Yet Another Breakout Set Up

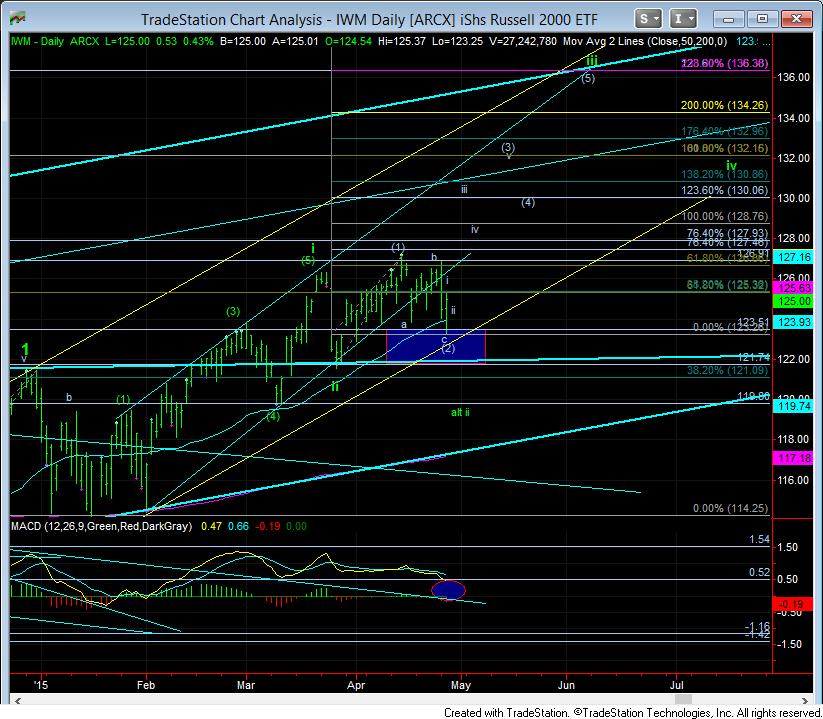

With the IWM finally striking out target box today, we have a nice a-b-c, wave (2) flat in place. And, once it struck that box, it lifted off that target like someone touching a hot stove. This is what the start to the heart of a 3rd wave should react like.

But, what we still need is follow through and confirmation. So, assuming that the low to wave (2) was struck today in the IWM, my expectation is that this 3rd wave should waste no time and provide us with a break out tomorrow over the high the IWM made yesterday at 126.91. A strong move through that level would have me looking for a fast move to the 130 level in wave iii of (3) of green iii. That would then provide us with a pullback/consolidation, which should hold over 127, and then take us to the 132 level to complete wave (3) of green iii. And, yes, all this can happen this week.

Again, as long as we do not breach the lows seen today, I am looking much higher. In fact, I don’t even want to see us approaching those lows if this is indeed the kickoff to the heart of the 3rd wave higher. And a break below 1245TF would get me very concerned about this bullish set up.

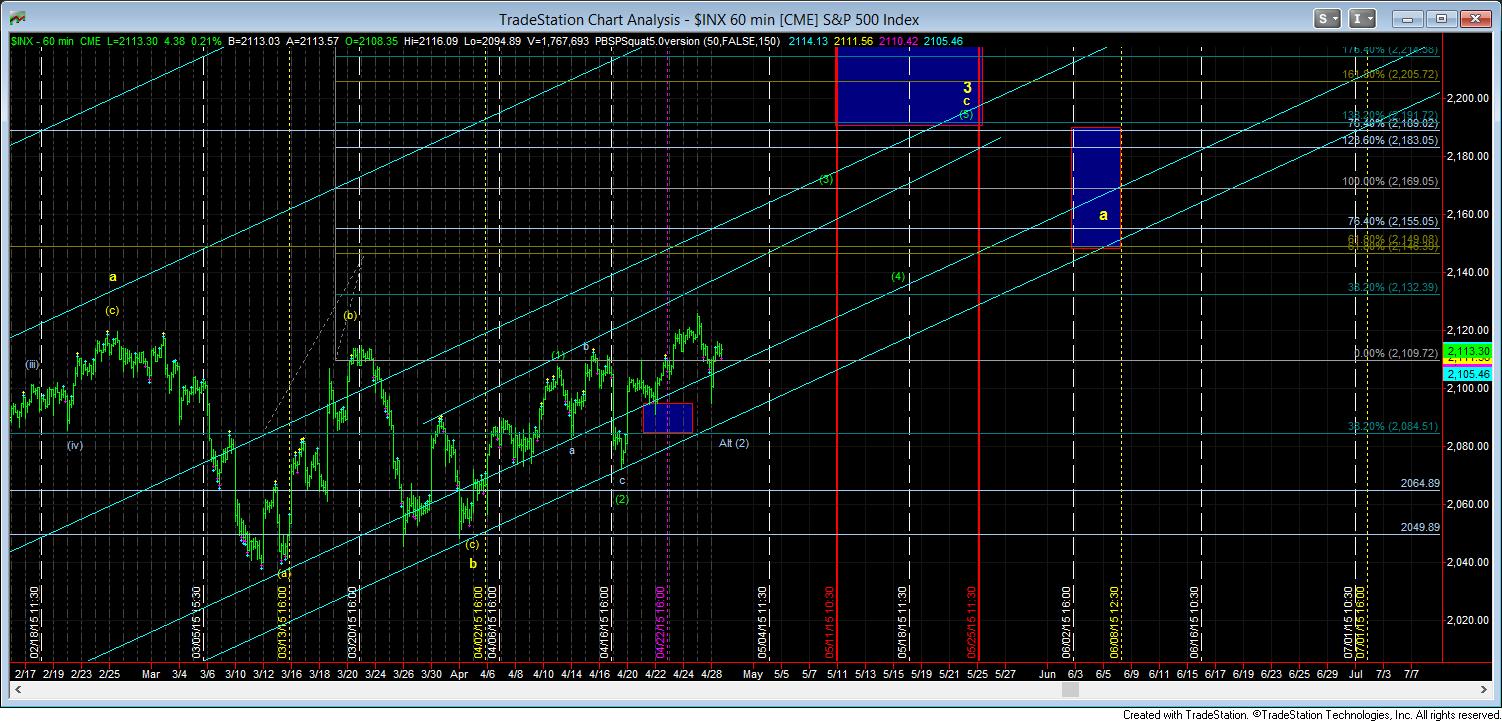

Yet, I cannot say I have as much confidence in the pattern in the ES or SPX. It has become quite overlapping and may even be tracing out as an ending diagonal itself for this c-wave of wave 3 in the larger ending diagonal in the SPX. And, yes, that is a messy pattern within a messy pattern. But, that would align well with a potential break out to be seen in both charts, with the IWM potentially outperforming on the next rally, exactly as it did today off the lows.

So, once again, we will look to tomorrow to provide us with upside follow through, and confirmation that the 3rd wave is finally in progress.