expected bounce, and when the market moved through the noted resistance regions, it opened the door back up towards the 2620-2640SPX region.

The downside we have seen thus far in the move from the March high has been less than fulfilling when it comes to reaching full downside targets. In fact, we have not even been able to strike a double bottom at the 2530 region, and that is definitely troubling me.

But, ultimately, I cannot argue with the market action, and tomorrow should be quite instructive as to whether we see the bears try to take this down one more time or if the bulls are going to take control.

While I did not want to see the SPX move through the 2640SPX level on this move up off today’s lows, as it would then exceed an (a)=(c) off the cash lows this morning, until we complete a full 5 waves up off a low we still do not have the initial stages of confirmation that we have begun that rally to 3000+ in earnest. In fact, the attached 5-minute chart in the SPX still shows the potential to drop tomorrow, but the move through the 2640SPX level has certainly made that potential a lot less likely than if we would have held below 2640SPX.

In fact, the IWM has also moved just beyond its 1.382 extension off the lows, which also suggests that it is potentially in the heart of its wave 1 off its recent lows.

So, if the SPX can rally over the coming week towards the 2700+ region and the IWM can rally up towards the 155 region, we would have an initial indication of a low being in place, which would be followed by 5 waves up off that low. In fact, I have this potential presented on the attached 60-minute charts for SPX and IWM. While the bears still have one more shot to attempt to take this down overnight, if they cannot do so by tomorrow, then I will be tracking the bullish counts from here on as my primary count, especially if we complete 5 waves up off the recent lows in the coming week.

Clearly, if we had seen the full extent of an appropriate downside extension in this c-wave segment of the wave (4), I would not be questioning if the market has something more sinister that it is planning for us in the coming months.

But, since we did not, I am going to post two “bearish” considerations on my 60-minute SPX chart. The first would be a triangle, as presented in purple, which would have us in the d-wave rally, and keep us below the March high. But, that also would suggest that the lows to this correction are in place. And, if we continue upside in impulsive fashion, the probability for this potential will drop even lower than it is right now.

The second would be a much bigger b-wave taking us as high as the 2823SPX region. Again, much is going to depend on how we rally off the current lows so I cannot handicap this potential just yet. Moreover, if we see a fully 5 waves up towards the 2700SPX region, then it is hard to align that yellow count to make sense. So, again, I cannot say that it leaves me with a lot of confidence in this potential, at least for now.

So, while the downside structure has certainly come short of the ideal targets, the further bearish counts are not terribly appetizing to me at this time either. If the patterns morph to something other than an impulsive 5 wave structure off the lows, then we can begin to consider those alternatives a bit more seriously.

As far as today goes, the bears have clearly let the bulls off the hook in not being able to drop them below the 2530SPX region. While they can certainly come back tomorrow with a vengeance, as they will have to do so in order to take us below the recent lows, the move through 2640SPX has made this potential a bit less likely now.

While I have been warning about the positive divergences we were seeing at the lows over the past several days, and to keep the bigger picture in mind wherein we will still likely be heading to 3000+, there is no question that the lack of downside follow-through for a solid c-wave bottom has left us somewhat wanting. But, the market does not always provide us what we want, and we have to track it as it develops. Again, our larger expectations are still pointing to 3000+ by the end of 2018 or early 2019, but we are still in need of a solid micro count pointing to the fact that we are now on our way. We may get that within the next week or two if we can complete an initial 5 waves up off the recent lows. Otherwise, we will be looking towards our alternative bearish structures.