Yesterday's Sell-Off Erased But Market Still Not Out Of The Woods

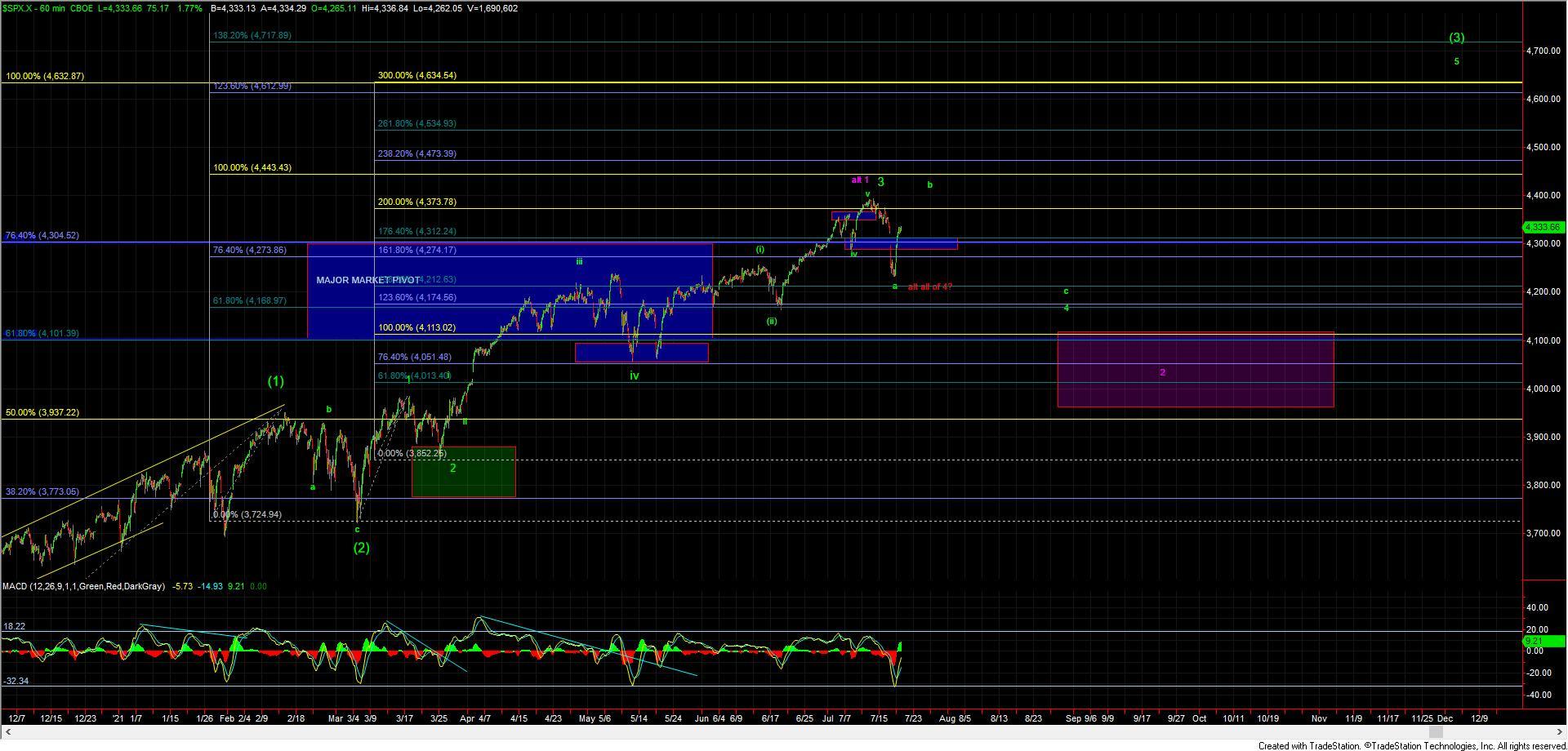

Today we saw the entire drop yesterday erased as we pushed sharply higher today. This sharp move higher has confirmed that we have indeed struck at least a local bottom in the form of a wave a of a larger wave 4. As we near the close we do however still only have three waves up off of the lows and are approaching a key resistance area on the smaller degree timeframes and from the move up off of the lows.

The 4325 level on the ES represents the 61.8 retrace level of the entire move down off of the highs and the 4329 level is the 138.2 ext of the initial move up off of the lows. This 138.2 -176.4 ext zone is the next key target area for the wave (c)/(iii) up off of the lows. This is the ideal area to see at least a local top for this move at which point we will need to watch both the structure and support levels of the next pullback below to help give us further guidance as to where this is headed in the near term.

If we push up into this target zone and then move back below the 4307-4294 zone then we will have the initial signal of at least a local top. The bigger question at that point would be whether we have topped in all of the wave b as shown in green on the ES chart or just the wave (a) of b as shown in yellow on the ES chart.

The structure of the move down will help give us further guidance on this. If that move takes the form of five waves then the door would be open to having put in a top in all of the wave b whereas a three-wave corrective move lower would suggest that we are only topping in the wave (a) of b.

If however we pull back and hold over that 4307-4294 zone and make another higher high then it would give us a potential five-wave move up off of the lows which we could view as an early signal that we may have bottomed in all of wave 4 which I am showing in red. This is still an alternate path at this point in time however with the strong move up off of the lows the potential for this to develop into a full five up off of the low is still in place at this point in time. We do however still need to hold over that 4307-4294 zone upon any pullbacks for this potential path to remain viable.

So while this rally has certainly given us some relief to the sell-off that we saw yesterday the market still has much to prove to give us a signal that this rally is anything but a corrective push higher before moving lower once again over the coming days and week. The structure and the support levels as laid out above should however help give us guidance as to what the market intends to do.