Will They Prolong The Pain?

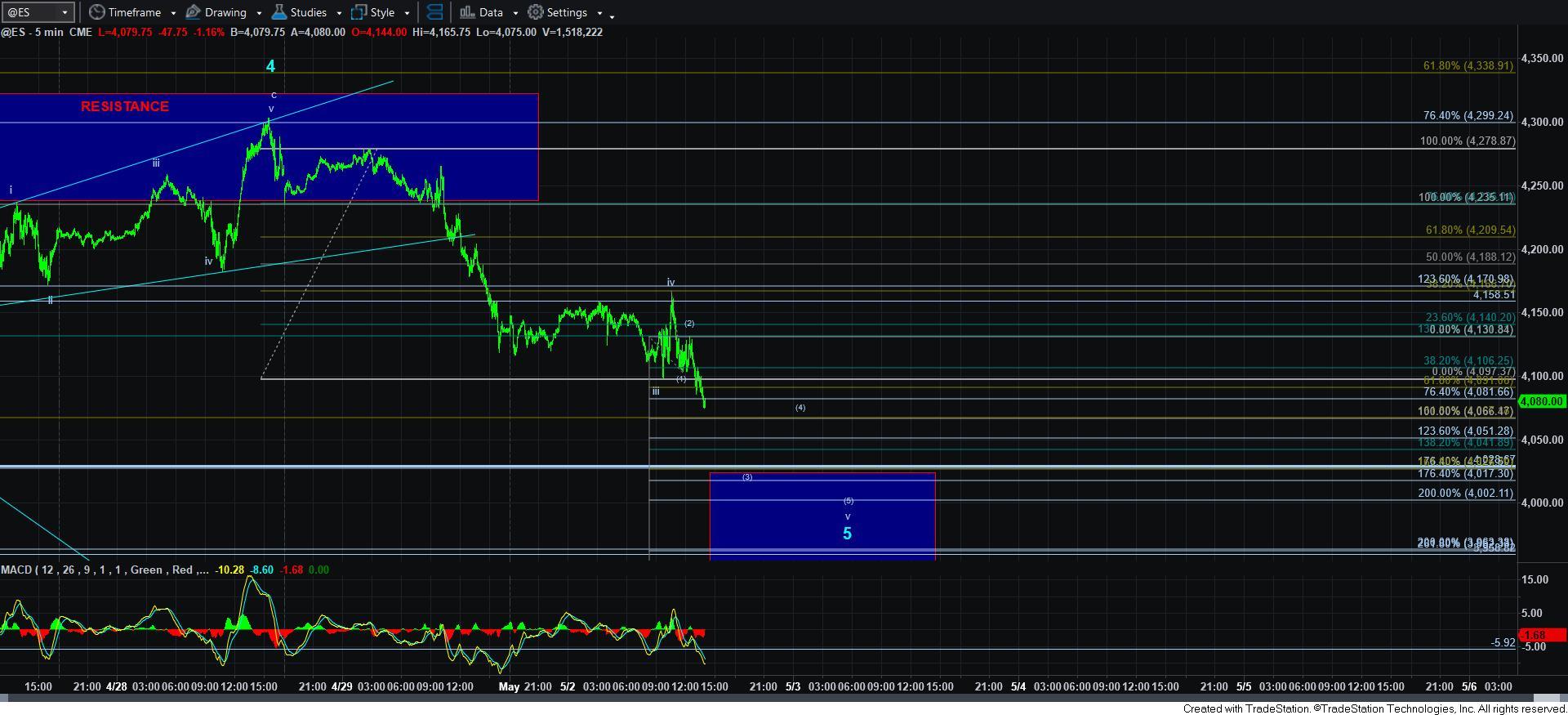

As I write this, the market is hitting the 1.618 extension of waves 1-2 in the downside structure for the c-wave. And, if this holds, then we can run back up to the 4245SPX region for a more protracted 3-4-5 structure, as outlined in the yellow count on the 5-minute SPX chart.

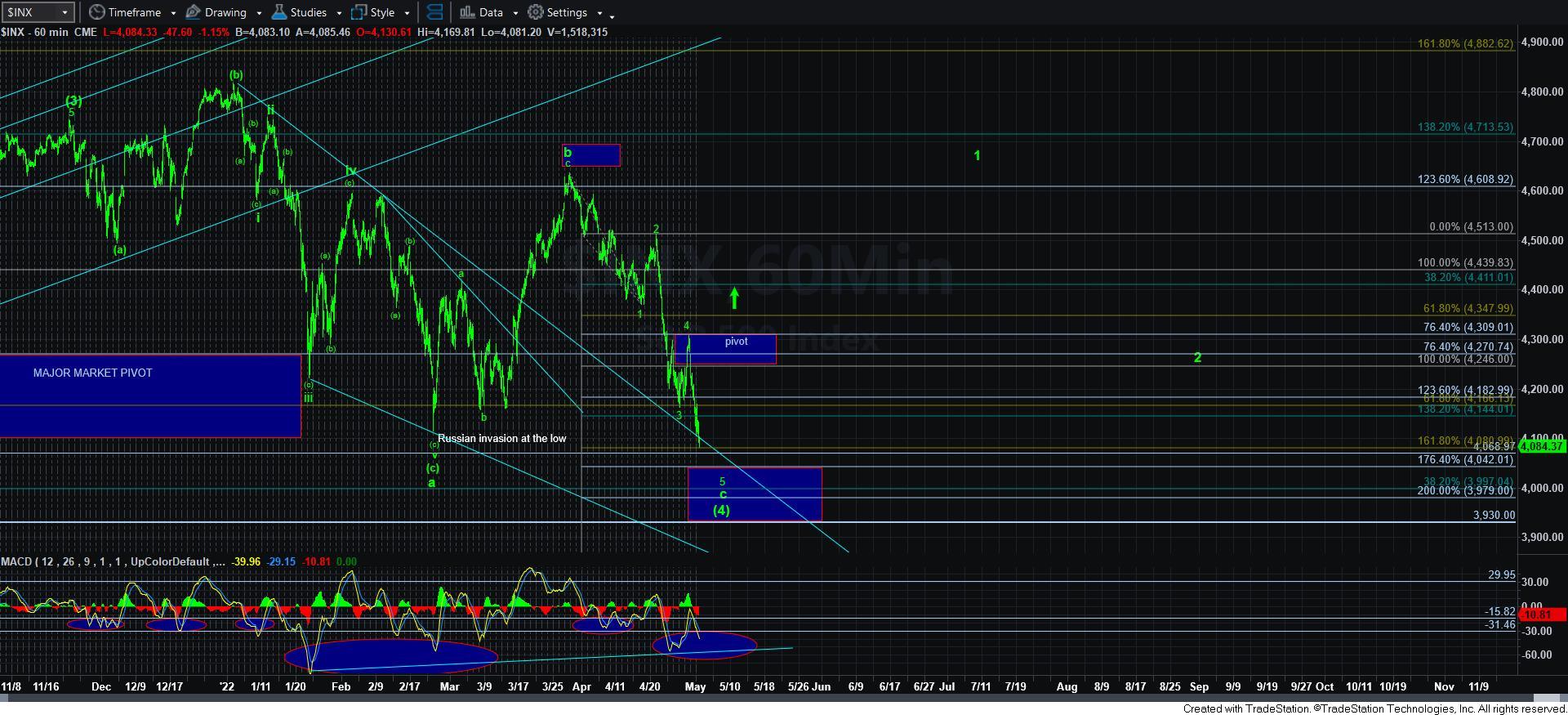

Before I continue, I want to note that the yellow count on the 5-minute chart is a different altenative than the one on the daily chart. The one on the 5-minute chart is simply an altenative manner in which the c-wave of wave [4] can take shape, whereas the one on the daily chart would become more likely on a break down below 3930SPX, and suggest we are one wave degree off and the market is actually completing wave [iv] off the March 2020 low, which means only one more rally will likely be seen to the 5500SPX. I have discussed this extensively in various weekend updates over the last 4 months along within various mid-week videos.

In the meantime, as long as the market remains below 4137SPX, pressure remains down to complete wave 5 of the c-wave of 4. Moreover, it would still take an impulsive move through 4310SPX to suggest that wave [4] is done and wave [5] has likely begun, pointing us to 5500SPX.

That brings me to another point. With the market breaking down below the February low, it has taken off my prior green count representing a diagonal for wave [5], as it is now invalidated. Therefore, my main target in the 5500SPX region remains as my primary expectation. Once waves 1-2 develop after we strike a low in the c-wave of [4], we will be able to view that a bit more realistically based upon where that 1-2 structure projects within our Fibonacci Pinball structure.

So, for now, the market is bottoming out. The only question remaining is if the market tries to prolong this completion with one more 4-5, as presented in yellow. Ideally, I want to drop below 4440SPX to make that a very low probability, as you can see how the last move down would fill in on the 5-minute ES chart. For now, it is still something we have to watch very carefully.